Leaders Become Laggards — Updated YTD Winners

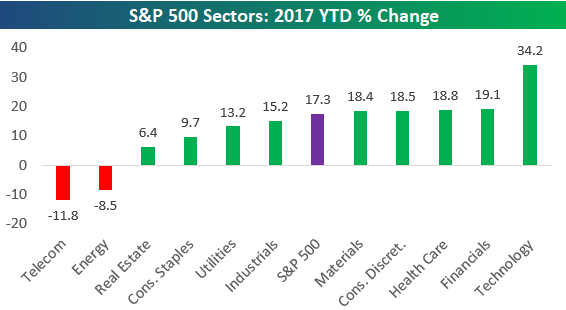

Below is a quick look at S&P 500 sector performance so far in 2017. As shown, even after a pullback over the last week or so, Technology is still up double the S&P 500 with a gain of 34.2%. The next best sector is Financials with a gain of 19.1%, followed by Health Care (18.8%), Consumer Discretionary (18.5%), and Materials (18.4%). Telecom and Energy are both down 8%+ on the year.

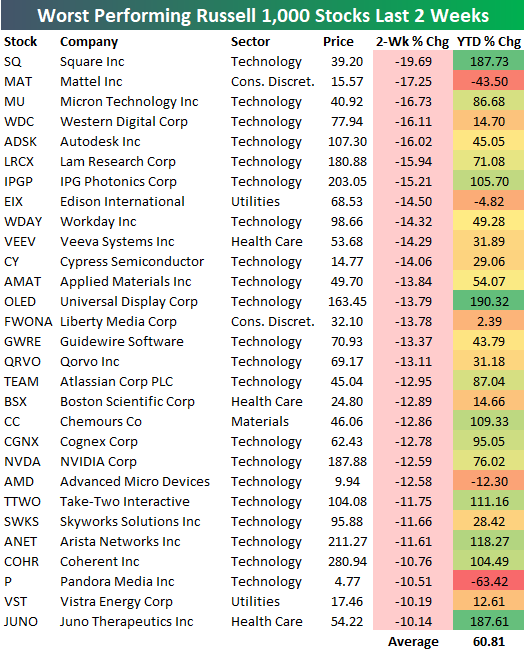

Over the last two weeks, we’ve seen the year’s biggest winners take a beating, while investors have shifted a bit into value stocks that had been underperforming. Below is a list of the biggest losers in the Russell 1,000 over the last two weeks. All of these stocks are down 10%+ over the last 10 trading days, and as you can see, there are quite a few of them!

On average, these stocks are up 60% year-to-date, which shows that investors have been selling the biggest winners.

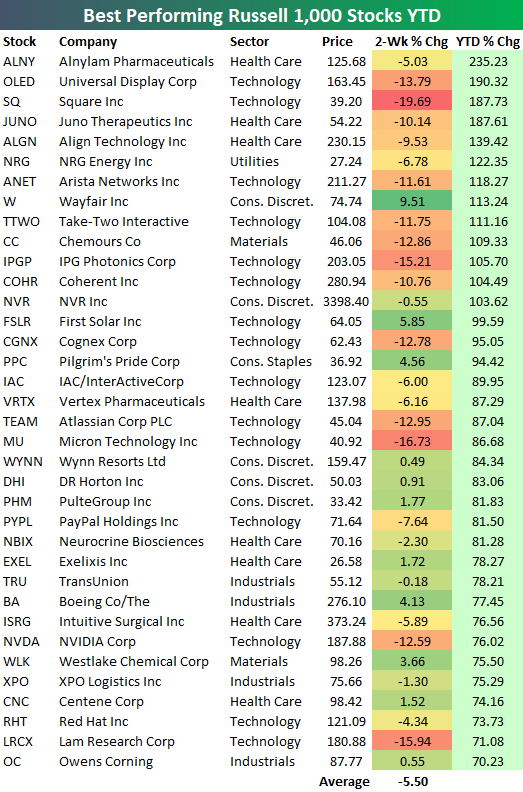

Another way to highlight the recent weakness in the year’s winners is to look at the two-week performance of the stocks that are up the most year-to-date. Below is a list of the top performing stocks in the Russell 1,000 year-to-date. As shown, these stocks are down an average of 5.5% over the last two weeks. Over this same two-week period, the S&P 500 is up 1.18%.

If you’ve had a great year thus far in the stock market, you’ve likely given some back over the last two weeks!

Emerging Markets (EEM) Breakdown

The emerging markets ETF (EEM) had been in a strong uptrend all year, as you can see in the chart below (pulled using our free Chart Tool). It’s about as picture-perfect of an uptrend as you’ll find. Every time the ETF tested support at the bottom of its uptrend channel, it bounced, and every time it tested the top end of the channel, it pulled back. That changed today, however, as the ETF finally broke down below the bottom of its channel. With this support now broken, the year-long uptrend that was in place for EEM is now no more.

