The Closer — Chinese Credit, US Deficit, Mexico Output — 12/12/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we review Chinese credit data out earlier this week, the US fiscal deficit, and the disappointing report on industrial production earlier today in Mexico.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Chart of the Day: Producer Prices Punchy

B.I.G. Tips – FOMC Preview – December 2017

Apple (AAPL): 37 Years Later

With such a lack of seemingly high-quality new issues, it’s hard to get excited about the IPO market these days. It’s worth remembering, though, that all of today’s largest companies got their start somewhere. For the largest publicly traded company in the world, that start was 37 years ago today. That’s right, Apple Computer (AAPL) began its life as a publicly traded company on 12/12/1980, just after Ronald Reagan was elected President and a month before the Iran hostage crisis came to an end. A lot has changed over the last 37 years, and there have been some major swings for Apple and the US stock market, but at this point, things have never been better for either of them.

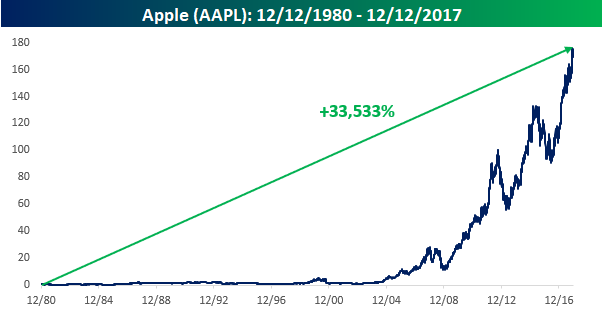

The chart below shows the performance of Apple’s stock since its IPO in December 1980. Not including dividends, the stock has rallied more than 33,500% from a split-adjusted price of 51 cents to its current price of $172 in what has been called one of the greatest wealth-creating engines of all time. Earlier in this century, as the iPod’s popularity peaked and the iPhone took off, the term “Apple Millionaire” was coined as thousands of investors saw their net worth surge by simply buying and holding the stock. Where Apple will ultimately top out or what new product they will launch next is anyone’s guess, but even if the returns are good for the next 37 years, they will never match the last 37 years. The question is, what stock will be the Apple of the next 37 years? With so few IPOs, the pickings are slim.

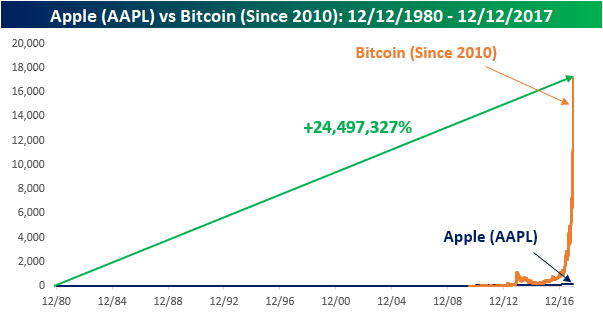

While Apple’s 37-year run of gains has been nothing short of breathtaking, bitcoin enthusiasts can’t be bothered with such pedestrian returns. As just another sign of how out of this world the rally in bitcoin has been, the chart below compares Apple’s performance since its IPO to bitcoin, going back to just 2010. Back in July 2010, bitcoin was trading at seven cents per share compared to today’s price of $17,148. That’s a gain of 24,497,327%! You read that right- almost 25 million! When you compare Apple to bitcoin, Apple just looks like its moving along the zero line. With a market value of $290 billion, bitcoin is still less than half of the market cap of Apple, but it has done all of this in just over 7 years compared to 37 years for Apple.

