Living in Mom and Dad’s Basement Watching Netflix Isn’t Cool Anymore?

As noted in a post earlier today, Consumer Confidence for the month of September came in slightly weaker than expected. Within each month’s report, there are a number of ways confidence levels are broken out which always uncovers some interesting trends. Two of the most interesting ways to track sentiment is by looking at both income and age.

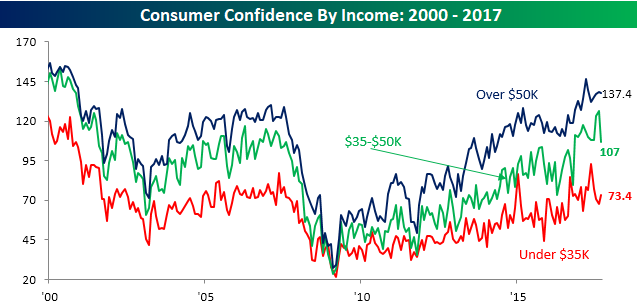

Starting with income levels, there was a real disparity in month/month changes in September. While lower income and higher income consumers saw their confidence levels increase (lower income) or stay steady (upper income), confidence among consumers with incomes of between $35K and $50K plummetted to its lowest level since last October. A lot of President Trump’s base comes from this income group, so if their confidence levels continue to decline, it could spell further trouble for the President in the polls.

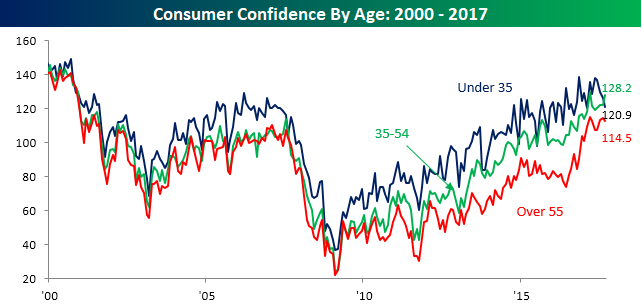

Looking at confidence levels by age shows an even more fascinating move. While overall confidence levels showed a slight decline this month, based on age, they were all over the map. Among consumers over the age of 55, the overall confidence level showed a slight decline but still remains right near its highs of the cycle. Middle-aged consumers (aged 35-54), however, saw an increase in optimism with overall confidence increasing from 122 up to 128.2. Where we saw the largest move in confidence, though, was among consumers under the age of 35. In this cohort, overall confidence fell from 126.6 down to 120.9.

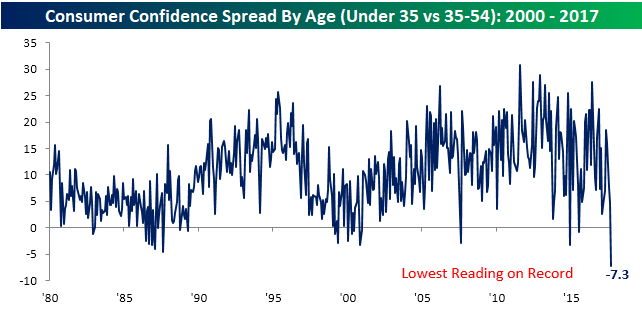

Looking at the chart above, you can see that confidence among younger consumers is almost always greater than older consumers. Looking more closely, though, you can see that in this month’s report middle-aged consumers actually have a higher level of confidence than younger consumers. Looking back over time, it’s uncommon enough that you see this type of reversal, but the magnitude of the current reversal has never been greater. As shown, going back to 1980, the negative 7.1 point spread in confidence among younger consumers (under 35) and middle-aged consumers (35-54) has never been wider. Alas, it was only a matter of time before the idea of living in mom and dad’s basement watching Netflix and piggybacking off their cell phone family plans lost some of its luster.

Gain access to 1 month of any of Bespoke’s membership levels for $1!

