Services Sector Remains Strong

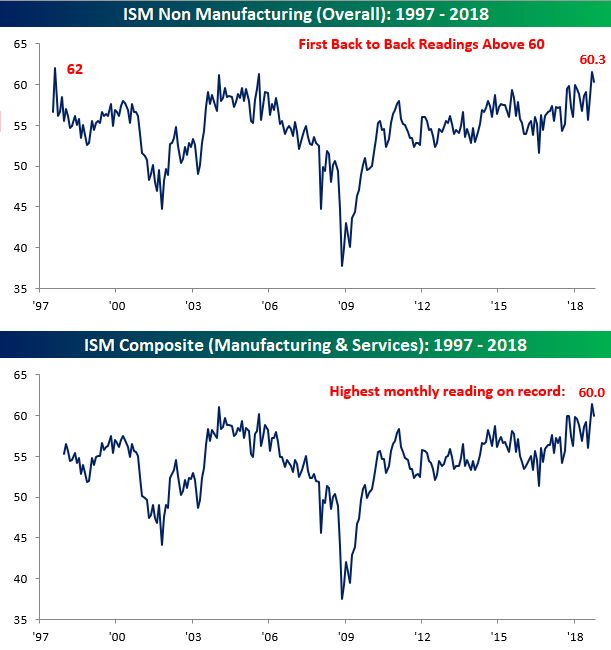

The ISM Services report for the month of October declined less than expected, falling from 61.6 down to 60.3 compared to expectations for a reading of 59.0. Even though the pace of growth declined, though, it was the first time in the history of the report dating back to 1997 that the headline index posted back to back readings above 60. With both the manufacturing and services data now in, accounting for each sector’s weight in the overall economy, the October Composite ISM fell from 61.4 down to a still very high reading of 60.0. Since composite data for the index begins in the late 1990s, there have only been four readings of 60 or above, and two of them came in the last two months!

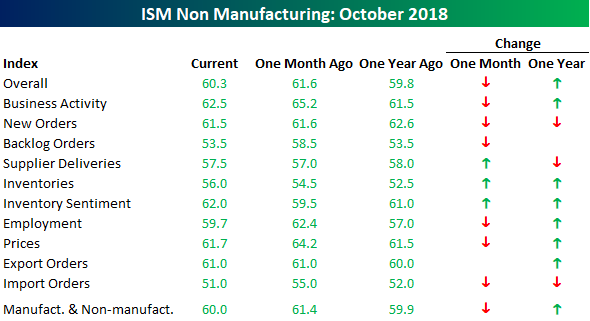

The table below breaks down this month’s report by each of its sub-components and shows how they stand relative to September and last October. On a m/m basis, breadth in this month’s report was weak with just three categories showing m/m increases, while Backlog Orders and Import Orders saw the largest declines. On a y/y basis, things look considerably better as the only components down were New Orders, Import Orders, and Supplier Deliveries.

This Week’s Economic Indicators – 11/5/18

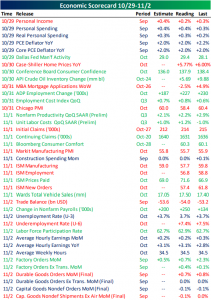

Last week was extremely busy in terms of economic data. ISM and PMIs data all pointed towards slowing in the manufacturing sector. The week was capped off with the most watched release of the week: the Nonfarm Payrolls Report. Payrolls increased by 50,000 more than expected alongside rising wages in October. Other employment data from ADP, Jobless Claims, and ECI echoed the positive NFP results. This continuously strong labor data is not a great sign for the market seeing as the Fed will now be more likely to maintain their hawkish tone.

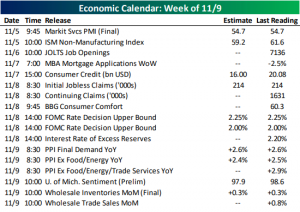

Coming up this week is a far quieter slate with only 19 releases versus last week’s 39. This morning, Markit Services PMI and ISM’s Non-Manufacturing Index were released. Tuesday, we will get further labor market data with the release of JOLTS. Following that, all eyes will be on the Fed. As we previously mentioned, all of the recent employment data is set to have a big impact on Fed policy. On Thursday, the FOMC will hold their seventh rate decision meeting of the year. While no change is expected for this decision, investors will still be fixated on the Fed’s tone. Finally, on Friday the week will finish off with producer inflation data.

