The Closer — Risk Sentiment — 9/5/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we look at how risk sentiment is showing up in various asset classes, as well as reviewing one of the worst years on record for the dollar and today’s factory sales for July released today.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See today’s post-market Closer and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research platform!

ETF Trends: International – 9/5/17

Bespoke Stock Seasonality — 9/5/17

Bespoke Stock Scores: 9/5/17

Chart of the Day: A Bounce For Bonds (And TLT)?

August 2017 Headlines

Bespoke Brunch Reads: 9/3/17

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

See this week’s just-published Bespoke Report newsletter by starting a no-obligation two-week free trial to our premium research platform.

New Research

Associations of fats and carbohydrate intake with cardiovascular disease and mortality in 18 countries from five continents (PURE): a prospective cohort study by Deghan et al (The Lancet)

A new study covering 135,000 people in 18 countries over 10 years has found higher fat share of calorie consumption has significant positive effects on a variety of outcomes including reduced mortality and cardiac disease. [Link]

Unemployment’s Steady Fall Could Signal Trouble—or a Broader Structural Shift by David Harrison (WSJ)

Dueling theories of how low the natural rate of unemployment is prompting big questions about the monetary policy and how hot the economy can get. [Link; paywall]

Sports

The most peculiar injury risk in college football: 10 hours a day in dress shoes by Gene Wang (WaPo)

Navy Midshipmen are required to wear dress shoes with hard soles, and that creates a challenge for players whose feet are made more vulnerable by the footwear. [Link; soft paywall]

Would Chris Hayes Get a Hit in a Full Season of Play? by Eno Sarris (Fangraphs)

MSNBC anchor and Cubbies fanatic Chris Hayes wondered on Twitter recently if he’d be able to get a single hit over the course of a full MLB season; Sarris takes a crack at estimating whether he could. [Link]

Albert Pujols Is The Worst Player In Baseball by Neil Paine (538)

Thanks to no defensive value and a brutal run at the plate, statistically speaking Pujols has been without competition as the worst player in MLB this year. [Link]

Missteps

Soros’ Worst Trade by Kevin Muir (The Macro Tourist)

An oral history of the worst trade that George Soros ever made, and a great review of the overall chaos that prevailed the week of Black Monday in 1987. [Link]

How a Black-Card Wannabe Went Down In Flames by Kim Bhasin and Polly Mosendz (Bloomberg)

Prior to the catastrophic effort at festival organization that was Fyre, Bill McFarland ran a company offering a black card that wasn’t actually a black card. [Link]

Abandoned States: Places In Idyllic 1960s Postcards Have Transformed Into Scenes Of Abandonment by Pablo Iglesias Maurer (DCist)

In the 1950s, 1960s, and 1970s, the Poconos were a booming resort region, but time hasn’t been kind as modernist architecture and grand ballrooms have fallen into grim disrepair. [Link]

Human Tragedy

South Asia Is Also Experiencing The Worst Flooding In Decades And The Photos Are Horrifying by Anup Kaphle (Buzzfeed)

While the tragedy of Hurricane Harvey’s Houston flooding is all over American media, it pales in comparison to the floods that are savaging Nepal, India, and Bangladesh. [Link]

The first social media suicide by Rana Dasgupta (The Guardian)

The heartbreaking story of young woman in France that live-streamed her own suicide to a global audience; painful to read but important in this age of pervasive social media. [Link]

Research

Hedge funds see a gold rush in data mining by Lindsay Fortado, Robin Wigglesworth, and Kara Scannell (FT)

A long, comprehensive read on alternative data sources, including job sites, credit card data, and all sorts of digital footprints used to get ahead by investors. [Link; paywall]

Small Hedge Funds Seen Quickest to Drop Research Under MiFID by Nishant Kumar and Suzy Waite (Bloomberg)

With MiFID 2 entering effect in Europe, research will now be mandated to have a price tag, and that price tag may be one that many smaller investors can’t afford. [Link]

