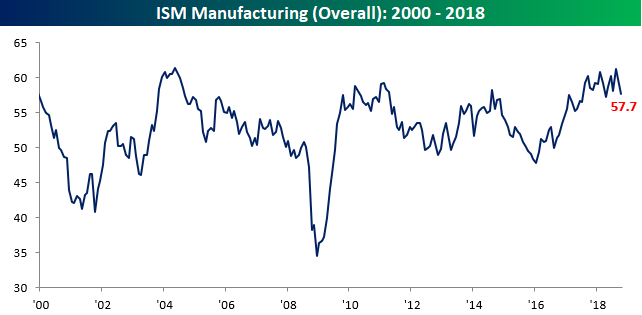

As Expected, Manufacturing Activity Slows

It was pretty widely expected that the ISM Manufacturing report for the month of October was going to show a slower rate of growth, and that’s exactly what we saw. While economists were forecasting the headline index to drop to 59.0 from last month’s reading of 59.8, the actual reading was much weaker at 57.7. That is the lowest reading for the headline index since April, and it was tied for the largest m/m decline since August 2016. Despite the decline and weaker than expected reading, the manufacturing sector is still expanding, but the rate of growth has slowed.

The table below breaks down this month’s report by each of the report’s subcomponents and shows their m/m and y/y changes. On a m/m and y/y basis, most components were down, but the disparity wasn’t all that wide. The only component that is in contraction mode is Customer Inventories, but it has been in the sub-50 range for quite some time now.

Heading into Friday’s Non-Farm Payrolls report, we wanted to highlight the employment component of this month’s ISM report. As shown above and in the chart below, October saw a two-point decline in the index putting in what is the second lower high since the peak last October. Again, the level of 56.8 still implies growth in employment for the manufacturing sector, just at a slower pace than last month and last year.

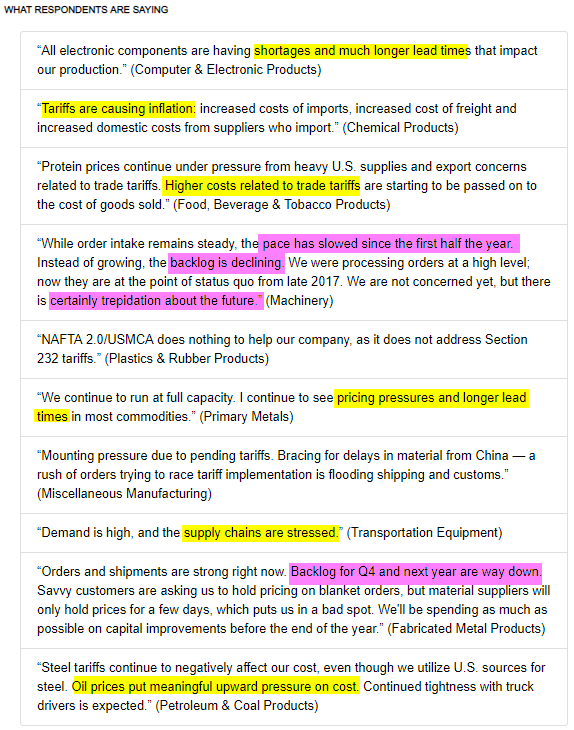

Finally, with respect to the commentary section of this month’s report, we wanted to highlight two trends that stand out: inflation and slower activity. The yellow highlights below indicate comments related to higher costs or upward pricing pressures (there’s a lot of them!), while the purple highlights commentary from the Machinery and Fabricated Metals sectors indicating a potential slowdown in the pace of business activity.

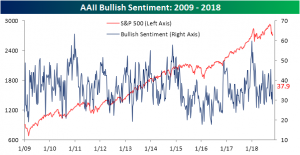

Individual Investors Reverse

Last week on the backs of negative price action, bullish sentiment fell sharply to the fourth lowest reading this year. According to the weekly survey from AAII, there has been quite the turn around this week as bullish sentiment jumped from just under 28% all the way up to 37.9%. This is actually just above the average of the year and an impressive improvement in a short span of time. If the rally from the last two days of October continues throughout the week, we should expect to see bullish sentiment increase once again next week.

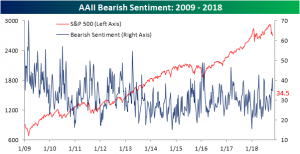

Conversely, the bearish camp shrunk this week to 34.5%. While this is lower than last week, it is still at fairly elevated levels compared to most of the year and is about in line with readings from early October.

