S&P 500 Quick-View Chart Book: 10/20/17

Each weekend as part of our Bespoke Premium and Institutional research service, clients receive our S&P 500 Quick-View Chart Book, which includes one-year price charts of every stock in the S&P 500. You can literally scan through this report in a matter of minutes or hours, but either way, you will come out ahead knowing which stocks, or groups of stocks, are leading and lagging the market. The report is a great resource for both traders and investors alike. Below, we show the front page of this week’s report which contains price charts of the major averages and ten major sectors.

As seen in the charts below, the only major average that didn’t hit an all-time high this week was the Russell 2000, but it remains at extremely extended levels. In terms of individual sectors, Industrials, Materials, and Technology all hit new highs.

To see this week’s entire S&P 500 Chart Book, sign up for a 14-day free trial to our Bespoke Premium research service.

The Hits Keep on Coming For the S&P 500

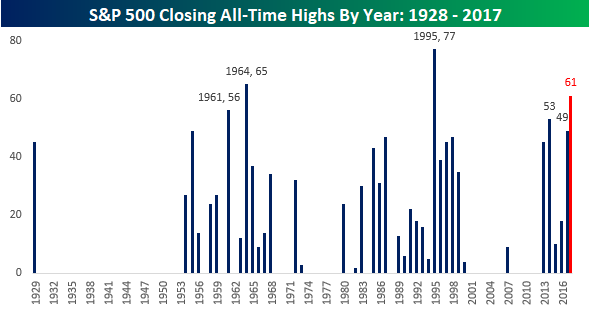

Here are some mind-blowing figures for you. In the 15 trading days since the start of October, the S&P 500 is on pace to close at a record high for the 10th time. Further, if the S&P 500 finishes up on the day Friday, it will be the 19th time that the index has closed at a record high since the start of September; a period covering 35 trading days. Keep in mind when reading these figures that all of these record highs have come at a time of year when stocks are typically at their weakest.

With all of these new highs piling up, 2017 is making a run for the record books in terms of the most record closing highs for a given year. Already, 2017 is tied for the fifth most closing highs on record (dating back to 1929), and provided we don’t see any major pullbacks, with two months left in the year, there’s the potential for more. For example, if the rest of the year goes along at the same pace as the first ten months (a big if given that new highs tend to come in bunches), 2017 is on pace to see 61 record closing highs for the S&P 500. That would rank as the third most for any given year behind only 1995 (77) and 1964 (65). Not only were both of those years good for bulls, but the years that followed them were also positive with a gain of 9.1% in 1965 and 20.3% in 1996. With 47 trading days left in 2017, surpassing the record of 77 back in 1995 would be an extremely tall task, but a move into the third spot is certainly possible.

Bespoke’s S&P 500 Sector Weightings Report — October 2017

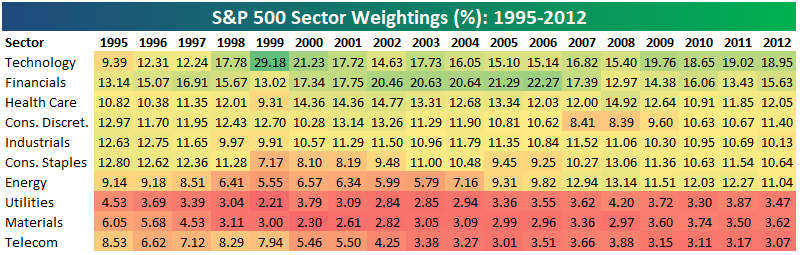

S&P 500 sector weightings are important to monitor. Over the years when weightings have gotten extremely lopsided for one or two sectors, it hasn’t ended well. Below is a table showing S&P 500 sector weightings from the mid-1990s through 2012. In the early 1990s before the Dot Com bubble, the US economy was much more evenly weighted between manufacturing sectors and service sectors. Sector weightings were bunched together between 6% and 14% across the board. In 1990, Tech was tied for the smallest sector of the market at 6.3%, while Industrials was the largest at 14.7%. The spread between the largest and smallest sectors back then was just over 8 percentage points.

The Dot Com bubble completely blew up the balanced economy, and looking back you can clearly see how lopsided things had become. Once the Tech bubble burst, it was the Financial sector that began its charge towards dominance. The Financial sector’s sole purpose is to service the economy, so in our view you never want to see the Financial sector make up the largest portion of the economy. That was the case from 2002 to 2007, though, and we all know how that ended.

If you would like to see the most up-to-date numbers for S&P 500 sector weightings, simply start a two-week free trial to our Bespoke Premium or Bespoke Institutional service. Click back to this post once you’re signed up to see the numbers.

