S&P 500 Quick-View Chart Book — 12/1/17

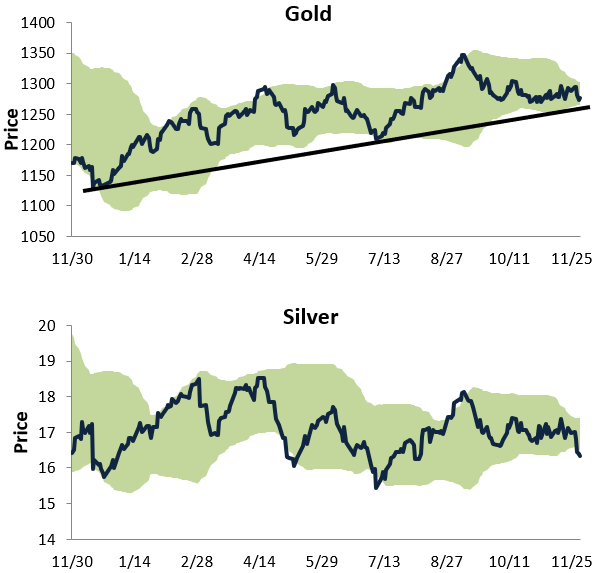

Charting Gold, Silver, Oil, and Natural Gas

Below we take a look at one-year trading range charts for gold, silver, oil, and natural gas. For each chart, the green shading represents between two standard deviations above and below the commodity’s 50-day moving average. Moves to the top of or above the green shading are considered overbought, while moves to the bottom of or below the green shading are considered oversold.

While gold has been flat as a pancake lately, it has been holding just above the bottom of its uptrend support line. Gold bulls are hoping this sideways period is just a re-charge for a big move higher back towards the top of the channel.

Silver looks much different than gold, with a slightly downward sloping pattern over the last year. Just this week, we’ve seen silver move into oversold territory. While oversold levels eventually result in mean reversion (to the upside), if we were trading silver, we’d wait for it to break out to a new 52-week high before buying.

Oil has had a very nice run over the last five months. In October it finally broke out of a long-term downtrend channel, and it recently formed a new uptrend channel when it broke out to new 52-week highs.

Natural gas has been trading in a sideways range around the $3 mark for six months now. The sideways trend is better than the downtrend that had been in place, and now natural gas bulls want to see a breakout above the top of this range so that a new uptrend can form.

The Closer — Thursday Thoughts: US Data, Credit Conditions, Global Inflation — 11/30/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we review the major US data point from today, October Personal Income and Spending from the BEA. We also take a look at strong truck tonnage, marginal credit performance, and the global inflation backdrop.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Bespokecast Episode 19 — Eddy Elfenbein — Now Available on iTunes, GooglePlay, Stitcher and More

Our newest episode of Bespokecast is now available! Be sure to subscribe to Bespokecast on your preferred podcast app to gain access to our full collection of episodes. We’d also love for you to provide a review as well!

Our newest episode of Bespokecast is now available! Be sure to subscribe to Bespokecast on your preferred podcast app to gain access to our full collection of episodes. We’d also love for you to provide a review as well!

In this episode of Bespokecast, we talk to the author of Crossing Wall Street Eddy Elfenbein. Eddy is an investor, portfolio manager, market commentator, and picks the stocks in the portfolio of CWS, the actively managed AdvisorShares Focused Equity ETF. Eddy’s popular Buy List is a simple portfolio of 25 equal-weighted stocks designed to outperform the S&P 500, which it has done in 8 of the last 11 years. Eddy takes an avid interest in history and current events, and he joined us from his home in Washington, DC for an hour long conversation about the markets.

To listen to our newest episode or subscribe to the podcast via iTunes, GooglePlay, OvercastFM, or Stitcher, please click the button or links below. Please note that third-party podcast feeds may update at a lag of a few hours to this blog post.

B.I.G. Tips – Year Like 2017: December Edition

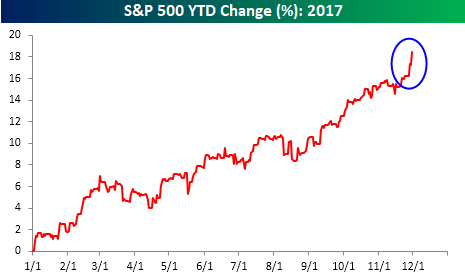

Heading into Thanksgiving, investors were already thankful for a great year in the equity market, but this week the S&P 500 has taken things into a higher gear with a performance that would even make bitcoin proud. A key catalyst for this week’s move has been the increased prospects of a tax reform package getting passed, proving the point we have been making for some time now that tax reform getting done was not already fully priced into the market.

