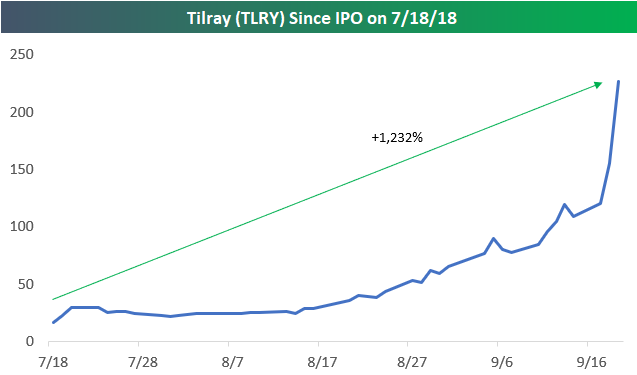

Tilray (TLRY): Canadian Blue Chip?

Canadian-based Tilray (TLRY) is up 1,232% since it IPOd two months ago on July 18th.

Wait, say that again!? Yes, TLRY is up more than 1,200% since going public just two months ago!

What does TLRY do? It’s a cannabis drug-maker, of course.

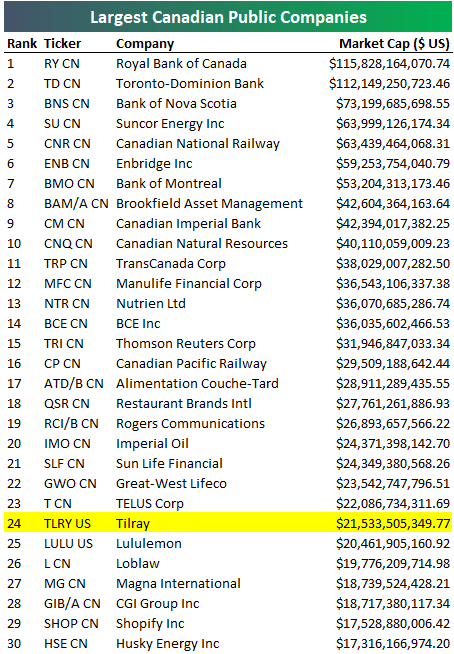

As the cannabis wave has swelled, Tilray’s massive gain over the last two months has left it with a market cap of $21.5 billion (USD). As shown below, this ranks Tilray as the 24th largest publicly traded company based in Canada. At $21.5 billion, TLRY’s market cap is now a billion dollars larger than lululemon (LULU), which is one of the most well known consumer brands based on Canada.

We have no comment on how or when this insane rally will end, except we’re confident that plenty of investors will end up losing their shirts.

Another Seasonal Trend Fails to Deliver

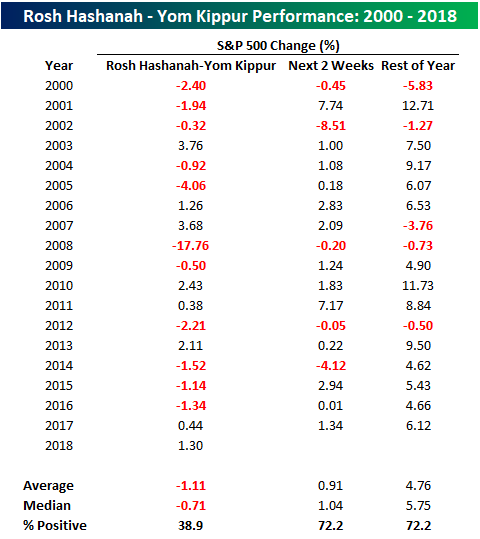

We pay close attention to historical trends in the market and believe that investors should be aware of them, and in certain cases incorporate them into their process, but we have also always contended that investing based solely on the calendar is not the wisest of investment strategies. This year has been a perfect example. Sell in May and go away? Nope. September swoon? Not quite. The latest seasonal trend not to work this year is the somewhat less well-known, sell Rosh Hashanah, buy Yom Kippur.

