ISM Manufacturing Report in a Word – Strong

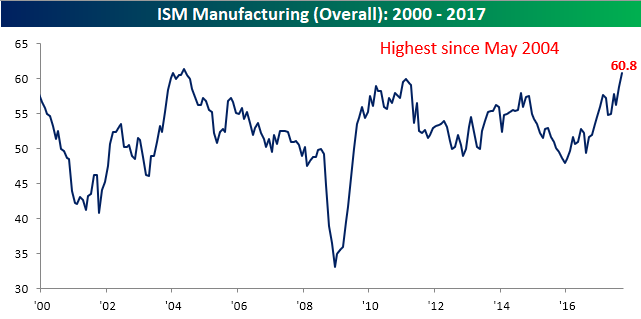

The ISM Manufacturing report for the month of September came in significantly ahead of expectations, topping 60 for the first time in over 13 years. While economists were forecasting the headline index to come in at a level of 58.1, the actual reading came in at 60.8. Relative to expectations, September’s report was the strongest since October 2014, and on an absolute level, this month’s print was the highest since May 2014.

Gain access to 1 month of any of Bespoke’s premium membership levels for $1!

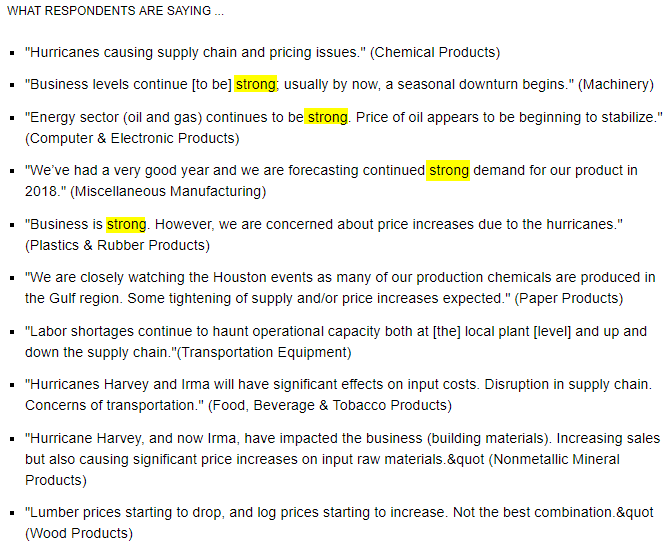

Looking at the commentary of each month’s report helps to get an idea of what issues manufacturers face, and besides the short-term disruption caused by the hurricanes, one word that stands out is “strong.”

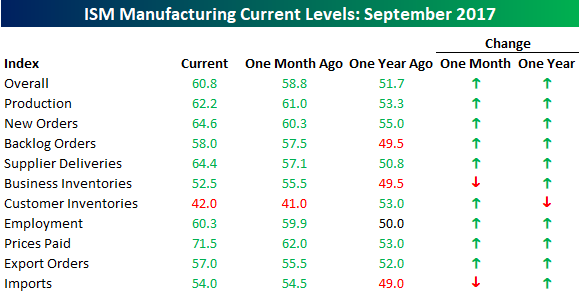

The table below shows the m/m and y/y changes in the headline ISM Manufacturing index and each of its subcomponents. On a m/m basis, the only components that declined this month were Business Inventories and Imports. On the upside, the biggest increases were in Prices Paid, Supplier Deliveries, and New Orders. Year/year, Customer Inventories was the only component that declined.

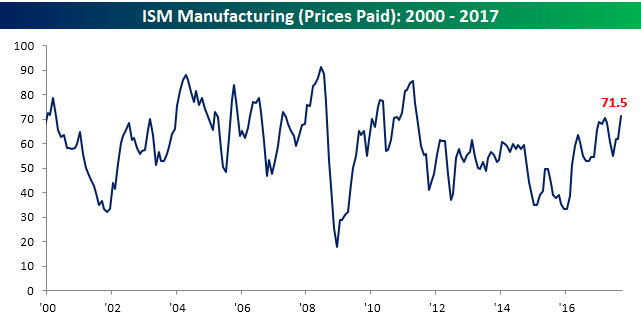

In terms of Prices Paid, this month’s increase was notable as the 9.5 point increase brought that index up to its highest level since May 2011.

Gain access to 1 month of any of Bespoke’s premium membership levels for $1!

