Chart of the Day: Oil Major, Major On The Wall…

Bespoke Stock Scores — 12/19/17

Chart of the Day: Everybody is Winning!

The Closer — Positive EM & Inflation Catalysts — 12/18/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we detail positive catalysts for the inflation outlook, as well as recapping two positive political developments for emerging markets.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

The Bespoke Report 2018 — Washington

Our 2018 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2018.

Our 2018 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2018.

The 2018 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, The Fed, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. In this year’s edition, we’ll also be featuring a Bitcoin/Crypto section as well as an ETF Trends report.

We’ll be releasing individual sections of the report to subscribers until the full publication is released on December 22nd, 2017. Today we have published the “Washington” section of the 2018 Bespoke Report, which looks at stock market and sector performance under various Presidents and Congressional control. We also highlight how market returns in the first year of Trump’s Presidency stack up versus past Presidents going back to 1900.

To view this section immediately and also receive the full 2018 Bespoke Report when it’s published on December 22nd, sign up for our 2018 Annual Outlook Special below.

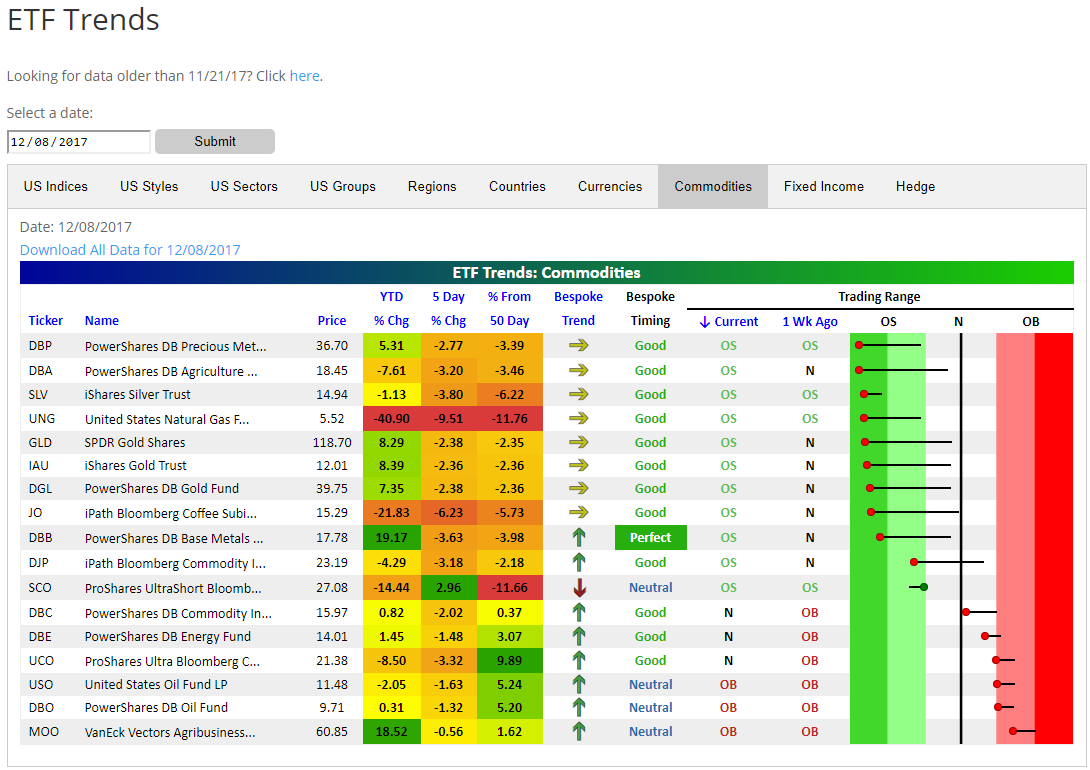

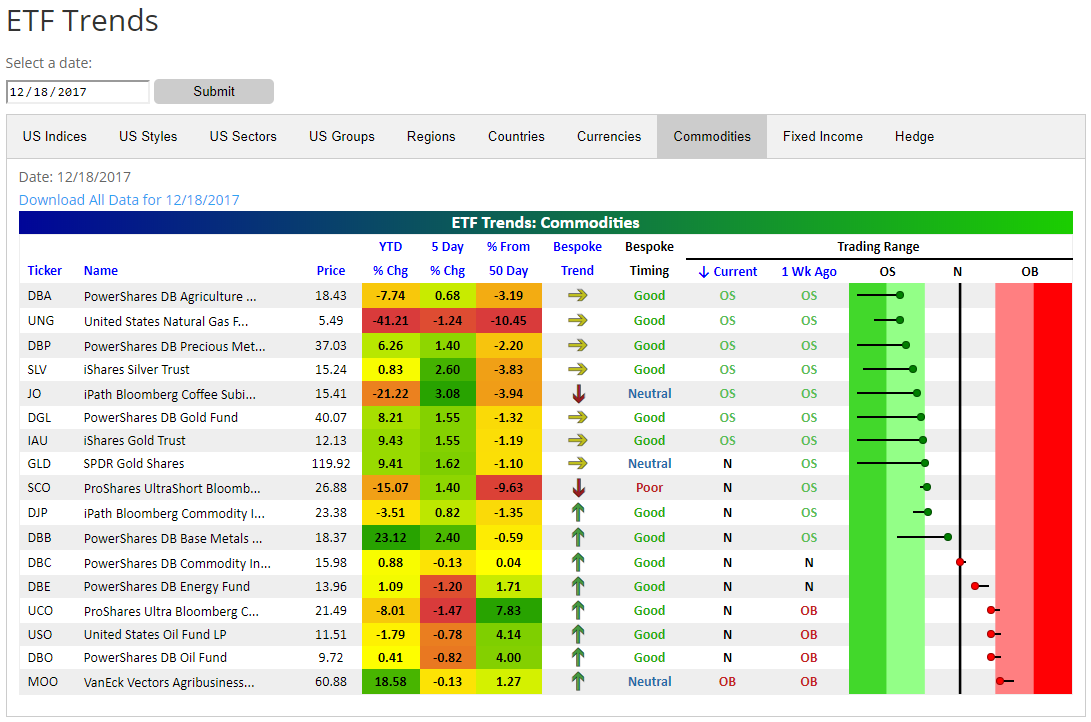

Commodities ETFs Bounce Back from Oversold Levels

Our new interactive ETF Trends tool lets investors monitor ETFs across asset classes from a trend and timing perspective. Ten days ago on December 8th, we noted that a number of commodity ETFs had moved into extremely oversold territory. A snapshot of these oversold levels is shown below from the 8th:

Since then we’ve seen an upside mean reversion trade for those commodity ETFs that had gotten oversold. While most of them are still oversold as of today, they have rallied higher from their recent depths. At the same time, the few commodity ETFs that were on the overbought side have moved down into neutral territory.

Try out our ETF Trends tool with a Premium or Institutional membership using our 2018 Annual Outlook sign-up special.

