It’s About Time: S&P 500 A/D Line Makes a New High

For more than a year now, we have repeatedly highlighted how the S&P 500’s cumulative A/D line has consistently confirmed each new high in the S&P 500. For those unfamiliar with the term, the cumulative A/D line is simply a running total of the net number of S&P 500 components rising in price (stocks trading up on the day minus stocks trading down) each day. When the market is rising, the cumulative A/D line, or ‘breadth’ as it’s often referred to, should be rising, and when the market is falling, the opposite should be the case. The chart below compares the two over the last year, and it’s easy to see how closely the two have tracked each other over time. That’s a sign of a healthy market.

In the last month, however, we did see a slight divergence between the S&P 500 and its cumulative A/D line. Prior to Tuesday’s trading, the last time the S&P 500 saw breadth reach a new high was more than a month earlier on 10/20. Despite the lack of a new high in breadth, the S&P 500 managed to post four closing highs during that span. Now, while there was technically a divergence between price and breadth, the difference was extremely minor, but big divergences have to start somewhere. Therefore, we were tracking it closely. When it comes to this indicator, though, there’s a lot less to worry about after Tuesday’s trading. That’s because the S&P 500 finally took out its cumulative A/D line as the index itself closed at another new all-time high just shy of 2,600. Thankfully breadth finally caught up.

The Closer — Peso Pushing, CFNAI Surge — 11/21/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we review a surging Mexican peso and a big up-move in the Chicago Fed’s National Activity Index.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Chart of the Day: Bitcoin-Related Stocks Echo Dot Com Boom

B.I.G. Tips – Retail Tries to Bounce – Can it Last?

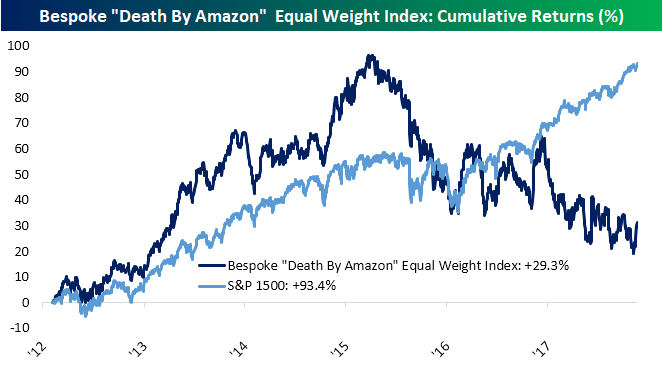

Awful. Simply put, the word awful sums up the year for investors with ties to stocks in the retail sector not named Amazon.com (AMZN), Home Depot (HD), or a handful of other companies. It hasn’t been just 2017 either. As shown in our Death By Amazon Index (DBA) below, the retail sector has been in a tailspin for over two and a half years now. Since 2012, the index has rallied 29.3%, which is less than a third of the S&P 500’s 93.4% gain. More recently, though, things have been even worse. Since its peak in Spring 2015, the DBA index has lost more than a third of its value, and in just 2017 alone, it is down 15% in a year where the S&P 500 is up 15%! Not good.

In the last two weeks, though, retail stocks have been attempting to bounce ahead of the holiday season. Investors seem to be in the “bargain hunting” mood. Can it last? In our latest B.I.G. Tips report, we look at the recent rally in retail to put the gains in perspective too see if the recent gains are likely to last or fall by the wayside. For anyone interested in the retail sector, this report is a must-read. To see the report, sign up for a monthly Bespoke Premium membership now!

Bespoke Stock Scores: 11/21/17

Things to Be Thankful For: 2017 Market Returns

Below is an updated look at our asset class performance matrix showing total returns for ETFs so far in 2017. We also show total returns so far this month and in the fourth quarter.

Aside from a few areas like the US Energy and Telecom sectors plus oil and natural gas, every other asset class on the matrix is positive on a total return basis in 2017. As we approach Thanksgiving 2017, there’s certainly a lot for investors to be thankful for this year.