In recent history, this seasonal trend based on the holidays of the Jewish New Year and Day of Atonement has actually been pretty consistent. Going back to 2000, the S&P 500 has seen an average decline of 1.11% (median: -0.71%) during the ten-day period with positive returns less than 40% of the time (see table below). What’s more, being out of the market during this period also would have avoided the nearly 18% decline that took place during the Financial Crisis in 2008. While there are a number of theories as to why this trend has worked over time, the most likely probably has to do with the fact that the period always occurs somewhere between early September and early October which has historically been one of the worst times of the year for equities.

While it has worked relatively well in the past, in 2018, the sell Rosh Hashanah, buy Yom Kippur trade hasn’t worked out for anyone following it. Through early afternoon Wednesday (Yom Kippur ends today), the S&P 500 is up 1.3% since the start of Rosh Hashanah, which is its best showing during this period since 2013.

While the period between Rosh Hashanah and Yom Kippur has historically been weak for equities, the two weeks after Yom Kippur have been very positive. Since 2000, the S&P 500 has averaged a gain of 0.91% (median: 1.04%) with positive returns nearly three-quarters of the time. For the remainder of the year, the results are similarly as strong with an average gain of 4.76% (median: 5.75%).

With the S&P 500 bucking the typical trend over the last week and a half, does that mean we can expect the market to do the opposite going forward? It’s possible, but prior history doesn’t suggest it. In fact, in prior years where the S&P 500 traded up during this period, it saw even stronger returns going forward. In the seven years where the S&P 500 was up from Rosh Hashanah through Yom Kippur, it traded up an average of 2.35% (median: 1.83%) in the following two weeks with positive returns all seven times. For the remainder of the year, the S&P 500’s average gain was 6.64% (median: 7.50%) with gains in all but one period (2007).

Residential Construction

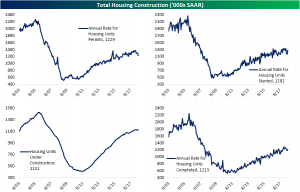

This morning’s release of US Census residential construction numbers for August came in mixed. Total housing starts reported a 9.2% MoM increase at a seasonally-adjusted annualized rate of 1.282 million, beating the estimate of 1.238 million. Permits, on the other hand, came in far worse. Estimates were for a seasonally-adjusted annualized rate of 1.31 million, but the actual level came in lower at only 1.229 million, a 5.68% MoM decrease. Units under construction and completed both saw month-over-month increases of 0.8% and 2.54%, respectively.

While starts did come in higher overall, a large portion of the gain can be attributed to growth in the West, up double digits for both single and multifamily homes on a MoM basis. That follows an extremely low starts rate in recent months relative to recent permit activity. Conversely, the Northeast is the biggest laggard, especially when it comes to completions and permits. Single family permits, single family starts, total completions, and single family conversions are all down double-digits YoY. While starts, units under construction, and completions have generally been pretty strong around the country, permits have fallen off a cliff. In aggregate, permits are down 5.5% YoY with single family permits only barely clinging to YoY growth.

While the numbers from this report tend to fluctuate, the annual rate for total housing permits are at their lowest point since May 2017. Given that permits are generally more reliable than starts, that’s not a good sign, though it ought to be balanced against the fact that the number of units under construction is at a record level, suggesting that permits are slowing because of supply constraints rather than soft demand.