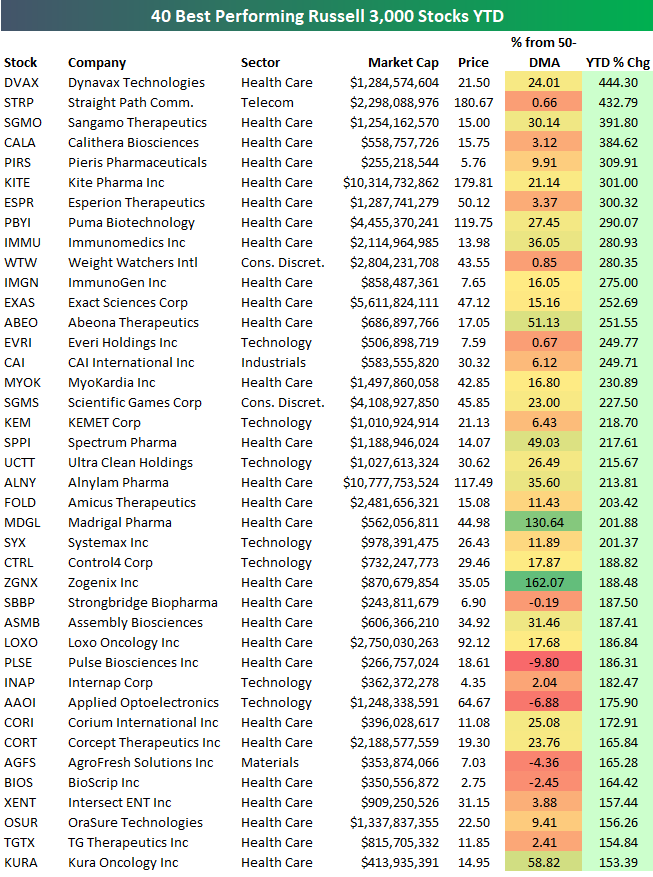

Best Performing Stocks YTD Through Q3 2017

Below is a list of the 40 best performing Russell 3,000 stocks on a year-to-date basis through the third quarter of 2017. You’ll notice that a bulk of the names on the list of biggest winners are from the Biotech space. Dynavax Tech (DVAX) ranks first with a YTD gain of 444%. Straight Path (STRP) ranks second at +432.79% but it’s in the process of getting acquired after a bidding war for the company’s valuable sprectrum. Sangamo Therapeutics (SGMO), Calithera Biosciences (CALA), and Pieris Pharma (PIRS) round out the top five. Eight of the top nine are Biotech stocks, and then Weight Watchers (WTW) ranks tenth with a gain of 280%.

Gain access to 1 month of any of Bespoke’s premium membership levels for $1!

Because so many Biotech companies top the list of winners this year, below is a list of the 40 best performing non-Biotech names in the Russell 3,000. There are 8 companies listed that are up more than 200% year-to-date, including Everi (EVRI), CAI Intl (CAI), Scientific Games (SGMS), and Ultra Clean (UCTT). Other notables on the list include Control4 (CTRL), Lumber Liquidators (LL), Cutera (CUTR), LendingTree (TREE), National Beverage (FIZZ), and Square (SQ). If you have some time this week, browse through these names to see what the back-story is behind the big outperformance this year.

Bespoke Stock Seasonality Report: 10/2/17

Bespoke Brunch Reads: 10/1/17

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

See this week’s just-published Bespoke Report newsletter by starting a no-obligation two-week free trial to our premium research platform.

Investing

Meet Wall Street’s New King Makers: the ETF Strategists by Asjylyn Loder (WSJ)

With centrally managed portfolios of ETFs becoming more common, cross-market impacts can often be tied back to single decisions makers allocating huge volumes of cash. [Link; paywall]

Clean Energy

London summit 2017: Breaking Clean by Michael Liebreich (Bloomberg New Energy Finance)

Don’t be scared off by the daunting page count – many of these slides have only a few words and it’s a much quick read than you might expect at 170+ pages. Liebreich gives an excellent recap of where non-carbon energy has come from, and where it’s going, including some downright hilarious pessimism about the growth of installed capacity from forecasters. [Link; 171 page PDF]

What’s Old Is New Again

The History of Sears Predicts Nearly Everything Amazon Is Doing by Derek Thompson (The Atlantic)

While Amazon’s ethos seethes disruption and innovation, it’s taking a truly remarkable number of pages from the playbook of Sears, the first American company to offer ubiquitous home delivery. [Link]

The Oil Ghost Towns of Texas by Dan Murtaugh (Bloomberg)

West Texas has been home to booms and busts in the oil industry since oil was first discovered in the region and the current crop of busts is part of that long heritage. [Link]

Economics

Labor Market Outcomes in Metropolitan and Non-Metropolitan Areas: Signs of Growing Disparities by Alison Weingarden (FEDS Notes)

Part of a growing focus on distributional growth analysis, this paper does an excellent job analyzing the disparities between large metros and rural metros in terms of employment and wages. [Link]

Demographic Transition and Low U.S. Interest Rates by Carlos Carvalho, Andrea Ferrero, and Fernanda Nechio (FRBSF Economic Letter)

