ETF Trends: International – 9/12/17

Apple (AAPL) Widens the Gap on Alphabet (GOOGL)

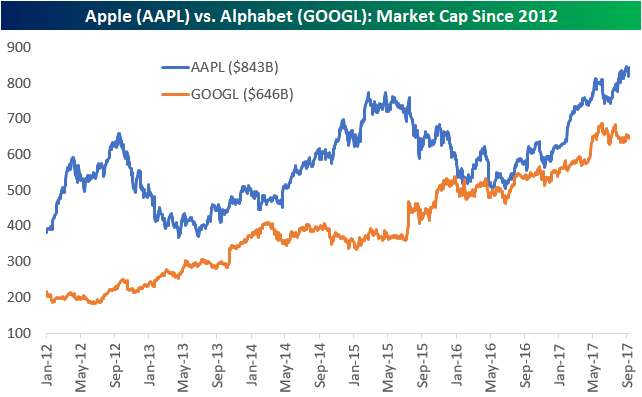

Apple (AAPL) has posted a 40% gain so far in 2017, which has pushed its market cap up to $843 billion as of this writing.

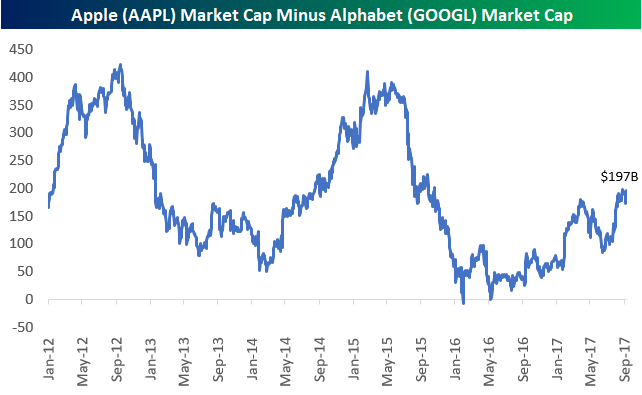

You might not remember, but there was a time last year when Alphabet (GOOGL) overtook Apple (AAPL) as the largest company in the world. That didn’t last long, however, as you can see in the charts below. At this point Apple has a lead on Alphabet of nearly $200 billion in market cap. That’s more in market cap than all but a handful of companies in the S&P 500.

Gain access to 1 month of any of Bespoke’s membership levels for $1!

Chart of the Day: Is The Apple Watch The Biggest Seller In The World?

Bespoke Stock Scores: 9/12/17

Small Business Optimism Tops Expectations

Small business optimism from the NFIB posted a slight increase in August, but that was still more than enough to top consensus expectations. Overall, the index of Small Business Optimism increased from 105.2 up to 105.3, and it was handily above expectations for a level of 104.8. August’s reading represents the second straight monthly increase and puts the index within 0.6 points of its post-election and cycle high.

The table below lists the issues that small business owners consider to be the number one problems they face and how things have changed over the last month. Looking at this month’s results, there was little in the way of changes to what issues are currently bothering business owners the most. Taxes (20%) and Labor Quality (19%) are still the biggest problems for business owners, while Inflation (1%) and Interest Rates (2%) are practically non-existent issues.

The Closer — New Highs and Global Leading Indicators — 9/11/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we take a look at the breadth of the S&P 500 and the breadth of global growth.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See today’s post-market Closer and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research platform!

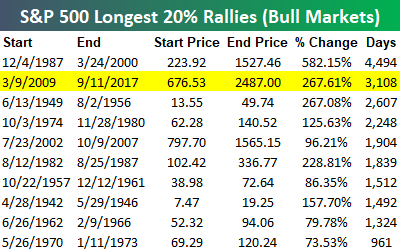

Longest Rally Since…

Back in late July we published a Chart of the Day looking at the current rally and how it ranks in terms of length without a significant pullback of any kind. With the S&P 500 closing at a new all-time high today, it has now been 3,108 calendar days since the last 20% decline (the standard bull/bear market distinction). As shown in the table below of the longest bull markets on record, the current bull is the second longest behind the 4,494 days that passed between December 1987 and March 2000 without a 20%+ pullback.

Today’s close was also a big deal in terms of gains for the current bull market. As shown, the S&P’s gain of 267.61% makes this the second strongest bull market on record as well.

Get Bespoke’s Chart of the Day for a month for just $1 when you sign up for any of Bespoke’s membership levels!

