Fixed Income Weekly – 11/15/17

Searching for ways to better understand the fixed income space or looking for actionable ideals in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s note, we take a look at yield curve flattening and the declining premium between Utilities dividend yields and long term UST yields.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

October 2017 Headlines

Chart of the Day: The End of Quite a Streak for the S&P 500

B.I.G. Tips – Retail Sales Growth Slows, But Still Beats Expectations

Bespoke’s Global Macro Dashboard — 11/15/17

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

The Closer — Quarterly Consumer Credit Review — 11/14/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we chart up the quarterly consumer credit data released today by the NY Fed.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

ETF Trends: Fixed Income, Currencies, and Commodities – 11/14/17

Chart of the Day: Best Scoring Charts

US Underperformance vs. Rest of World, Emerging Markets

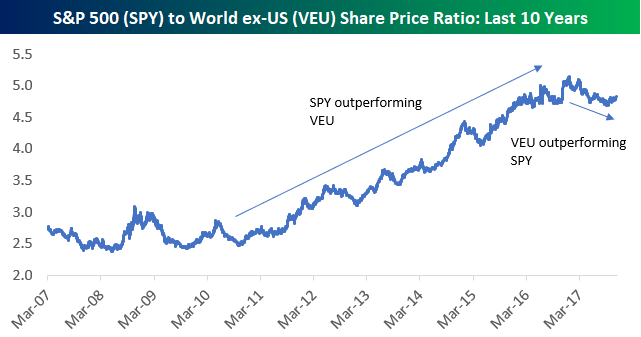

One of the easiest ways to track the relative equity-market performance of the US versus the rest of the world is to take the ratio of SPY to VEU. SPY tracks the S&P 500, while VEU tracks the FTSE All-World ex-US index. As shown in the chart below, when the line for this ratio is rising, the US is outperforming the rest of the world. When the line is falling, the US is underperforming.

After outperforming from 2011 through 2016, we’ve finally seen the US go through a period of underperformance versus the rest of the world in 2017. If this new trend of underperformance by the US lasts as long as the prior trend of outperformance, investors will certainly be better off rotating into non-US equity index ETFs.

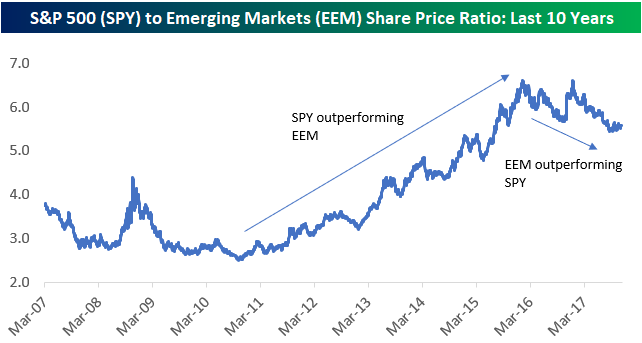

A similar trend has taken shape for emerging markets specifically versus the US. Only this trend of outperformance by emerging markets began a year earlier back in early 2016 than it did for the All World ex-US ETF.

General Electric (GE) Market Cap Down $240 Billion Last 10 Years

General Electric (GE) has gotten absolutely crushed over the last two days, falling 15% from $20.50 down to $17.50. GE’s peak of the current bull market for the S&P 500 came on July 20th of last year, but since then it’s down 47%. Even more shocking is that at $17.50, GE’s share price is trading at the same level it was at 20 years ago in early 1997. Of course there have been dividends paid, but it’s not a good look for a company when share price is unchanged on a 20-year basis.

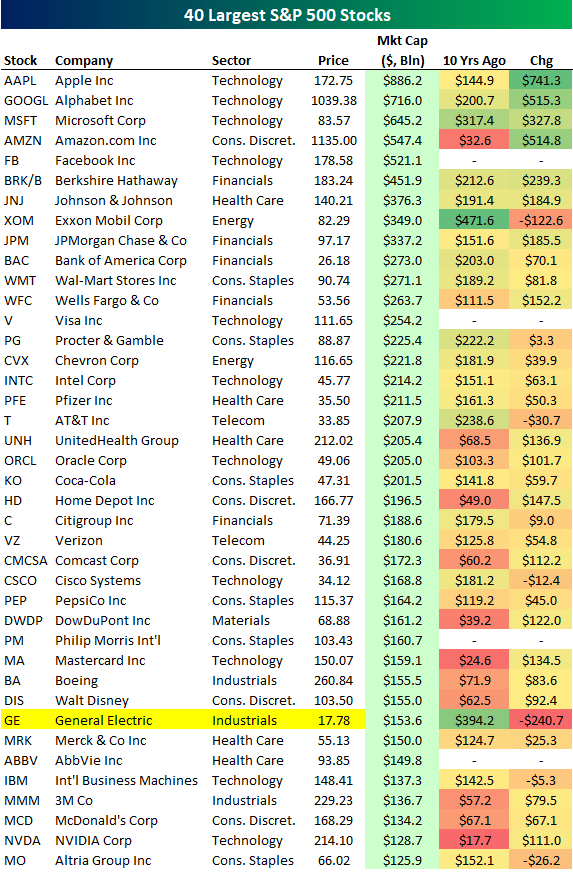

General Electric (GE) now has a market cap of $153.6 billion. That’s still larger than 93% of the stocks in the S&P 500, but it ranks 33rd from the top at this point. Ten years ago, GE was the second largest company in the S&P 500 behind only Exxon Mobil (XOM). Since then, GE has lost $240.7 billion in market cap.

Below is a look at the 40 largest stocks in the S&P 500 at the moment. While GE has lost $240 billion over the last ten years, three of the four largest stocks right now have each added more than $500 billion (AAPL, GOOGL, AMZN). Facebook (FB) has added $500+ billion in market cap as well given that it wasn’t even public ten years ago and it now has a market cap of $521 billion.

Had someone told you in 2007 that the S&P 500 would be up 80% ten years from now, you would have certainly expected GE to add to its market cap instead of subtract $240 billion. When it comes to long-term projections, it just goes to show you — expect the unexpected.