Fixed Income Weekly – 9/19/18

Searching for ways to better understand the fixed income space or looking for actionable ideals in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

This week we take a look at the very strong trend in 2 year note yields, and the uptick in the 2s5s yield curve.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

Chart of the Day: NOC-NOC-NOCing On Breakouts’ Door

Bespoke’s Global Macro Dashboard — 9/19/18

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

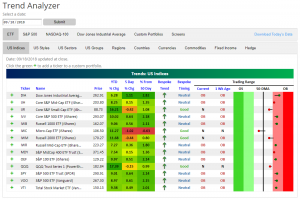

Trend Analyzer — US Index ETFs and Sector ETFs — 9/19/18

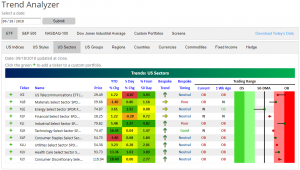

From our Trend Analyzer tool, ten major US Index ETFs are overbought, four are neutral, and none are oversold. Yesterday, we noted that most of the ETFs that were trading in overbought territory were just barely there, but yesterday’s gains pushed them to more overbought levels.

The Core S&P Small-Cap (IJR), Micro-Cap (IWC), Russell 2000 (IWM), and Nasdaq 100 (QQQ) are the only ETFs that are down from one week ago, and the Micro-cap ETF (IWC) once again remains the only ETF trading below its 50-DMA.

On the sector level, it is a similar story to yesterday with the major Index ETFs. Most sector ETFs are overbought, but not at extreme levels. Most notable of the sectors is Energy which currently sits slightly above the 50-DMA. This is a big change from one week ago when it was oversold. Conversely, the Telecommunications sector has seen the largest decline from one week ago. As you can see, it quickly fell out of the extreme overbought range.

The Closer — Metros Boomin’ — 9/18/18

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we discuss falling realized volatility and why they’re helping keep volatility low. We also review the likely avenue for China’s response to new US tariffs and Energy earnings relative to crude prices before discussing 2017 real GDP at the metropolitan statistical area level and some big shifts in international investor purchases of US financial assets.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

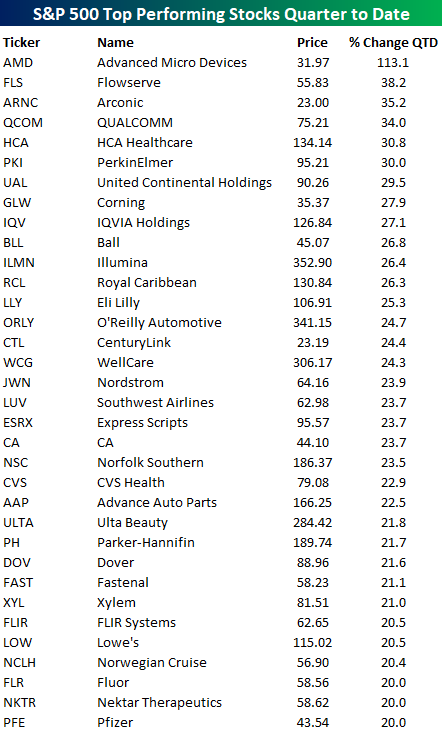

Best Performing S&P 500 Stocks QTD

With under two weeks left to go in the quarter, Q2 2018 is shaping up to be a good one for US equities. S&P 500 stocks have posted an average gain of 5.7% so far this quarter with over three-quarters of the index in the black. So much for the weak breadth argument! In terms of top performers, the 34 stocks listed below are all up 20% or more QTD. Leading the way higher is Advanced Micro (AMD), which is up an unbelievable 113%. Trailing way behind in AMD’s dust, the next best-performing stock on the list is Flowserve (FLS), which is still up a respectable 38% followed by Arconic (ARNC), QUALCOMM (QCOM), HCA Healthcare (HCA), and PerkinElmer (PKI), which are all up over 30%.

In terms of the FANG stocks, you have to go down to position number – wait. There are no FANG stocks on the list of top performers! 😱😱😱😱😱 In fact, in order to include even one FANG stock on this list, we would have to extend it to the top 100 stocks (AMZN – 95th). For the list to include two FANG stocks we would have to extend it to the top 300 names (GOOGL – 287th), and finally to include all the FANG stocks, we would simply have to show all the stocks in the S&P 500, as Facebook (FB) is all the way down at position number 490 in terms of its QTD rank. That’s right, only ten other stocks in the S&P 500 have done worse this quarter than Facebook.

