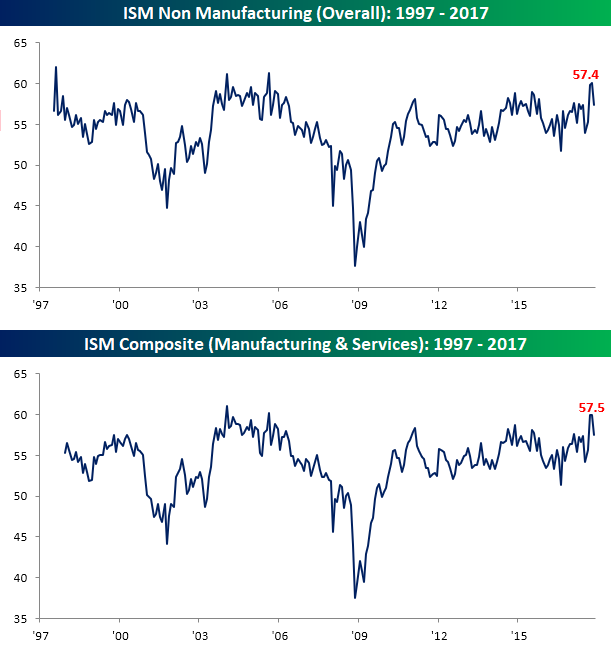

ISM Services Pull Back From a Multi-Year High

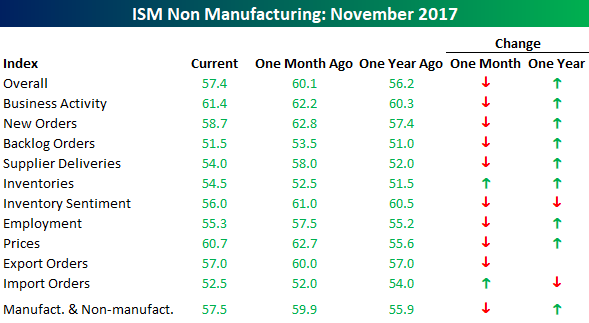

After hitting a 12-year high in October, sentiment in the services sector of the US economy pulled back a little more than expected in November. While economists were expecting November’s ISM Non-Manufacturing report to pull back from 60.1 to 59.0, the actual reading came in even weaker at 57.4. Taking this morning’s report and factoring in Thursday’s report on the Manufacturing sector, the combined ISM for November came in at 57.5 compared to 59.9 in October.

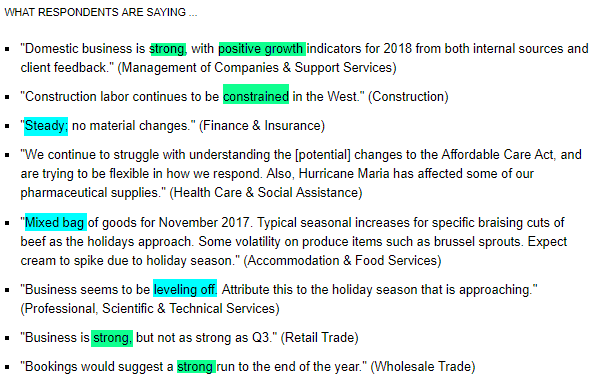

In a vacuum, the commentary section of this month’s report shows pretty widespread optimism, but if you’ve been reading these sections of the report on a regular basis, things aren’t quite as overwhelmingly positive as they have been in recent months.

Finally, the internals of this month’s report were, like the headline reading, weak on a m/m basis. As shown in the table below, the only components that showed a m/m increase in November were Inventories and Import Orders. To the downside, the biggest declines were in Inventory Sentiment, New Orders, and Supplier Deliveries. On a y/y basis, however, things still look very positive with Inventory Sentiment and Import Orders the only components that are down versus last November.

How Equity Returns Stack Up

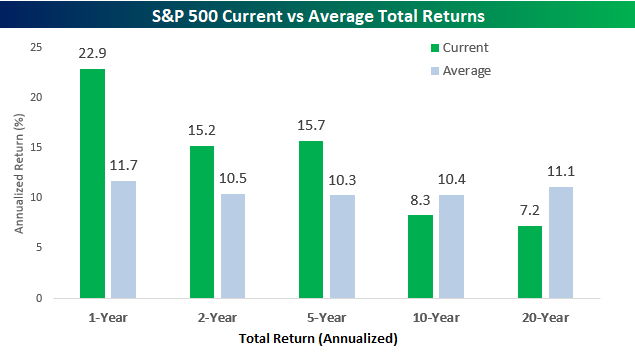

With the S&P 500 finishing November with a gain of 3.1% on a total return basis, the index saw its 13th straight month of gains. That’s right. Since last November’s election, US equities haven’t seen a down month, which is pretty remarkable when you think about it. With such continuous strength, the S&P 500’s total return over the last 12 months has been a gain of 22.9%, which is nearly double the historical average of 11.7%!

