Chart of the Day: What FX Has To Say About Stocks

“Business is Booming”

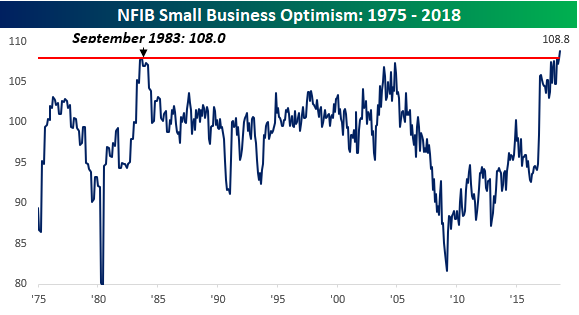

“Business is booming.” That statement was taken from the commentary section of the August NFIB report on small business optimism. In fact, business appears to be so strong for US small businesses that the index of Small Business Optimism rose to a record high of 108.8 in August. That surpassed the old record of 108.0 back in September 1983. While the record high in 1983 came just three years after small business sentiment in the US hit a record low, the current record high comes ten years after sentiment hit a generational low.

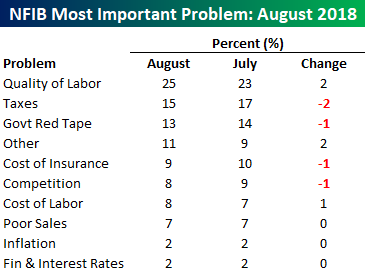

One of the trends that stood out in this morning’s release was that 89% of small business owners looking to hire have found either no or few qualified applicants, indicating a pretty significant skills gap in the US economy. Given the lack of available qualified labor, a record 25% of small businesses cited Quality of Labor as the number one problem they face.

Of all the various ‘problems’ small businesses face, Quality of Labor is the biggest. It wasn’t that long ago that issues like Taxes and Red Tape were the biggest issues, but they have now taken a backseat, and even after combining the two issues, they are only a slightly bigger (28%) problem than labor quality. Finally, while investors have been very concerned with upward price pressures this year, small businesses owners seem complacent with just two percent citing inflation as their number one problem.

The Closer — Backwardation, Earnings, Real Rates, European Data — 9/10/18

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we review crude markets, earnings forecasts, and real rates. We also review economic data from the UK and Sweden.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

B.I.G. Tips — Nasdaq 100 (QQQ), S&P 500 (SPY) Testing Key Support

Emerging Markets in Bear Market Territory

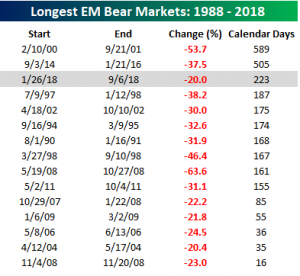

Things have been so bad for emerging market equities of late that the MSCI Emerging Market index has now declined over 20% from its January high on both an intraday and closing basis. That officially puts the index in bear market territory.

What’s particularly noteworthy about the current bear market for EM is that even though it is far from the most severe of the last 30 years, it already ranks as the third longest. The only longer declines of 20% or more in the index (without a 20% rally) were from February 2000 through September 2001 (589 days) and September 2014 through January 2016 (505 days).

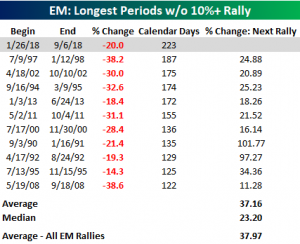

Even more significant, in our view, is the fact that the current downturn in EM is also the longest stretch without a 10%+ rally (223 days) in over 30 years. Going back to 1988, there has never been another period where EM went more than six months without a 10% rally. Looking ahead, when EM finally did turn, the average rally was just over 37%, which is right inline with the historical average.

In today’s Chart of the Day for Bespoke members, we looked at the huge performance gap between the US equity market and emerging markets so far in 2018 and whether or not it can last. Start a two-week free trial to any membership level to give it a read.

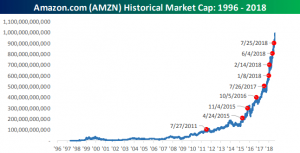

Amazon Surpasses $1 Trillion

Of the five FAANG stocks, Amazon.com (AMZN) made positive headlines last week as its market cap briefly breached the trillion level intraday Tuesday before pulling back. Since the stock didn’t finish the day with a market cap above that level, it wasn’t official, but for a brief moment, the two AAs of FAANG were both members of the trillion dollar club.

Looking at the ten largest S&P 500 companies by market cap, behind AAPL and AMZN, the only two stocks anywhere close to the trillion level are Microsoft (MSFT) and Alphabet (GOOGL), and when we say close, they still have to rally about 20% to get there.

