S&P 500 Quick-View Chartbook: 11/24/17

Bespoke’s Sector Snapshot — 11/24/17

We’ve just released our weekly Sector Snapshot report (see a sample here) for Bespoke Premium and Bespoke Institutional members. Please log-in here to view the report if you’re already a member. If you’re not yet a subscriber and would like to see the report, please start a two-week free trial to Bespoke Premium now.

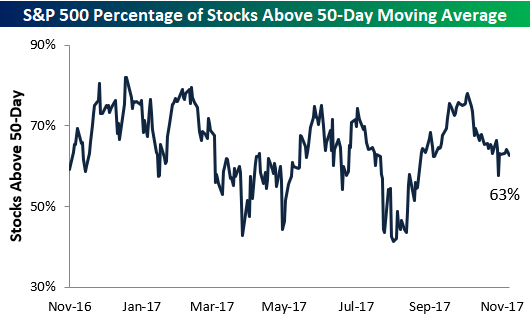

Below is one of the many charts included in this week’s Sector Snapshot, which highlights the percentage of S&P 500 stocks currently trading above their 50-day moving averages. This is one breadth measure that isn’t quite as high as we’d like to see it given that the S&P 500 is trading at a new 52-week high.

To see our full Sector Snapshot with additional commentary plus six pages of charts that include analysis of valuations, breadth, technicals, and relative strength, start a two-week free trial to our Bespoke Premium package now. Here’s a breakdown of the products you’ll receive.

Investors Rush Into Crypto

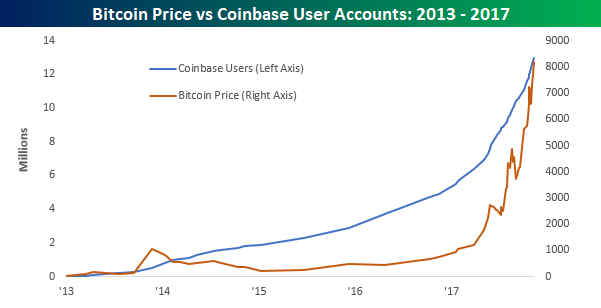

While a good deal of Americans opted to avoid talking politics around the Thanksgiving Dinner table this year, one topic filling the void was bitcoin. Whether it was a cousin bragging about buying it more than a year ago, or your uncle adamantly steadfast in his belief that the whole thing is a bubble, there’s a good chance someone mentioned it. With all the talk about bitcoin, a good deal of people are also starting to open accounts where they can buy and sell crypto-currencies. Coinbase is one of the largest platforms where consumers and merchants can transact in digital currencies like bitcoin and ethereum, and as bitcoin prices have surged, so too have the number of users on the platform. Just Wednesday, the company disclosed that the number of users on its platform had reached 13 million, but since then another 100,000 users have opened accounts!

To put this number of users into perspective, consider the fact that as of the end of 2016, Charles Schwab had 10.2 million brokerage accounts. Yes, Charles Schwab has a lot more assets in its accounts than Coinbase users, but the idea that crypto-currencies users are just a fringe part of the financial universe is not accurate.

The chart below shows the rate of change in bitcoin and the number of Coinbase users over the last four years (thanks to @alistairmilne for the user data). Not surprisingly, as prices have surged, so too have the number of accounts. In the last 12 months, as the price of bitcoin has increased more than ten-fold, the number of Coinbase users has increased from 4.9 million up to 13.1 million, for an increase of 167%.

the Bespoke 50 — 11/24/17

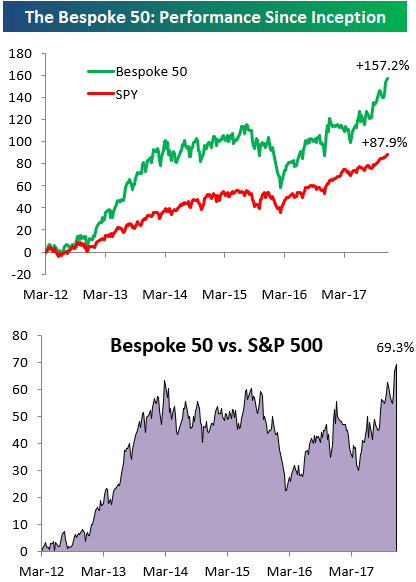

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” has beaten the S&P 500 by 69.3 percentage points. Through today, the “Bespoke 50” is up 157.2% since inception versus the S&P 500’s gain of 87.9%. Always remember, though, that past performance is no guarantee of future returns.

To view our “Bespoke 50” list of top growth stocks, click the button below and start a trial to either Bespoke Premium or Bespoke Institutional.

Sector Weightings: S&P 500 vs Emerging Markets

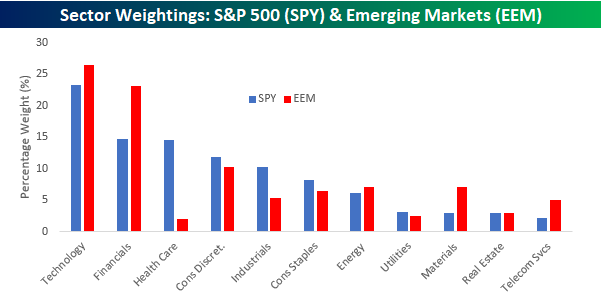

If we had a bitcoin for every time we heard someone say that the S&P 500 has been too reliant on the performance of tech stocks for its gains this year, we would be very rich. But if you think the S&P 500 is dangerously overweighted towards the Technology sector, beware of emerging markets. While the Technology sector’s 23% weighting in the S&P 500 makes it by far the largest sector in the index, the ETF tracking Emerging Markets (EEM) is even more heavily weighted towards technology. The chart below compares sector weightings in the ETFs that track the S&P 500 (SPY) and Emerging Markets (EEM). As you can see, Technology has a 26.5% weighting in EEM. So if you think the S&P 500 is too top heavy with tech, EEM is even more exposed.