An econometric analysis of the impact of low population rates and an aging population on the real neutral rate of interest. [Link]

An Inflation Expectations Experiment by Carola Binder (Quantitative Ease)

Do consumers’ unrealistically high inflation expectations respond to priming by seeing charts of actual inflation rates or learning about the Fed’s 2% target? Indisputably, yes. [Link]

Asia

The IMF’s China Problem by Brad W. Setser (Council On Foreign Relations)

The macro imbalances of China (excessive credit growth, a huge fiscal deficit) should result in a very high current account deficit, but the absurd savings rate in China (~46% of GDP) means that the 1% current account surplus would be roughly 4-5x as high without imprudent domestic policies. The real problem is not China’s current account surplus: it’s the savings rate. [Link]

The Lamps are Going Out in Asia by Joseph Dethomas (38 North)

We acknowledge this column is somewhat alarmist, but still think the logic it uses is worth considering and should be read: the current North Korean situation really does look like the summer of 1914 in Europe in many ways. [Link]

Productivity

Study: Women with more children are more productive at work by Ylan Q. Mui (WaPo)

St. Louis Fed researchers show in a recent paper that working economists with children are much more productive than their peers (as measured by output of papers). [Link; soft paywall]

Politics

Trump’s State-Tax Plan Could Cause Headaches for 52 Republican Lawmakers by Sahil Kapur (Bloomberg)

With Senate rules limiting the scale of budget impact for tax cuts wanted by GOP lawmakers, they’re forced to find pay-fors and have targeted the state and local tax deduction. Only problem? That deduction splits the Republican caucus badly in the House, where a unified front is needed to pass the package without Democrats. [Link]

Have a great Sunday!

The Bespoke Report – Everyone Gets a Trophy!

With two new closing highs this week, and a total of nine in September, the new closing highs for the S&P 500 are really starting to pile up. Year to date, there have now been 39 closing highs, which puts the index on pace for 52 new closing highs on the year. The last time we saw more was in 2014, but before that you have to go back to 1995 when there were 77. In the index’s history, there have only been more than 50 closing all-time highs four other times (1961, 1964, 1995, and 2014). That’s some impressive company!

If you’d like to read our thoughts on recent performance plus our outlook for the rest of the year, check out our weekly Bespoke Report. Sign up for a month to any of Bespoke’s premium membership levels for just $1!

With the third quarter coming to an end today, earlier today we did a post updating our asset class performance matrix using key ETFs traded on US exchanges. This is a great way to quickly see how various asset classes are performing on a total return basis. Looking through the performance figures, one thing that is hard to find is losers! Year to date, only five of the 58 ETFs in the matrix were down, and in Q3 just four were down. Call us crazy, but with everything seemingly winning, is the market starting to resemble kids little league?

If you’d like to read our thoughts on recent performance plus our outlook for the rest of the year, check out our weekly Bespoke Report. Sign up for a month to any of Bespoke’s premium membership levels for just $1!

Have a great weekend!

The Closer: End of Week Charts — 9/29/17

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. This week, we’ve added a section that helps break down momentum in developed market foreign exchange crosses.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by joining Bespoke Institutional at our special $1 introductory rate!

ETF Trends: US Indices & Styles – 9/29/17

S&P 500 Quick-View Chart Book — 9/29/17

Each weekend as part of our Bespoke Premium and Institutional research service, clients receive our S&P 500 Quick-View Chart Book, which includes one-year price charts of every stock in the S&P 500. You can literally scan through this report in a matter of minutes or hours, but either way, you will come out ahead knowing which stocks, or groups of stocks, are leading and lagging the market. The report is a great resource for both traders and investors alike. Below, we show the front page of this week’s report which contains price charts of the major averages and ten major sectors.

To see this week’s entire S&P 500 Chart Book, sign up for a 14-day free trial to our Bespoke Premium research service.

September, Q3, YTD 2017 Asset Class Performance

With the third quarter coming to an end today, below is a look at our asset class performance matrix using key ETFs traded on US exchanges. This is a great way to quickly see how various asset classes are performing on a total return basis. For each ETF shown, we provide its total return for the month of September, the third quarter of 2017, and year-to-date 2017.

Notably, the areas of the market that were performing best on a year-to-date basis mostly underperformed in September, while the worst performing areas of the market this year saw the biggest bounces in September. The Nasdaq 100 (QQQ) is ending September on a strong note, but it’s still slightly down on the month. Even still, QQQ is the top performing US equity index ETF on the year with a gain of 23.56%.

Small caps had been weak compared to large caps heading into September, but they’ve soared this month. The S&P Smalllcap 600 ETF (IJR) is up 7.89% on the month, while the S&P 500 (SPY) is up 1.96%.