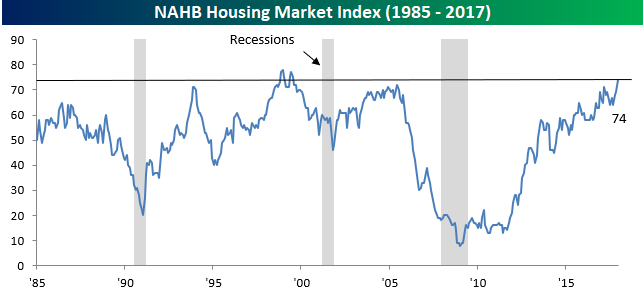

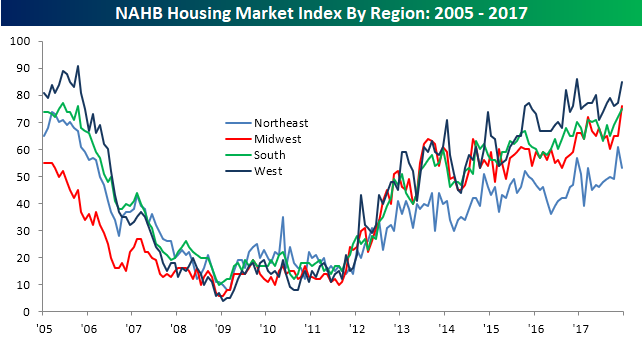

Homebuilder Sentiment Goes Beyond the Bubble

In last week’s B.I.G. Tips report on Retail Sales for the month of November, we noted that the internals of the report were “suggesting strength in the housing sector.” That idea was confirmed in the just-released December Homebuilder sentiment survey from the NAHB. While economists were expecting homebuilder sentiment to increase slightly from 69 to 70, the actual increase was much higher to 74. To put that reading in perspective, going all the way back to the report’s inception in 1985, there have only been six other months where the index was higher, and they were all back in 1998 and 1999. In other words, homebuilders are currently more optimistic than they were at any point during the housing bubble that peaked in 2005.

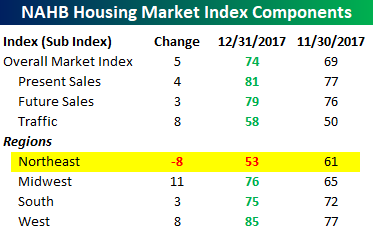

Looking at the internals of this month’s report, practically every metric was strong. Present and Future sales, as well as Traffic all saw healthy gains, with both Present Sales and Traffic surpassing their highs from the bubble. In terms of regional sentiment, we also saw healthy gains in every region except the Northeast where sentiment dropped by a rather large eight points. This leads one to ask if this is the first example of side effects of the GOP tax plan showing up in economic data. Given the generally high real estate taxes in this part of the country, it is expected to be among the most negatively impacted by the plan working through Congress.

The chart below shows the regional breakdown in sentiment over time. Here, it is interesting to note that the only region of the country where sentiment is higher than its peak at the bubble is the Midwest. The South (75 vs 77) and Midwest (85 vs 91) are relatively close, but not quite there, while sentiment in the Northeast remains well off its prior highs (53 vs 74). As a final note with regards to the large drop in sentiment for the Northeast, we would note that November’s reading did see a big spike, so December’s decline may have just been a little bit of giveback. Even still, the implications of the tax bill certainly aren’t going to have a positive impact on sentiment in the Northeast in our view.

S&P 500 Stock Seasonality Report: 12/18/17

While we don’t ever suggest that investors should base their trading solely on the calendar, there is evidence that the market and many stocks do indeed follow seasonal patterns. This makes our S&P 500 Stock Seasonality report a useful addition to every investor’s toolbox. Using the last ten years worth of price data, our Stock Seasonality report looks at the average returns for the S&P 500, its ten sectors, and its 500 individual stocks. In the report, we highlight the five stocks in each sector that have historically been the best and worst performers over the next two weeks. For each stock, we also include information such as average returns, the percent of time each stock or sector is positive/outperforms the S&P 500, and its historical performance over the next two weeks for each of the last ten years. The Stock Seasonality report is published on a weekly basis on Mondays, and it is available to all Bespoke Premium and Bespoke Institutional subscribers.

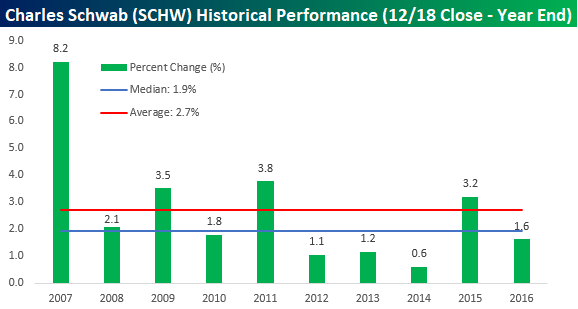

While the current time of year has historically been good for equities, as mentioned in this week’s report, there are three stocks in the S&P 500 that have been up in the final two weeks of the year for ten straight years. While two of these names (Duke Realty- DRE and Williams-WMB) may not be household names, Charles Schwab (SCHW), the third of the three is definitely a lot more well-known. As shown in the chart below, shares of the stock have traded higher from the close on 12/18 through year-end for ten straight years for a median gain of 1.9% and an average jump of 2.7%.