Consumer Confidence Slightly Weaker

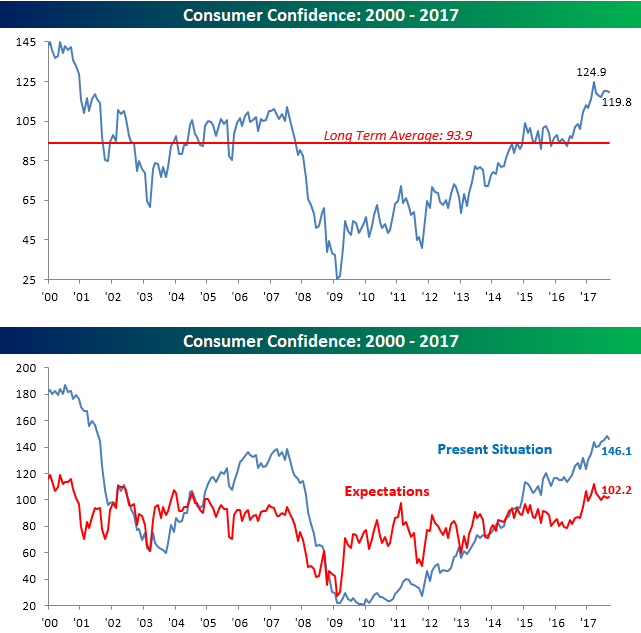

Consumer Confidence for the month of September showed a slightly larger than expected downtick, falling from 120.4 down to 119.8 compared to expectations for a drop to 120.0. While overall confidence is down a little over five points from its recent high, it remains comfortably above its long-term historical average of 93.9. Breaking out this month’s report by Present Situation and Expectations, while the Present Situations index pulled back slightly from its cycle-high, the Expectations component actually saw a slight increase.

Gain access to 1 month of any of Bespoke’s membership levels for $1!

Within this month’s report, one aspect that was interesting was the breakdown of consumers expecting higher or lower stock prices. As shown in the chart below, the percentage of consumers expecting equity prices to rise has fallen to 38.4% from a recent high of 47.1% in March. Conversely, the percentage of consumers looking for lower stock prices has risen from just 20.2% earlier this year up to 27.8% in September. While investors are certainly not as bearish as they were earlier in this bull market, there are still a lot of consumers who view the stock market with trepidation. From a contrarian perspective, that’s a healthy sign.

Chart of the Day: Dollar Back Above Its 50-DMA

Bespoke Stock Scores: 9/26/17

Industrials Sector on Fire

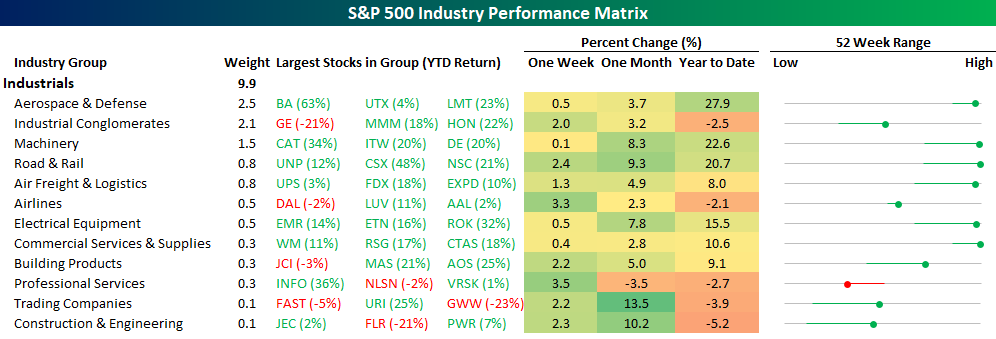

If you ever played the video game NBA Jam, you are no doubt familiar with the point in the game where a player would start to shoot so well that their hands would literally catch on fire. It was at that point that the player could temporarily shoot from anywhere on the court and the ball would go in accompanied by the announcer shouting, “He’s on fire!” In the market right now, the Industrials sector is on fire. While the various groups within the sector have seen mixed returns on a YTD basis, over the last week they have all traded higher. Besides the Energy sector, where there are just two industries, no other sector has seen every industry within it trade higher over the last week

The graphic below is from our S&P 500 Industry Performance Matrix which summarizes the performance of the S&P 500’s 60+ Industries showing each one’s weight in the S&P 500, its performance over various time periods, and the performance of its most heavily weighted stocks. In the charts to the right of each industry, we show where each group currently sits with respect to its one-year range (circle) as well as where it was a month ago (red or green tail). When the circle and tail are red, it indicates that the group has traded lower in the last month, while green indicates groups that have traded higher.

In the case of the Industrials sector, it’s practically all green across the screen with six out of the twelve industries trading at or right near 52-week highs. Some of the strongest performers over the last week have been Professional Services, Airlines, Road & Rail, Construction & Engineering, Trading Companies, Building Products, and Industrial Conglomerates. All seven of these groups are up at least 2% in the last week and in the case of Professional Services, as much as 3.5%. On top of that, while Aerospace & Defense, the sector’s largest group, hasn’t exactly been a leader in the last week, it is still up over 25% on the year driven by a 63% gain in Boeing (BA).