The Closer — Cross Asset Correlations & Leading Indicators — 10/19/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we review recent cross-asset correlations and discuss leading indicators at both the state and national level.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Bespoke’s Sector Snapshot — 10/19/17

We’ve just released our weekly Sector Snapshot report (see a sample here) for Bespoke Premium and Bespoke Institutional members. Please log-in here to view the report if you’re already a member. If you’re not yet a subscriber and would like to see the report, please start a two-week free trial to Bespoke Premium now.

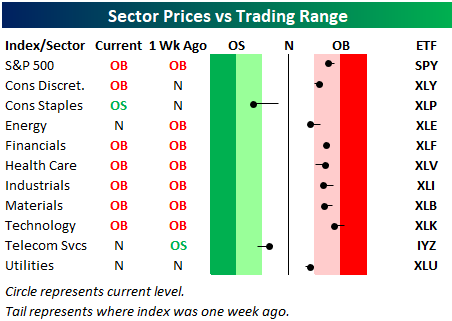

Below is one of the many charts included in this week’s Sector Snapshot, which is our trading range chart for S&P 500 sectors. The black vertical “N” line represents each sector’s 50-day moving average, and as shown, 8 of 10 sectors are currently above their 50-days. Consumer Staples remains below its 50-day and has moved into oversold territory, while Telecom has moved back into neutral territory.

To see our full Sector Snapshot with additional commentary plus six pages of charts that include analysis of valuations, breadth, technicals, and relative strength, start a two-week free trial to our Bespoke Premium package now. Here’s a breakdown of the products you’ll receive.

Investor Sentiment Dips in Yale Confidence Surveys

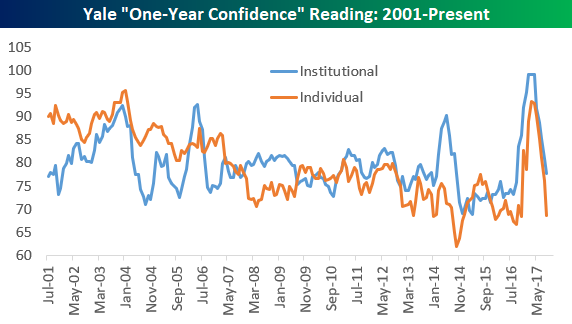

The Yale School of Management runs a monthly sentiment survey on both individual and institutional investors. Four questions are asked of investors, and below we provide charts showing the historical results through September 2017. The first chart shows the results for Yale’s “One-Year Confidence” reading which asked respondents how confident they are that the stock market will be higher a year from now.

As you can see, this reading amazingly spiked to nearly 100% in mid-2017 for institutional investors, and it got above 90% for individual investors. Over the last few months, however, bullish sentiment towards the stock market has dropped dramatically, and at this point investors surveyed are less optimistic towards stocks than they were just prior to last November’s Presidential Election.

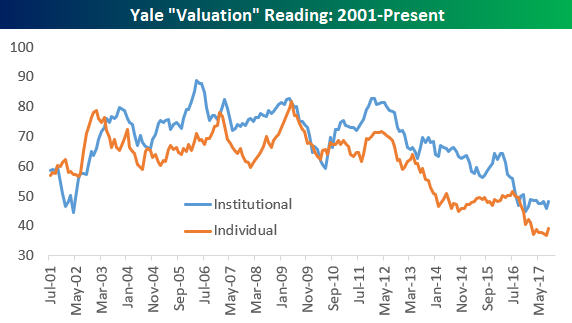

The second question covers investor confidence in the valuation of the stock market. High readings mean investors like the valuation of the market, and vice versa for low readings. As shown, both institutional and individual investors think valuations are as unattractive as they’ve been in the history of the survey dating back to 2001.

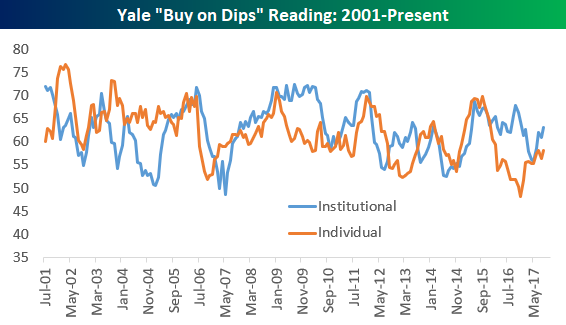

The “Buy on Dips” question asks investors how eager they are to buy stocks after the market experiences a big decline. This reading is in the middle of its historical range right now for both individual and institutional investors, but it has picked up a bit in recent months.