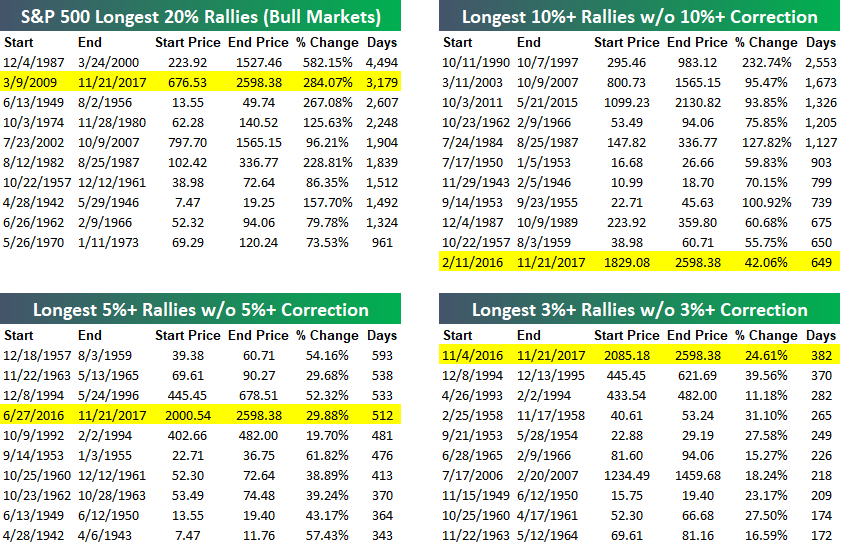

S&P 500 Hot Streak Extended

With today’s new highs, the S&P 500’s current bull market has extended to 3,179 calendar days dating back to March 9th, 2009. To surpass the record length for a bull market (20%+ rally without a 20%+ decline), there’s still a long way to go, as the bull market from 12/4/1987 through 3/24/2000 lasted 4,494 days.

The current streak of days without a 10%+ pullback has yet to crack the top ten, but it will if we go another 2 days. As shown in the top right table below, the 10th longest streak without a 10%+ pullback was 650 days from 10/22/1957 to 8/3/1959. The current streak without a 10%+ pullback is now at 649 days.

The S&P 500 isn’t anywhere close to breaking the longest streak of days without a 10%+ pullback. That title belongs to the rally that lasted 2,553 days from 10/11/1990 to 10/7/1997. During that seven-year span, the S&P rallied 232.74% without a single 10% decline on a closing basis. For the current streak to match the record, we’d have to make it to February 2023 without a 10%+ decline from a peak. Imagine that.

While the record for the longest rally without a 10%+ pullback is nowhere in sight, we’re getting closer to breaking the record for longest streak without a 5%+ pullback. As of today, the S&P hasn’t seen a 5%+ decline since June 27th, 2016 — a period of 512 calendar days. To break the record, the current streak would need to stretch to 594 days, taking us out to February 11th of next year — easily do-able given the market’s current lack of volatility, but by no means a guarantee.

Finally, one record the current rally does hold is the longest rally without a 3%+ pullback. The S&P 500 hasn’t pulled back 3%+ in 382 days dating back to last November. As shown in the bottom right chart below, that’s 12 days longer than the prior record stretch of 370 days without a 3%+ pullback that ran from December 1994 to December 1995.

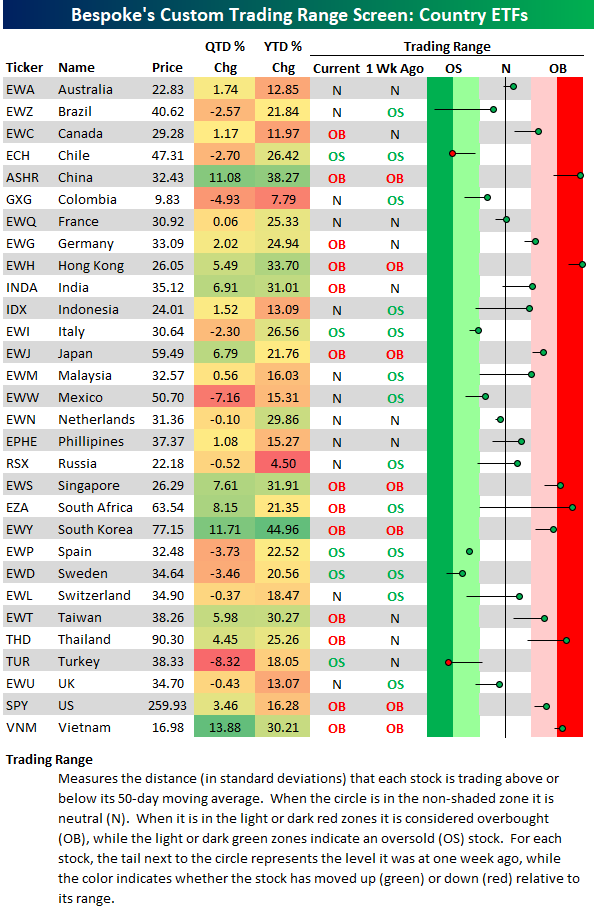

Global Bounce

Just last Wednesday we noted that stock markets around the world were trending lower and in many cases moving into oversold territory. Just six days later, it appears to be smooth sailing again as most countries have bounced back in a big way.