Bespoke Stock Scores — 12/12/17

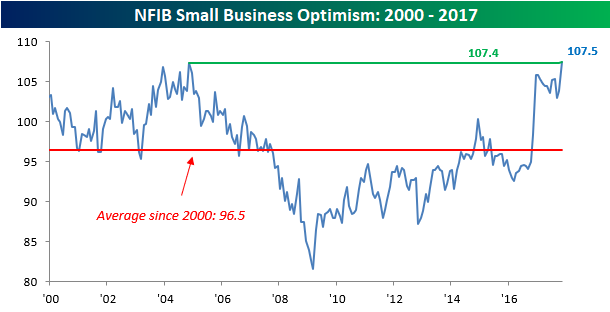

Small Business Optimism Spikes to a 34-Year High

There’s a big tide of optimism sweeping the nation’s small businesses. While individuals seem to hate the current GOP tax plan as much as they disliked ObamaCare when it was first passed, small business owners are the most optimistic they have been since the early 1980s in the days of “Stranger Things.” In the most recent release today, the NFIB’s Small Business Optimism Index spiked from 103.8 up to 107.5. That was well ahead of consensus expectations and took out the post-2000 high of 107.4 from November 2004.

The NFIB (known to be politically biased towards the right) summed up the optimism pretty succinctly in the release earlier today:

Not since the roaring Reagan economy has small business optimism been as high as it was in November, according to the National Federation of Independent Business (NFIB) Index of Small Business Optimism, released today.

“We haven’t seen this kind of optimism in 34 years, and we’ve seen it only once in the 44 years that NFIB has been conducting this research,” said NFIB President and CEO Juanita Duggan. “Small business owners are exuberant about the economy, and they are ready to lead the U.S. economy in a period of robust growth.”

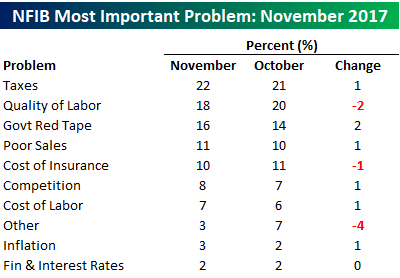

In each month’s report, respondents are asked what the number one problem is that they face in their business. Once again this month, Taxes is the number one problem facing small business owners, but that will likely start to abate once/if Congress passes their current tax reform package. Behind Taxes, business owners continue to have problems finding qualified candidates to fill job openings, but that doesn’t seem to be as big an issue as it was last month. Among specific industries, though, the NFIB reported that Labor Quality is the number one problem being faced by Construction and Manufacturing firms. Government Regulations were cited by 16% of small business owners as their number one problem, while just 11% see Poor Sales as the biggest issue they face.

Finally, the commentary section of this month’s report closed out with the optimistic forecast that “The NFIB indicators clearly anticipate further upticks in economic growth, perhaps pushing up toward 4 percent GDP growth for the fourth quarter.” 4% growth? Wouldn’t that be nice!

The Closer — Brent, Consumers, JOLTS — 12/11/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we take a look crude’s rally today, the release of consumer expectations data from the NY Fed, and a recap of JOLTS data reported by the BLS.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

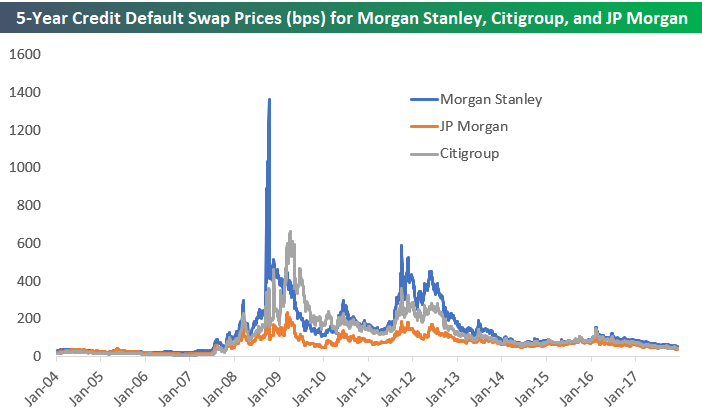

Bank and Broker Default Risk Back to July 2007 Levels

Below is a historical chart showing the annual cost of insuring against default for 5 years (5-year CDS) for three major US banks and brokers — Morgan Stanley, JP Morgan, and Citigroup. The price is in basis points, and basically the price shown is the cost in dollars per year to insure $10,000 of debt against default for five years. Large bondholders use credit default swaps (CDS) to hedge risk, but CDS also attract speculators as well. During the Financial Crisis, hedge funds betting against the banks made billions buying and selling CDS as prices to insure against default spiked.