So how does the 18%+ return for the S&P 500 in the first eleven months of the year stack up against prior years, and based on how equities have performed in the first eleven months of 2017, can we expect more of the same to close things out, or will the bulls run out of gas?

In our most recently released B.I.G. Tips report, we looked at years that had the most similar trading pattern to 2017 to see what trends the December performance of the S&P 500 in those years had in common. This helps give us an idea of what to expect for the remainder of the year. This report is a must-read. To see it, sign up for a monthly Bespoke Premium membership now!

Bespoke’s Sector Snapshot — 11/30/17

We’ve just released our weekly Sector Snapshot report (see a sample here) for Bespoke Premium and Bespoke Institutional members. Please log-in here to view the report if you’re already a member. If you’re not yet a subscriber and would like to see the report, please start a two-week free trial to Bespoke Premium now.

Below is one of the many charts included in this week’s Sector Snapshot, which highlights our trading range screen for the S&P 500 and ten sectors. The dot represents where each sector is currently trading in its range, and as shown, all but three sectors are currently trading well into overbought (OB) territory. The Financial sector (XLF) is at the most extreme levels — trading 3 standard deviations above its 50-day moving average.

To see our full Sector Snapshot with additional commentary plus six pages of charts that include analysis of valuations, breadth, technicals, and relative strength, start a two-week free trial to our Bespoke Premium package now. Here’s a breakdown of the products you’ll receive.

B.I.G. Tips – December 2017 Seasonality

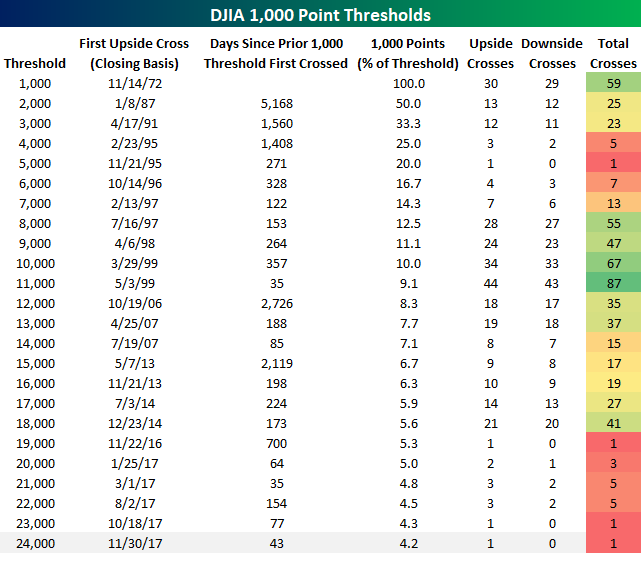

Another 1,000 Point Dow Threshold Bites the Dust

While all the attention shifted towards bitcoin and the pace with which it traded up through different 1,000 point price levels, the DJIA just reminded investors that it too has been on quite a run. With the index on pace to close above 24,000 for the first time today, that now makes it six 1,000 point thresholds that the DJIA has crossed for the first time since last November’s Election.

The table below lists the first day that the DJIA closed above each 1,000 point threshold beginning with 1,000 way back in 1972. Obviously, the higher the index goes, the less of a percentage move each successive threshold becomes, but the recent pace has still been quick. Even more impressive is the fact that for each of the recent thresholds the DJIA has crossed, it hasn’t dipped back below very often. In fact, since last November’s election, no single 1,000 point threshold has been crossed (on a closing basis) up or down more than five times.

Chart of the Day: Express Scripts (ESRX) Too Cheap To Ignore

the Bespoke 50 — 11/30/17

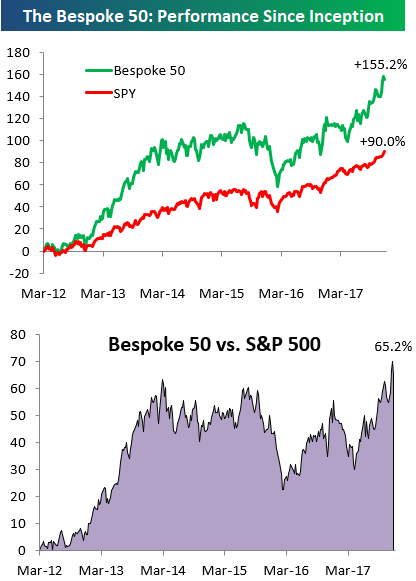

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” has beaten the S&P 500 by 65.2 percentage points. Through today, the “Bespoke 50” is up 155.2% since inception versus the S&P 500’s gain of 90.0%. Always remember, though, that past performance is no guarantee of future returns.

To view our “Bespoke 50” list of top growth stocks, click the button below and start a trial to either Bespoke Premium or Bespoke Institutional.