In the chart below, we have compared the S&P 500’s current one, two, five, ten, and twenty-year annualized total returns to their historical averages going back to the late 1920s. In the short to intermediate term, returns have been consistently above average with both the two and five-year annualized returns of over 15% exceeding the historical average by around five percentage points per year. Longer term, though, the impacts of the financial crisis and dot-com bust are still making their presence felt. Over the last ten years, the S&P 500’s 8.3% annualized return trails the historical average by about two percentage points, while the twenty-year annualized return of 7.2% trails the historical average of 11.1% by a pretty wide margin. The US equity market has obviously exited the dark ages of the early 2000s, but the scars, however faded they have become, are still there. Only time can heal.

The Closer — Energy, Trade, Manufacturing — 12/4/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we take a look at the performance of the Energy sector, recent developments in global trade, and recap today’s US Census release of US factory sales.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Chart of the Day – Massive Nasdaq Underperformance

Bespoke Stock Seasonality Report – 12/4/17

November 2017 Headlines

The Teflon Market

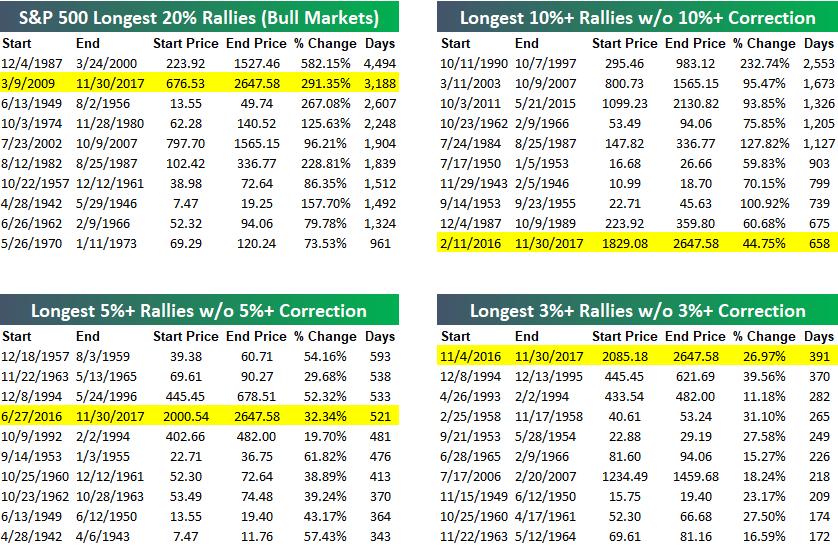

Despite a seemingly endless number of events that investors could easily use as justification to take profits, US equities just keep marching higher. While the magnitude of the gain this year has been far from record-breaking for a calendar year, the consistency has been without precedent by some measures. The tables below from our most recent Bespoke Report serve as an example of how Teflon the market has seemingly become as the S&P 500 is in its second-longest bull market, the tenth longest streak without a 10% correction, the fourth longest run without a 5% decline, and the longest rally ever without even a 3% decline. At some point the market’s luck will run out, but betting on when that will be has been tough on the wallet so far.

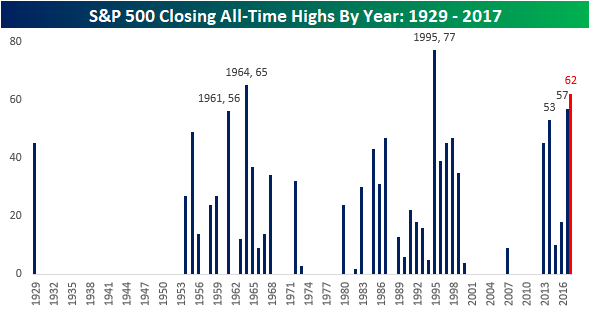

With the S&P 500 showing steady gains throughout the year, it seems a day doesn’t go by where we aren’t seeing new record highs. The chart below shows the number of all-time record closing highs for the S&P 500 on an annual basis since 1929. With 57 records (not including today) so far this year, 2017 ranks as the third most all-time closing highs for a calendar year behind 1995 (77) and 1964 (65). Unfortunately, with 19 trading days left in the year, it is now mathematically impossible for this year to overtake or even tie 1995’s 77 record highs, but 1965’s total of 65 is still within reach. Even that, though, will be tough as eight of the year’s final 19 trading days would need to be record highs to just tie for second all time. If the final few weeks of 2017 simply keep up the current pace of the first eleven months of the year, 2017 would finish with a total of 62 all-time closing highs. Still not a bad total by any stretch.

Bespoke Brunch Reads: 12/2/17

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

See this week’s just-published Bespoke Report newsletter by starting a no-obligation two-week free trial to our premium research platform.

