ETF Trends: Hedge – 11/16/17

The Closer — Industrial Output, Output Gap, Capex, And Trade Prices — 11/16/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we review today’s data releases in the US: industrial production, Philly Fed manufacturing (with a focus on capex plans) and trade prices.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Chart of the Day: Contrarian In A Collapse

Bespoke’s Sector Snapshot — 11/16/17

We’ve just released our weekly Sector Snapshot report (see a sample here) for Bespoke Premium and Bespoke Institutional members. Please log-in here to view the report if you’re already a member. If you’re not yet a subscriber and would like to see the report, please start a two-week free trial to Bespoke Premium now.

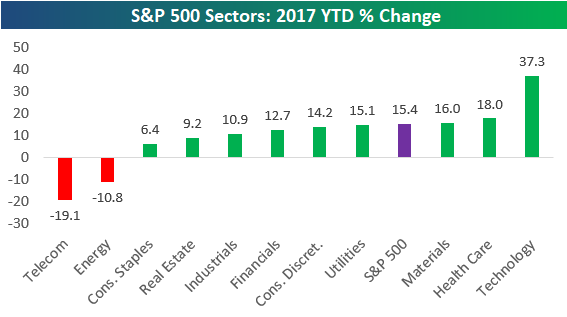

Below is one of the many charts included in this week’s Sector Snapshot, which simply highlights the year-to-date change for the major S&P 500 sectors. Note that Tech is now up more than twice as much as the 2nd best sector (Health Care) in 2017. And Tech is outperforming the worst sector (Telecom) by 56 percentage points. Talk about a spread.

To see our full Sector Snapshot with additional commentary plus six pages of charts that include analysis of valuations, breadth, technicals, and relative strength, start a two-week free trial to our Bespoke Premium package now. Here’s a breakdown of the products you’ll receive.

the Bespoke 50 — 11/16/17

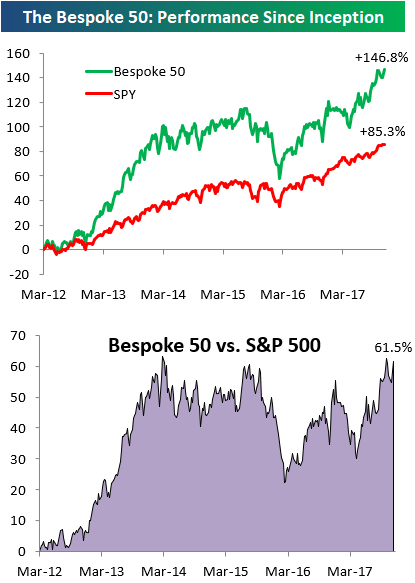

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” has beaten the S&P 500 by 61.5 percentage points. Through today, the “Bespoke 50” is up 146.8% since inception versus the S&P 500’s gain of 85.3%. Always remember, though, that past performance is no guarantee of future returns.

To view our “Bespoke 50” list of top growth stocks, click the button below and start a trial to either Bespoke Premium or Bespoke Institutional.

Bullish Sentiment Crashes

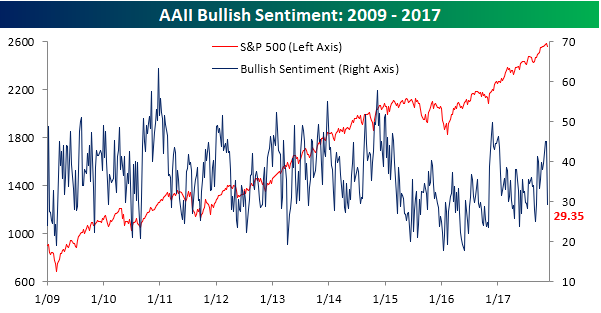

It looks like all of the negative talk from some high profile investors in recent days has made its way into the heads of individual investors, causing them to turn increasingly bearish on equities. According to this week’s sentiment survey from AAII, bullish sentiment crashed from 45.1% down to 29.35%. That’s the largest one-week decline since April 2013! With bullish sentiment now sporting a 20-handle, it’s also safe to say that the streak of sub 50% readings that has been in place for 150 straight weeks now won’t be broken anytime soon.

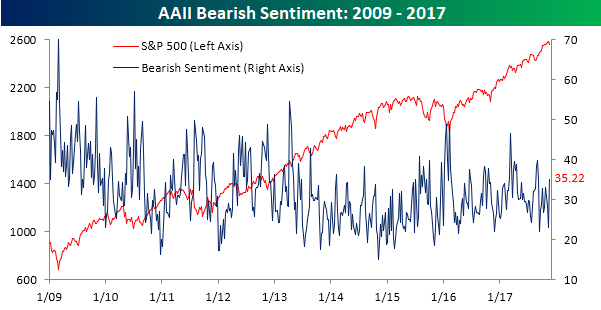

Bearish sentiment, meanwhile, didn’t see quite as big a move as bullish sentiment, but it did spike by 12 percentage points, and that’s the largest one-week increase since February 2016.