Below is our Country ETF Trading Range screen, which highlights where 30 of the largest country ETFs are trading relative to their historical range. For each country ETF, the dot represents where it’s currently trading, while the tail end represents where it was trading one week ago. The black, vertical “N” line represents each ETF’s 50-day moving average, and moves into the red or green zones are considered overbought or oversold.

As shown, nearly all countries have moved higher within their trading ranges over the past week (dot is to the right of the tail). At this point, 20 out of 30 countries are back above their 50-day moving averages, and 15 of 30 are back in “overbought” territory. China (ASHR), Hong Kong (EWH), and South Africa (EZA) are the most overbought ETFs in the screen. On the flip side, Chile (ECH), Italy (EWI), Spain (EWP), Sweden (EWD), and Turkey (TUR) are the five ETFs still trading at oversold levels.

On a YTD basis, all 30 country ETFs are in positive territory, with South Korea (EWY) up the most at +44.96%, and Russia (RSX) up the least at just +4.50%. The average country ETF is up just over 22% year-to-date.

Bespokecast Episode 18 — George Livadas — Now Available on iTunes, GooglePlay, Stitcher and More

We’re happy to announce that the newest episode of Bespokecast is now available to the general public both here and via the various podcast platforms. Be sure to subscribe to Bespokecast on your preferred podcast app to gain access to our full collection of episodes. We’d also love for you to provide a review as well!

We’re happy to announce that the newest episode of Bespokecast is now available to the general public both here and via the various podcast platforms. Be sure to subscribe to Bespokecast on your preferred podcast app to gain access to our full collection of episodes. We’d also love for you to provide a review as well!

In our newest conversation on Bespokecast, we sit down for a conversation with George Livadas, founder of Upslope Capital Management, a Colorado-based concentrated long-short equity manager. George offers insights into his process of stock selection on both the long and short side, as well as background on what led him to start Upslope, the educational and professional background that led him to develop his strategy, and how he practices risk management. We also discuss how he thinks about tax reform, US macro, and a wide range of other topics including some of the material he releases on his website. Below are links to some of the notes we mention specifically during our talk. You can also follow George on Twitter @upslopecapital.

Salvatore Ferragamo Investment Overview (26 page PDF)

Consolidated Learnings (3 page PDF)

Q3 2017 Investor Letter (7 page PDF)

To listen to our newest episode or subscribe to the podcast via iTunes, GooglePlay, OvercastFM, or Stitcher, please click the button or links below. Please note that third-party podcast feeds may update at a lag of a few hours to this blog post.

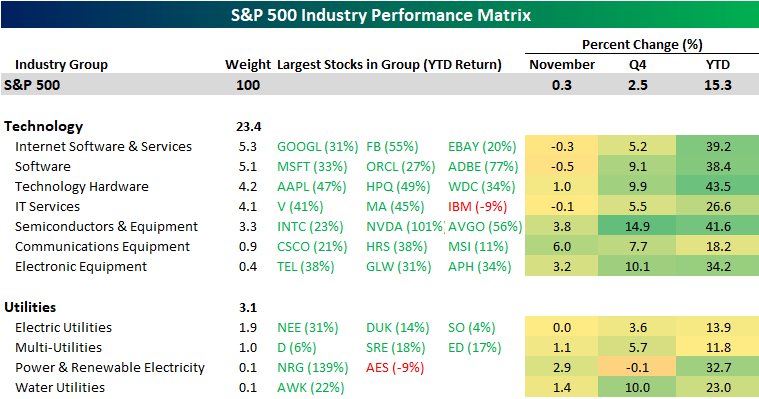

Strange Bedfellows: Technology and Utilities

We all know by now that it has been a very strong year for the Technology sector. Not only have the gains been large, but just about every stock associated with the sector not named IBM has had a great year. In fact, within the S&P 500 Technology sector, all seven Industry Groups have rallied at least 10%, and all but two (Communications Equipment and IT Services) are up over 30% (table below)! So far this quarter, Technolgy has remained strong with every Industry Group in the black by at least 5%. Suffice it to say, 2017 has been the year of Tech.

While Technology has seen broad-based strength in what has been a strong market overall, some may be surprised to see that the Utilities sector has also seen a very broad rally. While the gains haven’t been nearly as strong as the advance in Tech, the Utilities sector is the only other one where all of its Industry Groups are up at least 10%! When it comes to market performance, you don’t typically see Technology and Utilities sharing similar characteristics or trends, but this year they have seen among the most uniform rallies within their respective groups.