Neutral sentiment fell to its lowest since February 1st of this year. Investors seem to be increasingly taking sides with most leaving the bearish camp for the bulls.

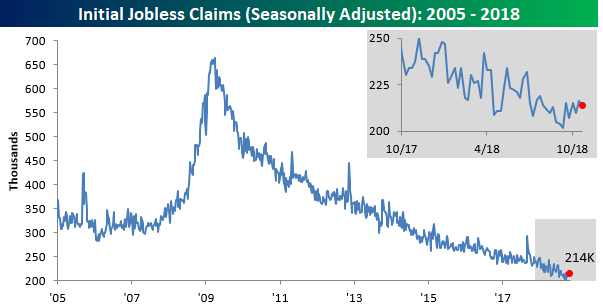

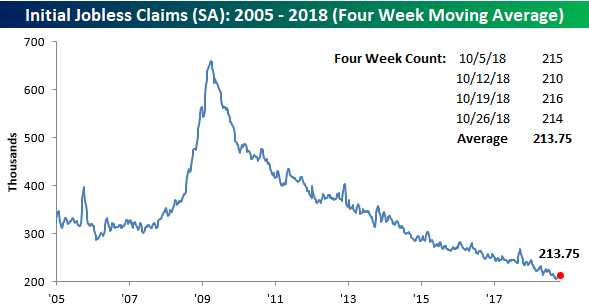

Jobless Claims Edge Slightly Lower

Jobless claims saw only a slight decline last week falling from 216K down to 214K, which was just a tad above consensus expectations for a decline to 212K. While claims have increased 12K from their low print in mid-September, they have now been at or below 300K for a record 191 straight weeks, at or below 250K for 56 straight weeks, and at or below 225K for 17 straight weeks. They may have stopped falling, but they are still extremely low.

The four-week moving average also edged higher this week, rising from 212K up to 213.75K. That’s 6.75K above the cycle low of 206K from mid-September, and given recent trends, we wouldn’t expect this indicator to make a new low anytime soon.

On a non-seasonally adjusted (NSA) basis, jobless claims dropped to 197.5K. For the current week of the year, this is the lowest weekly reading since 1969. It is also close to 125K below the average for the current week of the year dating back to 2000.

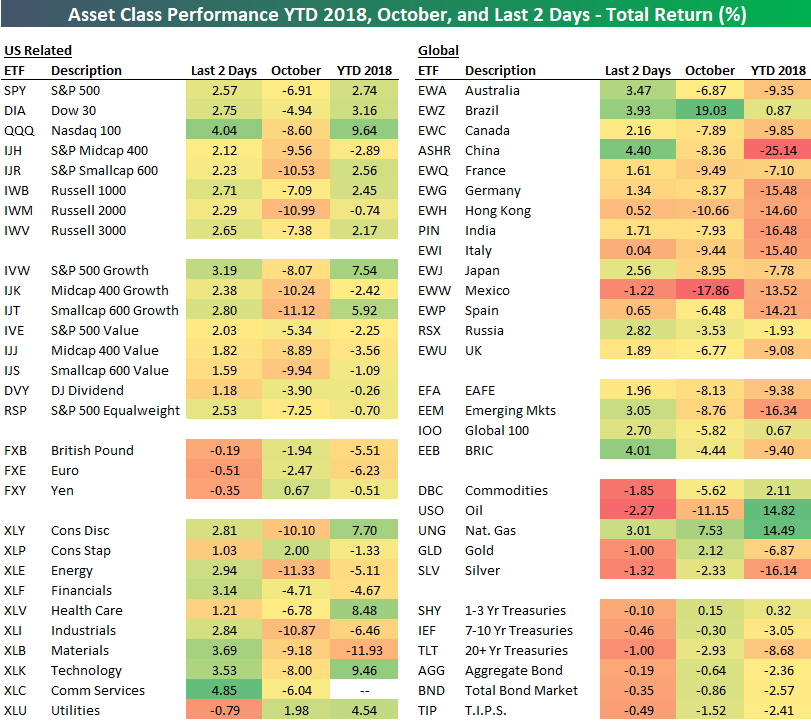

October 2018 Asset Class Performance Snapshot

Below is our asset class performance matrix highlighting the total return of various ETFs across asset classes during the month of October. We also include YTD total return as well as the percentage change over the final two trading days of October.

