Chart of the Day: NXPI Wide Valuation Range

Bespoke Stock Seasonality Report – 12/11/17

S&P 500 Industry Group Breadth Near 2017 Highs

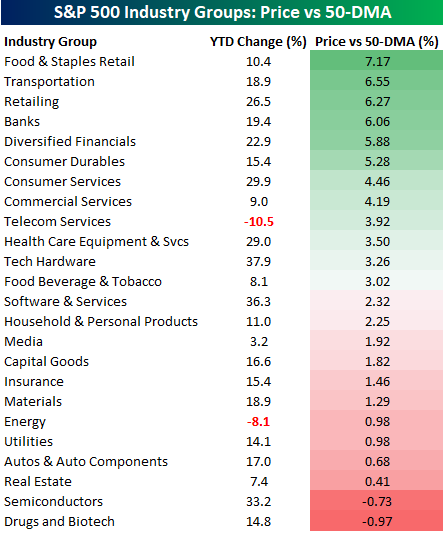

Even with all the rotation we have seen in equity prices over the last couple of weeks, the S&P 500 still managed to close at an all-time high on Friday and is just half of a percent below its intraday record high. Following all the relatively big swings (up and down) in various groups, there’s been a lot of movement in where the S&P 500’s industry groups stand relative to their 50-DMA. As shown in the table below, practically every industry group closed last week above its 50-DMA. Leading the way higher, Food & Staples Retail, Transportation, Retailing, and Banks are all at least 6% above their 50-DMAs, while the only two groups below their 50-DMAs are Drugs and Biotech and Semis. These two groups are also less than 1% below their 50-DMAs, so all in all breadth is really strong. YTD market performance has also been strong this year, as the only two industry groups in the red are Telecom Services (-10.5%) — which is made up of just three stocks — and Energy (-8.1%).

The chart below shows the daily reading of the percentage of S&P 500 industry groups trading above their 50-DMAs. At the current level of 91.7%, the percentage is currently not only right near its highs for the year, but also near its highs of the bull market. While there have been times when this percentage was higher, anytime you are in the 90s in terms of percentages, there’s only so much higher you can go.

Bespoke Brunch Reads: 12/10/17

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

Economic Research

A prince not a pauper: the truth behind the UK’s current account deficit by Stephen Burgess and Rachana Stanbhogue (BoE Bank Underground)

An argument that rather than incurring new liabilities, the UK’s current account deficit is a spending-down of accumulated national wealth. [Link]

Putting a Value on the Ecosystem Services Provided by Forests in the Eastern United States: Case Studies on Natural Capital and Conservation by Dan Kraus and Brian DePratto (The Nature Conservancy)

An attempt to demonstrate the economic value of forests across the East Coast of the United States, with a range of values per acre and methodology for how biological resources were assigned financial worth. [Link; 29 pages]

Tax Reform and the Trade Balance by Brad W. Setser (Council on Foreign Relations)

A rundown on likely macroeconomic account impacts from tax reform, focusing on the shifts in foreign taxation that will drive a re-alignment of the current account including the trade balance. [Link]

Retail

Long Online/Short Stores ETF (ProShares)

Just in time for a huge rally in traditional retail stores over the last few weeks, ProShares has created a custom index of traditional retailers to short and online retailers to be long, similar to Bespoke’s Death By Amazon index (link to more information). [Link]

Judge bars Starbucks from closing 77 failing Teavana stores by Lisa Fickenscher (NYP)

Starbucks has been ordered to keep stores open under the theory that closing them is a bigger burden on their landlord (Simon Property Group) than it is on Starbucks to keep the stores open. [Link]

Consumer

Want a Vintage Metallica T-Shirt? That’ll be $1,000 by Jacob Gallagher (WSJ)

Vintage t-shirts from across the musical spectrum are flying off the shelves of stores that specialize in digging up old tour merch for a new generation. [Link; paywall]

Design (Motiv)

A new fitness tracker that’s fully waterproof, lasts days without a charge, and is worn around…your finger. [Link]

