The Bespoke Report — Earnings Season Hits Stocks Hard

The Closer: End of Week Charts — 10/26/18

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. We also take a look at the trend in various developed market FX markets.

Below is a snapshot from today’s Closer highlighting positioning of speculators in interest rate futures. If you’d like to see more, start a free trial below.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by starting a two-week free trial to Bespoke Institutional now!

Morning Lineup – That Was Fast

It seems like longer ago now, but it was just on Monday that everyone was focused on the big 4% rally in China and how that could have marked the bottom indicating some stability for the global financial markets. As we noted at the time, big up moves typically occur in weak overall market environments, and sure enough, the next day, Chinese equities gave up more than half of Monday’s gain and global markets continued to sink

Yesterday, it was our turn to rally, but before the closing trades had even settled and before anyone even had the chance to ask if that move marked a low, Amazon (AMZN), Alphabet (GOOGL), and some other high profile tech stocks issued poor earnings reports sending the QQQs sharply lower. As things currently stand now, QQQ is set to open lower than Wednesday’s close, erasing all of Thursday’s gains! Just plain brutal.

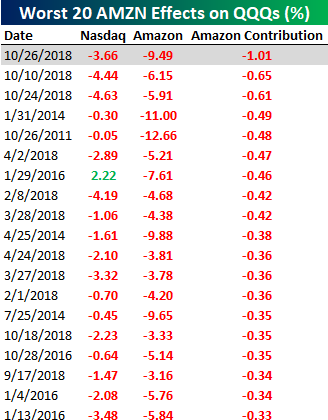

With AMZN trading down over 9%, it is set to have a massive negative impact on the Nasdaq 100 this morning. Of the QQQ’s indicated decline of 3.66% at the open, 28% of the entire drop is due to AMZN. As shown in the table below, never in the stock’s history has it had such a large one-day negative impact on the performance of the Nasdaq 100. When you add in the fact that Alphabet (GOOGL) is trading down over 5%, these two stocks are accounting for about 40% of the Nasdaq 100’s entire decline today.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

Trend Analyzer – 10/26/18 – Small and Mid Caps Continue to Lag

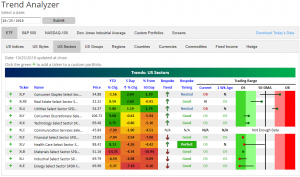

Even after huge rallies of nearly 2% for SPY and DIA yesterday and a gain of 3.5% for QQQ, every US index ETF that we track in our Trend Analyzer remains oversold. Given where futures are trading ahead of today’s open, things are set to get a lot more oversold at 9:30 AM ET.

While the overall picture has been less than optimistic, weakness in the major index ETFs focused on small to mid caps has been downright terrible. These ETFs have lagged behind the rest of the market considerably. At the current moment, each one of these names are down year-to-date and have entered into downtrends. With gains yesterday, some other ETFs such as the Core S&P Small-Cap (IJR) and the Russell (IWB) were able to move back to positive returns on the year, but with futures indicating a lower open today, this should not be expected to hold.

On a sector basis, Consumer Staples (XLP), Real Estate (XLRE), and Utilities (XLU) are the only ones to have thrived over the past week. XLP and XLRE are in oversold territory but are still down on the year. The Energy sector on the other hand (XLE) is down big this week at 7.19%. This month has not done any favors for the materials sector (XLB) either as it is now down big 14.35% YTD.

The Closer — Market Observations, Manufacturing, Trade — 10/25/18

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we look at some notable price action in Ford (F) and the Nasdaq 100 means for stocks going forward. We also review the pickup in earnings reactions, price action in the ten year yield, and the relative performance of Exploration & Production names versus WTI. We then take a look at economic data: durable goods, our Five Fed manufacturing activity index, and advance trade data from the US Census.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Bespoke’s Sector Snapshot — 10/25/18

