Chart of the Day: Semis – Knocking Your SOX Off

Fixed Income Weekly – 10/25/17

Searching for ways to better understand the fixed income space or looking for actionable ideals in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s note, we review changing bidder behavior in long-term Treasury auctions and shifts in ownership of the UST market.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

Looking For Action? S&P 1500 Most Volatile Stocks

For traders with a short-term time horizon who are looking for big moves over a short period, we have updated our list of the S&P 1500 stocks trading above $10 that have the largest intraday high-low ranges (based on the average percent spread between the intraday high and low over the last 50 days). The stocks are grouped based on whether they have a rising or falling 50-day moving average (DMA). Stocks highlighted in gray are new to the list this month.

With overall market volatility near record lows, it shouldn’t come as a surprise that there is not a whole lot of major volatility in individual stocks. As shown in the table below, just ten stocks in the S&P 1500 have an average daily intraday move of over 5%. Neck and neck in the lead for the title of most volatile stock are shares of MiMedx (MDXG) and Finish Line (FINL), which are both in short-term downtrends and have seen average daily moves of 6.4%. The only other stock in the S&P 1500 that has seen an average intraday move of 6% is Impax Labs (IPXL). While all three of the stocks mentioned have relatively low share prices, the highest priced stock on the list is RH (formerly Restoration Hardware). With a price of around $86 per share, the stock sees an average daily intraday move of nearly $4 each day.

In terms of sector representation, Health Care is the most heavily represented with twelve stocks and Consumer Discretionary is right on its heels with eleven. The only sector not represented is Utilities, but that shouldn’t be a surprise given the sector’s traditionally stable investor base.

Bespoke’s Global Macro Dashboard — 10/25/17

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

The Closer — Trade, PMIs & Richmond Fed Concur: Upward Bound Output — 10/24/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we review August global trade volumes, October flash Manufacturing PMI data, and Richmond Fed Manufacturing and Services activity data.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

B.I.G. Tips – Earnings Over Easing

Fryer-flation

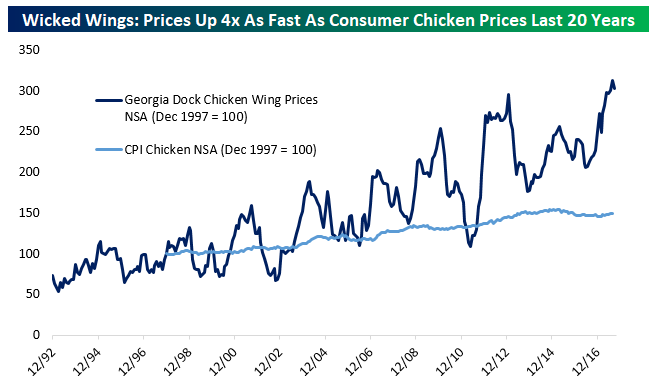

We sometimes like to look at the lighter side of capital markets. Or, in this case, the crispier, more tender side. Since the end of 1997, the CPI index for chicken is up about 50%. That may sound like a lot, but it’s actually right in-line with 2% inflation the Fed targets (of course, they target core PCE, which is a bit different from CPI, but that’s another story). Happily for white and dark meat lovers alike, consumers pay about 3% less for chicken than they did in March of 2015, when prices peaked. The interesting thing, though, is that wholesale chicken prices have been an entirely different story, especially for what we would argue are the best parts of the bird: high flavor, fun to eat, and imminently friable wings. As shown in the chart below, the Georgia Department of Agriculture’s price index for bulk chicken wing dock prices have risen by 200% since the same period in 1997.

You may be asking, “so what does this have to do with the price of wings in…” and believe it or not, we have an answer. Below, we show the percentage change in six stocks since the IPO of pure-play (and superior chicken tender purveyor, in our view) Bojangles’. BOJA was up about 50% right after it IPO’d but has been mired in the doldrums since, and over the last six months has suffered an especially rough run. Surprisingly – or perhaps not, given the menus – Buffalo Wild Wings (BWLD) has traded in lockstep with BOJA. BWLD isn’t quick service, instead focusing on the full-service market, but it’s got a similarly avian focus on fried chicken. Kentucky Fried Chicken, another ubiquitous source of all things clucky, is part of Yum! Brands (YUM), which has a more diversified portfolio of fast food options including Taco Bell and Pizza Hut. YUM hasn’t been a world-beater, but it’s handily out-feathered its crispy competition as far as current public chicken chains go. Before you ask: Chick-Fil-A is privately held, Church’s was taken out by PE firm FFL Partners in August of 2009, and Popeye’s was bought out by Restaurant Brands International (QSR) in March of 2017, just before the going got tough for chicken joints.

We’re sure you’ve noticed by now that there are three other stocks featured in our chart. All three are publicly traded chicken producers and distributors. Maple Leaf (MFI, traded in Canada; we show performance in USD) and Tyson (TSN) have more diversified business models, but Sanderson Farms (SAFM) is a pure play, with 100% of its revenues coming from various kinds of processed chicken. It’s no surprise, then, that as chicken prices have soared in the wholesale market despite relatively subdued consumer costs, that the companies who sell chicken to restaurants have pecked away at the performance of the firms that sell the juicy, delicious end product to consumers.