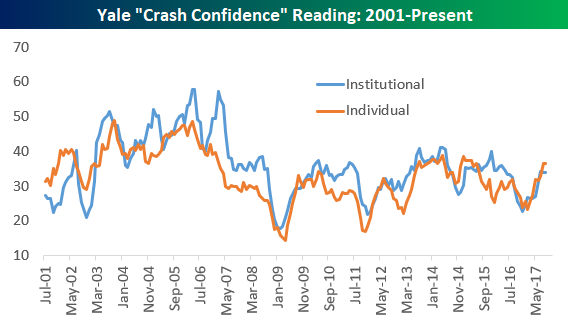

The last question asks investors how confident they are that there WILL NOT be a stock market crash in the next six months. A high reading means investors aren’t worried about a crash, which would be indicative of excess complacency in the market. While this sentiment measure has been rising slowly over the last year, it’s not elevated compared to historical readings by any means.

Earlier this week we published a more in-depth analysis of Yale’s sentiment survey including an update to our “Irrational Exuberance” indicator. Start a free trial to one of our membership levels to see the report.

ETF Trends: Hedge – 10/19/17

B.I.G. Tips – 2017 Sector and Asset Class Correlations

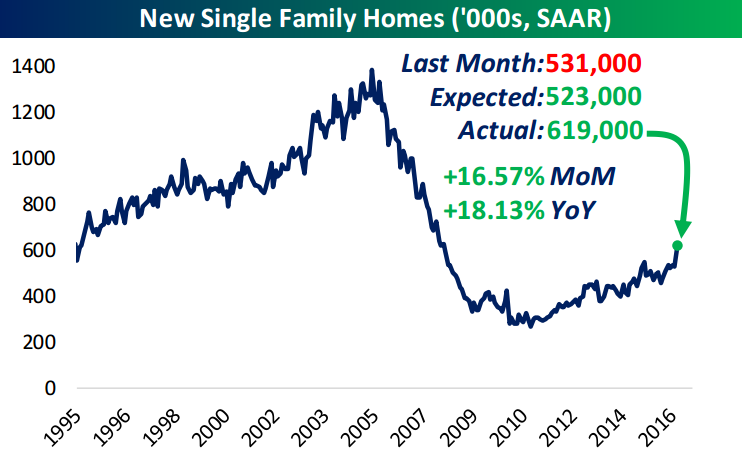

Housing Starts and Home Builder Stocks Diverge

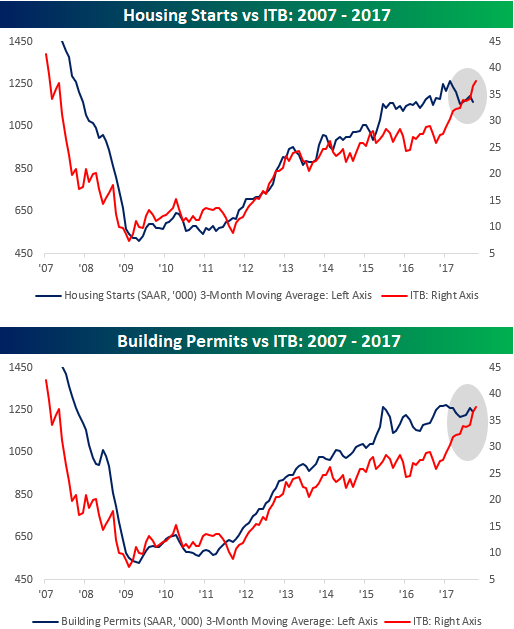

Throughout the bust and the ensuing recovery in residential housing, the performance of homebuilder stocks has closely tracked the trend in Housing Starts and Building Permits. Below, we highlight this relationship by comparing the iShares Home Construction ETF (ITB) to the three-month moving average of Housing Starts and Building Permits. The relationship between the two is so strong that the correlation coefficient between monthly Housing Starts and the closing prices of ITB is 0.89, while the correlation of ITB with Building Permits is even stronger at 0.91. For the sake of reference, a perfect correlation would be a reading of +1.

While the historical relationship between the two has been strong, we would note that in the last year both Starts and Permits have been drifting lower even as homebuilder stocks have surged. In 2015, we saw a divergence in the opposite direction where Starts and Permits outpaced the gains in homebuilder stocks. In that period, the homebuilder stocks eventually caught up, so perhaps we are just seeing the opposite pattern now. The two haven’t always tracked each other step for step, but the fact that the builders have rallied so much this year even as Starts and Permits have declined should be monitored for any signs of that weakness finding its way into the homebuilder stocks.