the Bespoke 50 — 10/25/18

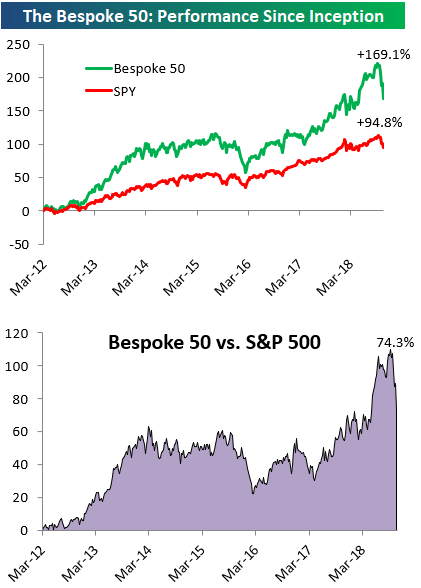

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” has beaten the S&P 500 by 74.3 percentage points. Through today, the “Bespoke 50” is up 169.1% since inception versus the S&P 500’s gain of 94.8%. Always remember, though, that past performance is no guarantee of future returns.

To view our “Bespoke 50” list of top growth stocks, click the button below and start a trial to either Bespoke Premium or Bespoke Institutional.

Future of Oil Is A Coinflip

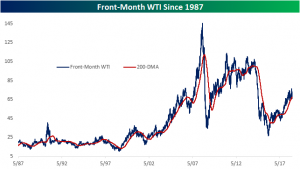

Earlier this week, oil prices did something they have only done a couple times in the past. After spending 262 consecutive trading days above the 200-DMA, oil closed below this average. Similar streaks of more than a year (254 trading days) above the 200-DMA has only happened two other times in the past 3 decades. The first occurrence was on April 10, 2000 ending a 272 day streak, and the second was back on September 2, 2008 when a 330 day streak came to a close.

As you can see in the chart below, it is basically a coin flip to see what will happen now. In 2000, oil managed positive returns over the course of the following year. But the opposite happened in 2008. The year following a move below the 200-DMA saw consistent declines. Of course, keep in mind that oil prices were nearly twice as high in the summer of 2008 and the economy and financial markets were melting down until Q2 2009 at the least, meaning a repeat of the 2008 declines looks pretty unlikely today. Only time will tell which scenario the current one will more closely resemble.

Chart of the Day: Intraday Averages Awful

Individual Investors Proceed to the Exits

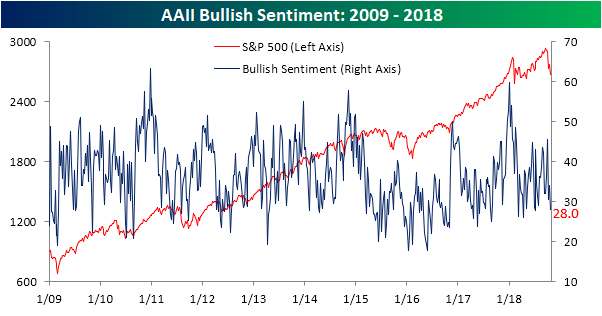

With US equities getting sucked into the global equity rout, individual investors are heading for the exits, although given the weakness, we’re a bit surprised it hasn’t been more of a rush. According to the weekly sentiment survey from AAII, bullish sentiment saw another decline this week falling from just under 34% to 27.97%. That’s low enough to rank as the fourth weakest reading in bullish sentiment this year. This week’s survey results also probably don’t fully take into account the weakness equities saw on Wednesday either, so barring a big v-recovery in the next several days, we could even see a weaker reading next week.

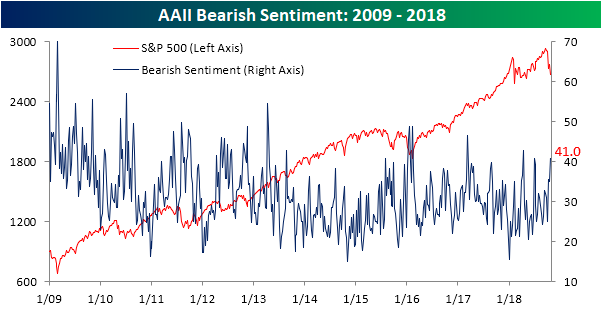

On the bearish side of the ledger, negative sentiment rose by a similar amount that bullish sentiment declined, jumping from 35.0% up to 41.0%. That’s the highest reading since the last week of June, right before the July 4th rally, and the third highest reading in bearish sentiment of the year.