In addition to the large weighting in tech, EEM also has a lot of exposure to Financials. That sector’s weighting is nearly 60% larger in EEM (23.1%) than it is in SPY (14.6%). With such large weightings in both sectors, just under half of EEM’s weighting is in Technology and Financials. So where is EEM underweighted relative to SPY? That would be in the Health Care sector. As shown below, Health Care accounts for 14.5% of SPY, but the sector’s weighting in EEM is a puny 1.95%.

Chart of the Day: Thankful for Emerging Markets

S&P 500 Sector Weightings Report — November 2017

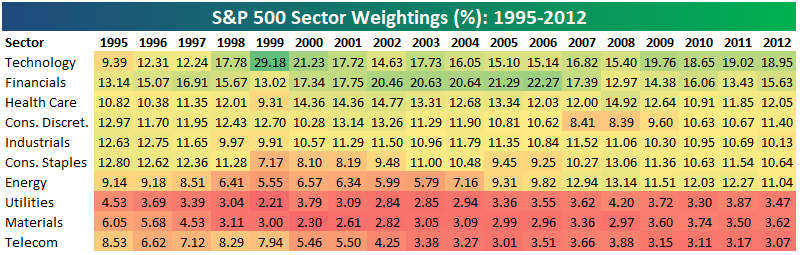

S&P 500 sector weightings are important to monitor. Over the years when weightings have gotten extremely lopsided for one or two sectors, it hasn’t ended well. Below is a table showing S&P 500 sector weightings from the mid-1990s through 2012. In the early 1990s before the Dot Com bubble, the US economy was much more evenly weighted between manufacturing sectors and service sectors. Sector weightings were bunched together between 6% and 14% across the board. In 1990, Tech was tied for the smallest sector of the market at 6.3%, while Industrials was the largest at 14.7%. The spread between the largest and smallest sectors back then was just over 8 percentage points.

The Dot Com bubble completely blew up the balanced economy, and looking back you can clearly see how lopsided things had become. Once the Tech bubble burst, it was the Financial sector that began its charge towards dominance. The Financial sector’s sole purpose is to service the economy, so in our view you never want to see the Financial sector make up the largest portion of the economy. That was the case from 2002 to 2007, though, and we all know how that ended.

Unfortunately we’ve begun to see sector weightings get extremely out of whack again as 2017 comes to an end.

If you would like to see the most up-to-date numbers for S&P 500 sector weightings, simply start a two-week free trial to our Bespoke Premium or Bespoke Institutional service. Click back to this post once you’re signed up to see the numbers.

Fixed Income Weekly – 11/22/17

Searching for ways to better understand the fixed income space or looking for actionable ideals in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s note, we continue to focus on yield curve flattening.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

Bespoke’s Global Macro Dashboard — 11/22/17

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

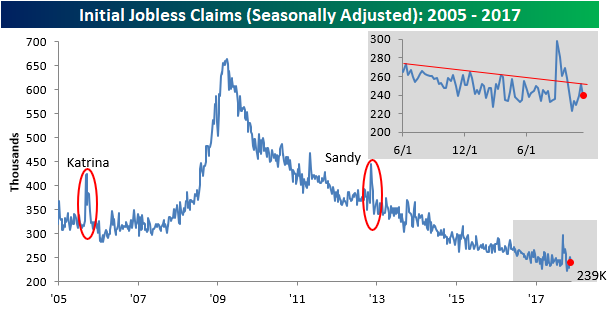

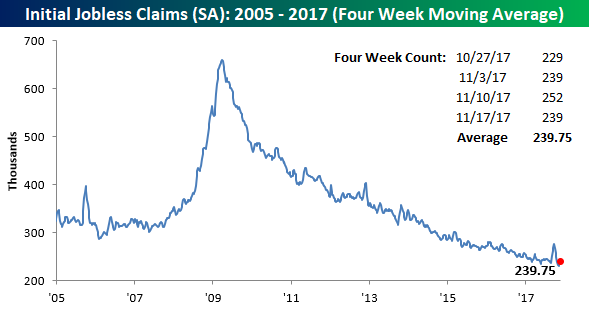

Jobless Claims Drop Slightly More Than Expected

Because of the Thanksgiving holiday, this week’s release of Initial Jobless Claims was moved up a day, but even though the day of the report was different, the positive trend remains the same. While economists were forecasting claims to come in at a level of 240K from last week’s reading of 252K, the actual reading came in at 239K. This marks the 142nd straight week of sub-300K claims.

Although claims dropped on the week, we’re still dropping off some very low readings from the four-week count, so that’s causing the four-week moving average to tick higher. This week it moved up to 239.75K, which is 8.5K above the multi-decade low of 231.25K that we saw to kick off November.

On a non-seasonally adjusted basis (NSA), claims remain impressive. While this week’s reading increased by over 37K, it’s common for NSA claims to increase at this time of year. Going back to 2000, this week’s print is still the lowest for this time of year since 1973 and 100K below the average of 374K going back to 2000.