We’re highlighting this chart today because of how low CDS prices have gotten again in the Financial sector. At this point, CDS prices for most of the major US financials are at the same levels they were trading at in July 2007. Back then, CDS prices had begun to rise a bit for the sector as some of the sub-prime mortgage companies were starting to go under, but prices didn’t really start to spike until late 2007.

You can see the moves a little better in the chart if we cap the price on the Y-axis at 300 basis points.

Even though the Financial sector appears to be on better footing now than it was prior to the Financial Crisis, the cost to insure against default remains more elevated than it was in the early to mid-2000s. In hindsight, the levels that CDS prices traded at prior to the crisis were way too low, and the negative result of those low prices that “the market” experienced during the collapse appears to have lifted the price level that is now considered “normal.”

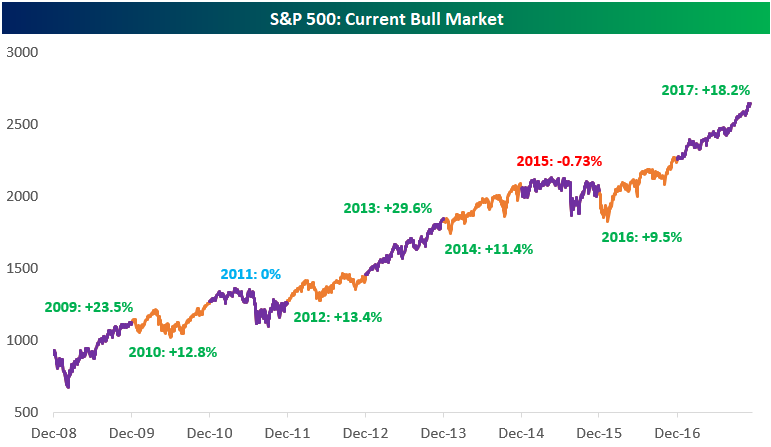

Year-To-Year Market Performance

The S&P 500 is up nearly 20% in 2017 after gaining 9.5% in 2016. The chart below highlights the annual price change of the S&P 500 since the current bull market began in 2009.

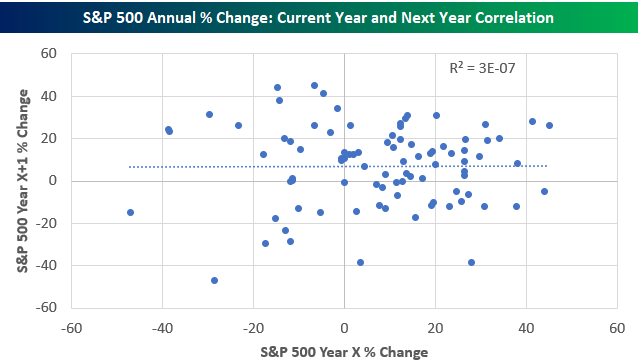

Contrarian investors might be prone to think that the market is likely to fall after a big up year, while momentum investors like to trade on strength one year turning into strength the next year. But if we look at the correlation between returns one year to the next, we find that there is none.

Below is a scatter chart showing the S&P 500’s move one year versus its move the next year. If the contrarian bet were true, you’d see a trend-line in the scatter chart that goes from the upper left to the lower right. If the momentum bet were true, you’d see a trend-line that goes from the lower left to the upper right. In reality, the trend line is flat as a pancake, meaning market returns one year have no correlation with market returns the next.

The Bespoke Report 2018 — Credit Markets

Our 2018 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2018.

Our 2018 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2018.

The 2018 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, The Fed, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. In this year’s edition, we’ll also be featuring a Bitcoin/Crypto section as well as an ETF Trends report.

We’ll be releasing individual sections of the report to subscribers until the full publication is released on December 22nd, 2017. Today we have published the “Credit Markets” section of the 2018 Bespoke Report, which looks at both high yield and investment grade bonds and credit spreads. Movements in the credit markets are often viewed as leading indicators for the stock market, so knowing how they’re trending and why is important for any equity investor.

To view this section immediately and also receive the full 2018 Bespoke Report when it’s published on December 22nd, sign up for our 2018 Annual Outlook Special below.