Jobless Claims Slightly Lower Than Expected

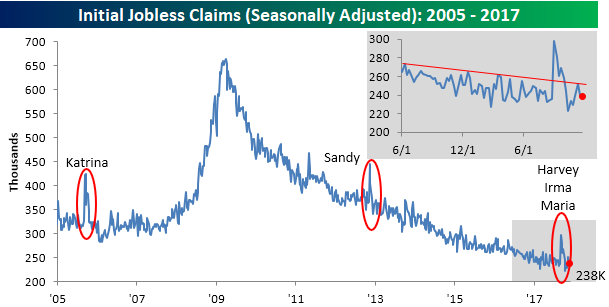

Like just about everything these days (besides bitcoin), there was very little volatility in this week’s jobless claims report as first-time claims fell by 2K to 238K compared to expectations for 240K. There’s not much new to say here as jobless claims continue to be one of the most consistent indicators of strength in the US economy. This week’s print marked the 143rd straight week where claims were below 300K, which is pretty incredible.

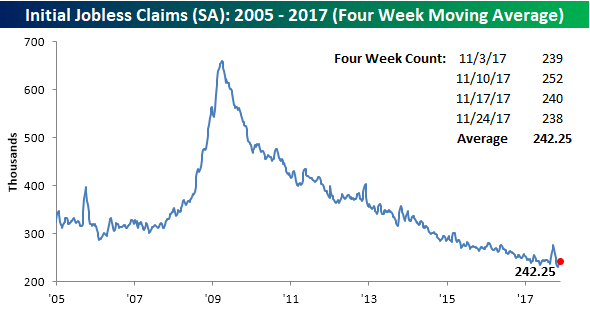

Even though this week’s print showed a slight decline, the four-week moving average actually ticked higher rising from 239.75K up to 242.25K. That now puts this reading 11K higher than the multi-decade cycle low of 231.25K that we saw four weeks ago.

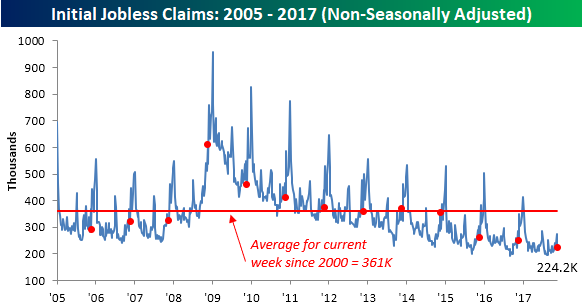

The most impressive aspect of this week’s report was the non-seasonally adjusted reading which declined from 274.2K down to 224.2K. For the current week of the year, NSA claims are more than 130K below their average since 2000 and haven’t been this low at this time of year since 1968!

The Closer — Rotation, Rotation, Rotation — 11/29/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we look at the massive rotation that has hit US equity markets this week. One area of the market that has seen huge buying interest recently is retail. Below is a list of our Death By Amazon index members. For each stock, we show its year-to-date percentage change along with its percentage change this week. On average, Death By Amazon stocks are down 15% year-to-date, but they’re up 8.2% this week. That’s a massive move. Of the 62 stocks in the index, 19 are up more than 10% on the week.

We discuss this week’s rotation in more detail in tonight’s Closer.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

B.I.G. Tips – Nasdaq Underperforms For a Change

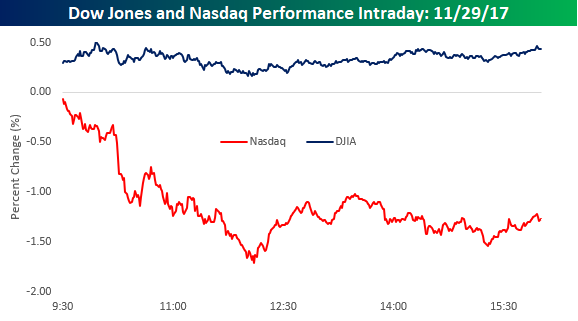

It was a rare painful day for the Nasdaq on Wednesday as the index fell more than 1% even as the DJIA traded up over 0.4%. For an index that was up close to 30% on the year heading into the day, Wednesday’s decline seemed even more extreme.

