The Closer — Living Large, Slipping Small — 10/2/18

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, tonight we look at the extremely overbought level of large cap equities versus the extremely oversold level of small cap equities. The results for what typically follows similar extremes are surprising. We also take a look at auto sales numbers released by the industry today and recent Fed speakers’ tone with regards to policy.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Chart of the Day — Turkey Rebounds

Ford Truck Sales: Blame the Weather. Really!

Ford just released sales figures for September and the results weren’t particularly good. While analysts were already expecting sales to decline by 9%, the actual decline was even larger at -11%. Whenever you start to see double-digit declines, it’s not a particularly encouraging sign. As we do each month, our focus in this report is truck sales, and more specifically, F-series pickup trucks. Trucks are often purchased by small businesses and contractors, so they provide a good read on the health of the small business sector, and similar to the prevailing narrative, Ford’s numbers continue to suggest a solid US economy.

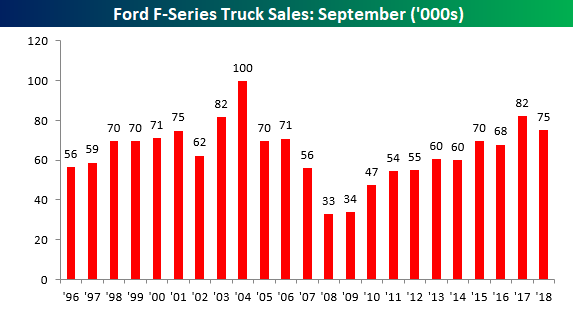

In this case, truck sales weren’t as bad for Ford as the headline figures. As shown in the chart below, F-series truck sales fell from 82.3K in 2017 down to 75.1K for a decline of nearly 9%. That’s still a relatively large decline, but keep in mind there are two caveats to this total. First, September 2018 (25) had one less selling day than September 2017 (26). The second factor to keep in mind is weather. Not only was this year’s September total negatively impacted by Hurricane Florence in the Carolinas, but September 2017’s total was artificially boosted by Hurricane Harvey, which hit the Houston area in August. You can see it in the chart below where 2017’s September total saw an enormous boost, while this year total sales declined.

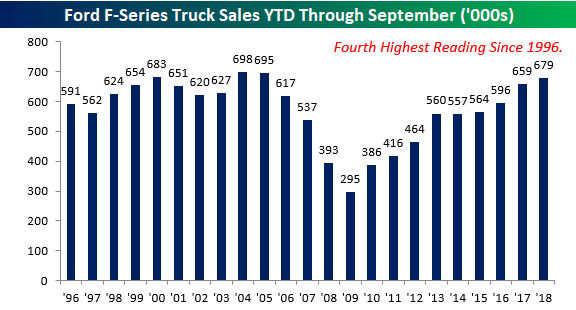

On a YTD basis, total sales look more in line with the trend of the last several years. On a YTD basis, sales increased by just over 3% from 658.6K up to 679.0K. At this rate, 2018 is on pace to be the strongest year for truck sales since 2005 and the fourth best year since 1996.

Bespoke Stock Scores — 10/2/18

B.I.G. Tips – September and YTD Decile Analysis

Trend Analyzer – 10/2/2018 – Small-Caps Get Oversold

As shown below in the snapshot of our Trend Analyzer tool, small-cap and mid-cap stocks have had a rough go of it lately. The Core S&P Small-Cap (IJR) and Micro-Cap (IWC) are both down the most of the major US index ETFs since last week at -2.17% and -2.18%, respectively. Along with the Russell 2000 (IWM), these ETFs have each moved well below their 50-day moving averages into oversold territory. This is the first time in a while that we have seen multiple ETFs oversold at the same time. Unfortunately—with the exception of the Dow (DIA) and Nasdaq (QQQ) who have continued to perform well recently—even the ones that have edged out gains are not necessarily saving graces.

Morning Lineup – Off the Lows

What was looking like quite a bad morning for US equities when our alarms went off a few hours ago is looking a lot more manageable now as futures have rallied off their lows.

