The Closer — Flow of Funds Review — 12/7/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we review the quarterly flow of funds data for Q3 released today by the Federal Reserve today.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

B.I.G. Tips – November Employment Report Preview

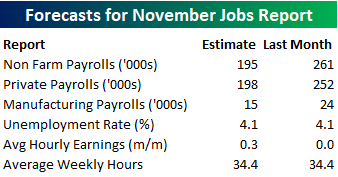

Heading into Friday’s Non-Farm Payrolls (NFP) report for November, economists are expecting an increase in payrolls of 195K, which would be a large decline from October’s reading of 261K. Last month’s big decline was largely due to the rebound effect of last Summer’s hurricanes, so even though total job growth is expected to fall, 195K is still a healthy number. In the private sector, economists are expecting a similar increase of 198K from last month’s level of 252K, and the unemployment rate is expected to remain unchanged at an exceptionally low level of 4.1%. Growth in average hourly earnings is expected to rebound back to 0.3%, while the average workweek should remain at 34.4 hours per week.

Ahead of the report, we just published our eleven-page monthly preview of the November jobs report. This report contains a ton of analysis related to how the equity market has historically reacted to the monthly jobs report, as well as how secondary employment-related indicators we track looked in November. We also include a breakdown of how the initial reading for November typically comes in relative to expectations and how that ranks versus other months.

One topic we cover in each month’s report is the S&P 500 stocks that do best and worst from the open to close on the day of the employment report based on whether or not the report comes in stronger or weaker than expected. In other words, which stocks should you buy, and which should you avoid? The table below highlights the best-performing stocks in the S&P 500 from the open to close on days when the Non-Farm Payrolls report has been better than expected over the last two years. Of the 25 top performing stocks on days when the NFP beats expectations, seven sectors are represented, with Energy leading the way with eight. Leading the way to the upside, Vornado (VNO), has seen an average open to close gain of over 2.5%. In terms of consistency, Urban Outfitters (URBN), Skyworks (SWKS), Autodesk (ADSK), and Cerner (CERN) have been in the black 91% of the time.

For anyone with more than a passing interest in how equities are impacted by economic data, this report is a must-read. To see the report, sign up for a monthly Bespoke Premium membership now!

Bespoke’s Sector Snapshot — 12/7/17

We’ve just released our weekly Sector Snapshot report (see a sample here) for Bespoke Premium and Bespoke Institutional members. Please log-in here to view the report if you’re already a member. If you’re not yet a subscriber and would like to see the report, please start a two-week free trial to Bespoke Premium now.

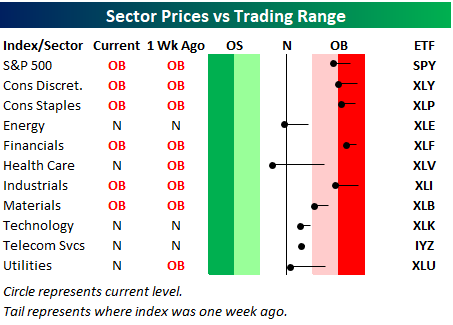

Below is one of the many charts included in this week’s Sector Snapshot, which highlights our trading range screen for the S&P 500 and ten sectors. The dot represents where each sector is currently trading in its range, while the tail end represents where it was trading one week ago. As shown, all but the Telecom sector has moved lower within its range over the last week, with the biggest drops coming in Energy, Health Care, and Utilities.

To see our full Sector Snapshot with additional commentary plus six pages of charts that include analysis of valuations, breadth, technicals, and relative strength, start a two-week free trial to our Bespoke Premium package now. Here’s a breakdown of the products you’ll receive.

Chart of the Day: Caution On Chemicals

the Bespoke 50 — 12/7/17

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” has beaten the S&P 500 by 63.1 percentage points. Through today, the “Bespoke 50” is up 153.8% since inception versus the S&P 500’s gain of 90.7%. Always remember, though, that past performance is no guarantee of future returns.

To view our “Bespoke 50” list of top growth stocks, click the button below and start a trial to either Bespoke Premium or Bespoke Institutional.

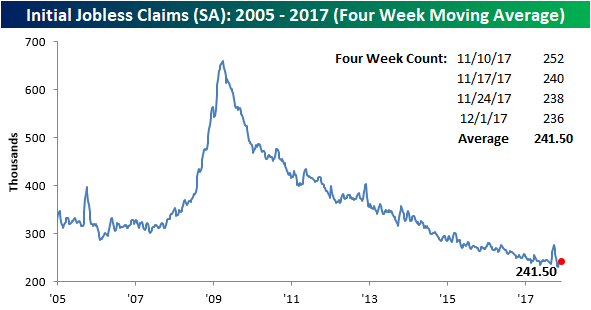

Jobless Claims Fall More Than Expected

Jobless claims saw a slight decline this week, falling from a seasonally adjusted level of 238K down to 236K, but given that consensus forecasts were looking for a slight increase to 240K, it was better than expected. This week’s reading also represents the 144th straight week where jobless claims have been below 300K, which is the longest streak since April 1970 when claims were below 300K for 161 straight weeks. In order to break that record, claims will need to come in below 300k right up through the end of Q1 2018.

