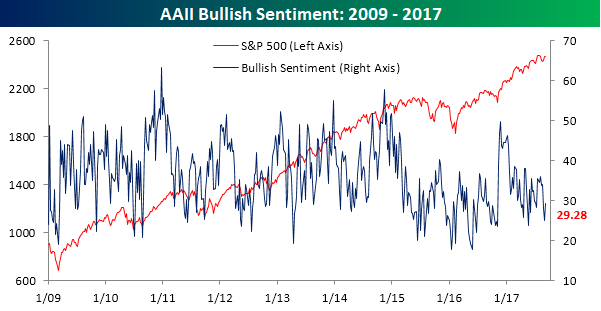

Investor Sentiment Improves From Depressed Levels

In last week’s update on investor sentiment, we noted that the extremely depressed levels of bullishness that we saw in the latest AAII survey seemed “a bit overdone.” In this week’s update, we did see an improvement in optimism, but overall, sentiment remains muted at best. In this week’s survey, bullish sentiment increased from 25.0% up to 29.28%. So even after the increase, bullish sentiment came in below 30% for the third straight week, below 40% for the 34th straight week, and below 50% for a record 140th straight week. In addition to the record 140 straight weeks below 50%, the current stretch of 34 weeks below 40% is also just the third time in the history of the survey that optimism has been below that level for more than 30 weeks, with the prior two streaks coming in 2015 and 2016.

As bullish sentiment increased this week, bearish sentiment ticked lower, falling from 39.89% down to 34.98%, marking the third straight week that bears have outnumbered bulls.

Summer may be ending, but we have just extended our Labor Day Special where you receive a month of full access to any one of our research services for just $1 and then 20% off for the life of the subscription!

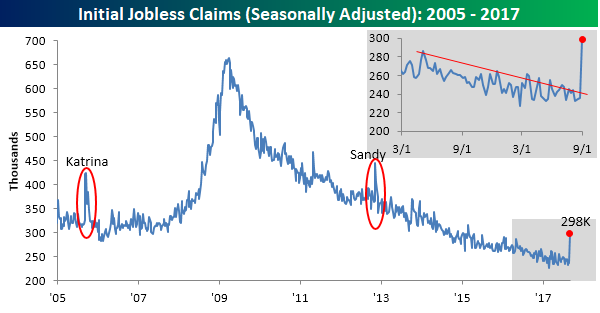

Rise in Jobless Claims Surprises No One (Except Economists)

Jobless claims surged higher this week, rising from 236K up to 298K in what was the largest one week increase since November 2012 in the aftermath of Superstorm Sandy. Given the complete halt to business activity in the Houston region as a result of Hurricane Harvey, this increase should have surprised nobody. As we noted in last week’s post on jobless claims, “All good things must come to an end, though, and because of the impacts from Hurricane Harvey, you can expect that in the next couple of weeks, claims will definitely be rising back above 250K and most like back above 300K as well.” Therefore, the increase in claims was generally expected by most market participants, which is evidenced by the fact that futures had little reaction to the release.

While this week’s surge in jobless claims was expected by just about everybody who looks at it, one group that got it completely wrong were economists. You know, the people who are supposed to be on top of these things! Heading into this week’s report, the consensus forecast for the print was an absurdly low level of 245K. Which causes us to question, how in the world did the people whose jobs it is to track the economy completely miss an increase in jobless claims that was expected by just about everyone else? Looking on the bright side of this week’s report, claims did still manage to remain below 300K, which extended the streak of sub-300K readings to 131 straight weeks! Whether we get to 132 remains a big if. With Hurricane Irma headed for Florida’s most populated region, it may be some time before the weekly claims reading normalizes.

Summer may be ending, but we have just extended our Labor Day Special where you receive a month of full access to any one of our research services for just $1 and then 20% off for the life of the subscription!

The Closer — Habemus Paciscor — 9/6/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we discuss today’s deal on the debt ceiling between Congressional Democrats and the President. We also review US trade data, global trade data, and the market reaction to the debt ceiling news.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See today’s post-market Closer and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research platform!

