ETF Trends: US Sectors & Groups – 10/11/17

Fixed Income Weekly – 10/11/17

Searching for ways to better understand the fixed income space or looking for actionable ideals in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s note, we discuss the growth (or lack thereof) in Eurozone government debt over the last few years.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

The Closer — Puigdemont Pulls Back From Catalonian Cliff — 10/10/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we review the speech made today by Catalan President Puigdemont. We also discuss why Canada’s housing “bubble” doesn’t look anything like it.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See today’s post-market Closer and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research platform!

ETF Trends: Hedge – 10/10/17

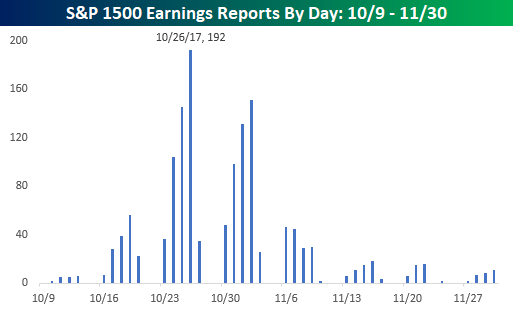

B.I.G. Tips – Analyst Sentiment Heading into Earnings Season

Earnings season kicks off this week as the first of the major companies start to report Q3 numbers. Most of the big names reporting are all Financials like Blackrock (BLK) on Wednesday morning, Citigroup (C) and JPMorgan (JPM) on Thursday morning, and then Bank of America (BAC), PNC, and Wells Fargo (WFC) on Friday before the open, so we will have to wait a little while longer to get a better read on things in general.

We just published our quarterly look at analyst revisions heading into this earnings season. In this report, we take the current trends and break down how the equity market has performed during prior periods when analyst revisions were at similar levels.

For anyone with more than a passing interest in how equities are impacted by earnings season, this report is a must read. To see the report, sign up for a monthly Bespoke Premium membership now!

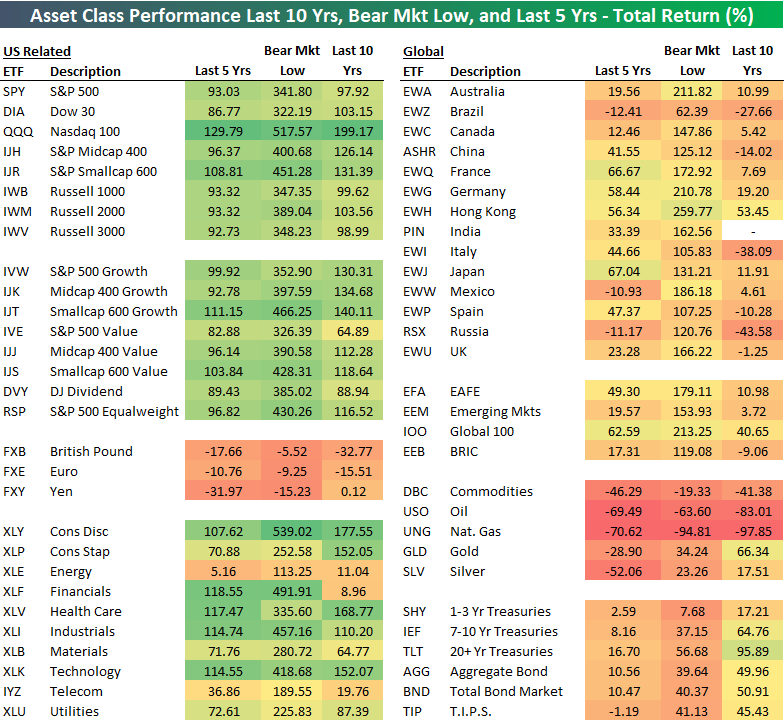

Asset Class Total Returns Over the Last 10 Years

Below is a look at our asset class performance matrix showing total returns for key ETFs that we track on a regular basis. Since today marks the 10-year anniversary of the start of the Financial Crisis bear market for the S&P 500, we thought it would be helpful to see how various asset classes have performed over the last ten years. We also include change from the ultimate low of the bear market on 3/9/09 as well as 5-year returns.