While the last two days of October were extremely strong for equities, major US index ETFs still finished October down 5-10% across the board. The most pain was felt in smallcaps which still fell 10%+ on the month even after 2% gains over the last two days. Looking at sectors, Consumer Discretionary, Industrials, and Energy were all down 10%+ in October, while Utilities and Consumer Staples actually finished up 2%.

Outside of the US, Brazil was the big winner with an October gain of 19.03%, while Mexico was the big loser with a decline of 17.86%. While China was down 8% on the month, it saw a massive gain of 4.4% over the month’s final two trading days.

Commodities overall were down in October, but both natural gas and gold were up on the month. Fixed income ETFs were down in October as well.

Morning Lineup – Fresh Start

Not in many years have bulls been this happy to put a month behind them as the declines of October are relegated to the history books. November is looking to start off on a positive note, but we still have about an hour until the opening bell for the month even rings. On the economic front, its a busy day with Initial Claims, Unit Labor Costs, Non Farm Productivity, ISM Manufacturing, and Car Sales all due to be released throughout the day. Then, after the close Apple (AAPL) will headline the earnings parade. And that’s just today. Don’t forget about tomorrow’s jobs report either!

We’re never ones to turn our noses to a one-day gain of 1% in the S&P 500, but we would be lying if we didn’t say that the way the market finished up in the last hour of yesterday’s session to close out the month wasn’t a bit disheartening. After trading up as much as 2% heading into the final hour of trading yesterday, the S&P 500 moved steadily lower to close out the month and gave up just about half of its intraday gains. Just one of many examples we’ve seen recently of investors selling into the close.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

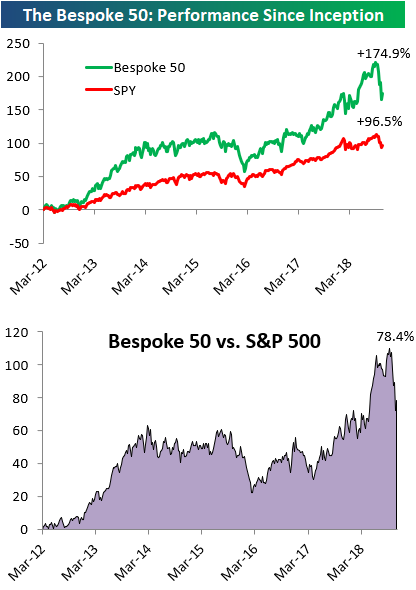

the Bespoke 50 — 11/1/18

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” has beaten the S&P 500 by 78.4 percentage points. Through today, the “Bespoke 50” is up 174.9% since inception versus the S&P 500’s gain of 96.5%. Always remember, though, that past performance is no guarantee of future returns.

To view our “Bespoke 50” list of top growth stocks, click the button below and start a trial to either Bespoke Premium or Bespoke Institutional.

The Closer — Cuts Priced, RSI Divergence, Wages Up, Crude Outlook Brightens — 10/31/18

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we identify a broad positive technical signal across global equity markets. We also discuss still-rising earnings estimates in the US and Europe, priced rate cuts in the US in the two years starting a year from today, weekly EIA petroleum inventory data, and the employment cost index release today that showed further acceleration in US wage growth.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Chart of the Day: What’s Next?

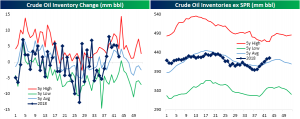

Crude Inventories: Up, But Inline

The EIA updated their weekly data for petroleum products this morning. Crude inventories rose to 426 million barrels this week, up 1.68 million from last week. While far from the highs of the past five years, this is only slightly above the five-year average for inventory levels. These numbers are in line with seasonal trends; oil inventories typically rise as refineries re-tool for winter product blends.

Strong demand from abroad paired with higher production has brought crude exports to their second-lowest deficit in the past five years. The smallest deficit actually came from earlier this month (10/5). Throughout this year, the deficit in crude exports has maintained a very low level relative to the last couple of decades.

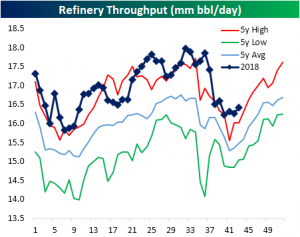

As shoulder season comes to a close, refinery demand has started moving back to more normal levels. Refinery throughput has been at elevated levels for most of the year, and is still high relative to the past five years, but is much closer to the average than where it has been.