Best and Worst Performing S&P 500 Stocks on Earnings

Below is a list of the best performing S&P 500 stocks on their earnings reaction days so far this season. Under Armour (UAA) ranks at the very top of the list with a huge one-day gain of 27.71% after it reported a triple play on October 30th. (A triple play is a company that beats EPS estimates, beats revenue estimates, and raises guidance.)

Vulcan Materials (VMC) ranks second with a gain of 17.49%, followed by Akamai Tech (AKAM), Newfield Exploration (NFX), and Twitter (TWTR). Other notables on the list of big winners this earnings season include International Paper (IP), Ford (F), PayPal (PYPL), Church & Dwight (CHD), Starbucks (SBUX), General Motors (GM), Procter & Gamble (PG), DowDuPont (DWDP), and Whirlpool (WHR). These certainly aren’t your typical high-fliers!

On the downside, Mohawk (MHK) has been the worst performer this earnings season with a one-day decline of 23.86% after it reported a reverse triple play on October 25th. The stock missed EPS estimates, missed revenue estimates, and lowered guidance.

Align Tech (ALGN) ranks second worst with a one-day decline of 20.2%, followed by Western Digital (WDC), Advanced Micro (AMD), and United Rentals (URI). Other notables on the list of losers include Equifax (EFX), Fortinet (not to be confused with the video game Fortnite!), Fortune Brands (FBHS), Kraft Heinz (KHC), Kellogg (K), General Electric (GE), AT&T (T), and Amazon (AMZN).

For more in-depth earnings season analysis, start a two-week free trial to Bespoke Premium today!

The Jekyll and Hyde Earnings Season

In the early part of the current earnings reporting period that began back on October 12th, stocks couldn’t sniff a bid on their earnings reaction days. Since Monday, however, investors have been busy buying up stocks after they report.

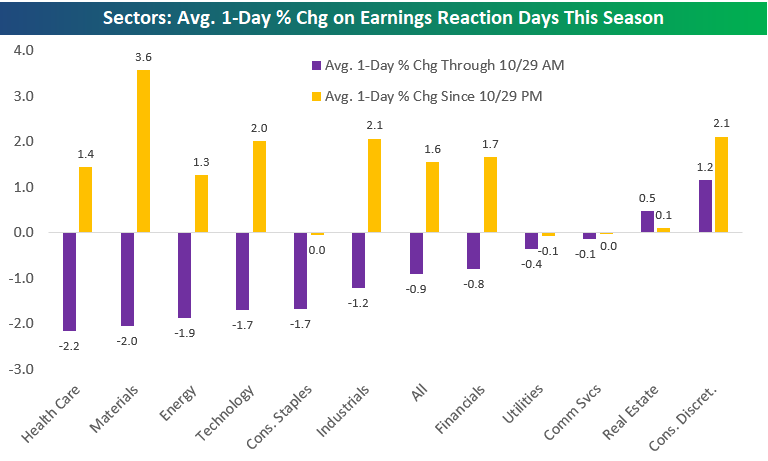

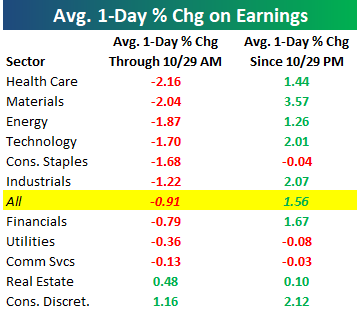

Below we show how stocks within sectors performed on their earnings reaction days from the start of earnings season through the morning of October 29th. We also show how stocks have performed on their earnings reaction days since the close on the 29th. As shown, for all stocks that have reported, the average stock fell 0.91% on its earnings reaction day through October 29th. Since then, the average stock that has reported has gained 1.56% on its earnings reaction day. That’s a huge shift in sentiment around earnings reports. Investors have flipped from selling the news to buying the news.

There have been some interesting trends within sectors as well. Health Care, Materials, Energy, Technology, Consumer Staples, and Industrials stocks that reported got hit the hardest prior to the 29th. Since then, the cyclical sectors of this group (all of them except for Consumer Staples) have seen stocks fly higher by 1.3% or more on their earnings reaction days, while Consumer Staples stocks that have reported since the 29th have actually declined. Utilities and Communication Services stocks have averaged very small declines on their earnings reaction days over both time frames. Finally, Consumer Discretionary stocks have been a positive outlier throughout earnings season. Discretionary stocks that reported prior to the 29th bucked the trend and averaged gains on their earnings reaction days. And since the 29th, they’ve continued to see gains, averaging a one-day change of +2.1%.

Morning Lineup – Back to Back to Back (to Back?)

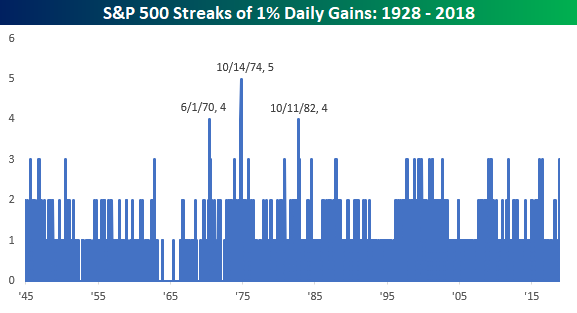

US equity futures are surging this morning despite Apple’s (AAPL) disappointing earnings report last night. Today’s catalyst is a report that President Trump has asked his cabinet to draft a potential trade deal with China. Optimists are hoping that this will help to ease ongoing trade tensions between the two countries, while skeptics see the timing of the recent reports coming out of the White House as an attempt to goose the market ahead of next week’s midterms. If the S&P 500 can hold on to and build a little bit on its early gains today, it has the potential to post back to back to back to back one-day gains of 1% or more. The last time that happened was the last time the song “Africa” was popular – 1982!