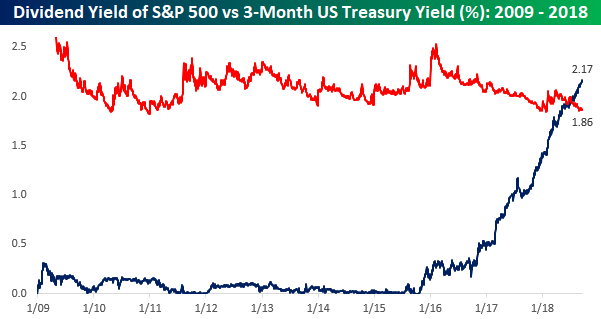

Cash is Less Trashy

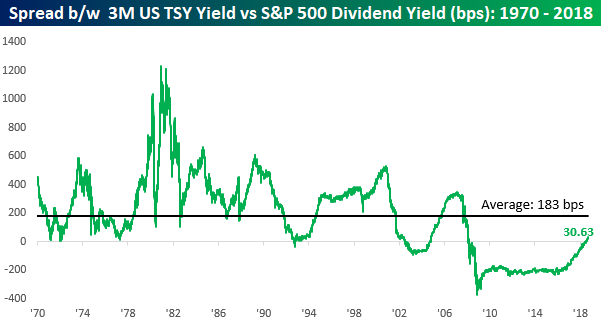

As interest rates have risen over the last few months, we have seen a number of charts similar to the one below comparing the yield on the 3-Month US Treasury (UST) to the dividend yield on the S&P 500. Up until just a couple of months ago, this entire bull market has occurred during a period where short-term interest rates have been lower than the dividend yield on the S&P 500. After over two years of rate hikes from the FOMC, though, short-term interest rates rose above the S&P 500’s dividend yield this summer and have continued higher ever since. With yields crossing this key inflection point, there’s been a decent amount of chatter that the higher yield on cash makes it more attractive than equities given their lower yield.

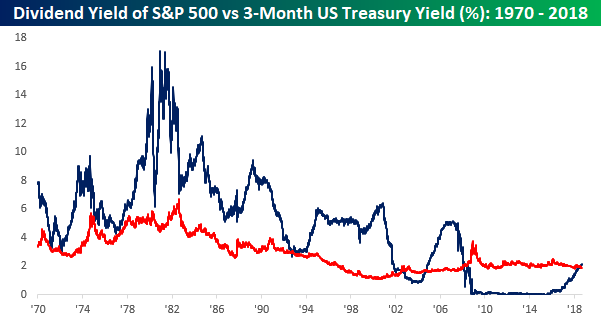

While any trader under the age of 30 (or algorithm using just ten years worth of history) has never known a world during their career where the dividend yield on equities was less than the yield on short-term Treasuries, those who are older or familiar with market history know that it is much more common for equities to yield less than short-term Treasuries. The chart below is the same as the one above except that instead of going back to just the start of 2009, it goes all the way back to 1970. As shown, prior to 2009, instances, where short-term Treasuries yielded less than the S&P 500 were few and far between. After all, unless you have some short-term needs for the capital, who would want to own an asset with zero upside potential (short-term treasury) if held through maturity that pays a lower coupon than equities, which outside of a couple of periods have always increased in value?

Below we compare the spread between the yield on the 3-month UST to the dividend yield of the S&P 500. While short-term Treasuries currently yield nearly 31 basis points (0.31%) more than the dividend yield of the S&P 500, that spread is still more than 150 bps below the historical average. Furthermore, even when the spread has been above the historical average, it has hardly represented a warning sign for equities. Throughout the entire mid to late 1990s period and nearly all of the 1980s (two very strong periods for equities), the spread was not only positive but well above the long-term average as well. The only thing that makes cash look less trashy when it is yielding marginally more than the S&P 500 is when it follows an outright garbage period of years where it yielded less.