We’ll let the table do the talking on this one!

Gain access to 1 month of any of Bespoke’s premium membership levels for $1!

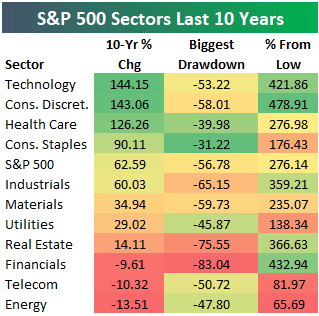

The Best and Worst Stocks and Sectors Since the Start of the Financial Crisis

Ten years ago today marked the peak of the mid-2000s bull market for the S&P 500 and the start of the Financial Crisis bear market that ran from 10/10/07 to 3/9/09. Below is a look at S&P 500 sector performance over the last ten years along with how much each sector declined at its bear market low. We also include each sector’s current gain from its bear market low.

As shown, the Technology sector has gained the most over the last ten years from the prior bull market peak at +144%. Consumer Discretionary and Health Care are up the 2nd and 3rd most. Three sectors are still down from the 10/9/07 peak, however — Financials, Telecom, and Energy.

From their bear market lows, Technology, Consumer Discretionary, and Financials are up the most with gains of more than 400%. Both Telecom and Energy, on the other hand, are up less than 85% from their bear market lows.

Gain access to 1 month of any of Bespoke’s premium membership levels for $1!

Below is a chart showing the rolling 10-year percentage change for the S&P 500 throughout its history. Note that the index is currently up 62.6% over the last ten years, which is well below the average rolling 10-year change of +103%. Moving forward from here, this reading should start to increase at a quick pace given that ten years ago today was the prior bull market peak. If the index were to stay at its current level, on March 9th, 2019, the rolling 10-year change would be +276% (the current % change from the bear market low on 3/9/09).

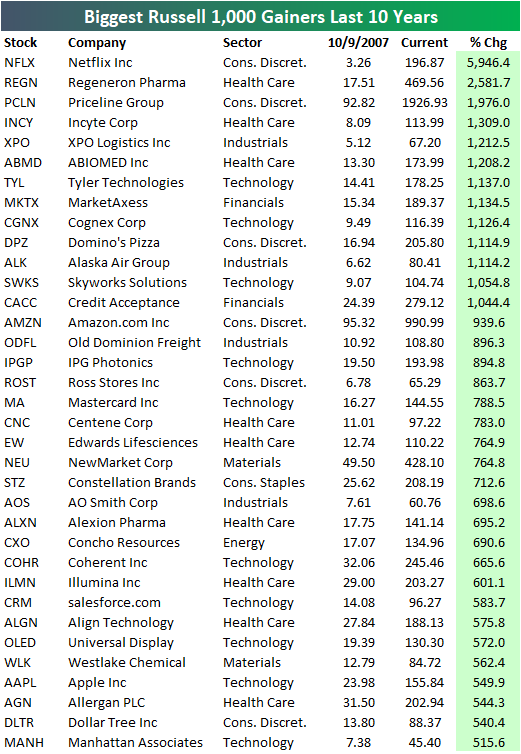

Below is a look at the current Russell 1,000 stocks that are up the most over the last ten years. There are 13 stocks that are up more than 1,000% over this time period, with Netflix (NFLX) on top at nearly +6,000%. Back on October 9th, 2007, NFLX was trading at $3.26/share. It’s currently at $196.87/share.

Other notables on the list of winners include Priceline (PCLN), Amazon.com (AMZN), Mastercard (MA), and salesforce.com (CRM). You may have expected to see Apple (AAPL) at the top of the list, but it ranks 32nd with a 10-year gain of 550%.

Gain access to 1 month of any of Bespoke’s premium membership levels for $1!

Chart of the Day: 10 Years On

Bespoke Stock Scores: 10/10/17

The Closer — Two Pages On EM — 10/9/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we take a look at recent price action, flows, and economic data from a few emerging markets.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See today’s post-market Closer and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research platform!