Recent Asset Class Performance Highlights Shift

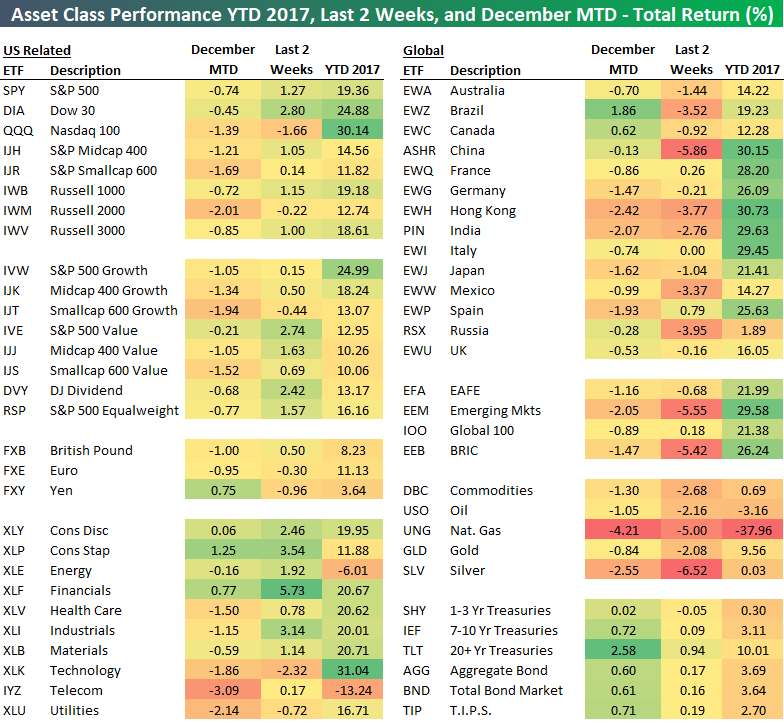

Below is a look at the recent performance of various asset classes using our ETF total return matrix. For each ETF, we highlight its total return month-to-date, over the last two weeks (since 11/22), and year-to-date.

Starting with the US (left side of matrix), we’ve seen the Nasdaq 100 (QQQ) and smallcaps (IJR, IWM) get hit the hardest so far this month. Value has been significantly outperforming growth as well recently.

Looking at sectors, we’ve seen the two consumer sectors, Energy, and Financials perform best of late, while Technology, Telecom, Industrials, Health Care, and Utilities have been underperforming.

Outside of the US, Brazil (EWZ) and Canada (EWC) are the only two countries that are up so far in December. On the flip side, we’ve seen Hong Kong (EWH), India (PIN), Spain (EWP), Germany (EWG), and Japan (EWJ) all fall more than 1%. Over the last two weeks, China (ASHR) has gotten hit the hardest with a drop of 5.86%.

Emerging markets have been especially weak as well recently. While EEM is up 30% year-to-date, it’s down 5.55% over the last two weeks and over 2% already in December.

As “risk on” asset classes have weakened of late, we’ve seen buyers step into the fixed income ETFs. The 20+ Year Treasury ETF (TLT) is already up 2.58% in December, which leaves it up more than 10% year-to-date.

Click here to learn more about how to use our popular ETF Trends tool.

Fixed Income Weekly – 12/6/17

Searching for ways to better understand the fixed income space or looking for actionable ideals in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s note, we review the size of the cryptocurrency market relative to the money supply of traditional currencies.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

Chart of the Day – Smart Money Indicator Hanging In There For S&P 500 and Nasdaq

Bespoke’s Global Macro Dashboard — 12/6/17

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

The Closer — Retail Detail, Trade Update — 12/5/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we review fundamental and valuation data for the major industries within the S&P 500 Retail industry group. We also update tracking of the US trade balance.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Chart of the Day: Three Recent Top Earnings Triple Plays

Bespoke Stock Scores — 12/05/17

Regional ETFs See Big Pullback from Overbought Levels

Bespoke’s “ETF Trends” tool is one of our most popular products available to Bespoke Premium and Bespoke Institutional members. Our ETF Trends tool helps investors find available ETFs to purchase (or sell) across asset classes. More importantly, our proprietary Trend and Timing scores help investors determine whether the timing is right based on each ETF’s historical trading patterns. Watch this tutorial video we made explaining how to make the most out of it. To start using our ETF Trends tool now, start a 14-day free Premium or Institutional trial today!

Below is a snapshot of today’s “Regions” category from our ETF Trends tool. Last week at this time, nearly every region of the world saw equity markets at overbought levels. Today, though, pretty much every region is back in neutral territory after experiencing a pullback over the last five trading days. Given that all of these ETFs are in long-term uptrends, a pullback from overbought to neutral levels triggers a “good” Timing score.

Click here to learn more about how to use our popular ETF Trends tool.