FAANG Stocks Get Hit

Fixed Income Weekly – 9/5/18

Searching for ways to better understand the fixed income space or looking for actionable ideals in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

This week we take a look at which parts of the high yield bond market are trading at double-digit yields. It’s a very small and much less distressed corner of the fixed income markets than you might expect!

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

Chart of the Day: Cooper-Standard (CPS) Scores Well

Sector Mean Reversion

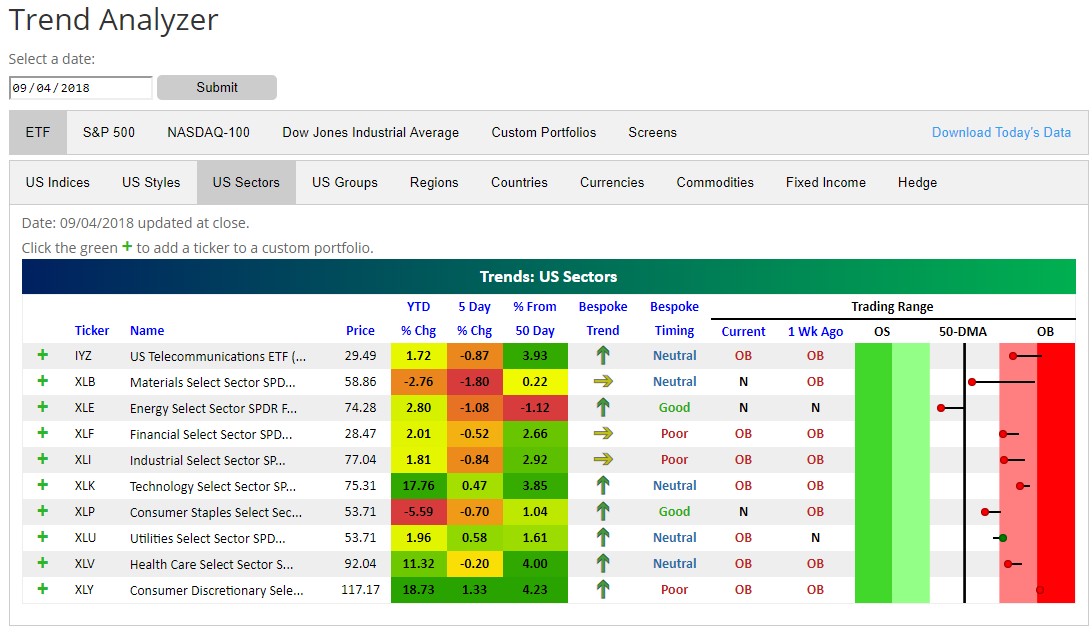

Below is a quick update on S&P 500 sectors using the most popularly traded ETFs on US exchanges. Here we show sectors through our Trend Analyzer tool, which is available to Bespoke Premium and Bespoke Institutional subscribers. We’ve seen some mean reversion over the last week, with seven sectors down and just three up. While all but three sectors remain in overbought territory, every sector except for Utilities has moved lower within its normal trading range.

Materials (XLB) has pulled back the most over the last week with a decline of 1.8%, followed by Energy (XLE) at -1.08%. Consumer Discretionary (XLY), Utilities (XLU), and Technology (XLK) are the three sectors that are up over the last week.

On a year-to-date basis, Consumer Discretionary and Technology are up by far the most with gains of more than 17%. Materials and Consumer Staples are the only two sectors in the red.

Looking at longer-term trends using our proprietary trend algorithm, all sectors are currently either in sideways or uptrends. You can learn more about our proprietary Bespoke Trend and Bespoke Timing rating system at the bottom of our Trend Analyzer page.

Bespoke’s Global Macro Dashboard — 9/5/18

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

The Closer — EM Collapse, PMIs Paltry — 9/4/18

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we review the ongoing slide in EM assets, including credit and FX. We also review Markit PMI data from around the world and domestic US data released today: auto sales, ISM, and construction spending.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Bespoke Stock Scores — 9/4/18

Chart of the Day – September Intra-Month Performance

ISM Manufacturing Blowout

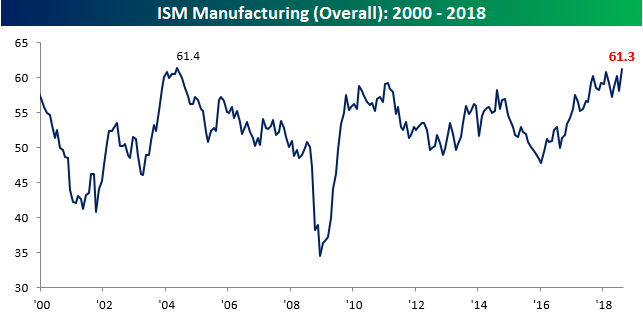

According to the most recent release of the ISM Manufacturing PMI report, August was not just a good month, it was great! While economists were expecting a modest downtick in the headline index, the actual reading saw a pretty sharp uptick, rising to 61.3, which was the highest reading since May 2004. With consensus expectations at 57.6, the last time an ISM Manufacturing report exceeded forecasts by a wider margin was in August 2001!