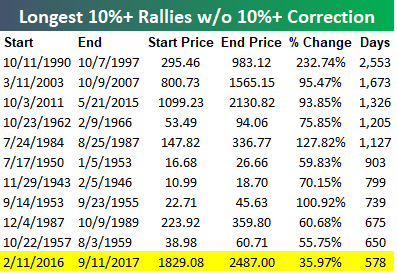

It has also been a long time since the S&P 500 had a 10% correction. As shown, the current streak of 578 days since the last 10%+ correction is the 11th longest on record going back to 1928.

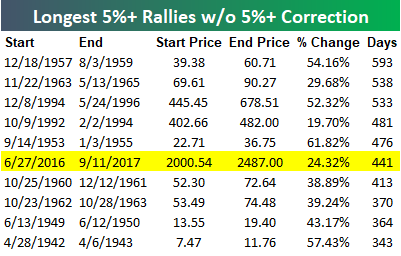

Not only have we not had a 10% correction in more than 18 months, but we also haven’t even had a 5%+ correction since last June. The 441-day streak without a 5%+ correction is the sixth longest on record for the S&P 500.

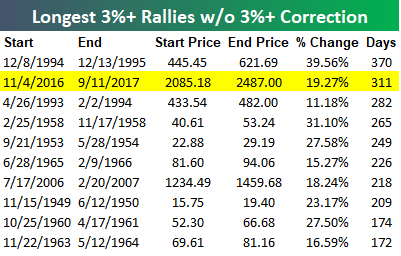

And finally, it has now been 311 days since the S&P 500 last experienced just a 3% pullback. As shown below, this is the 2nd longest streak of all-time without a 3%+ pullback.

To break this record, we’ll need to go another 59 days without declining 3% from today’s close.

Pay just $1 to access any of Bespoke’s premium membership levels for the next month!

Breadth Lagging New Highs

Below is a chart of the S&P 500-tracking SPY ETF from our Interactive Chart Tool platform (use it for free at any time here). If current prices hold, the S&P will make a new all-time closing high today…eclipsing highs last made in early August.

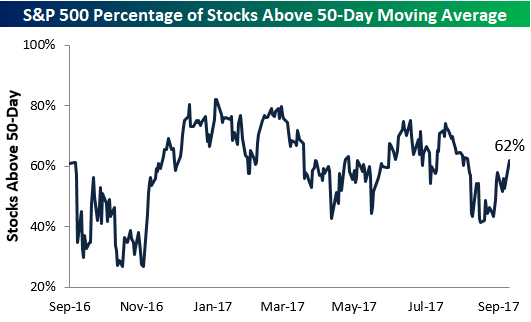

We’ve been covering underlying market breadth quite a bit over the last few weeks, and as shown below, as of this afternoon, 62% of stocks in the S&P 500 are above their 50-day moving averages. We realize the S&P 500 just made a new high today, but 62% is well below prior high points seen for this breadth measure over the last year. We’d like to see it more elevated when a new high for the index is made.

Get full access to any of Bespoke’s membership levels for just $1!

ETF Trends: US Sectors & Groups – 9/11/17

Another New High: Finally

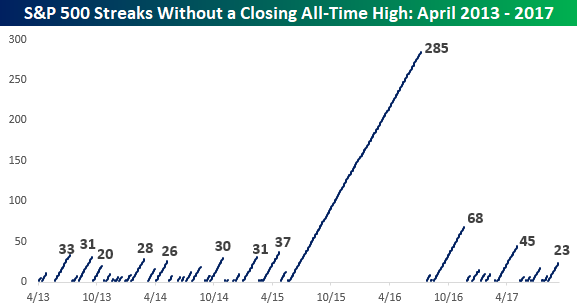

With the S&P 500 poised for an all-time closing high today, bulls are breathing a sigh of relief after what seems like forever since the S&P 500’s last record close. The reality is that the last record closing high for the S&P 500 was just 23 trading days ago. The chart below shows prior streaks for the S&P 500 where the index had consecutive closes without a new all-time high since April 2013 when the S&P 500 made its first record closing high for the current bull market. Shortly before the current streak, the S&P 500 went nearly twice as long without closing at a new high, and then in the period leading up to last November’s election, the length of time without a new high was just about triple the current streak. As if that wasn’t bad enough, before that streak from the middle of last year, we all remember the 285 trading day stretch from May 2015 through July 2016.

All in all, there have been eleven other streaks in the last ~4 years that were about as long or longer than the current streak. This streak may have seemed ‘long,” but that’s more indicative of investors potentially feeling entitled to gains than anything else.

Sign up now and receive full access to any of Bespoke’s membership levels for just $1!