Chart of the Day: Jobs, Jobs Jobs

Moving Averages On the Downturn

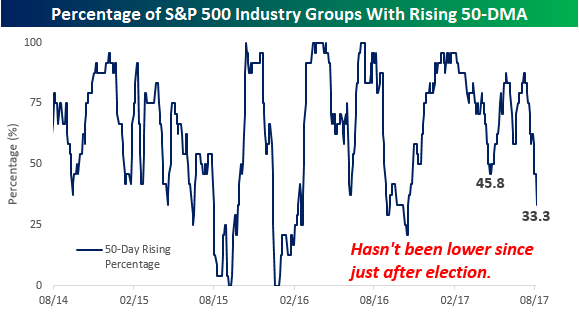

A key trait of the S&P 500’s strong performance this year has been that the major moving averages of the index and its industry groups have all been trending higher. In fact, there hasn’t been a single day all year where the S&P 500’s 50 or 200-day moving average (DMA) was lower than it was the week before. That’s indicative of a solid overall trend, but lately, there have been some cracks in the armor that we have been highlighting to clients over the last couple of weeks.

From a longer-term perspective, practically every industry group has a rising 200-day moving average. As shown in the chart below, just last week the percentage of industry groups with rising 200-day moving averages increased to over 95%. The last time we saw a stronger reading was back in November 2014. Now if only we could get Energy’s 200-DMA to turn. Then we’d be up to 100%!

Summer may be ending, but that means you can take advantage of our Labor Day Special and receive a month of full access to any one of our research services for just $1 and then 20% off for the life of the subscription!

While the long-term trends are still to the upside, we have seen the trend in short-term moving averages really start to shift. The chart below is the same as the one above, except that instead of looking at the percentage of industry groups with rising 200-DMAs, we used a shorter term 50-DMA instead. Here the picture has really deteriorated in the last few weeks. After getting as high as 95.8% earlier this year, at the June and August peaks, the percentage only reached as high as 88%. But after that second peak in early August, the percentage of industry groups with rising 50-DMAs has come crashing down to just 33.3% as of this morning. That’s the weakest reading we have seen since the days just after the election.

The Closer — Harvey’s Impact — 8/28/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we review the inflation implications of the price cut Amazon announced for Whole Foods today (negligible), the miss in existing home sales today (significant), mortgage delinquencies (up) and the impact of Harvey on energy markets (big).

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See today’s post-market Closer and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research platform!

Chart of the Day: Bubbles

B.I.G. Tips — 2017: A Stock Picker’s Year

ETF Trends: International – 8/28/17

Bespoke Stock Seasonality — 8/28/17

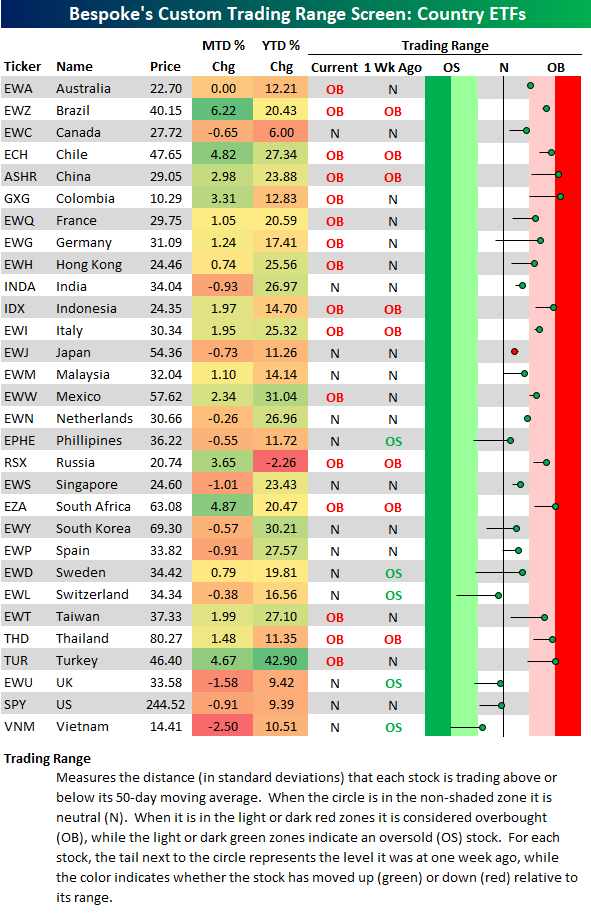

Bespoke’s Country ETF Trading Range Screen

Below is an updated look at Bespoke’s country trading range screen using 30 of the largest country stock market ETFs traded on US exchanges. For each ETF, the dot on the right-hand side of the screen represents where the ETF’s price is currently trading within its normal range. The tail end to either the left or right of the dot represents where the ETF was trading one week ago. Also, the black, vertical “N” line represents each ETF’s 50-day moving average, and moves into the green or red zones are considered trading “oversold” or “overbought.”

