The Bespoke Report 2018 — Market Cycles

Our 2018 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2018.

Our 2018 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2018.

The 2018 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, The Fed, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. In this year’s edition, we’ll also be featuring a Bitcoin/Crypto section as well as an ETF Trends report.

We’ll be releasing individual sections of the report to subscribers until the full publication is released on December 22nd, 2017. Today we have published the “Market Cycles” section of the 2018 Bespoke Report, which looks at where we stand in the current bull market and how it compares to past market cycles.

To view this section immediately and also receive the full 2018 Bespoke Report when it’s published on December 22nd, sign up for our 2018 Annual Outlook Special below.

The Bespoke Report 2018 — Dollar and Stocks

Our 2018 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2018.

Our 2018 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2018.

The 2018 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, The Fed, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. In this year’s edition, we’ll also be featuring a Bitcoin/Crypto section as well as an ETF Trends report.

We’ll be releasing individual sections of the report to subscribers until the full publication is released on December 22nd, 2017. Today we have published the “Dollar and Stocks” section of the 2018 Bespoke Report, which focuses on the performance of currencies in 2017 and expectations for 2018 as well as the impact that the dollar has on US stocks.

To view this section immediately and also receive the full 2018 Bespoke Report when it’s published on December 22nd, sign up for our 2018 Annual Outlook Special below.

The Closer — Data Wrap, Mexican’t — 12/21/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we analyze Canadian and US data updated today. We also recap major underperformance from Mexican assets.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Bespoke’s Sector Snapshot — 12/21/17

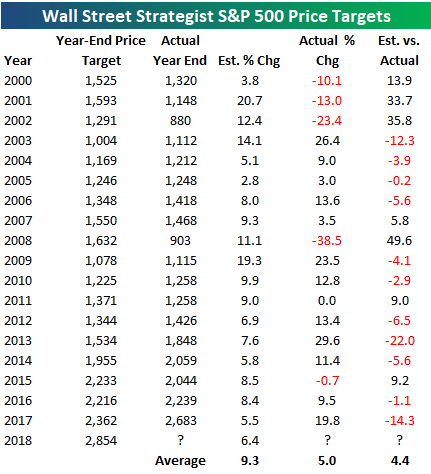

2018 Wall Street Strategists’ Year-End Price Targets

At the end of each year, we always like to take a look at where Wall Street strategists think the S&P 500 is headed over the next year. According to Bloomberg, the consensus S&P 500 price target for the end of 2018 stands at 2,854. That would represent a 2018 gain of roughly 6%.

Sign up for our Annual Outlook Special to see additional 2018 consensus projections for the economy and various asset classes.

Below, is a look at consensus year-end price targets for the S&P 500 for every year going back to 2000. For each year, we show where Wall Street strategists saw the S&P 500 trading at the end of the year, the estimated annual percentage change based on the price target, and the actual percentage change that the S&P 500 experienced that year.

Typically strategists project a gain of 9.3% for the S&P 500. That’s not surprising given that the S&P has historically averaged an annual gain of about that amount. In 2016, Wall Street strategists were spot on with their year-end target, missing the actual mark by just 1.1 percentage points. In 2017, however, strategists severely underestimated things. While they were looking for a gain of 5.5% this year, they undershot the actual mark by roughly 14 percentage points.

Underestimating is something strategists have done for most of this bull market. In the 9 years since 2009, strategists underestimated the actual move 7 times.

Also, notice that since 2000 there hasn’t been a year where the consensus year-end price target was negative.

With a price target that suggests a gain of roughly 6% in 2018, strategists are slightly more pessimistic than normal given that their average target over the years has called for a gain of 9.3%.

The Bespoke Report 2018 — Cryptocurrencies, Blockchain, and Bitcoin

Our 2018 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2018.

Our 2018 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2018.

The 2018 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, The Fed, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. In this year’s edition, we’ll also be featuring a Bitcoin/Crypto section as well as an ETF Trends report.

We’ll be releasing individual sections of the report to subscribers until the full publication is released on December 22nd, 2017. Today we have published the “Cryptocurrencies” section of the 2018 Bespoke Report, which takes a look at the mass hysteria going on in the blockchain/bitcoin/crypto space as we close out 2017. How long will the speculative frenzy last?

To view this section immediately and also receive the full 2018 Bespoke Report when it’s published on December 22nd, sign up for our 2018 Annual Outlook Special below.

Chart of the Day: Strong Years Finish Strong, And Often Reverse

The Bespoke Report 2018 — Housing

Our 2018 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2018.

Our 2018 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2018.

The 2018 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, The Fed, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. In this year’s edition, we’ll also be featuring a Bitcoin/Crypto section as well as an ETF Trends report.

We’ll be releasing individual sections of the report to subscribers until the full publication is released on December 22nd, 2017. Today we have published the “Housing” section of the 2018 Bespoke Report, which provides our view on homebuilders and the real estate market heading into the new year.

To view this section immediately and also receive the full 2018 Bespoke Report when it’s published on December 22nd, sign up for our 2018 Annual Outlook Special below.

The Bespoke Report 2018 — Economic Cycles

Our 2018 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2018.

Our 2018 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2018.

The 2018 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, The Fed, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. In this year’s edition, we’ll also be featuring a Bitcoin/Crypto section as well as an ETF Trends report.

We’ll be releasing individual sections of the report to subscribers until the full publication is released on December 22nd, 2017. Today we have published the “Economic Cycles” section of the 2018 Bespoke Report, which focuses on where we currently are in the business cycle and the likelihood of recession in the year ahead.

To view this section immediately and also receive the full 2018 Bespoke Report when it’s published on December 22nd, sign up for our 2018 Annual Outlook Special below.

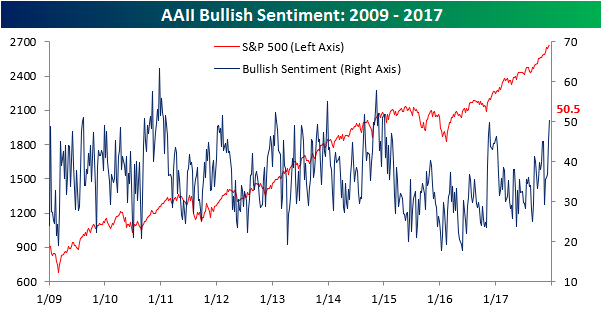

Welcome to the Bull Market

One of the most enduring and perplexing streaks of the last few years came to an end this week as bullish sentiment on the part of individual investors topped 50% for the first time in just under three years. That’s right! The weekly sentiment survey from the American Association of Individual Investors (AAII) showed that bullish sentiment increased from 45.0 up to 50.5%. That’s the first 50%+ reading since the first week of 2015! That streak of 154 weeks without a 50%+ reading was the longest that we have ever seen in the history of the survey!

Instances of bulls having a majority in the weekly AAII poll haven’t just been uncommon in recent years either. Throughout the course of the current bull market dating back to 2009, there have only been 21 times during the prior 458 weeks where bullish sentiment was above 50%. We mentioned above that this was one of the most perplexing streaks that we have seen in the market in some time. The reason we use the word “perplexing” is that the streak continued through what has been one of the most consistent market rallies many investors have ever seen. Based on this week’s survey at least, investors are only just now coming around to the idea of being bullish. Hopefully they aren’t too late to the party!