Bespoke Stock Scores — 8/21/18

The Closer — Spooz Steady Intraday, Turkish Trade Math — 8/17/18

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we take a look at the change in intraday trading patterns since the stock market began to rally consistently off Q1 lows. We also review Turkey’s current account and what it could take to close its enormous deficit.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Consumer Staples Leading

The Consumer Staples sector has been on fire lately. As shown in the snapshot from our Trend Analyzer tool below, Staples is up more than any other sector over the last week (+3.29%), and it’s now trading in extreme overbought territory at two standard deviations above its 50-day moving average.

Back in early May, the Consumer Staples sector was down more than 14% year-to-date, but it has gained back nearly all of its losses. As shown below, Staples is now down just 3.9% year-to-date. Unfortunately, Staples is still well behind its counterpart — Consumer Discretionary — which is up 14.7% on the year.

As you can see in the chart above, the first four months of the year were horrific for Consumer Staples. But since the sector hit its low for the year at the start of May, it’s been a different story.

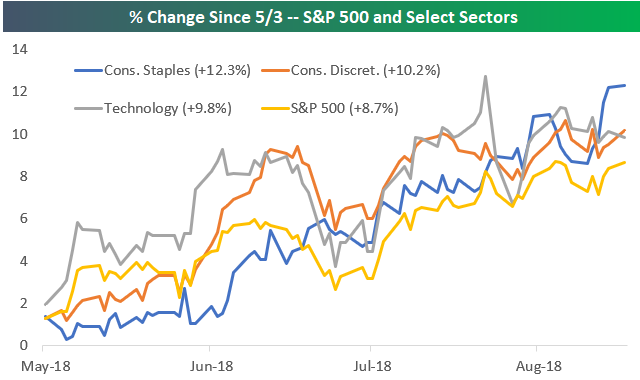

Since May 3rd, Consumer Staples is actually outperforming the S&P 500, Consumer Discretionary, and even Technology:

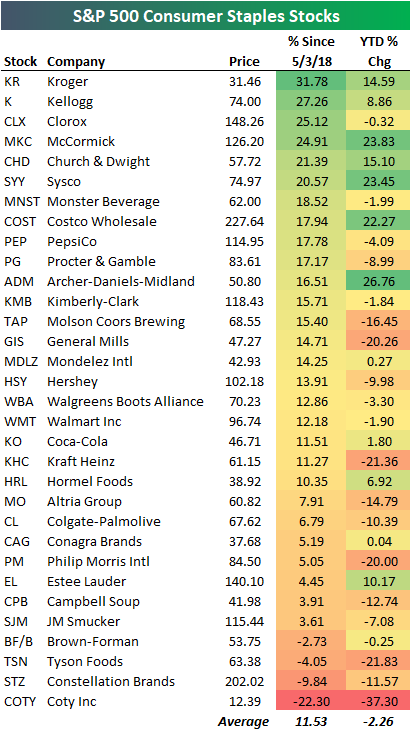

Below is a table showing the performance of S&P 500 Consumer Staples stocks on a year-to-date basis and since the sector’s May 3rd low. As shown, all but four stocks in the sector are up since May 3rd, while six are up more than 20%. Grocery store chain Kroger (KR) is up the most since May 3rd with a gain of 31.78%, followed by Kellogg (K), Clorox (CLX), and McCormick (MKC) all with gains of more than 24%.

The Real Longest Bull Market Ever

We’ve read or heard a number of erroneous reports lately claiming that we’re about to set the record for the longest S&P 500 bull market on record. Since the S&P 500 made its last bull market closing high on January 26th, the bull market actually stopped aging on that date, and we’ve essentially been in limbo since. (You can read more on this topic in this post we published late last week.)

But while the bull market for the S&P 500 really isn’t the longest on record, another major US index just set the record for its longest bull market ever.

