B.I.G. Tips – Charting the Selloff

And You Thought January Was Bad

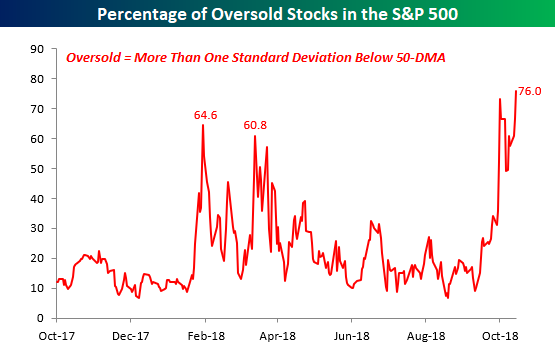

In our day to day research, we track hundreds of different market indicators related to breadth, technicals, fundamentals, sentiment, etc, but one of our favorite indicators to track is the percentage of overbought and oversold stocks in the S&P 500. Following yesterday’s face-plant, more than three-quarters of the stocks in the S&P 500 finished the day more than one standard deviation below their 50-DMAs, taking out the previous high of 73% from earlier this month. More importantly, though, the recent surge in the percentage of oversold stocks has now easily eclipsed the levels of ‘oversoldness’ we saw earlier this year. In fact, the last time we saw this high a percentage of oversold stocks in the S&P 500 was in January 2016. Simply put, these are levels you don’t see very often.

Morning Lineup – Up For a Change

Dow futures are indicating a positive open of over 200 points this morning, and while that sounds great at the service, it would only bring us back to levels we were at fifteen minutes before the close yesterday! To get back to levels we were at yesterday at 3 PM, we would need to rally an additional 200 points.

One welcome change this morning versus the last three weeks is that the S&P 500 is set to trade up versus its’ prior day’s close in early trading. As shown in the chart below, that hasn’t happened much over the last three weeks. As we highlighted in a B.I.G. Tips report last night, over the last three weeks, the S&P 500 has been down versus the prior day’s close over 70% of the time. That doesn’t happen very often!

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

B.I.G. Tips – Three Lousy Weeks

The Closer — Octoberus Horriblus, Housing Affordable, New Home Carnage, EIA — 10/24/18

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we illustrate how October has been one of the most frustrating stock market in history. We also note the US dollar starting to materially outperform equities, another bad sign for risk sentiment. We then move on to housing, with a four page look at housing affordability. Using a detailed analysis involving median incomes, both new and existing home prices, interest rates, and private mortgage insurance costs, we make the case that housing affordability is not facing a significant headwind from interest rate upticks, though there is less scope for appreciation than at other points in history when interest rates were lower or down payments a smaller share of income. We also take a look at the brutal new home sales data today and weekly EIA data on petroleum inventories.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

B.I.G. Tips – Blood in the Foyer

Chart of the Day: Triple Plays Starting To Roll In

Fixed Income Weekly – 10/24/18

Searching for ways to better understand the fixed income space or looking for actionable ideals in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

This week we look at how various GICS sectors of the high yield bond market have been looking.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

Bespoke’s Global Macro Dashboard — 10/24/18

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

Morning Lineup – Boeing Flies

For all the talk about yesterday’s rebound off the early lows, we think it’s important to keep some perspective that equities still finished the day in the red, marking the fifth straight down day for the S&P 500 and the 12th negative day in the last 14. Things are looking a little better today, though, as futures have rebounded off their overnight lows. Both the S&P 500 and Nasdaq are indicated modestly higher, while the Dow, being helped by a strong earnings report from Boeing (BA) is looking to open up half of one percent.

With respect to the rebound, the biggest gainers were the ones that fell the most from the September high until yesterday’s open. The chart below breaks the S&P 1500 into deciles based on the performance of individual stocks from the closing high on 9/20 through the open yesterday and then shows the average performance of the stocks in each decile from yesterday’s open to close.

Decile one is made up of the best performers heading into yesterday’s open, and they saw the smallest gains from the open to close yesterday (+0.08%). At the other end of the chart, the worst performers from the peak up until yesterday’s opening bell did the best yesterday, rising an average of 1.43%. In between, average performance numbers for each decile steadily improved as you moved from left (relative outperformers from 9/20 through yesterday) to right (relative underperformers).

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.