NXP Semiconductors Better Alone?

It has been a year now since rumors first started circulating about QUALCOMM’s (QCOM) interest in NXP Semiconductors (NXPI), and more than eleven months since the $110 per share takeover was officially announced. Since that time, we have published a number of notes for clients (two examples are here and here) discussing how through a combination of the performance of the semiconductor stocks and the breakup fee agreed upon in the original merger agreement, that NXPI shareholders would likely be better off if the deal didn’t go through. For starters, if for some reason QCOM can’t close the deal because of regulatory or financial issues, the company would be required to pay NXPI a breakup fee of $2 billion. With 330 million shares outstanding, that breakup fee works out to about $6 per share or 5% of NXPI’s current market cap.

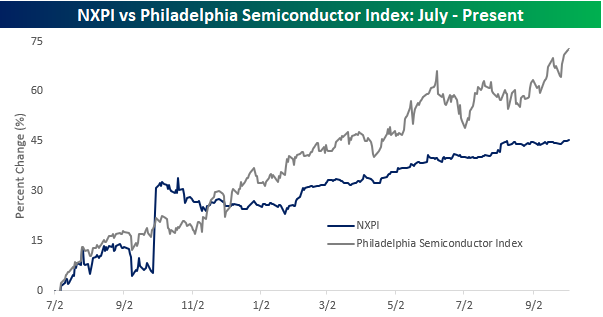

The second and bigger reason NXPI shareholders may be happy to see the deal fall apart is due to the performance of semiconductor stocks themselves since the deal was announced. The first chart below compares NXPI to the Philadelphia Semiconductor Index (SOX) since the start of July 2016. Leading up to the merger announcement, NXPI generally tracked the SOX index pretty closely. While the stock initially spiked and was outperforming its peer group immediately after the deal was announced, it started underperforming shortly thereafter and has continued to do so ever since. As of today, NXPI is up 45% since the start of July 2016, but the SOX index has gained 73%!

Gain access to 1 month of any of Bespoke’s premium membership levels for $1!

So how does that translate into stock prices? In the chart below we have plotted the price of NXPI along with where it would be trading had it simply matched the performance of the SOX index from 8/1/16 on. While NXPI has rallied 34.7% to $113.3 if it had performed inline with the SOX index, it would be trading at $134.6 today. Now obviously, that’s a counterfactual, but even before taking the potential $2 billion breakup fee into account, one could easily make the argument that with the original takeover price of $110 per share still in place and NXPI trading above $113, the biggest risk for NXPI shareholders now is that the previously agreed upon deal with QCOM actually does go through!

Gain access to 1 month of any of Bespoke’s premium membership levels for $1!

B.I.G. Tips – The Most Loved and Hated Sectors – October 2017

Blowout Truck Sales At Ford

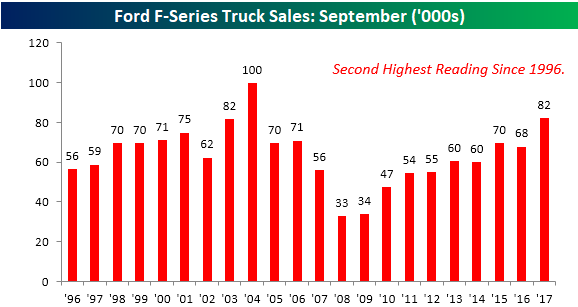

Whether or not the strength has been aided by the loss of the existing fleet due to the hurricanes in the South, auto sales for the month of September have absolutely been on fire. That strength in sales has been evident in truck sales too. We like to track sales of pickup trucks (specifically at Ford) as they are often a sign of strength or weakness in the small business and construction sectors, and based on these numbers from Ford, the small business sector looks strong. In the month of September, total F-Series truck sales at Ford totaled 82.3K. As shown in the chart below, that qualifies as the second strongest September sales total of F-Series trucks for Ford since at least 1996, trailing only September 2004 when total sales were 99.7K.

Gain access to 1 month of any of Bespoke’s premium membership levels for $1!

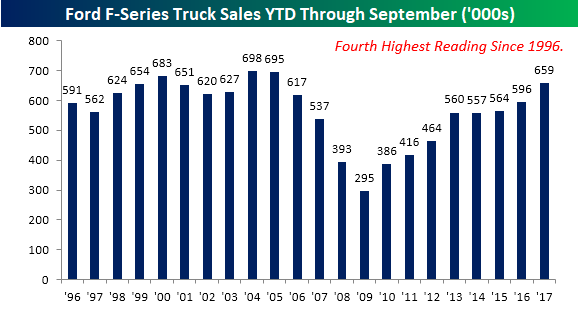

With this year’s strong September, total YTD sales of F-Series trucks from Ford now total 658.6K. That’s more than 10% above the YTD total through last year at this time and is the fourth highest YTD total through September dating back to 1996. The only years where the YTD run rate was stronger were 2004 (698K), 2005 (695K), and 2000 (683K).

Chart of the Day: Bank Breakout

The Closer — Powerful Market Indicator? — 10/2/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we discuss the surge in ISM Manufacturing for the month of September reported today. We also take a look at the rising spread between ISM and Markit PMIs and the soft level of construction spending in the US.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See today’s post-market Closer and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research platform!