The recent gains in the Industrials sector have been a great change of pace for a sector that for much of the year hadn’t really been a market leader. Like the hot players in NBA Jam, you can only stay “On Fire” for so long.

Gain access to 1 month of any of Bespoke’s membership levels for $1!

The Closer — Earnings Review, Capex Outlook, Dollar Bottoming — 9/25/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we review recent earnings trends by sector in the S&P 500, update tracking of US capex expectations, and review the outlook for the US dollar as it looks to test its 50-DMA after 99 closes below it.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See today’s post-market Closer and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research platform!

ETF Trends: Hedge – 9/25/17

Chart of the Day: Facebook Faceplant

Bespoke Stock Seasonality: 9/25/17

Gas Prices Retreat From Hurricane Highs

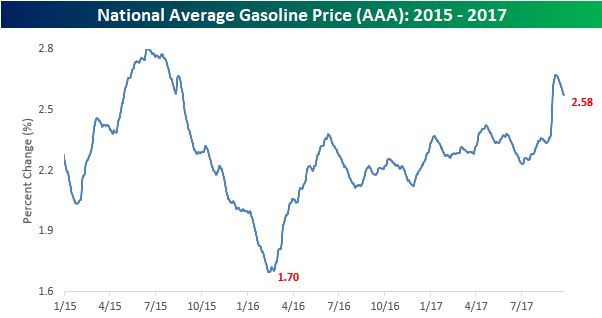

After a 15% spike from late August through early September, gas prices have started what has been a welcome retreat from their recent hurricane highs. According to AAA, the national average price of gasoline currently stands at $2.58 per gallon, which is down close to 4% from the recent high on 9/10 but still up 10% versus where it was before Hurrican Harvey started spinning in the Atlantic. Even after the recent spike, though, the national average price of a gallon of gas never quite made it to the highs we saw back in early 2015 before prices really began to crater and bottomed out at $1.70.

Gain access to 1 month of any of Bespoke’s membership levels for $1!

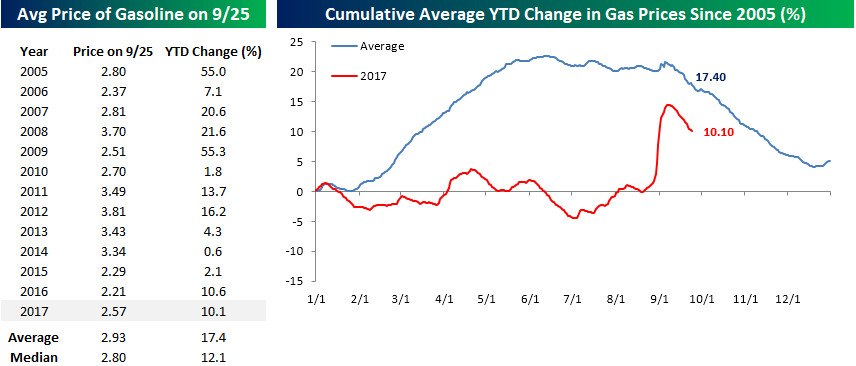

The table below compares the YTD change in gas prices this year to where prices were at the same point in prior years dating back to 2005. The recent surge in prices also wasn’t enough to push the YTD gain to an above average move. While prices so far in 2017 are up 10.1%, that is well below the average move of 17.4% for all years since 2005 and ranks as the sixth smallest YTD gain over the last thirteen years.

The chart to the lower right compares this year’s YTD change in gasoline prices and compares it to a composite of how average prices trend throughout the year going back to 2005. If the rest of this year follows the typical seasonal pattern, you can expect the recent pullback in gas prices to continue throughout the rest of the year.

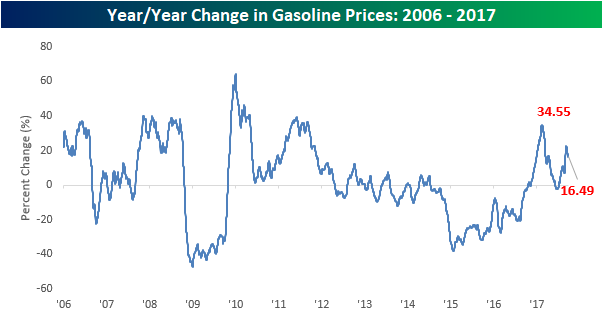

Finally, the chart below shows the y/y change in gas prices over time. Earlier this year, the y/y change in prices spike to 34.6% as the base effects from the 2016 lows reached their peak. In the most recent leg higher, the y/y change in prices peaked at just 16.5% highlighting how in the perspective of longer-term history, the most recent hurricane-induced surge in gas prices wasn’t that large.