Bespoke Consumer Pulse Shows September Sentiment Surge

Each month, Bespoke runs a survey of 1,500 US consumers balanced to census. In the survey, we cover everything you can think of regarding the economy, personal finances, and consumer spending habits. We’ve now been running the monthly survey for more than three years, so we have historical trend data that is extremely valuable, and it only gets more valuable as time passes. All of this data gets packaged into our monthly Bespoke Consumer Pulse Report, which is included as part of our Pulse subscription package that is available for either $39/month or $365/year. We highly recommend trying out the service, as it includes access to model portfolios and additional consumer reports as well. If you’re not yet a Pulse member, click here to start a 30-day free trial now!

Our September 2017 Pulse report was recently published, and it showed a big surge in a number of economic readings on a month-over-month and year-over-year basis. After a summer slowdown, our newest Pulse report suggests that we’re in the midst of another uptick in the economy.

Below is a heatmap included in our Pulse report that summarizes changes in the major economic categories covered in our monthly survey. Green is indicative of strength, and as you can see, there’s a lot of it this month!

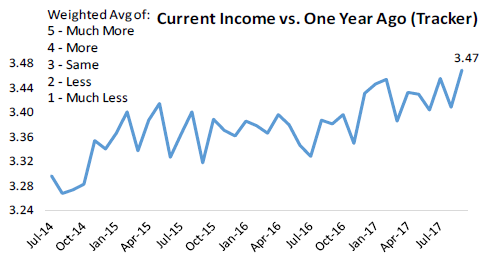

Below are charts that show the results of two questions we ask consumers on a monthly basis. The first asks respondents how their current income compares to their income from a year ago. As you can see, this reading made a new multi-year high in September, suggesting that consumers are flush with spending money as we approach the holiday months.

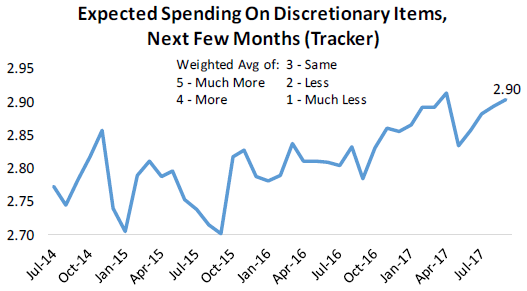

And consumers do plan on spending their additional income, as evidenced by the second chart below which asks about expected spending on discretionary items over the next few months.

To see our full economic Pulse report for September, click here to start a 30-day free trial now!

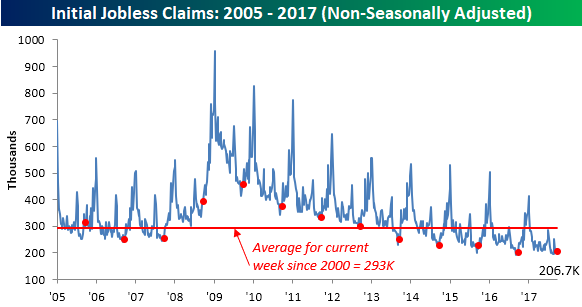

Jobless Claims Drop More Than Expected

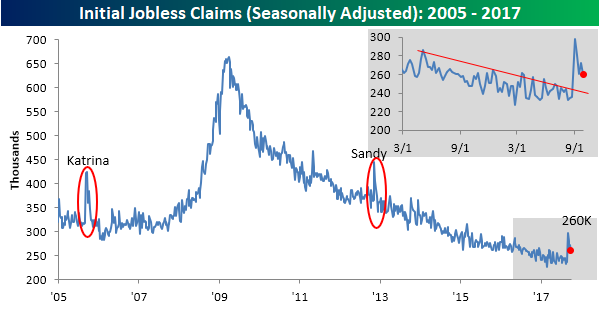

Weekly jobless claims are still feeling the impact of the late summer HIM-icanes (Harvey, Irma, and Maria), but the worst of the impact is over, and it wasn’t nearly as bad as we saw back in 2005 with Katrina and 2012 with Sandy. According to the Department of Labor, first-time claims dropped from 272K down to 260K, which was below the consensus forecast of 265K. This now makes it 135 straight weeks that jobless claims have been below 300K. While claims never did spike as much as they did with prior big hurricanes, the return back to trend seems to be taking a bit longer as well, but that could be the impact of three hurricanes hitting different parts of the country as opposed to the prior single storms hitting one region.