You can always check our Economic Monitor to keep up with the day’s releases.

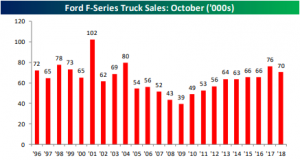

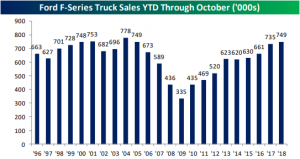

Ford Truck Sales Slowing

Many economic data points have been tapping the brakes recently indicating slower economic activity. One data point that we like to look at is Ford truck sales. Trucks are typically purchased by small businesses and contractors, so they provide a good read on the health of the small business sector. Based on these sales totals for October, small businesses took a little bit of a step back. Last month, sales of Ford F-series trucks totaled 70,438, which was down over 7% from last October’s total of 75,974. Although one caveat to this decline is that in 2017 sales totals were boosted by repurchases of vehicles flooded in the hurricanes making for a tough y/y comparison. Outside of 2017, this October’s sales were the highest since 2004 which also lends some credence to that argument even if this year did have an extra day of selling compared to last October (26 vs. 25).

On a YTD basis, sales of F-Series trucks have totaled 749.5K, which is still up slightly from last year’s pace and is the strongest YTD reading through the first ten months of the year since 2004.

Beat Rates Hold Steady with Bottom-Line Much Higher Than Top-Line

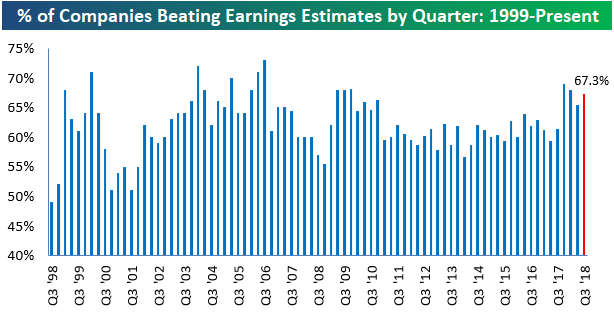

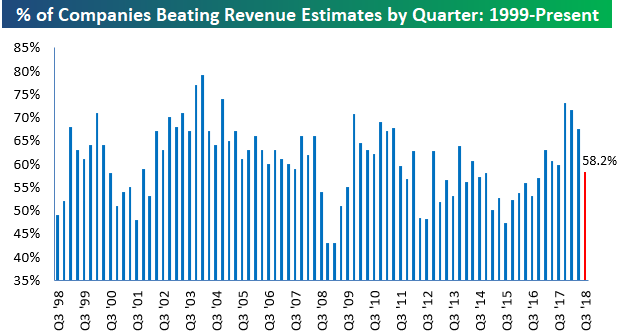

More than 1,350 companies have now reported their Q3 2018 earnings results, and below is an updated snapshot of the percentage that have posted better than expected bottom and top-line numbers.

The bottom-line earnings beat rate currently stands at a very strong 67.3%. As shown in the first chart below, this reading is comparable to readings seen over the prior three earnings seasons. It’s stronger than the reading seen last quarter but slightly weaker than the readings seen in Q4 2017 and Q1 2018.

For more in-depth earnings season analysis, start a two-week free trial to Bespoke Premium today!

While bottom-line beat rates remain healthy, the top-line revenue beat rate is down considerably relative to recent quarters. As it stands now, 58.2% of companies that have reported have beaten top-line consensus revenue estimates. This is sharply lower from the readings seen over the prior three quarters, and it’s one of the reasons investors are on edge this earnings season.

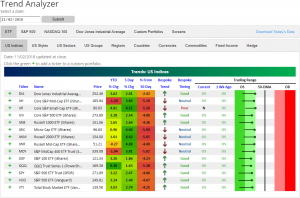

Trend Analyzer – 11/5/18 – Still Oversold!

There were large price movements in both directions last week, but overall, major US index ETFs traded up quite significantly. Even after last week’s gains, though, every ETF shown in our Trend Analyzer snapshot below is well below its 50-day moving average and trading slightly in oversold territory. Things are pointed in the right direction, however, as is evidenced by the long tails in the trading range section of the snapshot. For each ETF, the dot represents where it’s currently trading within its normal range, while the tail end represents where it was trading one week ago. At the start of last week, index ETFs were deeply oversold, but they’ve moved higher and momentum has them pointed in the right direction at least. We’ll see what this week brings!

