Homebuilder Sentiment Back on the Upswing

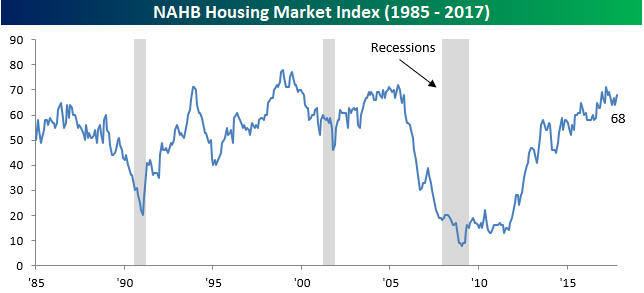

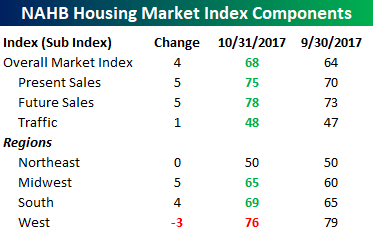

Homebuilder sentiment took a sharp turn higher this month, rising from 64 up to 68 and well ahead of consensus expectations for a reading of 64. While the magnitude of the beat seems large, there have been three other reports in the last year where sentiment saw as big or a bigger improvement relative to expectations.

Gain access to 1 month of any of Bespoke’s premium membership levels for $1!

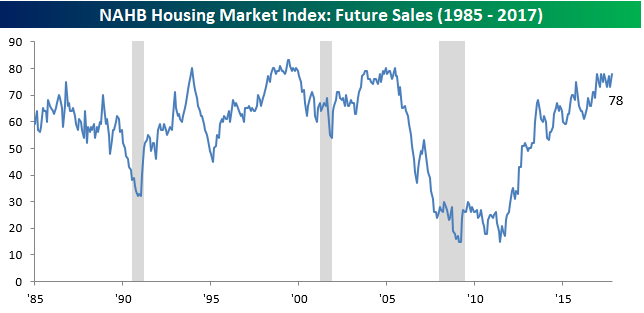

As shown in the table below, Present and Future Sales as well as Traffic all increased this month. Future Sales was a big standout to the upside, as it rebounded back to its highest level since 1999 (chart below).

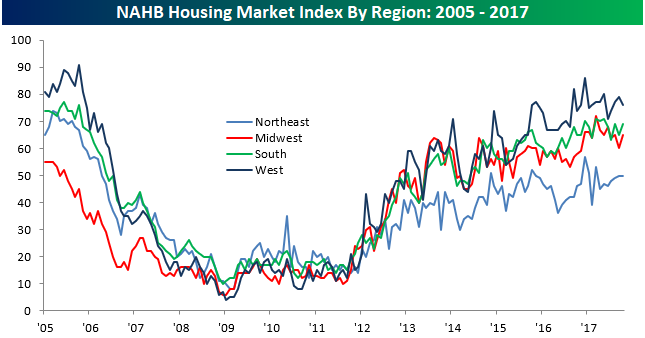

On a regional basis, the only region of the country where sentiment declined was out West. Sentiment in the Northeast was unchanged, while sentiment in the Midwest and South saw big improvements. While overall sentiment was stronger this month, no single area or aspect of the report hit a new high for the cycle.

The Closer — Analogues, Taylor, Pesos — 10/16/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we talk about recent price analogues for the S&P 500 and why 1987 isn’t one of them. We also give our thoughts on the Mexican peso and the possible replacement of FOMC Chair Yellen.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See today’s post-market Closer and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research platform!