Investment Picks

The Winners of the New World by Jim Cramer (TheStreet)

Worth reading amidst booming prices for tech stocks and cryptocurrencies alike: Jim Cramer’s summary of the lay of the market and his picks just weeks before the peak of the Nasdaq in the year 2000. [Link]

50 startups that will boom in 2018, according to VCs by Julie Bort (Business Insider)

Not so helpful as a measure of where returns will be, but definitely interesting as a pulse-taking on sentiment and thematic focus for the venture space. [Link]

Tax Reform

Trump’s Tax Promises Undercut by CEO Plans to Help Investors by Toluse Olorunnipa (Bloomberg)

While a key assumption of the Republican tax bill is that lower corporate taxes will boost wages and investment, CEOs have different ideas. [Link; auto-playing video]

Current Tax Reform Bills Could Encourage US Jobs, Factories and Profits to Shift Overseas by Steven M. Rosenthal (Tax Policy Center)

We don’t want to do a disservice to the details (which Rosenthal cogently explains) but the bottom line is that provisions in both the House and Senate tax bills would create large incentives to shift production overseas, the opposite of their intended approach. [Link]

Bitcoin

Let’s Talk About Arbitrage – Bitcoin Futures Edition by Kid Dynamite (Kid Dynamite’s World)

The introduction of bitcoin futures will create an easy method for shorting the currency, but because of how arbitrage works, there’s unlikely to be anything but upward pressure based on the introduction of the new contracts. [Link]

Bitcoin’s Trading Star Is Chicago High-Speed Firm That Nods to the Grateful Dead by Alexander Osipovich (WSJ)

A look inside DRW’s high frequency trading unit focused on cryptocurrencies, which has bought cryptocurrency from governments, rejected the idea of making money mining crypto, and now makes markets in the space. [Link; paywall]

Sports

The Case For Lefty Driesell by Dave Kindred (The Athletic)

A strong argument that Duke player, former high school coach, and 786 NCAA D1 game winner doesn’t get the respect he deserves. [Link]

I Saw The Buttfumble Live And It Fractured My Family by Jon Eisman (Deadspin)

An oral history of the stupidest play in NFL history’s impact on a family, complete with desperate bids for family unity, seasons tickets to the Jets, and the last time a Jets fan goes to one of their games. [Link]

Commodities

Oil demand: Beware the gap by Jamie Webster (Petroleum Economist)

A comprehensive but digestible review of the shifting economics of the global crude industry. [Link]

Will Tesla Die for Lack of Cobalt? by Spencer Jakab (WSJ)

While demand for cobalt has surged thanks to the explosive growth of global battery demand, there are talks of a shortage; that said, we’ve heard this sort of “no supply left” story before. [Link; paywall]

Software

Huge security flaw lets anyone log into a High Sierra Mac by Devin Coldewey (TechCrunch)

Users are granted full access to a device running Mac OS (note: not iOS, the phone operating system) by simply entering ‘root’ as the user when attempting to authenticate. [Link]

Ignored By Big Telecom, Detroit’s Marginalized Communities Are Building Their Own Internet by Kaleigh Rogers (Vice)

40% of the population (including 70% of school children) do not have access to any internet service in Detroit, thanks to underinvestment in infrastructure by telecoms that don’t see building what’s needed as profitable given the economic backdrop. This group is DIYing its way into broader access to the internet in response to the problem. [Link]

Stop Using Excel, Finance Chiefs Tell Staffs by Tatyana Shumsky (WSJ)

CFOs are leading the charge in reducing reliance on Excel as the workhorse software tool used by accountants, finance divisions, and other corporate analysts. [Link; paywall]

Shopping

The Triumph of the Latin American Mall by Nolan Gray (Citylab)

While mall construction is nonexistent in the United States with as many as 25% of the remaining 1100 expected to close over the next 5 years, Latin America is seeing an explosion of construction. [Link]

Best Tech Gifts 2017 by Wilson Rothman and Joanna Stern (WSJ)

Streaming, phones, laptops, Wi-fi, cameras, kids “toys”, remote controlled toys, cooking, tablets, games, and more. [Link; paywall]

Baltic News

For some Russian oligarchs, sanctions risk makes Putin awkward to know by Darya Korsunskaya, Katya Golubkova, and Gleb Stolyarov (Reuters)

US sanctions on Russian citizens are starting to pinch, and are putting at least some distance between powerful oligarchs and the President. [Link]

How 41 People in Lithuania Took Over Your Facebook Feed by Kevin Roose (NYT)

Inside a small boot-strapped startup that has become dominant in the world of digital publishing. [Link; soft paywall]

Food

The Fruit That Smells Like Gym Socks Is Skyrocketing in China by Anuradha Raghu (Bloomberg)

China is gobbling down durian at a staggering pace, creating an opening for non-traditional players to enter the booming market. [Link]

Wall Street

Inside the Race for the Top Job on Wall Street by Kate Kelly (NYT)

The Co-COOs of Goldman Sachs are neck-in-neck to replace CEO Lloyd Blankfein, and the two are a remarkable study in contrasts. [Link; soft paywall]

Have a great Sunday!

The Bespoke Report – 12/1/17 – Teflon Don, Meet Teflon Market

The Closer: End of Week Charts — 12/1/17

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. This week, we’ve added a section that helps break down momentum in developed market foreign exchange crosses.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by starting a two-week free trial to Bespoke Institutional now!