Bespoke Briefs — Cryptocurrencies, Bitcoin, and the Blockchain: An Explainer

B.I.G. Tips – Retail Sales Miss Estimates For Fourth Straight Month

The Closer — All About Inflation — 9/14/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we discuss today’s inflation report and the implications for Fed policy.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See today’s post-market Closer and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research platform!

Bespoke’s Sector Snapshot — 9/14/17

We’ve just released our weekly Sector Snapshot report (see a sample here) for Bespoke Premium and Bespoke Institutional members. Please log-in here to view the report if you’re already a member. If you’re not yet a subscriber and would like to see the report, please start a 30-day trial to Bespoke Premium now.

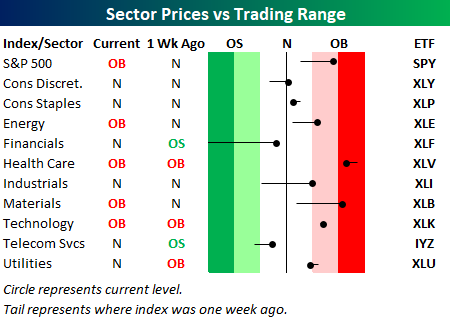

Below is one of the many charts included in this week’s Sector Snapshot, which shows our trading range screen for the S&P 500 and ten major sectors. The dot represents where each sector is currently trading, while the tail end represents where it was trading one week ago. The black vertical “N” line represents each sector’s 50-day moving average. Moves into the red zone are considered “overbought,” while moves into the green zone are considered “oversold.”

As shown, the S&P 500 and four sectors are currently overbought, while none are oversold. The Financial sector has seen a huge move out of oversold territory over the last week as well.

To see our full Sector Snapshot with additional commentary plus six pages of charts that include analysis of valuations, breadth, technicals, and relative strength, start a 30-day free trial to our Bespoke Premium package now. Here’s a breakdown of the products you’ll receive.

S&P 1500 Most Heavily Shorted Stocks

With the latest short interest figures for the end of August being released on Tuesday, we wanted to provide an update to our list of most heavily shorted stocks. Within the S&P 1500 as a whole, there are currently 17 stocks that have more than 40% of the free-floating shares sold short. Topping the list in the most recent update is Applied Optoelectronics (AAOI). You may recall a couple of months ago that we highlighted how well AAOI had performed even though it had more than half of its float sold short. Ironically, just after many shorts covered their bets, the stock cratered. Now, after the fact, the shorts are piling back in the name, pushing short interest to over 70% of its float. That’s higher than it ever got before the fall!

So far this month, shares of AAOI are just barely up, but most of the other most heavily shorted stocks are up a lot more. In fact, the average performance of the 17 stocks listed so far this month was a gain of 10.31% through Wednesday’s close. That average is a bit skewed by the 50%+ gain (yes, 50%!) in RH, but even on a median basis, the stock listed are up over 5% MTD compared to a gain of 1.1% for the S&P 1500 as a whole. Furthermore, only two of the stocks listed are down this month, and neither is down more than 1%.

Gain access to 1 month of any of Bespoke’s membership levels for $1!

ETF Trends: US Indices & Styles – 9/14/17

the Bespoke 50 — 9/14/17

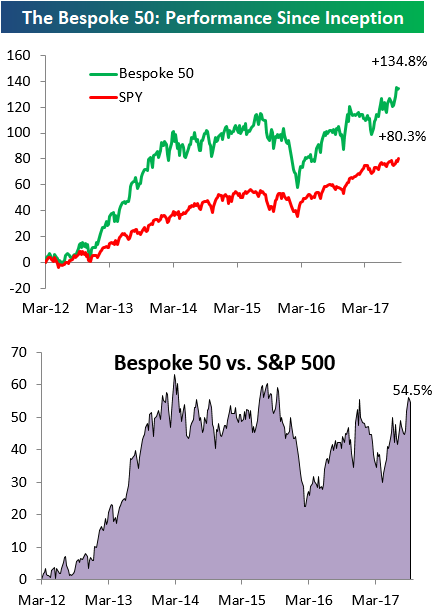

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” has beaten the S&P 500 by 54.5 percentage points. Through today, the “Bespoke 50” is up 134.8% since inception versus the S&P 500’s gain of 80.3%. Always remember, though, that past performance is no guarantee of future returns.

To view our “Bespoke 50” list of top growth stocks, sign up for Bespoke Premium ($99/month) at this checkout page and get your first month free. This is a great deal!

Two-Bitcoin

Here’s a type of chart you don’t see often. Below we show the performance of the Bitcoin Investment Trust (GBTC), which is meant to track (although doesn’t do a particularly good job of if) the performance of the digital currency Bitcoin. At the end of August, this trust was trading for over $1,000 per unit. Today, it’s under $500 and down over 50% for the month of September alone. Don’t feel too bad for long-term holders of GBTC, though; over the last year, it is still up 480%! Does the recent plunge in Bitcoin represent the end of the digital currency mania? Only time will tell, but this certainly hasn’t been the first time over the last few years that people have called the end of the bubble.

Gain access to 1 month of any of Bespoke’s membership levels for $1!

Chart of the Day: Turn East For Auto Sales Growth

Welcome Back Bulls

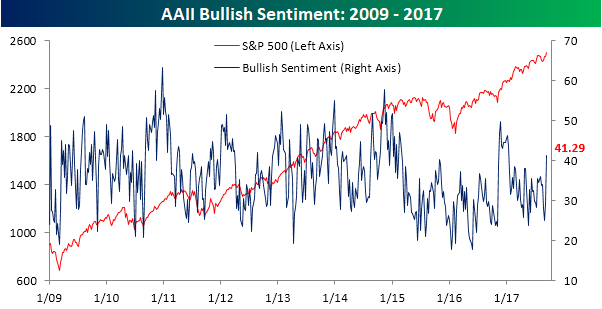

The title of this post contains probably the three words investors who have been bullish want to hear the least. After 34 straight weeks where the weekly AAII sentiment survey showed levels of bullish sentiment below 40%, this week’s survey showed a surge in optimism as the percentage of investors putting themselves in the bullish camp rose from 29.28% up to 41.29%. That’s the largest one week increase in bullish sentiment since the end of April and the highest weekly print since January. Even with this increase, though, bulls have failed to take the majority for a record 141 straight weeks.

Gain access to 1 month of any of Bespoke’s membership levels for $1!

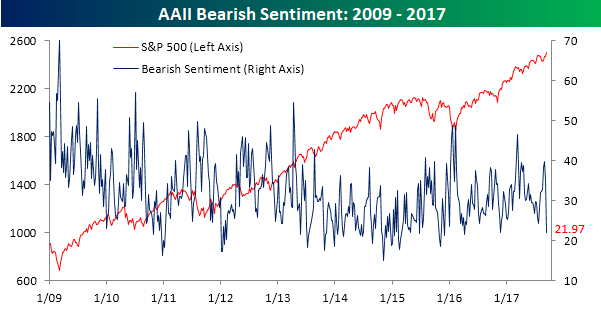

Just about all of the increase in bullish sentiment this week came from investors leaving the bearish camp. From last week’s level of 34.98%, bearish sentiment cratered to 21.97%. The last time bearish sentiment was this low was in early April. Again, while it seems nice to see that investors are increasingly warming up to the market, keep in mind that equities have gotten to these record high levels with little in the way of support from individual investors.