Chart of the Day: 300+ Days and Counting Above the 200-Day

ETF Trends: Fixed Income, Currencies, and Commodities – 9/6/17

Breadth: It’s All About Perspective

The recent sideways churning of the market that we highlighted in an earlier post has also made its presence felt in the short term breadth of S&P 500 Industry Groups. To highlight this, the top two charts below show the percentage of S&P 500 Industry Groups with rising 50-day moving averages (DMA) and the percentage trading above their 50-DMAs. While the picture is a bit wobbly in the short term with respect to Industry Groups and their 50-DMAs, things have improved somewhat in the last week or two. Less than two weeks ago, fewer than 40% of Industry Groups were above their 50-DMAs or even had rising 50-DMAs. Today, both of these readings are above 50%. Not great, but not necessarily bad either.

Summer may be ending, but we have just extended our Labor Day Special where you receive a month of full access to any one of our research services for just $1 and then 20% off for the life of the subscription!

While shorter term breadth readings have been weaker in the last several weeks than they were earlier this year, long-term readings look considerably more positive. The two charts below are the same as the two above except that instead of using the 50-DMA, they are based on the 200-DMA. Here, we haven’t seen any of the weakness that we have seen with groups relative to their 50-DMAs, and they reinforce the fact that while the short-term technicals have been showing weakness, the long-term backdrop for the market remains solid. As shown, 95.8% of Industry Groups have rising 200-DMAs, and the only one below that level is Energy. Similarly, 87.5% of Industry Groups are currently above their 200-DMAs with the only three trading below being Banks, Energy, and Telecom Services. If the current churning that we have seen in the charts above continues, it will start to show up in the charts below, but for now, the weak breadth remains a short-term as opposed to a long-term issue.

Fixed Income Weekly – 9/6/17

Searching for ways to better understand the fixed income space or looking for actionable ideals in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s note, we review market microstructure in high yield.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here to start your no-obligation free Bespoke research trial now!

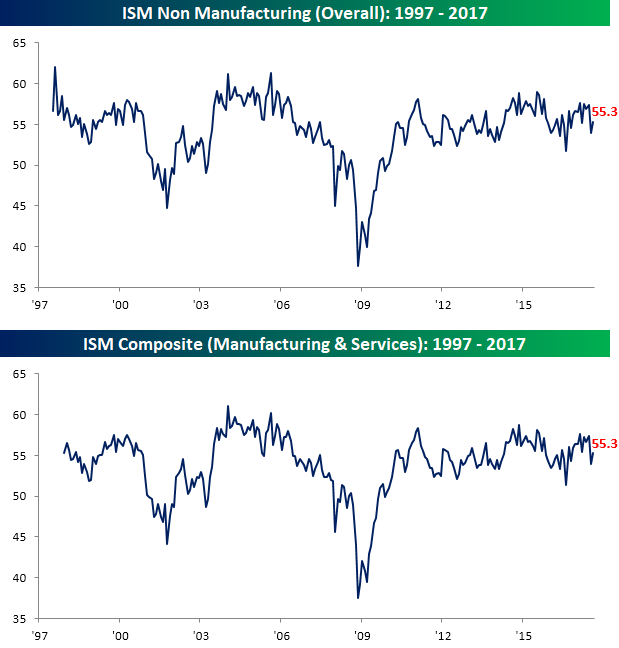

ISM Services Rises Less Than Expected

While last week’s ISM Manufacturing report came in at a six-plus year high, the current environment for the larger services sector was not nearly as strong. While Wednesday’s release of the ISM Non-Manufacturing report for the month of August did improve to 55.3 relative to July’s reading of 53.9, the rebound was not as strong as expected (55.6). Even with the disappointment, though, a reading of 55.3 is still solid. On a combined basis and accounting for each sector’s share of the overall economy, the August combined ISM also came in at 55.3 (second chart).

Summer may be ending, but we have just extended our Labor Day Special where you receive a month of full access to any one of our research services for just $1 and then 20% off for the life of the subscription!

