The Bespoke Report – Nothing Scary About This Friday the 13th

S&P 500 Quick-View Chart Book: 10/13/17

Each weekend as part of our Bespoke Premium and Institutional research service, clients receive our S&P 500 Quick-View Chart Book, which includes one-year price charts of every stock in the S&P 500. You can literally scan through this report in a matter of minutes or hours, but either way, you will come out ahead knowing which stocks, or groups of stocks, are leading and lagging the market. The report is a great resource for both traders and investors alike. Below, we show the front page of this week’s report which contains price charts of the major averages and ten major sectors.

As seen in the charts below, the only major average that didn’t hit an all-time high this week was the Russell 2000, but it remains at extremely extended levels. In terms of individual sectors, Industrials, Materials, and Technology all hit new highs.

To see this week’s entire S&P 500 Chart Book, sign up for a 14-day free trial to our Bespoke Premium research service.

The Closer: End of Week Charts — 10/13/17

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. This week, we’ve added a section that helps break down momentum in developed market foreign exchange crosses.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by starting a two-week free trial to Bespoke Institutional now!

September 2017 Headlines

The Closer — Demographic Yield & PPI — 10/12/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we review the impact of demographics on yields around the world and across time. We also take a look at today’s BLS release on producer prices.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See today’s post-market Closer and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research platform!

ETF Trends: International – 10/12/17

Crypto-corns

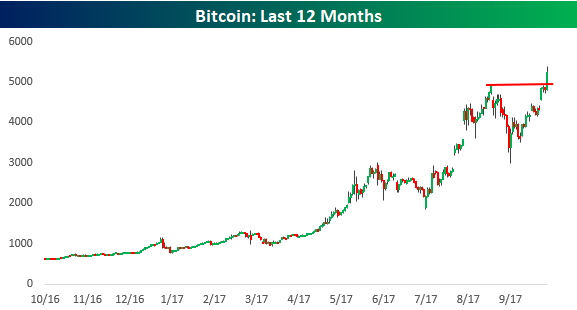

The price of bitcoin surged over 8% today and in the process smashed right through the $5,000 level as well as the prior highs from September 1st. Where this run ends is anyone’s guess, but trying to call the top in the past has been like stepping between a politician and a microphone.

Gain access to 1 month of any of Bespoke’s premium membership levels for $1!

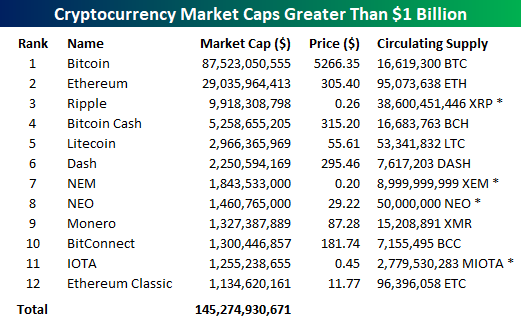

With bitcoin breaking through another 1,000 point threshold today, you may be wondering, “just how much bitcoin is there?” Courtesy of @CoinMktCap, we found that with just over 16.6 million bitcoins in circulation, the total value of bitcoins in circulation is over $87 billion which is larger than the market cap of all but 62 companies in the S&P 500. Behind bitcoin, though, there are also another 11 crypto-currencies with a total circulation valued at more than $1 billion! In the startup world, companies with a valuation above $1 billion are called unicorns, so along those lines, below we list the 12 digital currencies that currently qualify as “Crypto-corns” with circulation values of more than $1 billion.

Chart of the Day: 2017 Commodity Performance

Bullish Sentiment Approaching 40%

This week’s sentiment survey from AAII showed an increase in bullish sentiment back near 40% and back near the recent high of 41.29% from mid-September. While 40% is hardly an extreme reading by any stretch of the imagination, this year there have only been four weeks where bullish sentiment actually topped 40%. With 40% being hard enough, an actual majority is a long way off, and that should keep the current streak of 145 straight weeks below 50% safe for the foreseeable future.

Gain access to 1 month of any of Bespoke’s premium membership levels for $1!

As you might expect, bearish sentiment declined this week, falling from 32.8% down to 26.9%. That’s the lowest reading in five weeks and sixth lowest weekly print in bearish sentiment this year.

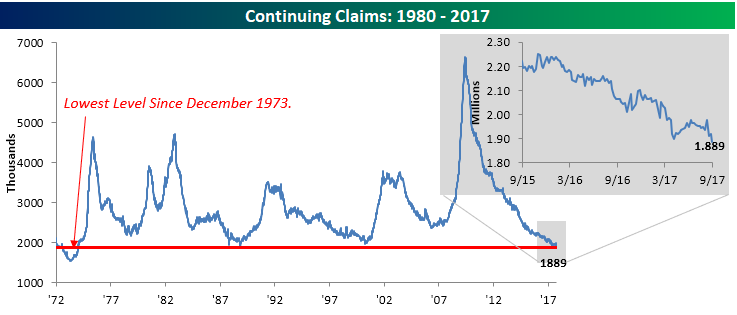

Continuing Claims Lowest Since 1973

December 1973. That’s the last time continuing jobless claims have been below this week’s print of 1.889 mln. Think about that for a minute. The median American age is currently 37.8 years old, so the majority of Americans weren’t even alive the last time claims were this low. Every week it seems like the weekly jobless claims report can’t top the recent reports of the past, but then we get another reading like this. Eventually the tide will turn, but for now, it keeps moving in the right direction.

Gain access to 1 month of any of Bespoke’s premium membership levels for $1!