ETF Trends: International – 9/19/17

Chart of the Day: Extreme A/D Line Readings for the Energy Sector

Housing Starts and the Economic Cycle

In our earlier post on Housing Starts and Building Permits, we highlighted how uncommon back to back better than expected readings in both reports have been in recent history. Strong economic data is obviously a positive for the economy, but in this post, we wanted to illustrate how housing data and the economic cycle have interacted with each other over time.

The chart below shows historical levels of Housing Starts (on a 12-month average basis) going back to 1967 with economic recessions shaded in gray. Looking at this chart, two things stand out. First, even after more than eight years of recovery, current levels of Housing Starts are closer to levels seen at the depth of recessions rather than late in an economic cycle. The second thing that stands out is that ahead of every prior recession since 1967, Housing Starts peaked and began to roll over well in advance of the economy’s peak. With current levels of Housing Starts right near their highs of the cycle, that would imply that any possible recession would still be months out from here.

Gain access to 1 month of any of Bespoke’s membership levels for $1!

Looking at the current period in more detail, the chart below shows the 12-month average of Housing Starts and Building Permits going back to 2010. In this chart, you can see that average levels of Housing Starts, while not rolling over, are actually showing some signs of leveling off in the last three months. Building Permits, on the other hand, continue to march higher to new cycle highs, so that bodes well for the future.

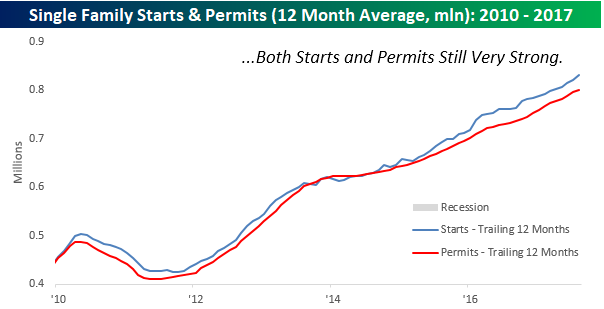

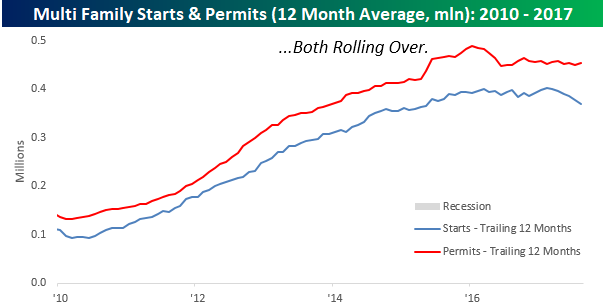

As mentioned in our earlier post, trends in single-family Housing Starts and Building Permits both have shown relative strength versus trends in multi-family units. Because single-family units tend to have more of an economic impact than multi-family units, this is a positive signal. The 12-month averages for single-family Starts and Permits show this trend as both are continuing to trend higher to their best levels of the cycle. Multi-Family units, however, aren’t looking nearly as positive with starts peaking back in February, while Permits topped out all the way back in January 2016.

Housing Starts and Building Permits Top Expectations

Despite a possible negative impact from Hurricane Harvey, both Housing Starts and Building Permits for the month of August came in better than expected. As shown above, the beat in Building Permits was especially impressive as there hasn’t been a bigger ‘beat’ versus expectations since November 2015! Furthermore, this month’s better than expected report comes on the heels of July’s reports which also exceeded expectations. How often do both Housing Starts and Building Permits exceed expectations for two straight months? Not often. At least not in recent history; the last occurrence was nearly five years ago in October 2012.