The Closer — Online Falters, Prices Punchy — 11/15/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we review today’s retail sales report, CPI data, EIA weekly storage numbers, and long-term real commodity prices.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

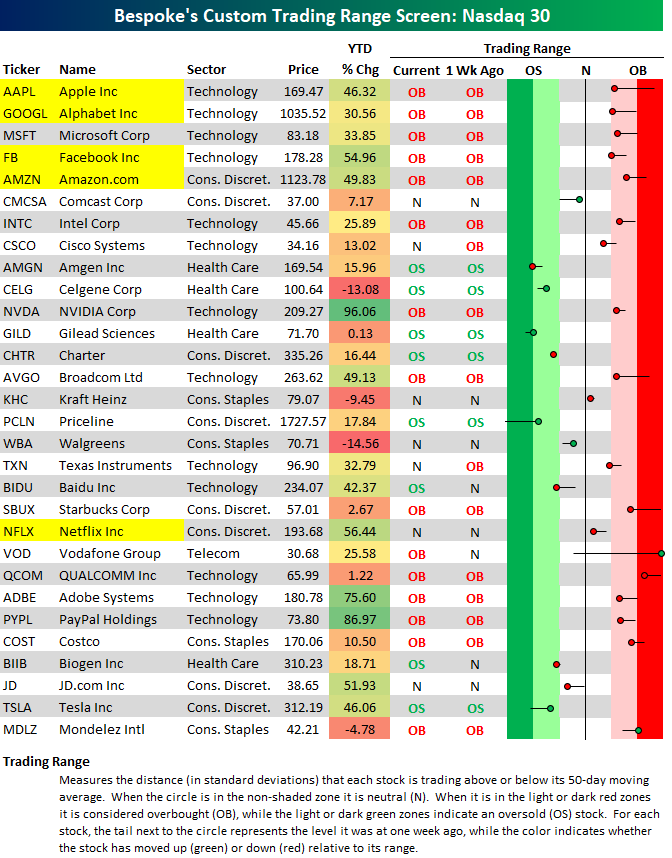

Bespoke’s FAANG+ Trading Range Screen

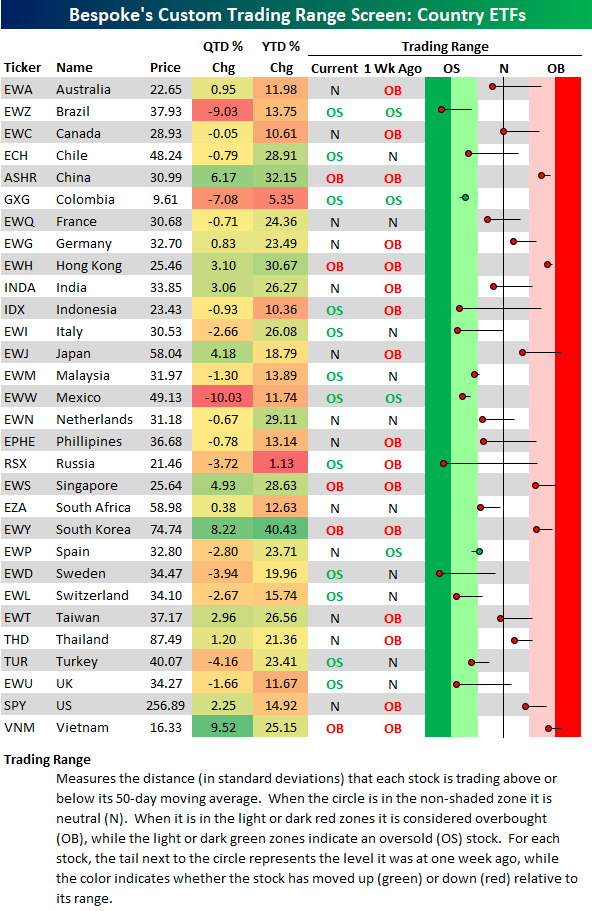

Bespoke’s Country Trading Range Screen: Trending Towards Oversold

Last week at this time, 16 of the 30 country ETFs in our trading range screen shown below were in overbought territory. After a week of declines, there are now just 5 countries still in overbought territory, while 12 are oversold. In our screen, the dot shows where the ETF is currently trading relative to its normal range (the black vertical “N” line represents each ETF’s 50-day moving average), while the tail end shows where it was trading one week ago.

As shown, Brazil (EWZ), Indonesia (IDX), Italy (EWI), Russia (RSX), Sweden (EWD), and the UK (EWU) are some of the countries that have gotten hit the hardest over the last week. Note that the US (SPY) has now moved out of overbought territory as well, but it remains above its 50-day moving average.

After the action we’ve seen over the last few months where pretty much everything was trading higher across the globe in lockstep, we’ve now got confirmation that yes…stocks can indeed still go down.