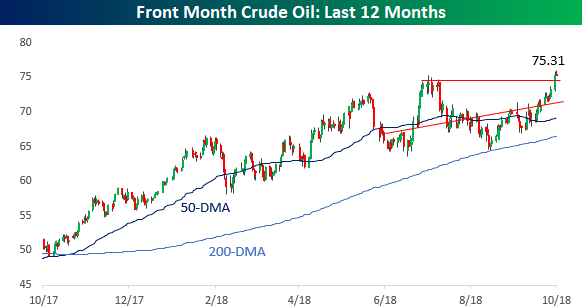

In yesterday’s session, the big star of the day was oil and the Energy sector in general. Driven by a 2.8% rally in crude oil prices, the S&P 500 Energy sector jumped 1.5%. Checking out the charts for oil and the Energy sector show some positive trends.

Crude oil prices are relatively quiet today, but yesterday’s rally took the front month future to a new 52-week high with a breakout above the summer highs.

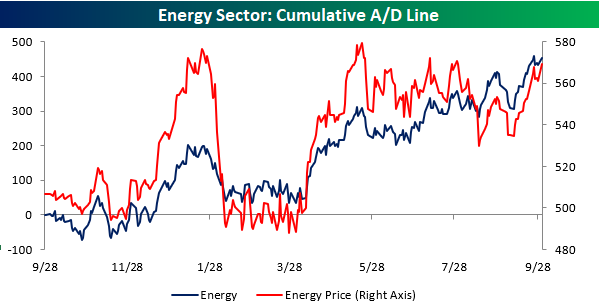

While not at a new high, the S&P 500 Energy sector looks to be on the right path after convincingly breaking its downtrend from the highs in the Spring. Also working in the sector’s favor is that along with the rally in crude oil, natural gas prices also rallied yesterday to their highest prices since January.

Internals for the Energy sector also look positive. The chart below compares the sector’s price and cumulative A/D line. While prices aren’t yet at new highs, breadth has been strong and consistently trending higher for the last several weeks.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer — Seasonal Tailwinds, Manufacturing Headwinds — 10/1/18

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we take a look at the very positive seasonality that historically dominates Q4. We also review manufacturing sentiment data from around the US and global economy and today’s residential construction release for the month of August.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

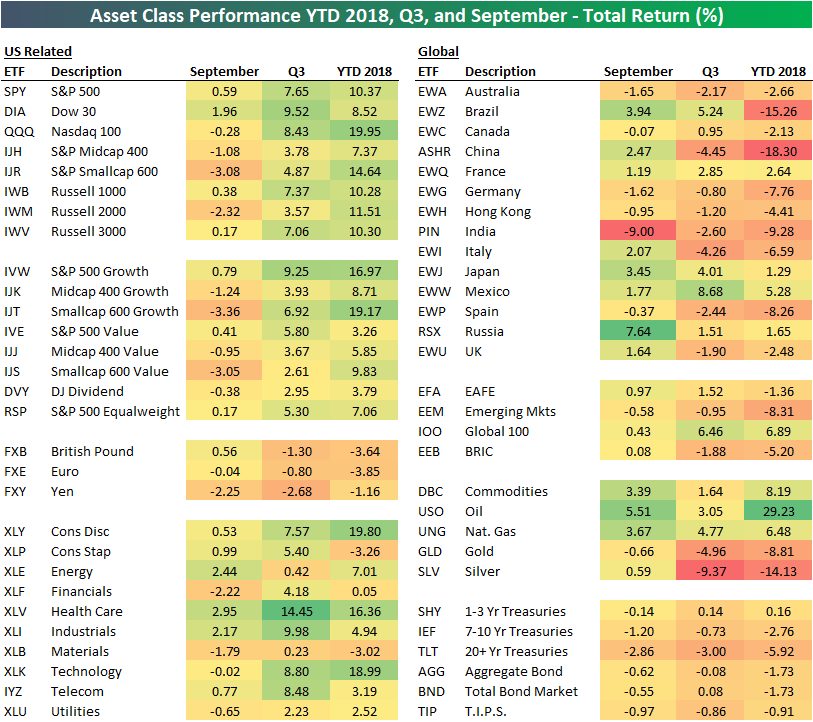

September, Q3, and YTD 2018 Asset Class Performance

Below is a snapshot of total returns for various asset classes through the first three quarters of 2018. In September, we saw gains for the S&P 500 and Dow 30, but we saw declines for the Nasdaq 100 and small-caps. The Technology sector was also down in September along with Financials, Materials, and Utilities.

Outside of the US, India (PIN) got slammed in September with a drop of 9%. Russia, on the other hand, saw a gain of 7.64% on the month as commodities rallied.

Fixed income ETFs were down across the board in September, and they’re down YTD as well on a total return basis.