Injustice

Nothing Protects Black Women From Dying in Pregnancy and Childbirth by Nina Martin and Renee Montagne (ProPublica)

A heartbreaking story about the post-partum death of a CDC researcher which serves as an example of the horrific inequality in mothers’ mortality in the United States. [Link]

Millions Are Hounded for Debt They Don’t Owe. One Victim Fought Back, With a Vengeance by Zeke Faux (Bloomberg)

Debt collectors are hounding consumers for payments on debts they never incurred, but one man they chose to threaten over an invented balance decided to fight back. [Link]

History

Napoleon was the Best General Ever, and the Math Proves it. by Ethan Arsht (Towards Data Science)

Using methods that will be familiar to any hard-core baseball fan, Arsht ranks generals and attempts to determine how well they performed relative to the typical general. [Link]

The Conflict in Jerusalem Is Distinctly Modern. Here’s the History. by Mona Boshnaq, Sewell Chan, Irit Pazner Garshowitz, and Gaia Tripoli (NYT)

Background on the history of Jerusalem, helpful in the context of President Trump’s decision to move the US embassy to that city this week. [Link; soft paywall]

Finance

Private equity investors are paying through the nose for midsize companies by Matthew C. Klein (FTAV)

An update on the P/E market, which looks a little bit excessive these days given huge war chests and extreme valuations. [Link; registration required]

Bloomberg’s rising terminal count signals hope for the beleaguered bond trader by John Detrixhe (Quartz)

After recording only its second subscriber count decline in history last year, Bloomberg’s terminal business saw its customer count rise in 2017. [Link]

Cuisine

I Made My Shed the Top Rated Restaurant On TripAdvisor by Oobah Butler (Vice)

In a frankly hilarious stunt, a journalist listed their shed as a restaurant then gamed TripAdvisor to make it the highest ranked restaurant in all of London. [Link]

Crypto

This Mining Company Soared 159% After Saying It’s Buying a Crypto Firm by Camila Russo (Bloomberg)

All a company needs to do these days is change a part of its name to something bitcoin-related. [Link; auto-playing video]

There’s an $814 Million Mystery Near the Heart of the Biggest Bitcoin Exchange by Matthew Leising (Bloomberg)

In any investing fad there is inevitably fraud, and it looks like the combination of tether and the crypto exchange Bitfinex are gunning for the poll position in the blockchain’s tally. [Link; auto-playing video]

SEC Targets Initial Coin Offering ‘Scam’ by Paul Vigna (WSJ)

The first enforcement action against an initial coin offering has been dropped by the SEC, and it could be important in setting precedent for how ICOs are handled by US regulators. [Link; paywall]

Bitcoin miner: ‘I haven’t paid for heat in three years’ by Krystal Hu (Yahoo Finance)

A North Carolina man who mines bitcoins hasn’t needed to turn on his heat thanks to the huge volume of heat thrown off by CPUs on rigs he uses to mine. [Link; auto-playing video]

A Bitcoin Frenzy Like No Other Is Gripping South Korea by Kyungji Cho, Yuji Nakamura , and Narae Kim (Bloomberg)

Roughly 21% of trading in bitcoin globally takes place in Korean won, and thousands of speculators in the relatively small country have piled in to the surge. [Link; auto-playing video]

Meet CryptoKitties, the $100,000 digital beanie babies epitomizing the cryptocurrency mania by Evelyn Cheng (CNBC)

An explainer on the strangest fad you’ll read about this weekend. [Link; auto-playing video]

Have a great Sunday!

How Bitcoin Miners Will Hedge With Futures

Have a crypto question or request? DM us on twitter @bespokecrypto.

Most bitcoin miners have been living the good life as bitcoin’s price goes parabolic, but now with the launch of futures trading, their lives may have gotten even better. Unlike traditional miners, bitcoin miners aren’t digging through dirt. Instead, they’re running specialized hardware devices day in and day out in order to obtain small chunks of bitcoin over and over again.