With this week’s lower weekly print, the four-week moving average also declined slightly from 242.25K down to 241.5K. That’s just over 10K above the multi-decade low of 231.25K reached back in early November.

On a non-seasonally adjusted basis (NSA), jobless claims spiked up by more than 100K to 325.8K from 224.9K. That sounds like a big move, but if you look at the chart, big increases are common on a non-seasonally adjusted basis at this time of year. In fact, this week’s print is more than 100K below the post-recession average of 442.3K.

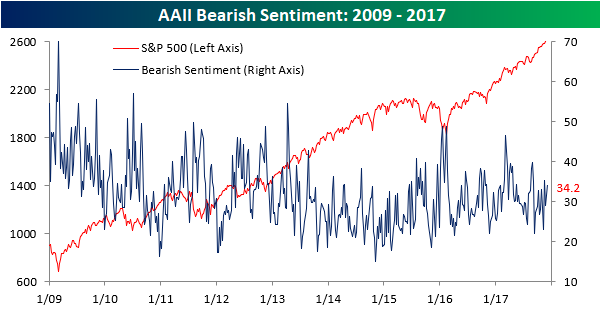

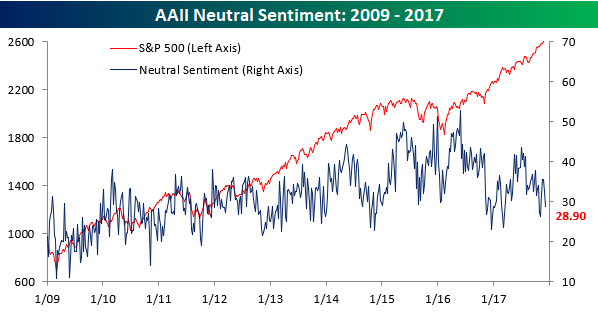

Little Change in Investor Sentiment

In this week’s AAII sentiment survey, bulls remained out of the majority once again, extending the record to 153 straight weeks. This week’s survey showed little change in optimistic sentiment as bulls remained right near 36%. Given some of the weakness and rotation we have seen in recent days and knowing how fickle this group of investors has been, we would have expected the already weak bullish reading to decline, but it managed to hang in there.

Bearish sentiment, meanwhile, ticked a bit higher this week rising from 31.6% up to 34.2%, which is a three-week high.

Finally, neutral sentiment fell back below 30%, falling from 32.4% down to 28.9%. That’s the lowest neutral reading since the first week of November. All in all, there was little in the way of sentiment changes this week based on the AAII release.

The Closer — Curve Signals, Energy Data, Productivity Updates — 12/6/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we examine what kind of yield curve signal is the most dangerous with respect to recession risk. We also review EIA weekly data released today, and the BLS update on productivity for Q3.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Bespoke Consumer Pulse Report — December 2017

Bespoke’s Consumer Pulse Report is an analysis of a huge consumer survey that we run each month. Our goal with this survey is to track trends across the economic and financial landscape in the US. Using the results from our proprietary monthly survey, we dissect and analyze all of the data and publish the Consumer Pulse Report, which we sell access to on a subscription basis. Sign up for a 30-day free trial to our Bespoke Consumer Pulse subscription service. With a trial, you’ll get coverage of consumer electronics, social media, streaming media, retail, autos, and much more. The report also has numerous proprietary US economic data points that are extremely timely and useful for investors.

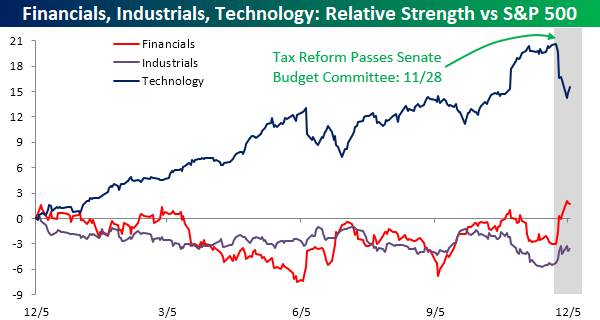

Taxes: Tech Pain is Financials and Industrials Gain

Ever since the GOP tax reform bill moved out of the Senate Budget Committee on the 28th of November, we’ve seen some pretty big rotation out of some sectors and into others. The biggest loser by far, though, has been Technology, while Financials and Industrials have been beneficiaries. The chart below shows the relative strength of all three sectors versus the S&P 500 over the last year where a rising line indicates the sector is outperforming the S&P 500, while a falling line indicates underperformance.

As shown in the chart, Technology had been a huge outperformer on the year leading up to late November, while both Financials and Industrials were lagging the market. That trend came to an abrupt halt last Tuesday, though, when the trends completely reversed. Now before we all start crying over the performance of the Technology sector, we would note that even after the recent moves, it is still outperforming every other sector this year by more than 15 percentage points, so there is a long way to go before it is actually lagging. Furthermore, the stocks that have been hit the hardest are still, for the most part, the biggest winners in 2017. The move in Financials, however, has been impactful as the sector has gone from underperforming the S&P 500 to outperforming on a YTD basis.