Gain access to 1 month of any of Bespoke’s premium membership levels for $1!

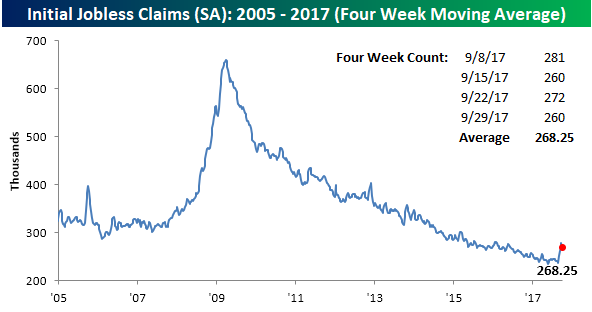

On a four-week moving average basis, claims dropped from 277.75K down to 268.25K. That decline of 9.5K was the largest single-week decline in the four-week average since March 2015.

On a non-seasonally adjusted (NSA) basis, jobless claims dropped to 206.7K from 215K. That’s more than 85K below the average for the current week of the year dating back to 2000, but actually above the level we saw in the same week last year. Here again, though, the weather definitely played a role.

The Closer — Correlation Crash, EIA Review — 10/4/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we take a look at plunging correlations and review EIA data on the petroleum market updated today.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See today’s post-market Closer and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research platform!

Bespoke Consumer Pulse Report — September 2017

Bespoke’s Consumer Pulse Report is an analysis of a huge consumer survey that we run each month. Our goal with this survey is to track trends across the economic and financial landscape in the US. Using the results from our proprietary monthly survey, we dissect and analyze all of the data and publish the Consumer Pulse Report, which we sell access to on a subscription basis. Sign up for a 30-day free trial to our Bespoke Consumer Pulse subscription service here. With a trial, you’ll get coverage of consumer electronics, social media, streaming media, retail, autos, and much more. The report also has numerous proprietary US economic data points that are extremely timely and useful for investors.

ETF Trends: International – 10/4/17

The Most Volatile Stocks on Earnings

The start of the new quarter brings with it the start of another earnings season, and next week is when we’ll start to hear from companies reporting their Q3 2017 earnings. As we do prior to the start of each earnings season, in this post we update our list of the most volatile stocks on earnings.

Using our Interactive Earnings Report Database (which you can use for 30 days for just $1 by joining Bespoke Institutional here), we’re able to calculate the average move that stocks experience on their earnings reaction days. For a stock that reports in the morning before the open, its earnings reaction day is that same trading day. For a stock that reports after the close, we use the next trading day.

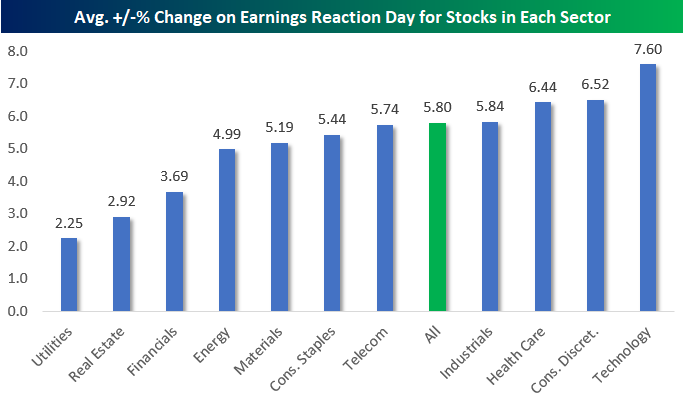

Below is a look at how volatile stocks are on earnings by sector. Since 2001, US stocks have experienced an average move of +/-5.80% on their earnings reaction day. This means that quarterly earnings reports typically result in a change in market cap of +/-5.8% for public companies. But some sectors are more volatile than others of course. As shown in the chart, Tech stocks that reports earnings typically move an average of +/-7.60% on their earnings reaction day. Conversely, the average stock in the Utilities sector only moves +/-2.25% on earnings. It’s not surprising that Tech stocks are 3x as volatile as Utilities stocks when it comes to earnings reactions, but these numbers help to quantify the differences.