As we enter the week, all but four countries are trading above their 50-day moving averages, and unfortunately, the US (SPY) is one of the four trading below it. Switzerland, the UK, and Vietnam are the other three countries below their 50-day moving averages.

While the US has lagged recently, a majority of countries in the screen are trading in “overbought” territory. This means they’re trading in either the light or dark shaded red zones in the screen. An “overbought” reading is triggered when the ETF trades at least one standard deviation above its 50-day moving average. When the ETF is in or above the dark red shading, it’s trading in “extreme overbought” territory, which is 2+ standard deviations above the 50-day.

Some of the countries trading in extreme overbought territory as we enter the trading week are China (ASHR), Colombia (GXG), South Africa (EZA), and Turkey (TUR).

Bespoke Brunch Reads: 8/27/17

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

See this week’s just-published Bespoke Report newsletter by starting a no-obligation two-week free trial to our premium research platform.

Macroeconomics

Globalization in retreat: capital flows decline since crisis by Shawn Donnan (FT)

While economic growth has recovered following the global financial crisis, there’s been a stark reversal in the previously inexorable growth of global cross-border capital flows. [Link; paywall]

Inequality and macroeconomic policies by Vitor Constancio (ECB)

While ECB President Draghi’s speech on Friday got most of the attention this week, we would argue that Constancio’s mid-week missive on the distributional effects of QE to the European Economic Association in Lisbon was more interesting and more innovative. [Link]

Demographics

Millennial Americans Are Moving to the ‘Burbs, Buying Big SUVs by Kieth Naughton (Bloomberg)

A friend of ours once quipped “the most interesting thing about young people is that they get older”. While that can probably be taken too far, in the case of big ticket spending and lifestyle Millennials are behaving an awful lot like their parents: leaving cities and buying houses. [Link; auto-playing video]

Facebook may have a grown-up problem: Young people leaving for Instagram and Snapchat by Jessica Guynn (CNBC/USA Today)

Speaking of young people, new eMarketer forecasts predict a 3.4% decline in teenagers’ use of Facebook this year, driven by migration to other apps (one of which is Instagram, which Facebook of course owns). [Link; auto-playing video]

Quants

Maersk’s tanker unit invests in quant hedge fund by Robin Wigglesworth (FT)

In order to get access to a high value shipping database and better deploy its ships, one of the world’s largest shipping lines has invested in a quantitative hedge fund. [Link; paywall]

Quant Firm AQR Capital Management Seeks SEC Approval to Sell ETFs by Dani Burger (Bloomberg)

If AQR follows through on new filings, getting acesss to the investment acumen of Cliff Asness and the rest of AQR might become even easier. We should note, no specific ETFs are planned for launch at this time, and the firm basically appears to be keeping its options open for the future. [Link; auto-playing video]

Education

Turnaround University: Quant School On The Hudson by Matt Schifrin (Forbes)

A look at a rapidly growing STEM college with majors including quantitative finance and cybersecurity; the school leaped 68 spots in a single year on the America’s Top Colleges list. [Link]

University of Iowa’s Tippie College to End Full-Time M.B.A. Program by Kelsey Gee (WSJ)

Iowa’s business school is closing amidst declining demand for two-year business degrees. Instead, the school will offer part-time and specialized master’s programs. The school describes the market for two year MBA degrees as “shrinking”, a remarkable turn-around from a few years ago when students flocked to programs thanks to the brutal labor market. [Link; paywall]

Archaeology

3,700-year-old Babylonian tablet rewrites the history of maths – and shows the Greeks did not develop trigonometry by Sarah Knapton (The Telegraph)

Improbably, a clay tablet that dates back almost 4,000 years is teaching modern mathematicians a thing or two. The Babylonian numerical system was base 60 instead of base 10, making trigonometry calculations look much different – and more precise – than our current approach. [Link]

Silicon Valley

Wal-Mart and Google Team Up to Challenge Amazon by Jack Nicas and Laura Stevens (WSJ)

The nation’s largest retailer has signed up with Google Express, the online shopping marketplace run by Alphabet. Wal-Mart will still be responsible for fulfillment as it is with its existing online ordering options. [Link; paywall]

What’s New in the iPhone 8 by Mark Gurman (Bloomberg)

A rundown of the new features and design of the iPhone due out this fall, which looks somewhat similar to the 4 and 4S, along with much higher screen share of surface area, an OLED screen, inductive charging, and a virtual home button. [Link]

Have a great Sunday!

The Closer: End of Week Charts — 8/25/17

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. This week, we’ve added a section that helps break down momentum in developed market foreign exchange crosses.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

Click here to start your no-obligation two-week free Bespoke research trial now!