The next two largest companies — Berkshire and Facebook — would essentially have to double from here, while the remaining four stocks in the top ten would basically have to triple.

Amazon’s road to a trillion has been extraordinary. It took AMZN 5,186 days as a public company to first cross the $100 billion mark, but only 41 days to go from $900 billion to $1 trillion (on an intraday basis). Since first crossing the $200 billion threshold in April 2015, AMZN has added $100 billion in market cap at an average of once every six months. Talk about a money machine!

Equifax – One Year Later

This past Friday (Sept. 7th) marked the one year anniversary of the Equifax (EFX) data breach announcement. The breach, which exposed 143 million Americans’ personal information, sent EFX plummeting 37.23% from $142.72 to a low of $89.59 one week later.

As you can see from the chart below, EFX has been steadily recovering since the lows made in the immediate aftermath of the breach announcement. At the close on Friday, EFX was sitting at a 52-week high of $135.91, only 5.13% from its level before the data breach was announced and 7.55% from its all time high. After the breach was announced, many wondered how EFX could ever recover, but at this point just one year later, it’s been all but forgotten by investors.

Chart of the Day – US vs EM Dichotomy

10 Year Yields Eye A Breakout

Friday’s strong wage numbers catalyzed a significant uptick in yields with 10s rising 6.8 bps to the highest yield since August 8th. One day does not a trend make, but we’ve seen a pretty persistent uptick in yields over the last few weeks. That uptick has been off support that dates back to February. Overhead, there’s been a trend of lower highs since the peak in yields back on May 18th. While yields haven’t broken out of this consolidation yet, they’re certainly moving towards it; a close above either overhead resistance or support below would be a technical signal making a larger move more likely.

Bespoke Brunch Reads: 9/9/18

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

Retail

This Space Available by Corey Kilgannon (NYT)

A photographic journal of open retail space around New York City that captures simultaneously the decline of traditional retail and the consequences of soaring lease costs. [Link; soft paywall]

Amazon’s treasure trove of data by Erica Pandey (Axios)

Arguably the most under-valued component of the online giant’s business is its massive trove of data on consumer behavior. [Link]

Football

Runs in the Family by Sarah Spain (ESPN)

The story of an adopted NFL coach and his journey to find his biological parents. [Link]

Healdsburg High Football Team Calls It Quits After Crushing Shutout Losses by Emily Turner (CBS)

A high school team in California suffered two losses so brutal that they decided to disband the team. With only 18 players, the team lost its first two games by a combined score of 102-0, and two of the 18 players quit. [Link; auto-playing video]

Nike’s online sales jumped 31% after company unveiled Kaepernick campaign, data show by Ciara Linnane (MarketWatch)

This week’s decision by Nike to release an advertisement featuring quarterback Colin Kaepernick appears to have been good business thus far, with a 31% increase in sales over the following week (versus a 17% increase the prior year). [Link]

US Dollars

One more reminder that the US dollar is dominant by Colby Smith (FTAV)

While the demise of the dollar as the world’s reserve currency is constantly proclaimed, in reality cross-border funding is overwhelmingly dominated by the greenback and if anything that dominance is growing. [Link; registration required]

Missteps

The Regrets of Lewis Ranieri by Cezary Podkul (WSJ)

A retrospective on the career and contributions (not all positive, mind you) of the man who invented bonds backed by mortgage backed securities in the 1980s. [Link; paywall]

What went wrong at Social Capital by Dan Primack (Axios)

The downfall of what was once the hottest investment vehicle in Silicon Valley appears to have been driven by pure hubris on the part of its founder. [Link]

Social Media

SEC Wants to Keep Tabs on Social Media Posts That Could Move Markets by Aaron Boyd (Nextgov)

In a recent solicitation the SEC has started looking for a tool to monitor social media posts that can have an effect on financial markets. [Link]

Americans are changing their relationship with Facebook by Andrew Perrin (Pew)

New survey data shows over 40% of users have taken breaks from the site for at least several weeks in the past year, suggesting much less intensive use than the relatively recent history. [Link]

Meltdowns

Elon Musk appears to smoke marijuana during an interview by Victor Reklaitis (MarketWatch)

While marijuana may now be legal in numerous states, consequences and stigmas from marijuana use are still in place as Tesla CEO Elon Musk is now discovering after toking up during an interview. [Link]

Italy’s Populists Begin Their Big Betrayal by Ferdinando Giugliano (Bloomberg)

Markets forced some harsh realities onto the populist coalition governing Italy, which has backtracked on anti-euro and anti-austerity rhetoric quickly. [Link; soft paywall]

Read Bespoke’s most actionable market research by starting a two-week free trial today! Get started here.

Have a great Sunday!