Let’s not get ahead of ourselves, though, Non-Farm Payrolls was just released with the headline number coming in at 250K versus estimates for an increase of 200K.

With the S&P 500 already up 1% or more for three straight days, the chart below shows prior streaks of daily gains of more than 1% in the post-WWII period. While there have been about 30 prior streaks of three days, only three of those went on to four trading days.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer — Stocks Up, Dollar Down, Productivity Perks Up, Earnings Delights — 11/1/18

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we review the rapid bounce US equities have enjoyed over the last couple of days and the sharp decline in the US dollar today. We also review productivity and costs data released by the BLS today, BEA GDP by industry, and finally take a look at how discriminating investors have been about earnings results across EPS, revenues, and guidance.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Chart of the Day: CIEN

Bespoke’s Sector Snapshot — 11/1/18

B.I.G. Tips – October 2018 Decile Analysis

B.I.G. Tips – Less Than a Week Until Midterms

October Employment Report Preview

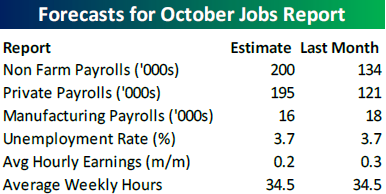

Heading into Friday’s Non Farm Payrolls (NFP) report for October, economists are expecting an increase in payrolls of 200K, which would be a big increase from September’s report which came in significantly below expectations at 134K. In the private sector, economists are expecting an increase of 195K, which would imply a similar improvement versus September as the headline reading. The unemployment rate is expected to remain at 3.7%. Average hourly earnings are expected to grow at a rate of 0.2% versus the 0.3% reading last month. Slower wage growth would certainly be welcomed by bulls worried over potential inflation pressures. Finally, average weekly hours are expected to be unchanged at 34.5.

Ahead of the report, we just published our eleven-page preview of the October jobs report. This report contains a ton of analysis related to how the equity market has historically reacted to the monthly jobs report, as well as how secondary employment-related indicators we track looked in October. We also include a breakdown of how the initial reading for October typically comes in relative to expectations and how that ranks versus other months.

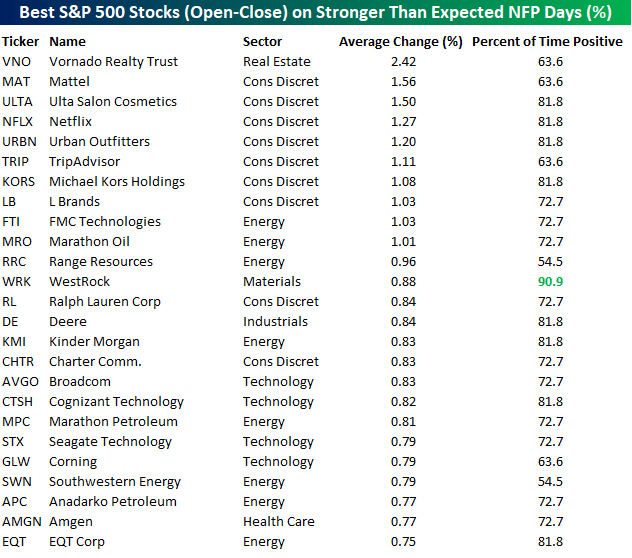

One topic we cover in each month’s report is the S&P 500 stocks that do best and worst from the open to close on the day of the employment report based on whether or not the report comes in stronger or weaker than expected. In other words, which stocks should you buy, and which should you avoid? The table below highlights the best-performing stocks in the S&P 500 from the open to close on days when the Non-Farm Payrolls report has been better than expected over the last two years.

Of the top performing stocks on days when NFP beats expectations, seven sectors are represented, but Consumer Discretionary leads the way with nine. Vornado (VNO) has been the best performing stock with an average open to close gain of 2.42%, but it is followed by seven stocks in the Consumer Discretionary sector which have all gained 1%+ from the open to close. Westrock (WRK) has been the most consistent stock to the upside with open-close gains 91% of the time.

For anyone with more than a passing interest in how equities are impacted by economic data, this October employment report preview is a must-read. To see the report, sign up for a monthly Bespoke Premium membership now!

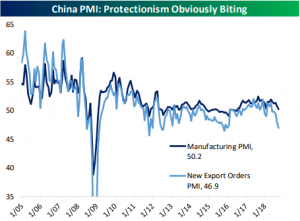

Chinese Activity Drags Down EM Asia Per Markit PMIs

Overnight, Markit released October manufacturing PMI data for a big swath of the global economy. One notable area of weakness was EM Asia. While China’s Markit manufacturing PMI was up sequentially from 50.0 to 50.1, an average of seven other EM Asia economies (South Korea, Taiwan, Malaysia, Myanmar, Thailand, Indonesia, and Vietnam) made new cycle lows. PMI readings above 50 indicate expansion, while readings below that level indicate contraction. The average for the seven economies is now right at 50, the joint-lowest since December 2016. We also note that China’s PMI tends to lead these economies’ somewhat, which leaves hope that the average won’t slip into contraction. On the other hand, four of the seven (Taiwan, Malaysia, Myanmar, and Thailand) are in contraction already; the only other international manufacturing sector in that category of contraction for October was Turkey.