ETF Trends: Fixed Income, Currencies, and Commodities – 10/16/17

The Most Hated Stocks in the Market

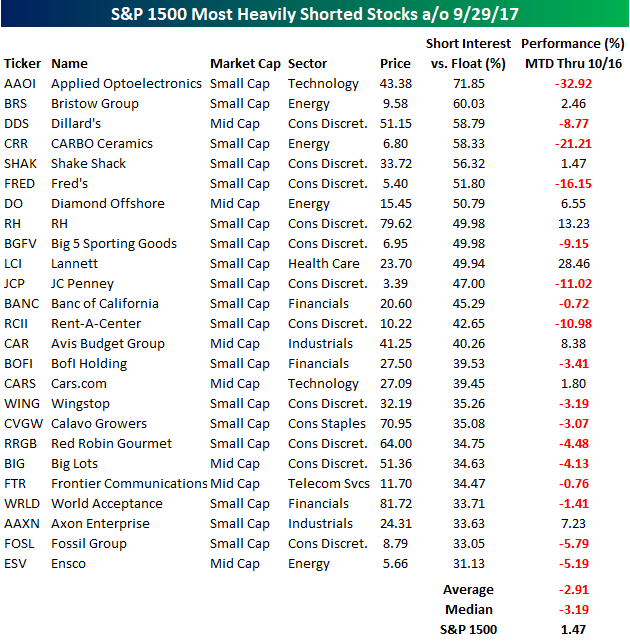

Short interest figures for the end of September were released last week, and we just recently sent out our regular update of overall and stock specific trends in short interest levels to clients. In the table below, though, we wanted to provide a quick look at which stocks in the S&P 1500 have the highest levels of short interest (as a percentage of float). All 25 names shown have at least 30% of their free-floating shares sold short, but amazingly, eight of those stocks have more than half of their float sold short. The most shorted stock in the S&P 1500 is Applied Optoelectronics (AAOI), which has more than 70% of its float sold short. It’s not very often that you see a stock with this high a level of short interest, but given the stock is down by a third this month alone, the high short interest looks justified.

Other notable names with high levels of short interest include retail-related names like Dillard’s (DDS), Shake Shack (SHAK), Fred’s (FRED), RH (formerly Restoration Hardware), JC Penney (JCP), and Big Lots (BIG). Outside of SHAK and RH, these retail names are all down MTD. Overall, the 25 names listed below have seen an average decline of 2.91% (median: 3.19%) this month, compared to a gain of 1.47% for the S&P 1500. Normally, stocks with high short interest rally during periods when the market is strong, but these days, investors generally want nothing to do with them.

Gain access to 1 month of any of Bespoke’s premium membership levels for $1!

Bespoke Short Interest Report – 10/16/17

Key Earnings Reports to Watch (10/16-10/20)

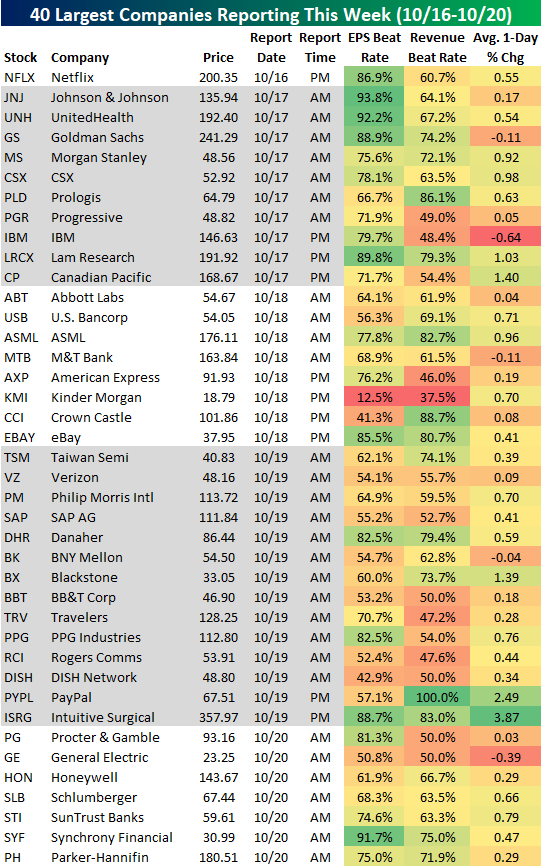

Our Interactive Earnings Calendar is a useful tool for Bespoke subscribers during earnings season. From our calendar, we’ve pulled the table below which shows the 40 largest companies set to report earnings this week. For each stock, we show its historical earnings and revenue beat rate (% of time it beat consensus analyst estimates) along with its average one-day change in reaction to its earnings report.

Netflix (NFLX) kicks things off this week with earnings after the close today. The stock has historically beaten EPS estimates at an 86.9% clip, while its revenue beat rate is a little lower at 60.7%. NFLX is an extremely volatile stock on earnings, but throughout its history, it has averaged a gain of 0.55% on its earnings reaction days.

Tomorrow morning we’ll hear from big Dow 30 stocks like JNJ, UNH, and GS, and then IBM will report after the close. JNJ, UNH, and GS beat EPS estimates at a very high clip compared to the rest of the key stocks set to report this week. IBM beats EPS often, but it has a low revenue beat rate and it typically averages a decline on its earnings reaction day.

Wednesday is relatively quiet, but key companies reporting include American Express (AXP) and eBay (EBAY) after the close. Thursday picks up again with Verizon (VZ), Blackstone (BX), and Travelers (TRV) in the morning followed by PayPal (PYPL) and Intuitive Surgical (ISRG) after the close. Both PYPL and ISRG have seen big gains historically on their earnings reaction days.

