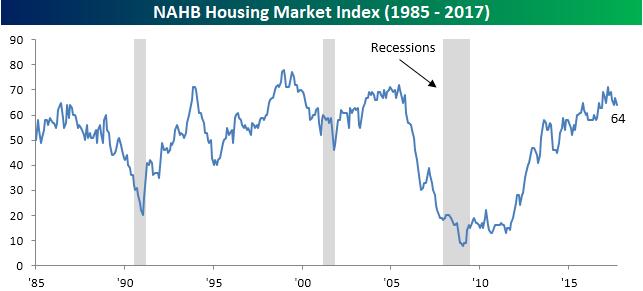

Homebuilder Sentiment Drops More Than Expected

Homebuilder sentiment unexpectedly declined this month as the headline reading dropped from 67 down to 64 compared to consensus estimates for a print of 67. If you had a deja vu moment when the numbers were released, that’s because the consensus estimate and actual print were the exact same as we saw in July. From its high back in May, homebuilder sentiment has now declined by seven points.

Gain access to 1 month of any of Bespoke’s membership levels for $1!

The table below breaks down this month’s report by Present and Future Sales as well as Traffic. In this month’s report, every category saw a decline with both measures of sales taking the biggest hit. For the fourth straight month, Traffic came in below 50, which is the dividing line between positive and negative sentiment.

The chart below breaks down homebuilder sentiment by region. Here, there was a mixed picture. While both the Northeast and West regions saw increases in sentiment, the Midwest and South regions saw sizable declines. In the case of the Midwest, this is the region of the country that saw the biggest improvement in sentiment immediately following the election, but it has now given up all of those post-election gains.

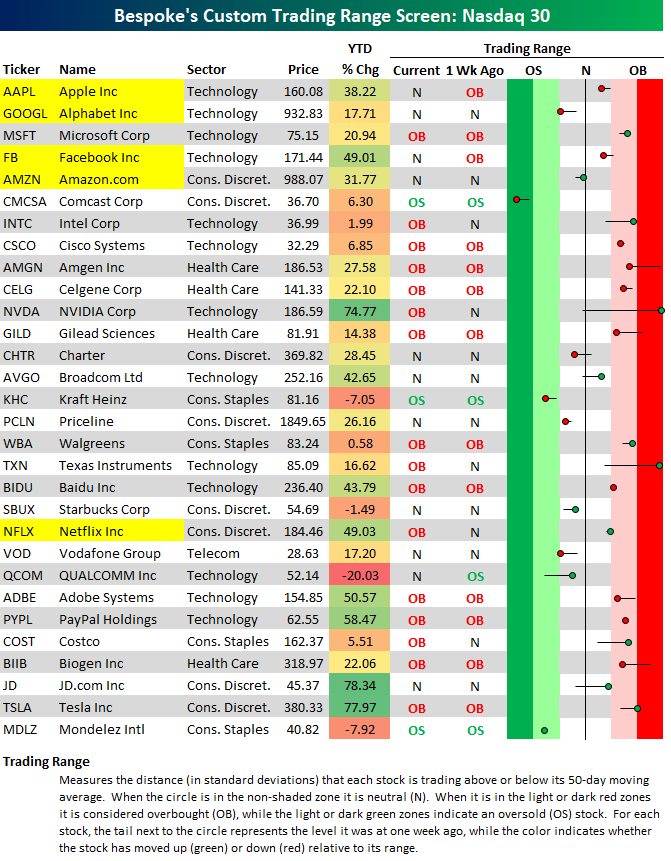

Bespoke’s Trading Range Screen: 30 Largest Nasdaq Stocks

Below is an updated look at our trading range screen for the 30 largest stocks in the Nasdaq 100. The vaunted “FAANG” stocks are highlighted in yellow.

A majority of the stocks listed in our screen are trading in overbought territory, while just three are oversold — CMCSA, KHC, and MDLZ. NVIDIA (NVDA) and Texas Instruments (TXN) are the two most overbought stocks, with both trading 3 standard deviations above their 50-DMAs. Note that Amazon (AMZN) and Alphabet (GOOGL) are both below their 50-DMAs, with GOOGL approaching oversold territory. Facebook (FB) and Apple (AAPL) have pulled back into neutral territory after trading overbought a week ago.