On a sector basis, Energy (XLE) saw by far the biggest gains at +10.08% in September. Even with the 10% gain, though, XLE is still down 6.79% year-to-date. Financials (XLF), Industrials (XLI), and Materials (XLB) were the next best performing sectors during the month. On the weak side, Telecom (IYZ) and Utilities (XLU) both fell 2%+, while the two consumer sectors, Technology, and Health Care were flat.

Outside of the US, we actually saw weakness in China (ASHR), Hong Kong (EWH), India (PIN), and Mexico (EWW) in September. But areas like Brazil (EWZ), Canada (EWC), France (EWQ), Germany (EWG), and Russia (RSX) saw big gains. Italy (EWI) is now the best performing country in our screen on a year-to-date basis with a gain of 31.64%.

While the emerging markets ETF (EEM) is up 28.46% YTD and 8.15% in the third quarter, it’s actually slightly down in September.

Finally, while oil (USO) gained 8% on the month, other commodities like natural gas (UNG), gold (GLD), and silver (SLV) were in the red. Fixed income ETFs also fell slightly, but they’re still up year-to-date across the board.

Gain access to 1 month of any of Bespoke’s premium membership levels for $1!

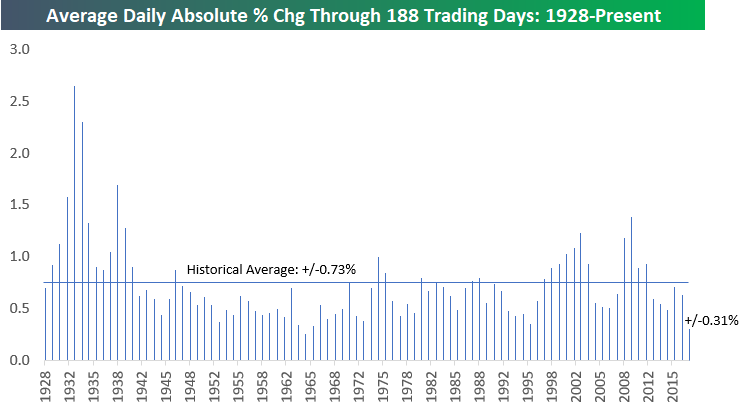

2017 Least Volatile Year Since 1964

Today marks the end of the third quarter of 2017. There have been 188 trading days so far this year, and the S&P 500 has experienced an average absolute move of +/-0.31% on these days.

As shown in the chart below, historically, the S&P 500 has averaged a daily change of +/-0.73% over the first 188 trading days of any given year.

Gain access to 1 month of any of Bespoke’s premium membership levels for $1!

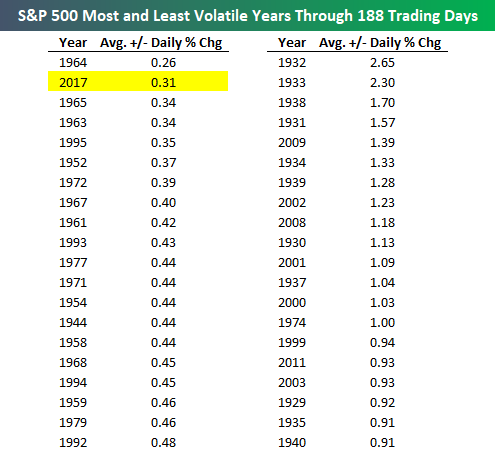

The only year where the S&P 500 experienced a smaller daily change through 188 trading days is 1964. In that year, the index averaged a daily move of just +/-0.26%! As shown in the table below, though, the S&P 500 went through a three-year period of extremely low volatility in 1963, 1964, and 1965. 2017 now ranks as the second least volatile year through 188 trading days, but 1964 ranks 1st, 1965 ranks 3rd, and 1963 ranks 4th. The 1963-1965 period shows that 2017 doesn’t have to be a one-year outlier — this type of low volatility environment can go on for even longer.

That’s not to say vol WILL remain low, however. It can pick up again at any given moment. On the right hand side of the table below, we show the most volatile years through 188 trading days as well. The four most volatile years and six of the top seven all came in the 1930s. 1932 was the most volatile with an average daily move of +/-2.65%.

Three of the ten most volatile years have come since the year 2000, so only the youngest investors haven’t experienced a period of massive volatility. 2009 ranks 5th with an average daily move of +/-1.39% through 188 trading days. Memory is fleeting, though, and at this point it’s difficult for most investors to remember exactly how they felt during the darkest days of the Financial Crisis. The further we distance ourselves from the Crisis and the lower volatility gets, the more complacent investors will become.

Gain access to 1 month of any of Bespoke’s premium membership levels for $1!