Generally speaking, stocks in the Utilities, Real Estate, and Financial sectors move the least on earnings, while Technology, Consumer Discretionary, and Health Care stocks move the most.

Gain access to 1 month of any of Bespoke’s premium membership levels for $1!

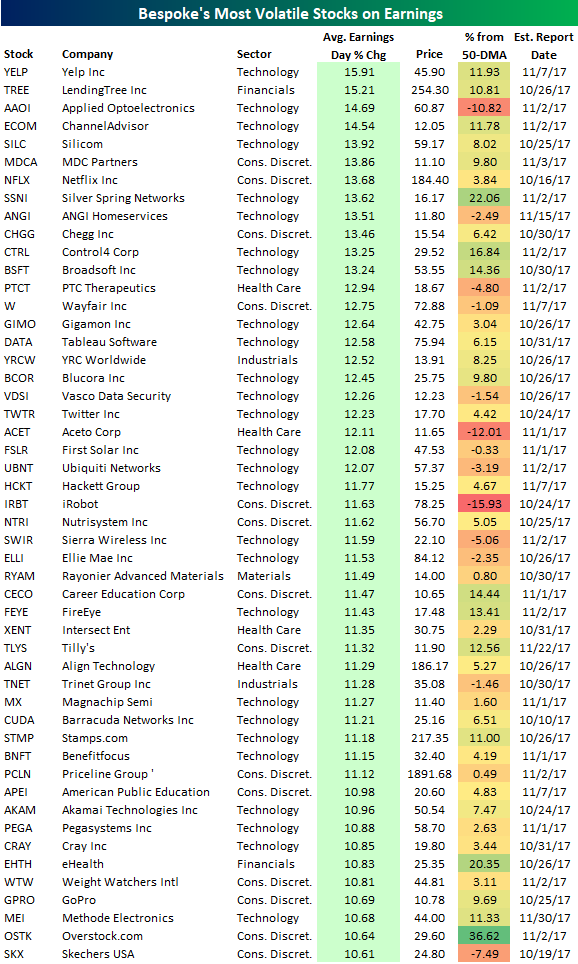

Using our Interactive Earnings Report Database, below is a list of the individual stocks set to report between now and the end of November that typically move the most on their earnings reaction days. To make the list, a stock must have at least 12 quarters (3 years) of earnings reports and trade for more than $10/share.

As shown, Yelp (YELP) is the most volatile stock on earnings with an average one-day change of +/-15.91%. LendingTree (TREE) ranks second and is the only other stock that typically moves more than +/-15%. Applied Opto (AAOI), ChannelAdvisor (ECOM), and Silicom (SILC) round out the top five.

Netflix (NFLX) is the most well-known stock in the top ten with an average one-day change of +/-13.68% on earnings. Other notable names on the list include Wayfair (W), Tableau Software (DATA), Twitter (TWTR), First Solar (FSLR), FireEye (FEYE), Priceline (PCLN), and GoPro (GPRO).

One final note. In the table below we’ve also included how far each stock is currently trading from its 50-day moving average. Heading into earnings season, there are a lot of stocks trading significantly above their 50-day moving averages (overbought). For stocks on the list with prices that are extended to the upside, expectations are going to be quite high for earnings. Failure to meet these lofty expectations will likely result in significant pain for investors. The reverse is true for stocks that are trading well below their 50-day moving averages.

Fixed Income Weekly – 10/4/17

Searching for ways to better understand the fixed income space or looking for actionable ideals in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s note, we build on last week’s note, identifying a number of interesting emerging markets FX trades based on the valuations we discussed previously.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here to start your no-obligation free Bespoke research trial now!

