Bespoke’s Sector Snapshot — 10/26/17

We’ve just released our weekly Sector Snapshot report (see a sample here) for Bespoke Premium and Bespoke Institutional members. Please log-in here to view the report if you’re already a member. If you’re not yet a subscriber and would like to see the report, please start a two-week free trial to Bespoke Premium now.

Below is one of the many charts included in this week’s Sector Snapshot, which is our trading range chart for S&P 500 sectors. The black vertical “N” line represents each sector’s 50-day moving average, and as shown, 8 of 10 sectors are currently above their 50-days. We have seen a slight pullback over the past week for most sectors, though, with the biggest pullback coming from Health Care (XLV).

To see our full Sector Snapshot with additional commentary plus six pages of charts that include analysis of valuations, breadth, technicals, and relative strength, start a two-week free trial to our Bespoke Premium package now. Here’s a breakdown of the products you’ll receive.

Chart of the Day: Playing Two-Way Oil Flows

ETF Trends: Hedge – 10/26/17

Jobless Claims Still Below Pre-Hurricane Levels

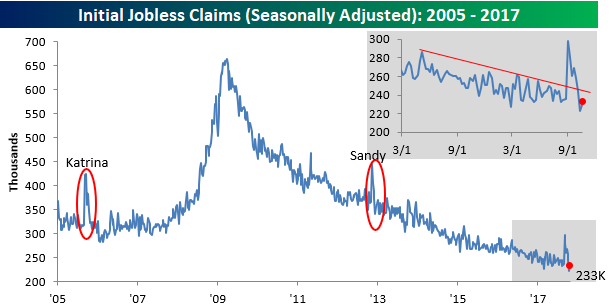

Jobless claims rose by 10K this week but still managed to come in slightly below consensus expectations (233K vs 235K). Claims have now been below 300K for 138 straight weeks, which is the longest such streak since the early 1970s. If Hurricanes Harvey, Irma, and Maria weren’t able to push claims above 300K, it’s hard to imagine what will.

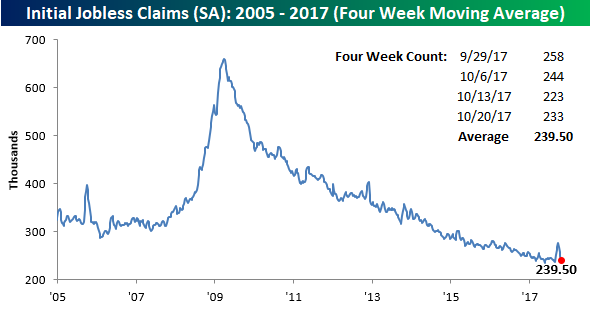

With the recently low string of weekly prints, the four-week moving average continues to sink. Even with this week’s 10K increase, the four-week moving average declined to 239.5K from 248.5K. That now puts this metric within 4K of the multi-decade low of 235.5K we saw back in May. Looking ahead to next week, as long as claims don’t increase by more than 8K, we should see a new low in the four-week moving average.

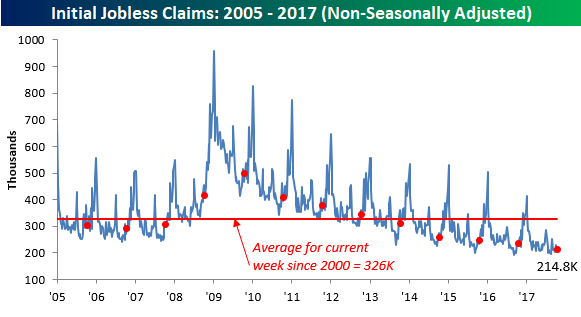

On a non-seasonally adjusted (NSA) basis, claims increased by 9.3K this week, but that is still well below typical levels for this time of year as the average reading for the current week of the year since 2000 is more than 110K higher at 325.75K. To find a week where claims were lower than this week’s print at this time of year, you have to go all the way back to 1973.

the Bespoke 50 — 10/26/17

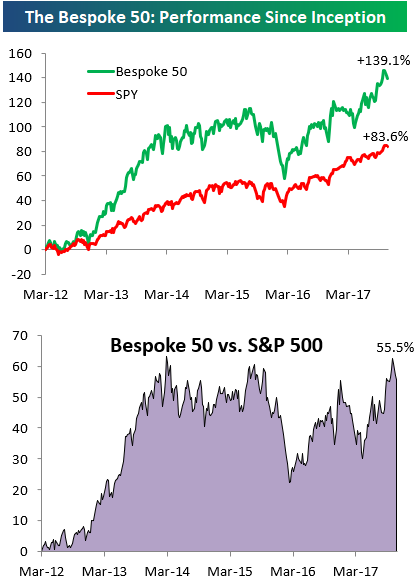

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” has beaten the S&P 500 by 55.5 percentage points. Through today, the “Bespoke 50” is up 139.1% since inception versus the S&P 500’s gain of 83.6%. Always remember, though, that past performance is no guarantee of future returns.