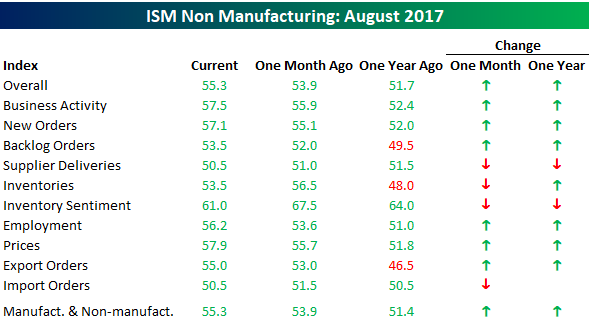

Looking at the internals of this month’s report shows a mixed picture. Of the ten components, six increased on a m/m basis and eight rose relative to their levels from last year. The largest increases this month were in Employment and Prices, while the largest declines were in Inventory Sentiment and Inventories.

Overall Breadth Neutral; Financials Sink

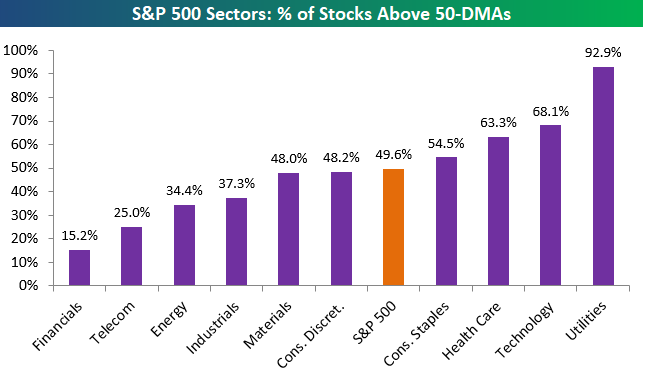

Entering today, 49.6% of stocks in the S&P 500 were above their 50-day moving averages. Below is a chart highlighting this breadth reading over the last year. As you can see, this indicator has put in a series of lower highs as the year has progressed, which indicates that a smaller and smaller number of stocks are participating in each rally.

Summer may be ending, but that means you can take advantage of our Labor Day Special and receive a month of full access to any one of our research services for just $1 and then 20% off for the life of the subscription!

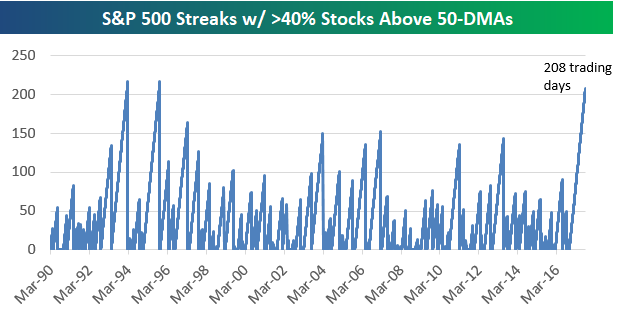

Even though breadth has been weakening throughout the year, it hasn’t gotten outright negative. In fact, 40% or more of stocks in the index have closed above their 50-day moving averages for 208 consecutive trading days. That’s a remarkable streak. As you can see below, the last time we had a streak this long was back in the early 1990s. The longest streak since 1990 is 217 trading days, so we’ll have a new record if the current streak goes on for a couple more weeks.

From a sector perspective, Utilities has the strongest breadth at the moment with 92.9% of stocks above their 50-DMAs. Technology and Health Care rank 2nd and 3rd.

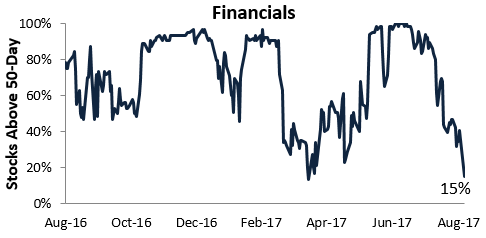

At the bottom of the list is Financials with just 15.2% of stocks above their 50-DMAs. A week ago it was the Energy sector that was struggling, but now it’s the Financials that have begun to break down.

Below is a look at weakening breadth for the S&P 500 Financial sector:

Summer may be ending, but that means you can take advantage of our Labor Day Special and receive a month of full access to any one of our research services for just $1 and then 20% off for the life of the subscription!

Bespoke’s Global Macro Dashboard — 9/6/17

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

Click here to start a no-obligation two-week free trial to Bespoke Institutional!