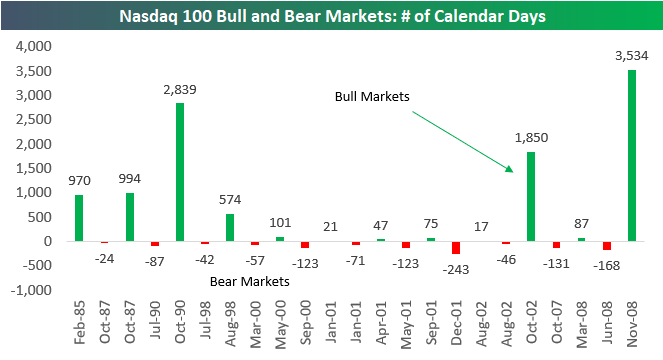

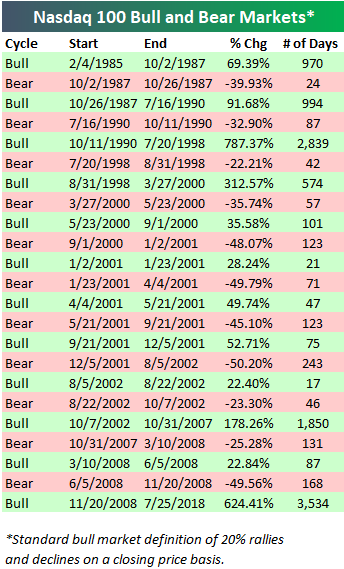

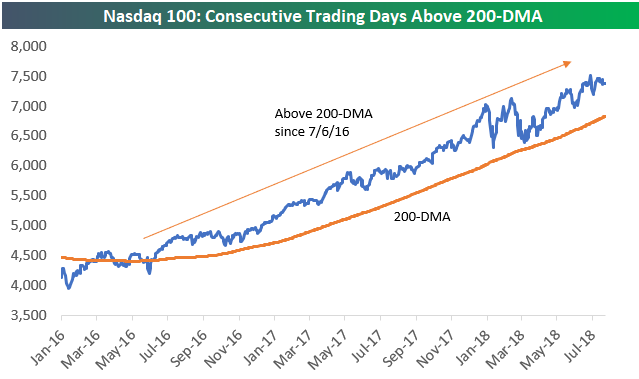

The Nasdaq 100’s current bull market has lasted 3,534 calendar days (from 11/20/08 through its most recent high on 7/25/18). As shown in the chart below, that’s easily its longest on record since the index began in 1985.

While the current Nasdaq 100 bull is easily the longest on record, it’s still not the strongest. The 1990s bull that ran from October 1990 through July 1998 saw the index gain 787.37% before it eventually fell into a short bear market in July/August ’98. The current bull for the Nasdaq has only seen a gain of 624.41%.

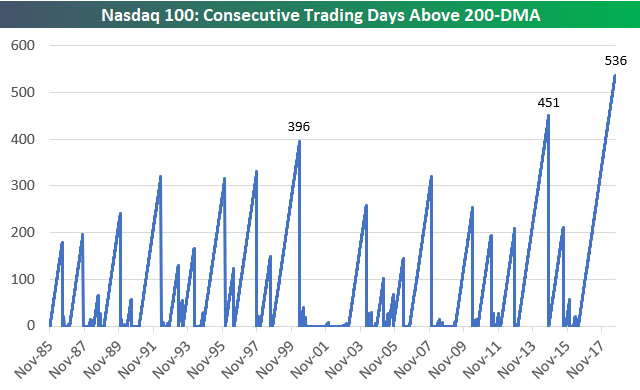

In addition to being in its longest bull market ever, the Nasdaq 100 is also in the midst of another record streak.

As shown below, the index has now closed above its 200-day moving average for a record 536 trading days dating back to July 6th, 2016. That’s well above the 396-trading day streak that ended in May 2000 and the 451-trading day streak that ended in October 2014.

See Bespoke’s most actionable stock market research with a Bespoke Premium free trial.