Setting up a bitcoin mining operation requires a little technical know-how and a bit of money (competitive bitcoin mining devices retail for about $3,000, although the sudden spike in demand for them has pushed prices as high as and above $6,000 for a single mining device). However, once the devices are up and running they can operate 24/7 with just occasional maintenance, generating “free bitcoin” with the primary cost being the electricity it takes to run them. The more mining devices you have, the more electricity you’ll use, but the more bitcoin you’ll be able to mine. When bitcoin prices rise, the mining operation becomes more profitable.

Suppose a bitcoin miner wants to reduce his exposure to bitcoin and sells a futures contract to lock in profits. Considering how wildly the prices swing, locking in some profits early may not be a bad idea for many of these miners who have high electricity and equipment costs to consider. Just how high are these electricity costs, and what does the profitability look like for bitcoin mining operations? Below is a table illustrating an example setup for a small-scale bitcoin mining operation:

| Mining Unit | Antminer S9 |

| Cost per unit ($) | 3000.00 |

| Total units | 20 |

| Watts per unit | 1400 |

| Electricity cost ($/kwh) | 0.12 |

| Total Antminer electricity use (Watts) | 28000 |

| Total Antminer cost ($) | 60,000.00 |

| Cooling fan cost ($) | 550.00 |

| Cooling fan electricity use (Watts) | 598 |

| Shelves ($) | 200.00 |

| Internet cost per month ($) | 35.00 |

| Video surveillance ($) | 100.00 |

| Network Equipment ($) | 100.00 |

| Maintenance costs ($/month) | 100.00 |

| Total 1 time cost ($) | 60,950.00 |

| Daily cost ($) | 86.86 |

An operation using the parameters above would generate approximately 0.056 bitcoin per day, but this amount varies depending on the number of other active miners on the bitcoin network. An estimate for the bitcoin mined per day can be calculated quite simply. First, divide the total hash rate of the mining operation by the total hash rate of the network. The resulting figure is the bitcoin operation’s % of the total hash rate. Multiplying this by the sum of total bitcoin mined per day and total fees collected per day gives a rough estimate of how much bitcoin that mining operation should produce per day. Total bitcoin mined per day is fixed (there is a standard reward that is halved periodically), and the fees may vary day to day.

Many miners also opt to join a mining pool, which allows small miners to earn income directly from the contribution of hash power, rather than relying on the “luck” required to successfully mine a bitcoin. The mining pool operator will collect 1-2% in fees from the miners, and in return, the miners get an income stream of small frequent payouts, instead of the large but inconsistent payouts they would receive mining alone.

Below is a chart showing the break-even point for the mining operation above. To lose profitability, bitcoin would have to fall over 85% from current price levels. On the other hand, if bitcoin moves up to $20,000, this mining operation is making over $1,000/day in profits. Not bad!

If bitcoin stayed around its current price of $15,500, the total network hash rate would have to multiply by a factor of 10 for this mining operation to become unprofitable. That’s a total of 10x as many miners as there are now!

If mining is so profitable, why isn’t everyone doing it? The demand for mining equipment has risen so rapidly that supply hasn’t had a chance to keep up. The original price of the Antminer S9, the most efficient and popular bitcoin miner, was $2,100. Now you’d be lucky to find one on Amazon or any other re-seller for less than $6,000. Even at $6,000, though, it’s still a very profitable operation as long as bitcoin prices remain high. However, as the supply of mining hardware expands, miners’ profit margins will begin to shrink; all miners compete for a finite supply of bitcoin.

With the new futures contracts, institutions who previously could not trade bitcoin due to a lack of regulation will now have a regulated avenue to be long or short bitcoin. How this might affect the price or compare to the volume of hedges by miners remains unknown, but we do know that the futures market will offer hedging opportunities for miners and change market dynamics.

Below is a chart showing profit per day with 10x the miners that there are now. Break-even point is around $15,500 per bitcoin.

Have a crypto question or request? DM us on twitter @bespokecrypto.