Chart of the Day: Economic Indicator Diffusion Index Still Negative

Huge Beat in ISM Services

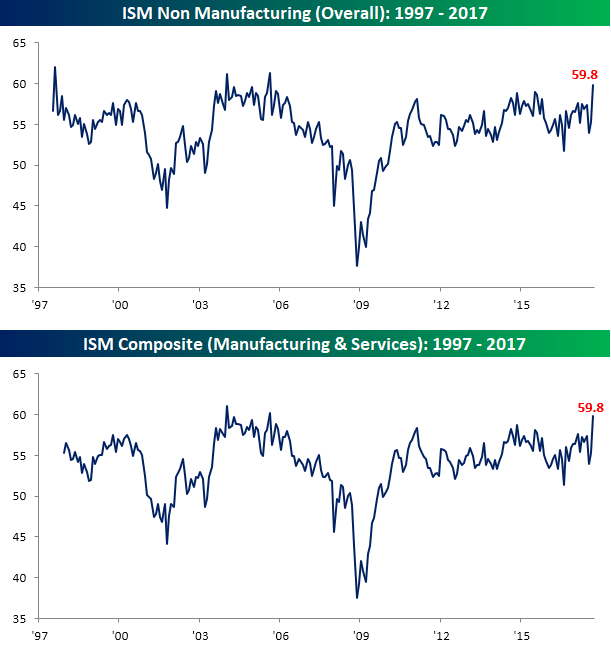

Following on the heels of a strong ISM Manufacturing report on Monday, today’s ISM report on the Non Manufacturing sector was also a good one. With economists expecting the headline index to come in at a level of 55.5 compared to August’s reading of 55.3, the actual reading came in at 59.8. This is the highest level for the index since August 2005. This month’s 4.5 point surge also represented the fourth largest one month increase in the history of the survey going back to 1997 and the biggest beat relative to expectations since May 2007. On a combined basis, the September ISM came in at 59.8, which was the highest reading since August 2005.

Gain access to 1 month of any of Bespoke’s premium membership levels for $1!

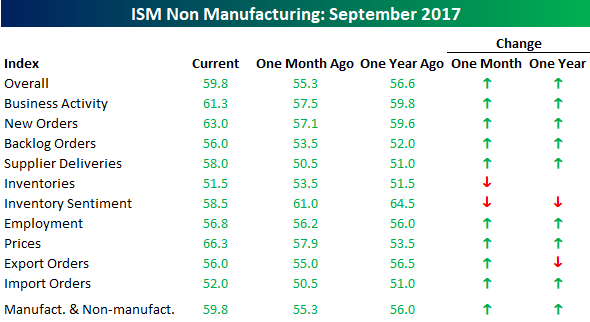

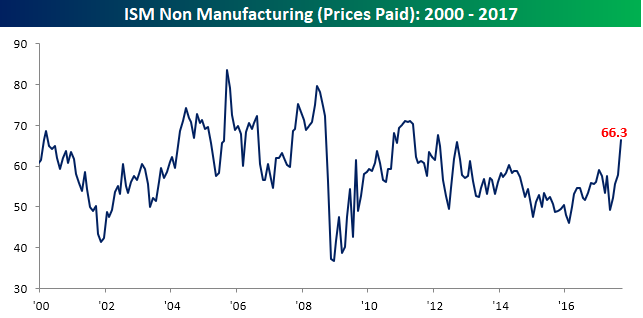

The table below breaks down this month’s report by each of its subcomponents. On a month/month basis, the only two categories that declined were Inventories and Inventory Sentiment. On the upside, Prices Paid (+8.4) showed the largest increase, followed by Supplier Deliveries (+7.5) and New Orders (5.9). The Employment component was also up this month but by an extremely small amount. In the case of Prices Paid, this month’s spike took the index to its highest level since February 2012 after what was its largest m/m increase since October 2010.

Gain access to 1 month of any of Bespoke’s premium membership levels for $1!

Bespoke’s Global Macro Dashboard — 10/4/17

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

Click here for a special $1 introductory Bespoke Institutional membership rate.