Chart of the Day: 2000 vs 2018 – Similar But Very Different

This Sox

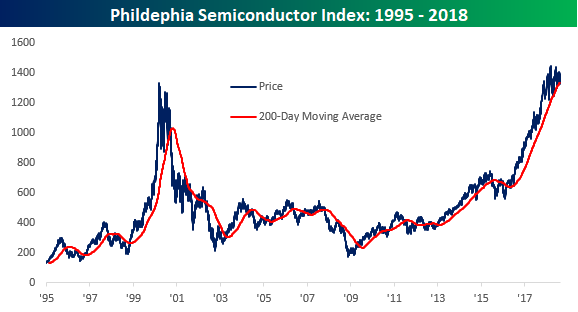

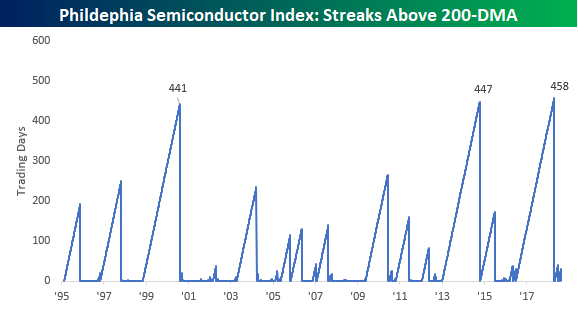

For much of the two-plus years since the Brexit vote in June 2016, semiconductors were one of, if not, the market’s biggest leaders. From the time it broke out in mid-2016 through its highs earlier this year, the Philadelphia Semiconductor Index (SOX) more than doubled, taking out its dot-com highs in the process.

Another notable aspect of the rally in semis during that span is that the group saw a record run of 458 consecutive daily closes above its 200-day moving average. Going back to 1995, this was just the third such streak of more than 400 consecutive closes above the 200-DMA, only eking out the two other streaks from 1999/2000 and 2013/2014 by a number of days.

For much of the last 20+ years, semiconductors have been considered a leading indicator for the Technology sector, if not the market as a whole. While trends tend to change over time as certain sectors of the economy lose their relevance and are overtaken by others, recent price action in the semis has been a bit concerning. When the SOX first broke its streak of consecutive closes above the 200-DMA back in April, it quickly bounced back more than 15%. While the snapback was impressive, the rally stalled out short of a new high and pulled back down to its 200-DMA. On the second test of its 200-DMA in early July, the SOX bounced again, but that rally not only failed short of a new high, it also came up short of the prior lower high.

Since that most recent lower high, the SOX has once again broken below its 200-DMA and still has yet to bounce. Not only that, but if it doesn’t find its footing soon, it will become increasingly likely that the SOX will fall below levels seen in early July, resulting in a lower low. Two lower highs followed by a lower low? From a technical perspective, that wouldn’t be an especially promising pattern.

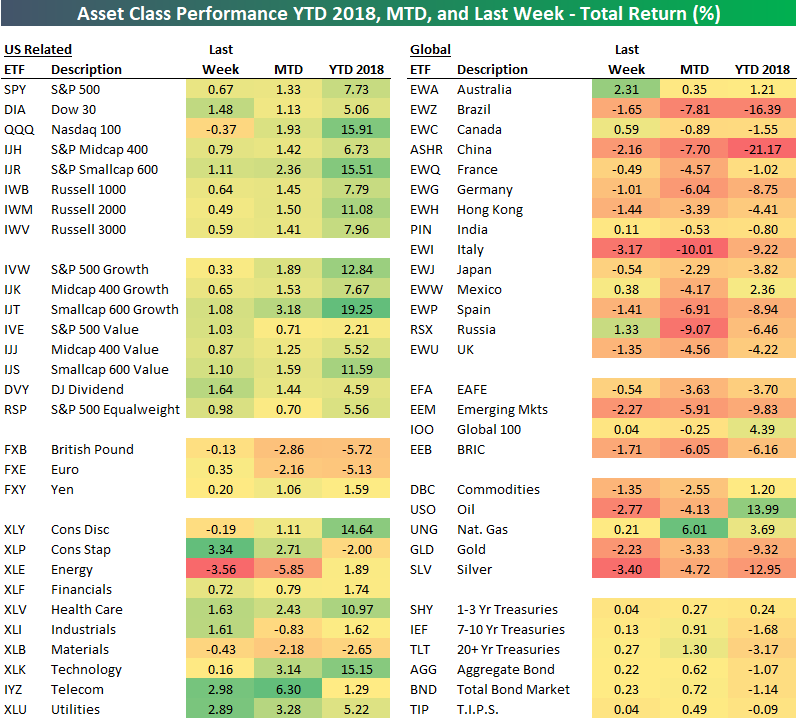

Bespoke Asset Class Performance Matrix

Below is our total return ETF matrix highlighting the performance of various asset classes from the perspective of a US investor.

With a solid end to the week on Friday, US equities finished the week with across the board gains as all of the major averages with the exception of the tech-heavy Nasdaq 100 (QQQ) finished in the green. Don’t feel too bad for the Nasdaq, though, as it is still up nearly 2% MTD and over 15% on the year. The biggest laggard of the major US index ETFs on a YTD basis has been the Dow (DIA) with its YTD gain of 5.06%, and that’s after taking into account its leading 1.48% gain last week.