JD.com (JD), Tesla (TSLA), and NVIDIA (NVDA) are up the most on a year-to-date basis, while QUALCOMM (QCOM) is down the most at -20%.

Gain access to 1 month of any of Bespoke’s membership levels for $1!

Gain access to 1 month of any of Bespoke’s membership levels for $1!

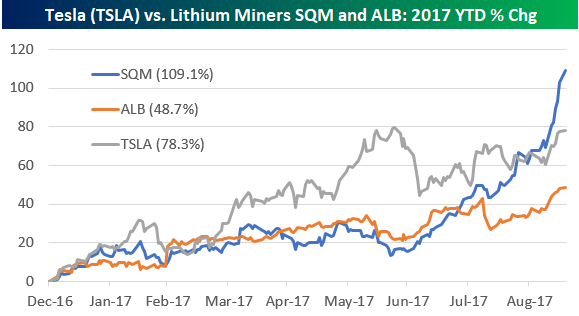

Lithium Producers SQM and ALB Powering Higher

Last week we noted that Tesla (TSLA) had become the largest automaker in the US (if you want to call it an automaker). As shown below using our free Interactive Chart Tool, TSLA has recently broken out of a near-term flag formation, and it’s now approaching all-time highs once again.

Gain access to 1 month of any of Bespoke’s membership levels for $1!

Today we want to look at two companies that are essential to building a battery-powered car. They’re miners and producers of lithium — SQM and ALB. SQM is a Chilean materials company that produces lithium (among many other things). As shown in the one-year chart of SQM below, the stock has basically gone parabolic over the last two and a half months.

Albemarle (ALB) hasn’t had quite the run that SQM has, but its action has been impressive nonetheless. Following its last earnings report on August 7th, ALB fell from $123 to $108 in the span of a week. As shown in the chart below, the stock has already recovered all of its post-earnings losses and then some.

Below is a look at the year-to-date change of TSLA compared to both SQM and ALB. While ALB is underperforming TSLA in 2017, SQM is beating TSLA by more than 30 percentage points. This is quite a remarkable story.

Bespoke Brunch Reads: 9/17/17

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

See this week’s just-published Bespoke Report newsletter by starting a no-obligation two-week free trial to our premium research platform.

Legal Proceedings

Lords of Misrule by Matt Stoller (The Baffler)

A comprehensive account of why so few white collar criminals – especially those on Wall Street – face the full fury of the American legal system. [Link]

A Judge, a Clerk and Secret Recordings: Drama Engulfs a Staten Island Court by Alan Feuer (NYT)

This story reads like something out of a poorly written farce: a judge who won’t let go of control over her criminal court despite her husband serving as DA in the same jurisdiction. [Link; soft paywall]

Investors

‘False Peace’ for Markets? A Trader Is Betting Millions on It by Landon Thomas Jr (NYT)

A profile of Christopher Cole, whose Artemis Capital is making big bets on a significant uptick in volatility in the US equity market. [Link; soft paywall]

Bridgewater’s Ray Dalio Spreads His Gospel of ‘Radical Transparency’ by Alexandra Stevenson and Matthew Goldstein (NYT)

Every preacher needs a fundamental text, and in the case of the world’s largest hedge fund that text is “The Principals”, a quasi-philosophical approach to how he sees the world. [Link; soft paywall]

Europe

Italian banks’ bad loans fall sharply as economy rebounds by Valentina Romei and Thomas Hale (FT)

Banks in Italy have sold billions of bad debt off in portfolios to third party investors, reducing the aggregate stock of non-performing loans on their balance sheets by about 15%. [Link; paywall]

Agriculture

How the Potato Changed the World by Charles C. Mann (Smithsonian)

The fifth-most important crop worldwide is the humble potato, brought to Europe, Asia, and Africa from the Americas almost half a millennia ago, fundamentally disrupting how humans eat. [Link]

Profiles

Harrison Ford on Star Wars, Blade Runner, and Punching Ryan Gosling in the Face by Chris Heath (GQ)

Call us corny, but we’ve always thought Harrison Ford was just…cool. There’s really no other way to put it, and we don’t think you’ll walk away from this interview thinking otherwise. [Link]