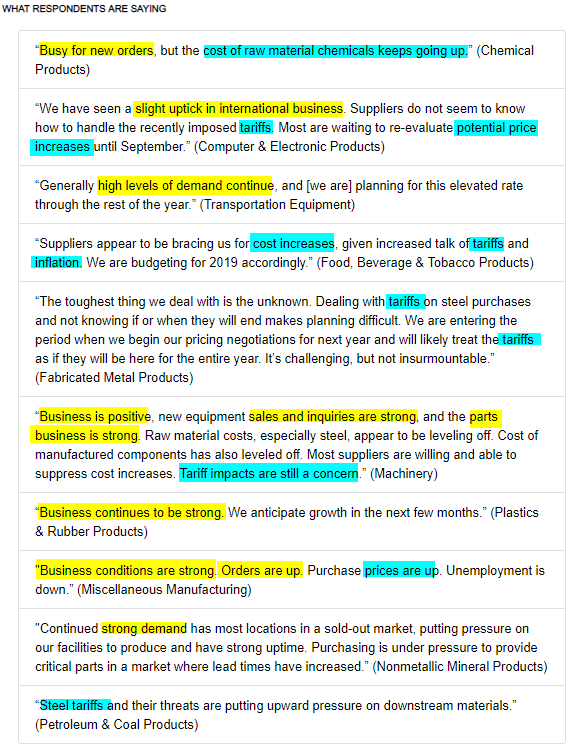

Looking through the selected commentary section of the report also shows strength across the board. Although while commentary is generally positive (yellow highlights), concerns over inflation pressures are just as prevalent.

Looking through the internals of the August ISM Manufacturing report also shows broad-based strength. Of the ten subcomponents, the only three that declined m/m were Prices Paid, Export Orders, and Import Orders. The biggest increases were seen in New Orders and Production (although neither hit a new cycle high like the headline index). Finally, on a y/y basis, breadth in the report was not as strong as the subcomponents of the report were evenly split between gains and losses.

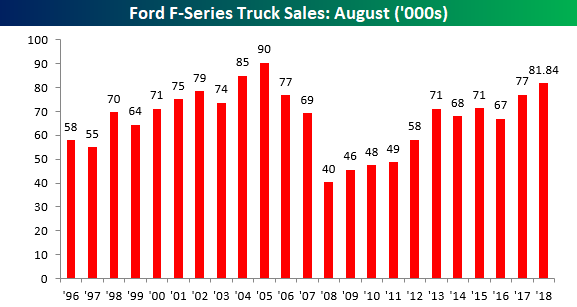

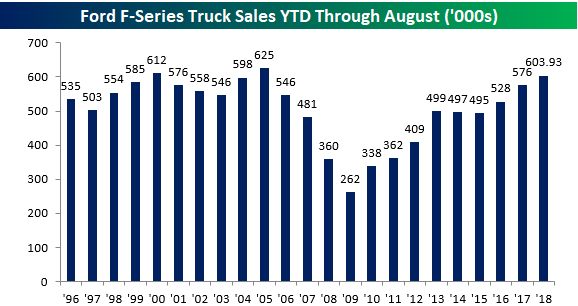

Ford Truck Sales – No Slowdown Here

Ford just released its monthly auto sales numbers for August, and the results came in better than expected at +4.1% versus expectations for a decline of 0.8%. As we do each month, our focus in this report is truck sales, and more specifically, F-series pickup trucks. Trucks are often purchased by small businesses and contractors, so they provide a good read on the health of the small business sector, and similar to the prevailing narrative, Ford’s numbers continue to suggest a solid US economy.

For the month of August alone, total sales of F-Series trucks totaled 81,839, which is up over 6% compared to the same month last year and is the highest monthly sales total for August since 2005 and the third best August going all the way back to 1996.

With the strong August results, total YTD sales of Ford F-Series trucks now stands at 603,926. Since 1996, the only two years that saw a stronger YTD total through August were 2005 (625K) and 2000 (612K). Ford’s stock may not be doing much, but the company’s trucks are selling like hotcakes!