On a sector by sector basis, defensive stocks led the way higher as Consumer Staples (XLP), Telecom Services (IYZ), and Utilities (XLU) all had gains of close to 3% or more. On the downside, commodities related stocks took it on the chin with Energy (XLE) falling over 3.5% and Materials (XLB) dropping 0.43%.

Outside of the US, it was a rough week for global equities. Italy (EWI) was the biggest decliner with a drop of 3%, which brings its MTD decline to more than 10%. Not far behind Italy, though, Russia (RSX) is down over 9% even after rising more than 1% last week, while Brazil (EWZ) and China (ASHR) are both down more than 7%. On the year, China is down over 21% and Brazil is down more than 16%. Just to illustrate how bad a year it has been for international equities from the perspective of a US investor, the only two countries we track in the matrix that are up on the year are Australia (EWA), which was actually down heading into the week, and Mexico (EWW).

In the commodities sector, outside of Natural Gas (UNG), all of the commodities ETFs we track were down on the week (hence the weakness in Energy and Materials sectors).

Finally, we saw marginal gains in fixed income, with slightly more strength at the longer end of the curve as 20+ year Treasuries were up 0.27%.

Bespoke Brunch Reads Linkfest — 8/19/18

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

Drinking

Uh-Oh, Germany Is Rapidly Running Out Of Beer Bottles by Esme Nicholson (NPR)

A European heatwave is driving a surge in beer consumption, meaning the normal circulation of beer bottles from consumer to recycler to bottler and around again is badly disrupted. [Link]

Bribes, Backdoor Deals, and Pay to Play: How Bad Rosé Took Over by Victoria James (Bon Appétit)

The story of low quality rosé’s own payola scandal: marketers paying restaurateurs to put their swill (typically industrial, by product laden product from low-quality inputs) on wine lists. [Link]

Cities

It’s no laughing matter — SF forming Poop Patrol to keep sidewalks clean by Heather Knight (SF Chronicle)

With a large homeless population to deal with, San Francisco faces a serious issue with people relieving themselves in parts of the city’s streets, a concern that has gotten lots of attention in the media. The poop patrol aims to cut down on the smell. [Link]

Economics

Swelling clout of US corporate giants is depressing pay, analysts say by Sam Fleming and Brooke Fox (FT)

New research suggests that increasing market power among large US firms is leading to reduced wage growth; monopsony purchasers of labor. [Link; paywall]

Turkey’s Crisis Exposes the Perils of Strongman Rule by Max Fisher (NYT)

An overview of why autocratic regimes struggle with the trade-off between policies they want to execute and the collateral damage (very frequently, higher inflation). [Link]

How Subscription Business Models are Changing Business and Investing (the Microeconomics of Subscriptions) by Tren Griffin (25iq)

A very comprehensive analysis of how subscription economics work and when they are or are not appropriate for a business to deploy. [Link]

Finance

CLOs Are the New Hedge Funds. Plan Accordingly. by Stephen Gandel (Bloomberg)

An overview of the rise in collateralized loan obligations, securitized pools of bank loans. While the article does not mention this, CLOs performed very well during the last credit crisis; while recent structures are somewhat weaker and concerns are valid, their history is impressive. [Link]

NYSE is putting its own interest ahead of investors’ by David Swensen (FT)

Why the advent of a profit-seeking Big Board may be not so good for the individual investor, or indeed investors of all kinds. [Link; paywall]

Social Media

“He loves me unconditionally, I count my blessings every day. (Channel 4 News/Twitter)

While not a “read”, we had to include this short video about a former drug user and his dog. It’s guaranteed to bring a very big smile to your face. [Link; auto-playing video]

Zuckerberg Doesn’t Care About Publishers? Facebook Denies It. by Glenn Fleishmann (Fortune)

In a meeting with Australian media executives, an employee of the social network claimed CEO Zuckerberg doesn’t care about third-party news organizations and publishers. [Link; soft paywall]

Have a great Sunday!

The Bespoke Report – Need Mo-mentum

The Closer: End of Week Charts — 8/17/18

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. We also take a look at the trend in various developed market FX markets.

Below is a snapshot from today’s Closer highlighting weekly intraday price charts for major equity indices and other asset classes. If you’d like to see more, start a free trial below.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by starting a two-week free trial to Bespoke Institutional now!