Bespoke’s Global Macro Dashboard — 11/1/17

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

The Closer — Households, Homes, & Wages — 10/31/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we review quarterly household formation, homeownership, and rental vacancy stats, August’s Case-Shiller home price indices, and the quarterly employment cost index report from the BLS.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

B.I.G. Tips – Fed Days November 2017

B.I.G. Tips – October 2017 Performance Drivers (Decile Analysis)

ETF Trends: Fixed Income, Currencies, and Commodities – 10/31/17

Chart of the Day: Meh-lennials

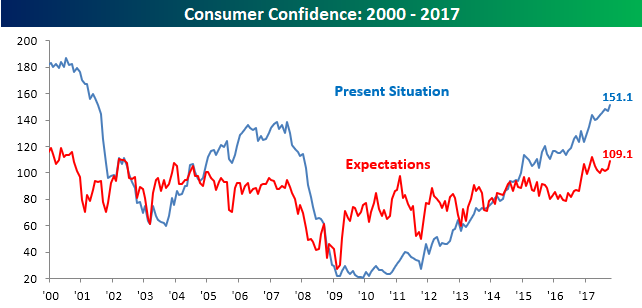

Highest Confidence Since 2000

Consumer Confidence for the month of October surged to the highest level since December 2000. While economists were expecting the headline index to show a slight increase to 121.0 from last month’s level of 120.6, the actual reading rose to 125.9, taking out the 124.9 high from March. This month’s print was also the best reading relative to expectations since March.

Consumers aren’t as optimistic about the future as they are about the present, however. When it comes to the present, consumers haven’t been this optimistic since July 2001. When it comes to the future, though, confidence levels still have yet to take out the recent highs from last March. As shown in the chart below, the divergence between sentiment towards the present and future tends to get wider the later you get into the economic cycle, so this kind of trend is closer to late-cycle than early cycle behavior.

Bespoke Stock Scores: 10/31/17

Nikkei: All It Does Is Win

When settling into our desks this morning and checking out how international markets performed overnight, we had to do a double-take when the color next to Japan’s Nikkei 225 was actually red. Sure it was a drop of just 0.0003%, but it was a decline nonetheless. And that’s something we haven’t been accustomed to seeing for Japanese stocks this month. In fact, for the entire month of October, the Nikkei traded down on the day just two times out of 21 trading days! That works out to up days on just over 90% of all trading days and is a level of consistency that has never been seen before.

Since 1970, there have only been three months where the Nikkei traded higher on 85% or more of a month’s trading days, and the other two months were in May 2015 (88.9%) and March 1986 (85%). Each of those three months are highlighted in the chart below, and the performance of the Nikkei following the two prior months is summarized in the table below. The Nikkei’s performance following each of those prior two experiences couldn’t be more different. Back in 1986, the Nikkei was in the middle of an epic bull run that lasted another three years, while the occurrence in May 2015 was followed by a relatively steep decline and then a period of consolidation that continued right up until this month when the Nikkei finally made another multi-year high in mid-October.

The Closer — Equity Strength Readings, Savings Rate Bombs, China Assets — 10/30/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we discuss the goings on today in Catalonia, the ECB’s decision to trim stimulus, and the strong footing for the dollar.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!