To view our “Bespoke 50” list of top growth stocks, click the button below and start a trial to either Bespoke Premium or Bespoke Institutional.

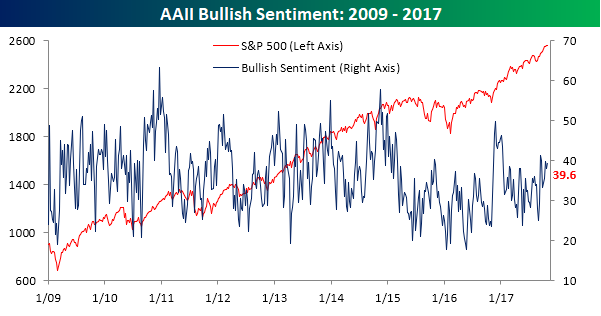

Bullish Sentiment Approaches 40%

In normal times a bullish sentiment reading of 40% wouldn’t be much of a big deal, but given the state of sentiment over the last several years, 40% is now considered an accomplishment. In this week’s sentiment survey from AAII, bullish sentiment increased 1.7 percentage points up to 39.6%. That represents a five-week high, but also a record 147 straight weeks where bulls have failed to be in the majority.

While bullish sentiment may have ticked higher, bearish sentiment surged 5.1 percentage points to a seven-week high of 33.0%. 33% may not sound like much and it is lower than the 39.6% bullish reading, but when you consider the fact that stocks have been hitting record highs on a seemingly daily basis, it represents a healthy degree of skepticism.

With both the bull and bear camps expanding this week, fence sitters plummeted, falling 6.8 percentage points down to 27.3%. That was the largest weekly decline since August and is the lowest weekly reading since March.

The Closer — Capex Comeback, No Fiscal Fecundity — 10/25/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we discuss US investment spending, government contribution to growth, and new home sales data updated today.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

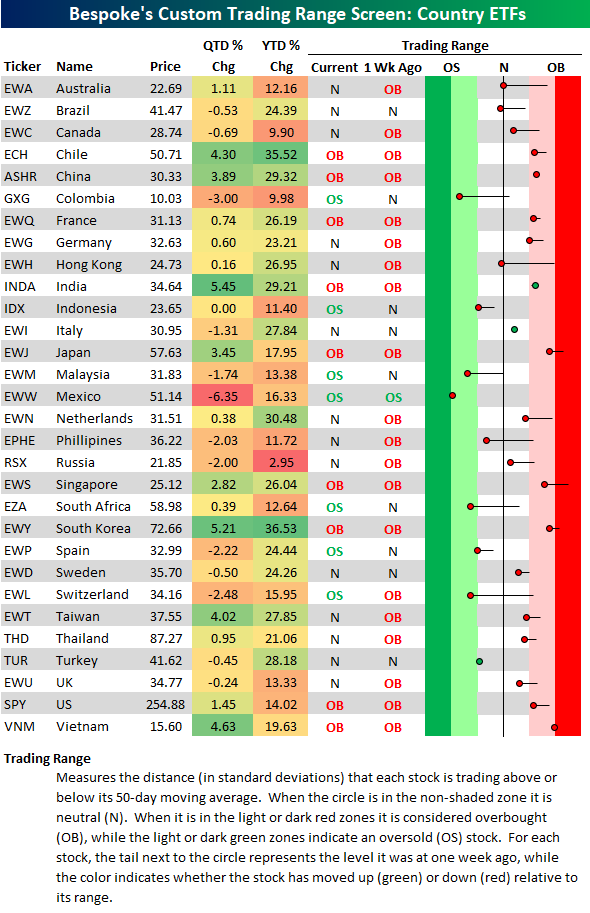

Global Equities Pulling Back

US equity markets have been on a pretty epic run over the past few weeks, but today the major indices are finally pulling back a bit. We’re seeing mean reversion in international equity markets as well. You can see the pullback in our Country Trading Range Screen below. The screen highlights where each of the 30 largest country ETFs (traded on US exchanges) are trading relative to their 50-day moving averages (the black vertical “N” line in the screen). The dot represents where each ETF is currently trading relative to its range, while the tail end shows where it was trading a week ago. A red dot means the ETF is down within its range over the last week, and vice versa for a green dot.

As you can see, there are only three green dots versus twenty-seven red dots, so we’ve pretty much seen across-the-board mean reversion for global equities over the last week. There were twenty countries that were trading in overbought (OB) territory last week at this time, but now there are only nine. And there are now seven countries in oversold territory versus just one last week.

Countries like Australia (EWA), Brazil (EWZ), Colombia (GXG), Hong Kong (EWH), the Philippines (EPHE), South Africa (EZA), and Switzerland (EWL) all broke below their 50-days over the last week.