ETF Trends: Hedge – 10/2/17

B.I.G. Tips – Strong ISM: As Good As it Gets?

Chart of the Day: Winners and Losers of 2017

The Most Volatile Month of the Year

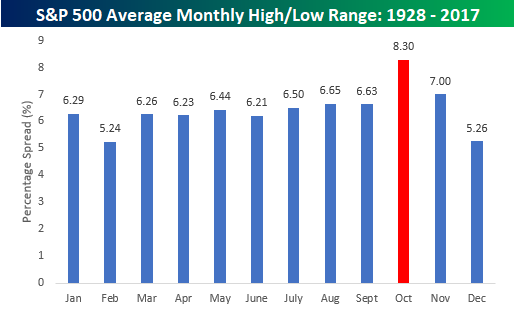

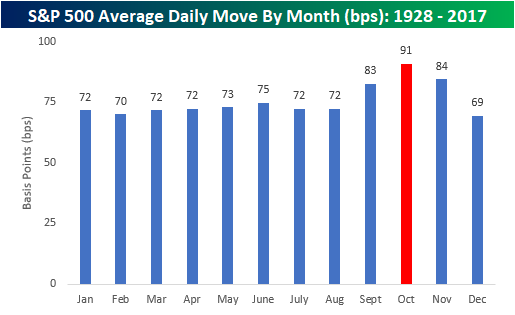

While it has historically been positive, October has the distinction of being known as the most volatile month of the year. What that means in a year where volatility has been non-existent remains to be seen, but if the market was going to become more unsettled at some point, history says that now is the time. Today, we wanted to show two examples of how volatility tends to spike during October. In terms of the S&P 500’s average intra-month range, going back to 1928, the percentage spread between its closing high and low during the month of October has been a staggering 8.30%. That’s more than 1.3 percentage points above the next highest month (November – 7.0%). After October and November, though, volatility really recedes with an average spread of only 5.26% in December.

Gain access to 1 month of any of Bespoke’s premium membership levels for $1!

As shown in the chart above, February and December tend to have the smallest intra-month ranges, but February also has the fewest amount of trading days as well, so that skews things. Another way to look at monthly volatility on a more apples to apples basis is by measuring the index’s average daily percentage move (up or down) during each trading day of the month. Using this approach, the picture is very similar; volatility tends to pick up in September, October, and November and then fades in December to close out the year. Once again, October sees the largest average daily percentage move at 91 basis points (bps). In other words, the S&P 500 has historically averaged moves of close to +/-1% on trading days throughout the month of October. The key difference between this chart and the one above is that on this basis volatility in February is right inline with the other first eight months of the year. In fact, it’s pretty striking how average daily volatility tends to be so uniform for the first eight months of the year before going haywire in the final third.

Gain access to 1 month of any of Bespoke’s premium membership levels for $1!

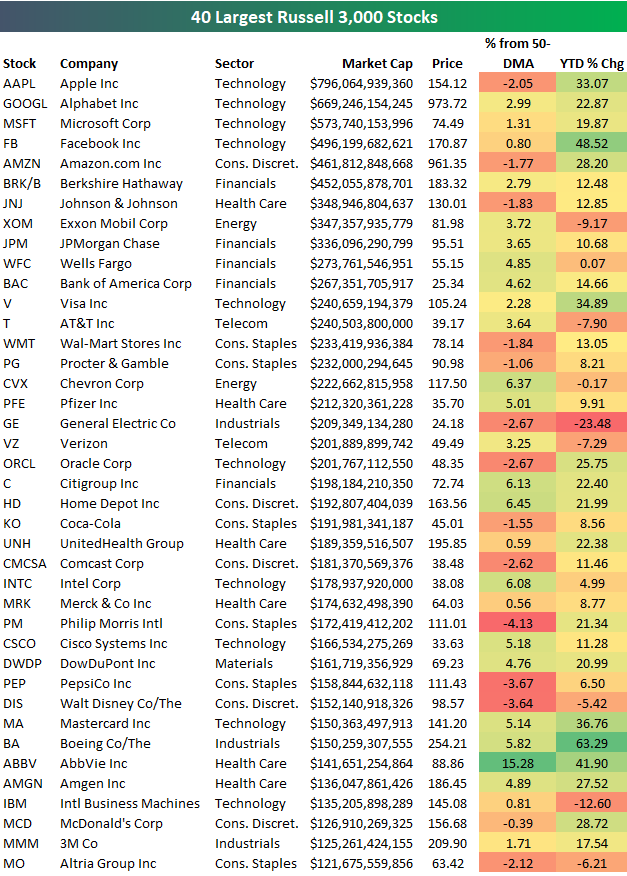

2017 YTD Performance of the 40 Largest Stocks

Below is a look at the year-to-date performance of the 40 largest stocks in the US through the end of the third quarter. As shown, the five biggest companies are all Tech related (even though AMZN is categorized as Consumer Discretionary), and they’re all up 19% or more year-to-date. Of the five largest stocks, Facebook (FB) is up the most this year with a gain of 48.52%.

While Facebook is up the most of the five largest stocks, Boeing (BA) is up the most of the stocks listed with a YTD gain of 63%. General Electric (GE) is the worst performer with a YTD decline of 23.48%.

Gain access to 1 month of any of Bespoke’s premium membership levels for $1!