On Bitcoin Security

With its skyrocketing price, Bitcoin’s popularity has also hit feverish levels. Despite the mania, many newcomers still have no idea what kind of risks they face with improperly securing their investment. The most common of the “security sins” is leaving bitcoin on an exchange. Coinbase, perhaps one of the most reputable bitcoin exchanges, is insured against any hacks of their digital currency “hotwallets” – the online storage used to facilitate deposits and withdrawals of bitcoin to the exchange. However, they do not insure individual Bitcoin accounts against theft resulting from a compromised password. If a cybercriminal manages to get into your Coinbase account, there’s nothing to protect you from losing everything.

Due to the almost anonymous nature of bitcoin, many cyber-criminals have switched their focus from hacking traditional financial institutions to hacking bitcoin accounts, as the funds are much harder to trace and recover, and the risks of them getting caught are far lower. Aside from hacking, holding bitcoin on an exchange means trusting the exchange to stay solvent and honestly report any security breaches. Those who followed bitcoin in the early days remember the Mt. Gox incident, in which hacking combined with mismanagement and fraud caused the exchange to collapse in 2014. In the process, the company lost millions of dollars in customer money. These combined factors mean those who continue to hold bitcoin or any other cryptocurrencies on an exchange face increased risks compared to traditional trading accounts.

Ransomware, depicted above, holds a user’s computer hostage until a fee is paid. Often the fee is paid in cryptocurrency.

To offset those risks, Savvy ‘bitcoiners’ can run programs on their computers that store their bitcoin offline, acting as personal “bitcoin banks” and sheltered from the threat of hackers. While this is the preferred alternative to holding bitcoin on an exchange, a little more technical knowledge is required to set up and use these programs. Running one of these programs, which are referred to as “software wallets” in the crypto community, is considered to be the bare minimum level of security a bitcoin owner should have. If storing bitcoin on an exchange is level 0, meaning it’s completely insecure, than software wallets are considered level 1. Software wallets offer decent security, as long as the computer they operate on is not compromised.

Continuing this analogy, level 2 would be hardware wallets. A hardware wallet is a physical device with a specialized chip designed to house bitcoin keys in a secure manner. When using the device the secret keys never leave the chip, and sending bitcoin requires one to plug the device into an internet connected computer and enter a secret passcode. However, even these “safe” mechanisms of storage have drawbacks. A Turkish man who had been flaunting his bitcoin wealth on social media found himself on the receiving end of “rubber-hose cryptanalysis” – a euphemism for extracting cryptographic secrets, like passwords, by using torture or coercion. While gang kidnappings may not be as big of a problem in the U.S., the threat of bitcoin burglary remains real.

As one descends deeper into the “levels” of bitcoin security, a trend begins to emerge: the trade-off of convenience for security. There is a varying degree of security that makes sense for everyone. For example, a crypto trader might leave a small percent of their assets on an exchange, knowingly taking that risk because they make frequent trades, and to be constantly moving assets from the exchange to another wallet would not only be cumbersome, but would rack up sizeable transaction fees over time. The average person might be satisfied with a simple software wallet, but what does a company like Coinbase, which has to safely hold billions of dollars worth of Bitcoin, do?

It turns out Coinbase must employ the facilities that bitcoin evangelists claim are destined to be taken down by cryptocurrencies: banks. Enter, security level 3. Directly from their website, Coinbase states, “98% of customer funds are stored offline… we distribute bitcoin geographically in safe deposit boxes and vaults around the world.” So how is a digital currency like Bitcoin stored in a physical vault? Before being stored in the vault, Coinbase adds extra layers of security by splitting and encrypting the private key data. The encrypted data is then transferred to a USB device, which is then placed in a bank vault similar to other physical items or currencies of high value. Paper backup copies are also made and secured in a vault. Yes, you read that correctly. The largest bitcoin exchange in the U.S. still uses paper. Even the effortlessly digital nature of Bitcoin can’t escape the realities of the physical world.

Our recommended storage for any amount of cryptos that you or your family can’t afford to lose is security level 3 mentioned above — encrypted on a FIPS 140 compliant USB drive stored in a safety deposit box with backup USBs stored elsewhere.