A Most American Terrorist: The Making of Dylann Roof by Rachel Kaadzi Ghansah (GQ)

Gut-wrenching, horrifying, and deeply disturbing: dive into the world of Dylann Roof, the white supremacist terrorist who murdered 10 people while they were attending bible study at their church in Charleston, South Carolina. [Link]

“Real” Estate

A 58-story skyscraper in San Francisco is tilting and sinking — and residents say their multimillion-dollar condos are ‘nearly worthless’ by Melia Robinson (Business Insider)

Since completion in 2008, a rise in San Francisco has sunk 17 inches and tilted 14 inches, built on packed sand instead of bedrock and surrounded by other construction. [Link]

Economic Musings

A Few Words on the Dollar by Brad Setser (Council on Foreign Relations)

Setser is being modest with his “few words”: this is a very dense but digestible piece on the value of the dollar and its impacts on the economy both to the upside and the downside. [Link]

The Rise and Fall of Mexican Migration by Adam Ozimek (Moody’s)

Contrary to every popular narrative in politics and culture, immigration from Mexico to the US has fallen to zero net flow; what’s more, shifting demographics mean that a return to inflows from Mexico to the US is almost certainly not going to happen. [Link]

Who Owns The Wealth In Tax Havens? Macro Evidence And Implications For Global Inequality by Annette Alstadsæter, Niels Johannesen, and Gabriel Zucman (NBER Working Papers)

Using new data, the authors estimate the share of global wealth by country held in tax havens, with some incredible results including wealth equivalent to more than half of GDP in some countries held in tax havens. [Link; 34 page PDF]

EVs

China Fossil Fuel Deadline Shifts Focus to Electric Car Race (Bloomberg)

The world’s largest auto market has decided to do away with the internal combustion engine and join developed countries like the UK and France in pursuing that goal. [Link; auto-playing video]

Have a great Sunday!

The Closer: End of Week Charts — 9/15/17

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. This week, we’ve added a section that helps break down momentum in developed market foreign exchange crosses.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by joining Bespoke Institutional at our special $1 introductory rate!

S&P 500 Quickview Chartbook – 9/15/17

Each weekend as part of our Bespoke Premium and Institutional research service, clients receive our S&P 500 Quick-View Chart Book, which includes one-year price charts of every stock in the S&P 500. You can literally scan through this report in a matter of minutes or hours, but either way, you will come out ahead knowing which stocks, or groups of stocks, are leading and lagging the market. The report is a great resource for both traders and investors alike. Below, we show the front page of this week’s report which contains price charts of the major averages and ten major sectors.

To see this week’s entire S&P 500 Chart Book, sign up for a 14-day free trial to our Bespoke Premium research service.

The Bespoke Report — 9/15/17

ETF Trends: Hedge – 9/15/17

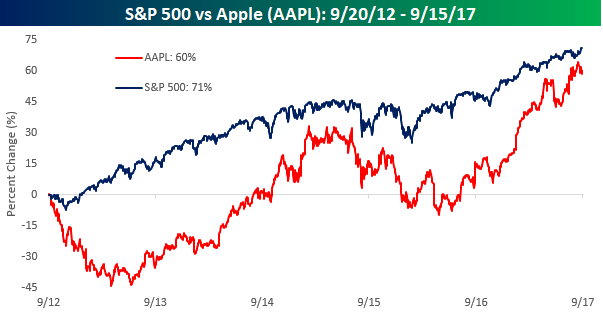

Apple Plays Catch Up

One popular knock against Apple is that rather than being innovative, the company merely copies existing technology and makes it more user friendly. For that reason, whenever the company announces a new phone or product, you always hear how the new model is finally ‘catching up’ to offerings from Samsung or another company. With regards to its stock price, no one would ever accuse Apple of needing to play catch up. After all, the stock is up 38% this year, which is more than three times the gain of the S&P 500. What you may not realize is that you could say that this year’s strong performance is just an example of Apple’s stock playing ‘catch up’ to the broader market. It may sound hard to believe, but since the iPhone 5 first went on sale in September 2012, shares of Apple are up 60%. The S&P 500, however, is actually outperforming Apple by eleven percentage points for a gain of 71% over the same time period.

Gain access to 1 month of any of Bespoke’s membership levels for $1!

