B.I.G. Tips – November 2018 Seasonality

Fixed Income Weekly – 10/31/18

Searching for ways to better understand the fixed income space or looking for actionable ideals in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

This week we review the longest drawdown in the bond market in over three decades.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

Back to Back Gains: Finally!

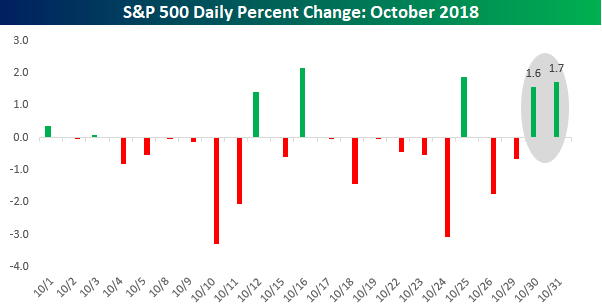

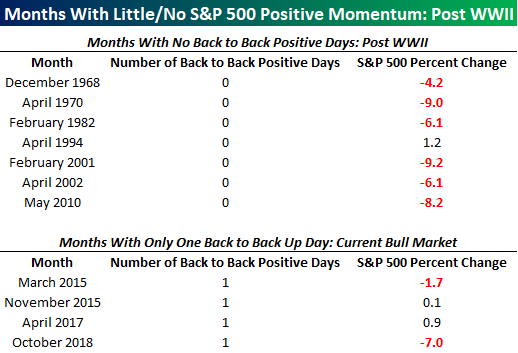

The market gods are taking it right down to the wire, but the S&P 500 looks like it’s finally going to have back to back positive days! Heading into Tuesday, the S&P 500 had only seen five up days during the entire month, and none of those daily gains came back to back with each other. Yesterday and today have been a different story, though, as the S&P 500 is not only on pace for back to back gains, but also back to back gains of more than 1.5%! The last time that happened was back in June 2016 just after the Brexit vote.

Even with back to back gains Tuesday and Wednesday, this month’s showing will still be weak, to say the least. Since the lows of the Financial Crisis in March 2009, October will go down as only the fifth month where the S&P 500 had only one or no instances of back to back gains in a given month. The last occurrence was a year and a half ago in April 2017, and surprisingly enough, the S&P 500 was actually up during that month! The other three instances were in March and November 2015, when there was just one instance of back to back daily gains, as well as May 2010 when the S&P 500 had no instances of back to back gains. May 2010 was also similar to this October because we saw the largest sell program this month since the Flash Crash back on 5/6/10. Finally, along with May 2010, there have only been six other months in the post-WWII period where an entire month passed without a single instance of back to back gains. Thankfully, it’s almost over!

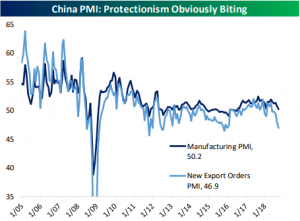

Tariffs Take Their Toll On China PMI

China released PMI data overnight, and the results seem to point towards further impacts from the trade US-China trade spat. The releases had been forecast to show declines, and the actual levels not only did that, but they also dropped more than expected. The manufacturing PMI is now sitting at 50.2—the lowest level since July. Services saw a steeper decline falling to 53.9 from 54.9, which is the lowest since August 2017. The biggest factor dragging down these numbers is new export orders. As protectionist tariffs have settled into place—this month was the first full month with the most recent round of tariffs in effect—export orders have declined. As it stands now, since 2005 there were only a few times that new export orders have been this weak: 7/08, 10/08-2/09, 12/11-1/12, 7/12-8/12, and 11/15. It will be interesting to see if this is reflected in hard data going forward given the large and growing US trade deficit with China.

Bespoke Consumer Pulse Report — October 2018

Bespoke’s Consumer Pulse Report is an analysis of a huge consumer survey that we run each month. Our goal with this survey is to track trends across the economic and financial landscape in the US. Using the results from our proprietary monthly survey, we dissect and analyze all of the data and publish the Consumer Pulse Report, which we sell access to on a subscription basis. Sign up for a 30-day free trial to our Bespoke Consumer Pulse subscription service. With a trial, you’ll get coverage of consumer electronics, social media, streaming media, retail, autos, and much more. The report also has numerous proprietary US economic data points that are extremely timely and useful for investors.

We’ve just released our most recent monthly report to Pulse subscribers, and it’s definitely worth the read if you’re curious about the health of the consumer in year two of Trump’s economy. Start a 30-day free trial for a full breakdown of all of our proprietary Pulse economic indicators.

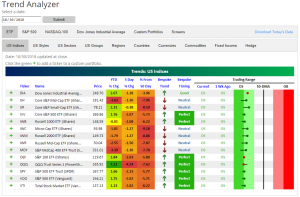

Trend Analyzer – 10/31/18 – Ways to Go

As shown in our Trend Analyzer snapshot below, even after 1%+ gains across the board yesterday, every major US index ETF that we track remains oversold (more than one standard deviation below its 50-DMA). Small-caps are the furthest below their 50-DMAs, while the Dow 30 ETF (DIA) is the closest to its 50-day at -3.96%. You can check up on sector and group ETFs along with individual US stocks at our Trend Analyzer page.

Morning Lineup – First Back to Back Gains of the Month?

A number of positive reactions to earnings reports are driving the market higher to close out the month as shares of Facebook (FB) are trading up 5% and General Motors (GM) is up 8%. Strength in foreign markets on the heels of dovish comments from the BoJ and Chinese officials is also contributing to the positive tone in futures as bulls try and salvage something from what had been a horrible month for US and global equities.

Even though it looks to be ending on a positive note, bulls will no doubt be happy to see this October come to an end. While the monthly performance numbers will look a bit more respectable with the gains we are likely to see in the final two trading days, as of Monday’s close, the 20-day rate of change in the S&P 500 was one of the weaker readings we had seen during this bull market. In fact, it was the weakest reading we had since August 2015. As it always does (eventually), the market recovered from that decline in August 2015, but it was one of the shakier six-month periods that equities have seen during the current bull market. It wasn’t until February of 2016 that stocks finally made a low and began their epic run.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer — Real Rates, Industrials, Housing — 10/30/18

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we look at whether industrials outperformance has been helpful in identifying broader market bottoms. We also note still-high real rates despite the broader fixed income rally in recent weeks. Finally, we dive into housing data released today including Case-Shiller Home Price indices for August and Q3 data on household formation and vacancy rates.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Chart of the Day: Pulse Underperforms

25% Off At Amazon.com

It’s hard to believe but less than two months ago, Amazon.com (AMZN) was trading over $2,000 a share and briefly enjoyed a market cap of over $1,000,000,000,000.00. That’s right — a trillion dollars! Those days seem long gone now, though, as today AMZN is trading under $1,500 and down more than 25% from its recent highs. He may still be the richest person in the world, but Jeff Bezos now also owns the record for losing more wealth in the course of two days ($19.2 billion) than any other person.

While pretty uncommon in recent years, 25% drawdowns in the stock of AMZN have been relatively frequent. The last drawdown from a record closing high was back in February 2016 when AMZN was briefly down 30% from its previous high, and going back to the lows of the Financial Crisis in 2009, there have been a total of five prior drawdowns of more than 25% (red line). Also, while it is a little bit of a misleading statistic, AMZN has actually spent nearly half of its existence as a public company down at least 25% from its prior all-time closing high. The seven year stretch from 2000 to 2007 accounts for a big chunk of that percentage, but it does serve as a reminder that stocks don’t always trade right near all-time highs.