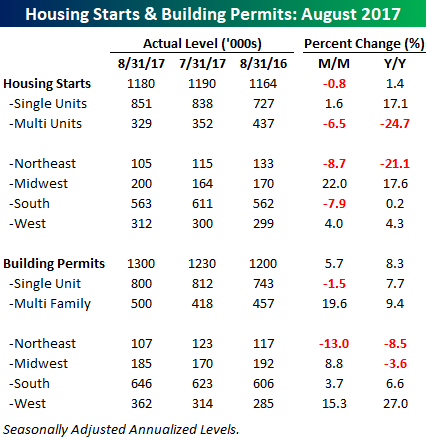

The table below breaks down this month’s report by region and size of unit. While overall housing starts were down this month, all of the weakness was in multi-family units which were down 6.5% m/m and by nearly a quarter y/y. Single-family units, on the other hand, rose 1.6% m/m and are up over 17% versus this point last year. As a result of these moves, even though overall Housing Starts are down by nearly 150K from their peak last October, single-family starts are just 26K off their peak. For Building Permits, it is a similar story as single-family starts are within 30K of their cycle peak, while multi-family units are down by over 160K.

Gain access to 1 month of any of Bespoke’s membership levels for $1!

Bespoke Stock Scores: 9/19/17

The Closer — Global Breadth, International Flows, & Industry Inflation — 9/18/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we review relative performance of global equity sectors, as well as breadth for each. We then recap monthly international capital flows data from the US Treasury and review industry-level inflation over the past decade.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See today’s post-market Closer and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research platform!

ETF Trends: US Sectors & Groups – 9/18/17

Wasn’t September Supposed to Be a Bad Month For Stocks?

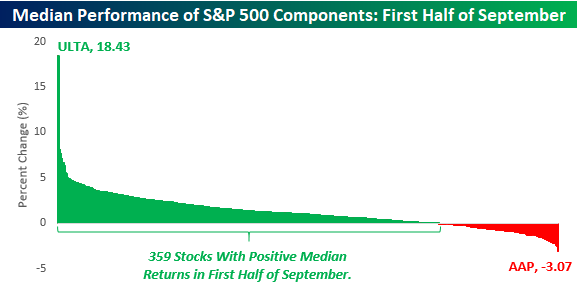

For all the talk about how bad a month September has historically been for US equities, this September surely isn’t fitting the mold. Through Monday afternoon, the S&P 500 has gained 1.4%, which is a good return for the first half of any month, let alone the month that has historically been weaker than any other month. Looking a little bit deeper, though, it should be noted that the first half of September has historically been considerably stronger than the second half of the month. The chart below shows a distribution of the median returns for every stock in the S&P 500 during the first half of September over the last ten years. As you can plainly see, well over half of the stocks in the index have seen gains during the first half of the month; 359 to be exact. Overall, the median return for each stock in the S&P 500 is 1.02% with Ulta Beauty (ULTA) leading the way higher with a median gain of 18.43%, while Advanced Auto Parts (AAP) brings up the rear falling 3.07%.

Gain access to 1 month of any of Bespoke’s membership levels for $1!

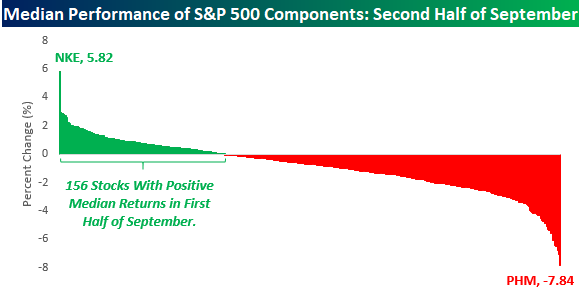

The first half of September may historically be positive, but the picture changes considerably in the second half of the month. During this period, just 156 S&P 500 components have positive median returns, and the median return for all 500 stocks is a decline of 0.72%. Leading the way higher during the second half of September, shares of Nike (NKE) have seen a median gain of 5.82%, while Pulte Group (PHM) leads the way to the downside with a median decline of 7.84%. Just to further illustrate how much weaker the second half of September has been relative to the first half on a historical basis, while just one stock (AAP) has seen a median decline of 3% during the first half of the month, 52 stocks in the index have been down more than 3% during the second half of September.