For active traders, our Stock Seasonality report is an excellent tool keep track of the best and worst times of year for the overall market, sectors, and individual stocks. To see the report, sign up for a monthly Bespoke Premium membership now!

Bespoke Brunch Reads: 12/17/17

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

Machine Learning

The Future Is Bumpy: High-Tech Hedge Fund Hits Limits of Robot Stock Picking by Bradley Hope and Juliet Chang (WSJ)

A skeptical take on the viability of using machine learning to pick stocks that outperform; unlike algorithms at quant funds written by humans, only the machine knows why it’s doing what it does. [Link; paywall]

AlphaZero AI beats champion chess program after teaching itself in four hours by Samuel Gibbs (The Guardian)

While machine learning may not be working well in financial markets yet, it’s done extremely well in more bounded environments like the world of chess. [Link]

Crypto Chronicles

Crypto money-laundering bust alert [siren] by Alexandra Scaggs (FTAV)

The DoJ unsealed an indictment this week against a 27 year old long Island woman who used loans, credit cards, and crpotcurrency to attempt to fund ISIS. [Link; registration required]

EU agrees clampdown on bitcoin platforms to tackle money laundering by Francesco Guarascio (Reuters)

Following the US action earlier this week, EU nations and parliamentarians reached a deal to make money laundering via the blockchain harder. [Link]

Retail Commodity Transactions Involving Virtual Currency by Commodity Futures Trading Commission (Federal Register)

In a proposed rulemaking that could make the operation of some bitcoin exchanges subject to regulatory oversight, the CFTC takes steps to lay down ground rules for transactions in crypto. [Link; 23 page PDF]

Bitcoin Made This Man (Briefly) One of the Richest People in America by James Mackintosh (WSJ)

CEO of Crypto Co (CRCW) was a billionaire on paper when illiquidity and the crypto craze drove the pinksheets stock to nearly $4 billion overnight. [Link; paywall]

Don’t get caught up in blockchain hype by Robbie Mitchell (Apnic)

A good rundown of what blockchain is actually useful for, in plain English. The list is much shorter than you might think based on all of the hype. [Link]

Tech Company Blog Posts

AIM will be discontinued on December 15, 2017 (AOL)

Venerable and ubiquitous messaging application AOL Instant Messenger is being discontinued, the end of an era for chat apps. [Link]

Hard Questions: Is Spending Time on Social Media Bad for Us? by David Ginsberg and Moira Burke (Facebook)

In a major move, Facebook has admitted that some research shows negative effects of social media. [Link]

Policy

Tax “reform” and America’s transfer union by Matthew C. Klein (FTAV)

Some interesting data work on the effective tax rates of states, and the effective subsidies granted to state and local governments, as well as the distribution of federal employment expenditures. [Link; registration required]

Natural Disasters

Sin Luz: Life Without Power (WaPo)

A massive audio-visual assessment of the ongoing struggles for Puerto Rico, which is still undergoing the longest and largest blackout in American history. [Link; auto-playing video]

Alpha-Bets

Alphabet wants to deliver Internet access via laser beams by Ron Amadeo (ArsTechnica)

Alphabet’s X Lab has signed an agreement with the state government of Andhra Pradesh in India to provide internet services via laser. [Link]

Math

Colorized Math Equations by Kalid Azad (Better Explained)

An awesome way to think about mathematical concepts, making instruction and deduction much more intuitive. [Link]

Cheese

A Premium for Velveeta? by Jeff Wilson (Bloomberg)

Bad news for processed cheese fiends: the key input (barrel cheese) trades at a 25 cent per pound premium over the traditional stuff on the CME futures markets. [Link]

Have a great Sunday!

The Closer: End of Week Charts — 12/15/17

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. This week, we’ve added a section that helps break down momentum in developed market foreign exchange crosses.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by starting a two-week free trial to Bespoke Institutional now!