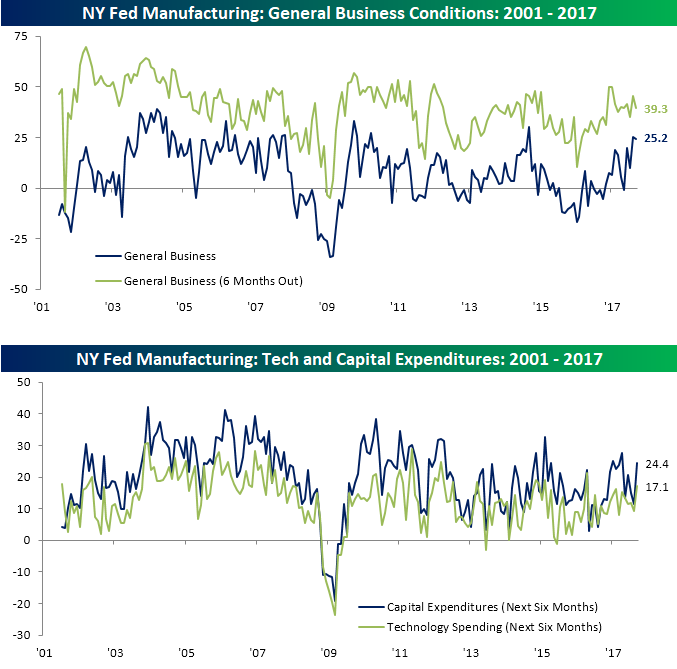

Empire Manufacturing Bucks the Trend

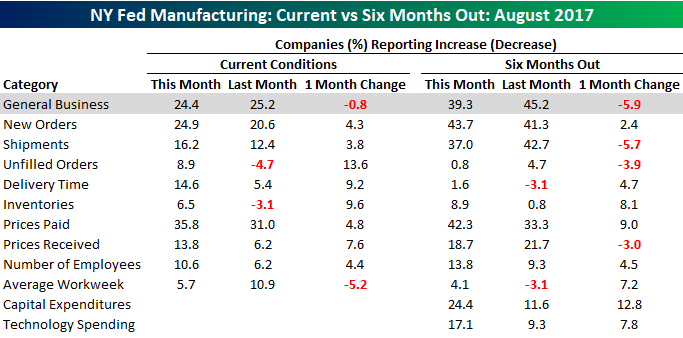

Although a number of economic reports disappointed compared to expectations today (9/15), the Empire Manufacturing report bucked the trend and handily surpassed consensus expectations. While economists were expecting the September reading to come in at 18.0, the actual reading showed a much smaller decline relative to last month’s reading of 25.2 and came in at 24.4. Given it’s a regional report far removed from Texas and Florida, the damage of Hurricanes Harvey and Irma had little impact. While current business conditions saw little in the way of a change this month, expectations for the next six months took more of a hit (although still small). Overall plans for Cap Ex and Technology Spending saw nice rebounds this month and are both either at or near their highs of the year.

Gain access to 1 month of any of Bespoke’s membership levels for $1!

The table below breaks out this month’s report by each of its components. While the headline General Business Conditions Index declined this month, the only sub-sector to see a decline was the average workweek. Likewise, looking out over the next six months, not a single sub-sector saw as large of a m/m decline has the headline index, and most actually increased.

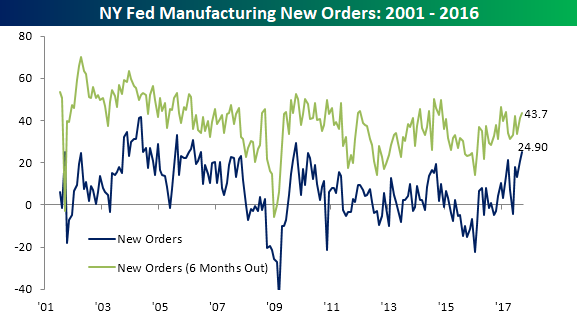

Finally, one sub-sector we wanted to specifically highlight this month was the New Orders component of the report. At a level of 24.90 this month, the current conditions for New Orders reached its highest point since October 2009! Where weather wasn’t an issue this month, it appears as though economic activity remained solid.