Tech

FANG still has teeth as tech dominance continues by Jack Neele (Robeco)

The ecstasy of near-monopoly and groundbreaking investments in the next wave of tech innovation is starting to face the agony of regulatory risk. [Link]

Odd

Mysterious Strangers Dog Controversial Insurer’s Critics by Mark Maremont (WSJ)

We really can’t sum this odd story about people posing as consultants showing up to do business with critics of a struggling insurance company. [Link; paywall]

GoT

Why ‘Game of Thrones’ fans may have to wait until 2019 for the final season by Kim Renfro (Business Insider)

While Thrones fans are still basking in the glow of last week’s season finale, they’re going to have a long wait for their next chance at catching the dragon. [Link]

Policing

The Militarization of the Hamptons by Joe Nocera (Bloomberg)

If you’re wondering why a town of 50,000 people on Long Island needs a counterterrorism squad complete with AR-15 toting officers dispatched to concerts, you’re not alone. [Link]

Have a great Sunday!

The Bespoke Report — 9/1/17

The Closer: End of Week Charts — 9/1/17

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. This week, we’ve added a section that helps break down momentum in developed market foreign exchange crosses.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

Click here to start your no-obligation two-week free Bespoke research trial now!

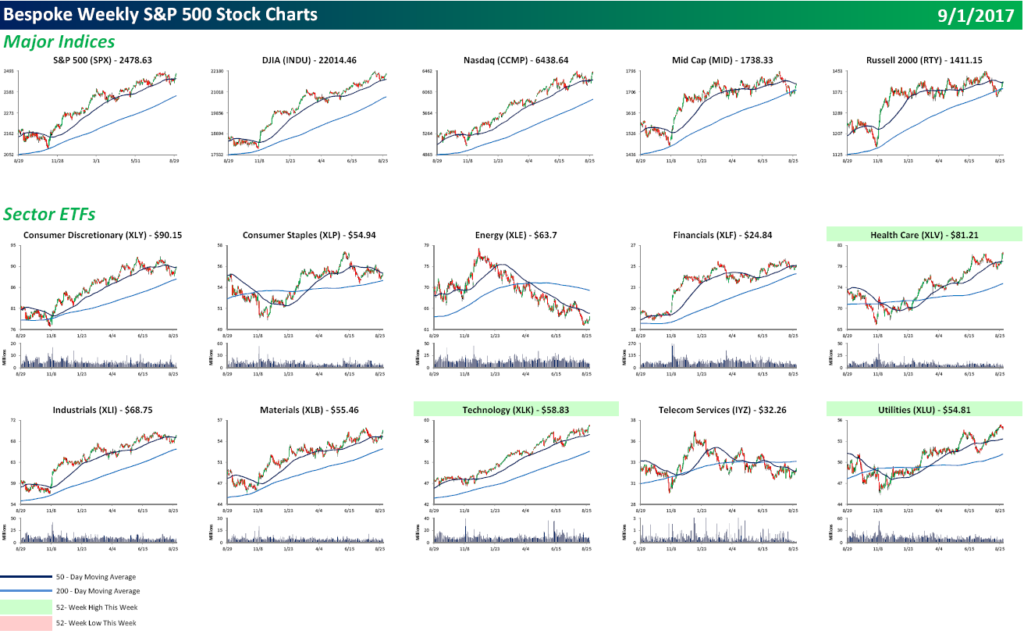

S&P 500 Quickview Chartbook — 9/1/17

Each weekend as part of our Bespoke Premium and Institutional research service, clients receive our S&P 500 Quick-View Chart Book, which includes one-year price charts of every stock in the S&P 500. You can literally scan through this report in a matter of minutes or hours, but either way, you will come out ahead knowing which stocks, or groups of stocks, are leading and lagging the market. The report is a great resource for both traders and investors alike. Below, we show the front page of this week’s report which contains price charts of the major averages and ten major sectors.

To see this week’s entire S&P 500 Chart Book, sign up for a 14-day free trial to our Bespoke Premium research service.