Have a crypto question or request? DM us on twitter @bespokecrypto.

The Bespoke Report — Keeping It Simple — 12/8/17

The Closer: End of Week Charts — 12/8/17

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. This week, we’ve added a section that helps break down momentum in developed market foreign exchange crosses.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by starting a two-week free trial to Bespoke Institutional now!

S&P 500 Quick-View Chart Book: 12/8/17

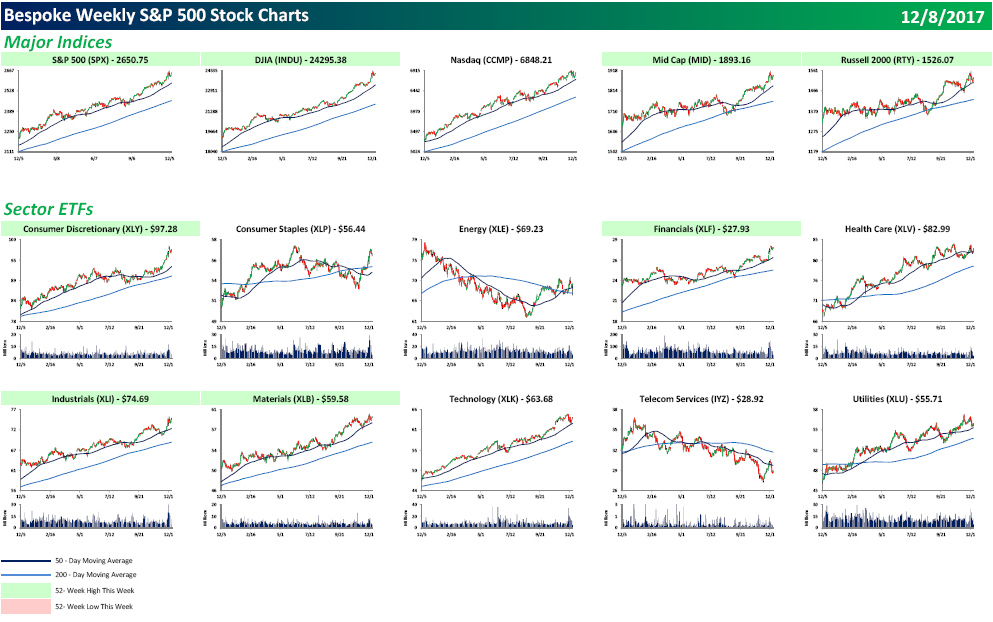

Each weekend as part of our Bespoke Premium and Institutional research service, clients receive our S&P 500 Quick-View Chart Book, which includes one-year price charts of every stock in the S&P 500. You can literally scan through this report in a matter of minutes or hours, but either way, you will come out ahead knowing which stocks, or groups of stocks, are leading and lagging the market. The report is a great resource for both traders and investors alike. Below we show the front page of this week’s report which contains price charts of the major averages and ten major sectors.

As seen in the charts below, all of the major averages with the exception of the Nasdaq made new highs this week, and even the Nasdaq isn’t far from its recent highs. In terms of individual sectors, we saw new highs from Consumer Discretionary, Financials, Industrials, and Materials. No sectors made a new low this week, but Telecom Services (a sector with just three stocks) isn’t far from its recent lows.

Make sure to check out our entire S&P 500 Chart Book by signing up for a 14-day free trial to our Bespoke Premium research service.

Breadth and Price: Joined at the Hip

With some of the big intra-market moves we have seen in the last week to ten days, we thought it would be a good idea to provide a quick update of market breadth. In this case, we looked at the cumulative A/D line, which takes the difference between the number of advancing and declining issues each day and adding the result to the previous day’s value. In a healthy market, you want to see breadth either tracking or leading price, while periods where breadth lags and diverges from price is a red flag.

Take a look at the chart below for the S&P 500 where the blue line is the S&P 500’s price and the red line is the cumulative A/D line over the last year. Could the two lines be any more similar? Based on this measure at least, market internals remain healthy.