There haven’t been too many times in recent history where we have seen a similar divergence between the Nasdaq and DJIA. In fact, Wednesday was only the 7th time during the current bull market (since March 2009) where the DJIA was up on the day while the Nasdaq traded down over 1%. In our most recently released B.I.G. Tips report, we looked at how both the Nasdaq and DJIA performed following prior days where there were similar divergences. This report is a must-read. To see it, sign up for a monthly Bespoke Premium membership now!

B.I.G. Tips – Decile Analysis Highlights Rotation Underway

Chart of the Day: Economic Surprises Pile On

Fixed Income Weekly – 11/29/17

Searching for ways to better understand the fixed income space or looking for actionable ideals in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s note, we review the performance of auto loan securitizations.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

Bespoke’s Global Macro Dashboard — 11/29/17

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

The Closer — Tax Progress, Strong Data — 11/28/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we take a look at the impact of tax reform progress made today by the GOP, review strong data across the global economy, break down the monthly Richmond Fed activity indices, and review the acceleration in US home prices.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Slightly Less Bearish on Multi-Line Retailers

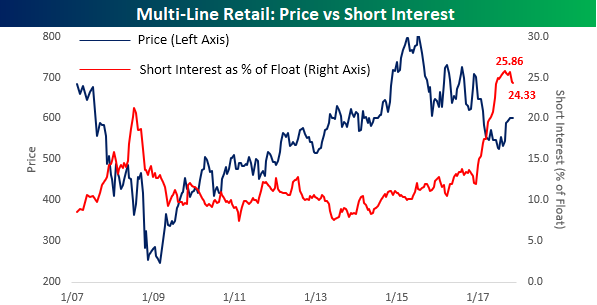

If there’s one area of the market that investors couldn’t be more bearish on, it’s the multi-line retailers. With Amazon eating their lunch, consumers changing the way they spend money (choosing experiences over stuff), and an overall bloated retail footprint, multi-line retailers have faced a perfect storm and their stocks have reacted accordingly. With all the negative headwinds, short-sellers have been piling on the group. At the end of 2016, average short interest as a percentage of float for the group was an already high 14.3%, but through the course of the year, short interest levels ballooned to more than 25%. Shorting retail stocks has become one of the consensus trades of 2017. The trade has become so consensus, in fact, that ProShares imitated (to put it kindly) our Death by Amazon Index and created an ETF that increases in price when the stocks of traditional brick and mortar retailers decline.

In recent weeks, however, we have begun to see some easing in the pressure by short sellers towards traditional brick and mortar retailers. The chart below compares the S&P 500 Multi-Line Retail Index to the average short interest (as a percentage of float) of multi-line retailers in the S&P 1500. While the average SIPF level of stocks in the group peaked at 25.86% at the end of August, in four of the last five short interest reports, the average has declined. Granted, it’s not much of a drop and it has coincided with a rally in the stocks, but it’s the first time we have seen such consistent declines in short interest for the group all year.

US Style ETFs Trending Higher But Overbought

Bespoke’s “ETF Trends” tool is one of our most popular products available to Bespoke Premium and Bespoke Institutional members. Our ETF Trends tool helps investors find available ETFs to purchase (or sell) across asset classes. More importantly, our proprietary Trend and Timing scores help investors determine whether the timing is right based on each ETF’s historical trading patterns. To start using our ETF Trends tool now, start a 14-day free Premium or Institutional trial today!

Below is a snapshot of today’s “US Styles” category from our ETF Trends tool. As you can see, our proprietary Trend indicator shows that every single ETF in this category is in an uptrend (based on a 6-month price chart). All but two ETFs are currently overbought (OB) versus their 50-day moving averages as well. (In our trading range screen, the black vertical “N” line represents each ETF’s 50-day moving average, while the dot represents where the ETF is currently trading. The tail end represents where it was trading one week ago.)

The across-the-board “overbought” readings indicate that the US stock market is once again extended to the upside. So even though these ETFs are trading in long-term uptrends (a good thing), their Timing scores are mostly Neutral or Poor. This means that investors looking to add exposure to these ETFs might want to wait for a pullback to more “normal” trading levels.

Only two ETFs in this category currently have “Good” Timing scores — the Russell 2,000 Value ETF (IWN) and the Buyback Achievers ETF (PKW). Both of these ETFs are currently in uptrends but they’re not currently trading overbought.

To view and interact with other categories of our ETF Trends tool, start a 14-day free Premium or Institutional trial today!