On Friday we’ll close out the week with reports from General Electric (GE), Procter & Gamble (PG), Honeywell (HON), and Schlumberger (SLB). GE has only beaten EPS and revenues half the time over the last 15+ years, and it has averaged a decline of 0.39% on its earnings reaction day.

Use Bespoke throughout earnings season with this great membership offer!

Chart of the Day: Empire Signals

Bespoke Stock Seasonality Report: 10/16/17

Bespoke Brunch Reads: 10/15/17

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

See this week’s just-published Bespoke Report newsletter by starting a no-obligation two-week free trial to our premium research platform.

Money

New York Fed President Sent Puerto Rico a Jet Filled With Cash by Jonathan Levin (Bloomberg)

Liquidity is the lifeblood of activity, and when the New York Fed realized how devastating Maria would be to Puerto Rico, it immediately took steps to insure there would be enough cash available on the island. [Link; auto-playing video]

Bitcoin is fiat money, too (The Economist)

While bitcoin and other blockchain-based currencies claim to remove the interference of central banks and other interventions in the money supply. But consensus-built code platforms have the same foibles; nothing is new. [Link]

Disaster & Tragedy

In a smoldering California winery, a boiling river of red wine emerges by AJ Willingham (CNN)

As well as the tragic human toll (more than 30 deaths) the horrific wildfires in California have also laid waste to local commerce, sometimes in near-biblical metaphoric terms. [Link; auto-playing video]

Lawsuit Over Las Vegas Shooting Tests Gun Industry’s Immunity by Polly Mosendz (Bloomberg)

While Congress has granted immunity to gun makers and ammunition sellers, the maker of the bump stock that allowed for high rates of fire in the Las Vegas mass shooting may become a test case. [Link; auto-playing video]

Natural Disasters and the Measurement of Industrial Production: Hurricane Harvey, a Case Study by Kimberly Bayard, Ryan Decker, and Charles Gilbert (FEDS Notes)

An assessment of the impact of Hurricane Harvey on national industrial production, with special focus on the petroleum and refining industries so concentrated in Houston. [Link]

District Chaos

Is Washington bungling the Census? by Danny Vinik (Politico)

The state of federal statistical agencies is dire, and it’s entirely due to neglect of funding. High value data is a fantastic return on investment for public dollars, and it’s being brutally neglected. [Link]

An old-school pharmacy hand-delivers drugs to Congress, a little-known perk for the powerful by Erin Mershon (Stat News)

A seemingly benign story filled with some frankly concerning details about the state of lawmakers’ health. [Link]

Demographic Change

A Town’s Dilemma—Find a Savior, or Just Move On by Shibani Mahtani (WSJ)

A survey of the impact of closing public housing in relatively small towns that benefit from labor supply, labor demand, and the flow of money that comes from SNAP, Medicaid, and other programs that many public housing residents depend on. [Link; paywall]

First Evidence That Online Dating Is Changing the Nature of Society (MIT Technology Review)

More than one-third of American marriages started as online dates; for some demographics, it’s a much more dramatic story with nearly 70% of same-sex couples meeting online. There are some interesting effects, including drastically higher rates of interracial marriage. [Link]

USDOT Releases 2016 Fatal Traffic Crash Data (National Highway Traffic Safety Administration)

Data released this week by the DOT shows a concerning uptick in road fatalities including a 5.6% uptick in total deaths. Most subcategories rose by less than that amount, with decreases in drowsy and distracted deaths (so cellphones aren’t to blame). Pedestrian fatalities soared by 9% to the highest count since 1990. [Link]

Cybersecurity

Computer virus hits US Predator and Reaper drone fleet by Noah Shachtman (Ars Technica)

The machines which allow Air Force personnel to operate drones across the world have been infected with viruses, and data could have potentially been breached. [Link]

New Financial Products

Goldman Has a New Way for You to Bet on the Next Banking Crisis by Alastair Marsh and Tom Beardsworth (Bloomberg)

Goldman and JP Morgan are ramping up trading in total return swaps based on indices of bank bonds which can be marked down or converted to equity during periods of financial stress. [Link]

Sports

California’s Breakup With the NFL by Andrew Beaton (WSJ)

After moving up from San Diego, the LA Chargers can’t fill a 27,000 seat soccer stadium, while LA Rams and San Francisco 49ers fans are similarly disinterested this season. [Link]

Social Media

Weibo in meltdown over heartthrob Luhan’s new girlfriend by Laurie Chen (South China Morning Post)

Weibo isn’t very popular outside of China, but the network is massive behind the Great Firewall and its users went absolutely wild over a pretty germane piece of news this week. [Link]

Have a great Sunday!