Morning Lineup – Muted Start to Busy Week

After a wild week to close out October and kick-off November, US equity futures are trading pretty much flat to kick off the week. Even more surprising about the lack of movement in either direction is that overnight we heard a major speech from Chinese President Xi at the China International Import Expo in Shanghai, tomorrow is Election Day, and the Fed meets later this week!

Last week’s rally for equities in the middle of the week sure helped bulls to breathe a sigh of relief, but the market still has some more work to do before bulls can rest easy. As shown in the chart below, the S&P 500’s rally ran out of steam on Friday just shy of the 200-DMA, which is now trending lower for the first time since early 2016. Until the market can break its string of lower lows and lower highs or trade back above its key moving averages, caution is still warranted.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

Bespoke Brunch Reads: 11/4/18

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, try a two-week free trial to Bespoke’s premium stock market research!

Investing

The day Volkswagen briefly conquered the world by Jamie Powell (FTAV)

A long but incredible read re-capping the mother of all short squeezes: during the middle of the financial crisis, Volkswagen briefly became the most valuable company in the world as shares quintupled in a few days. [Link; registration required]

Morgan Stanley breaks with rest of Street, thinks October sell-off is ‘morphing’ into a bear market by Thomas Franck (CNBC)

An out-of-consensus call from MS blames the Fed’s liquidity drain and over-optimistic earnings assumptions for declines that will persist in the bank’s equity strategy view. [Link]

National Security

The CIA’s communications suffered a catastrophic compromise. It started in Iran. by Zach Dorfman and Jenna McLaughlin (Yahoo!)

A deep read on the massive intelligence failure which lead to scores of deaths for CIA assets in Iran and China (as well as other countries) when foreign intelligence services literally used Google searches to break into the previously secure communications system used to communicate with operatives on the ground. [Link]

Consumers & Advertising

On Hold for 45 Minutes? It Might Be Your Secret Customer Score by Khadeeja Safdar (WSJ)

Unbeknownst to many consumers, companies track their value in terms of spending over time and use it to inform who gets which perks, deals, or customer care. [Link; paywall]

By the numbers: The rise of “belief-driven” buyers by Marisa Fernandez (Axios)

Fully two-thirds of people worldwide say a company’s stance on societal issues impacts whether they do business with company, a significant leap versus a year ago per new Edelman data. [Link]

We posed as 100 Senators to run ads on Facebook. Facebook approved all of them by William Turton (Vice)

Advertisers can easily pose as others on Facebook’s ad system, potentially allowing deception by creating ads that contain false information attributed to other campaigns. [Link]

Real Estate

The problem with housing is prices have recovered but demand hasn’t: Real estate mogul Sam Zell by Tyler Clifford (CNBC)

Zell thinks housing is facing a breakdown of traditional housing market structure which has disconnected prices and demand. [Link]

As the housing market stagnates, American homeowners are staying put for the longest stretches ever by Andrea Riquier (MarketWatch)

The average length of time that a house has been occupied before being solid has doubled over the past 10 years, reflecting lower mobility and less flow of transactions as well as lower new home sales. [Link]

Weird News

‘Better Call Saul’ Actor Cut Off His Own Arm So He Could Pass As A Wounded Vet And Land Roles by James Clark (Task & Purpose)

An actor who claimed he lost his arm during military services admitted that he amputated his own arm in order to pass himself off as a wounded veteran. [Link]

Meet The Hydro-Haters: The People Who Refuse To Drink Water, No Matter What by Quinn Myers (Mel Magazine)

There are actually people out there who think that drinking water is so bad that they’ll risk an ER trip for dehydration instead of taking a sip of the substance which make up 50-60% of our bodies. [Link]

Regulation

Market Cheats Getting Caught in Record Numbers by Gabriel T. Rubin (WSJ)

Spoofers face a much higher risk of getting caught thanks to new data sharing provisions between the CME and SEC. In 2018 more than 25 cases were brought against spoofers, more than double the previous high. [Link; paywall]

Cancer-linked Chemicals Manufactured by 3M Are Turning Up in Drinking Water by Tiffany Kary and Christopher Cannon (Bloomberg)

A huge number of manufacturing facilities, military bases, and civilian airports are contaminated with a substance commonly found in Teflon and other products. Since the chemicals don’t break down naturally by design, they can build up over time and have been linked to cancer. [Link; soft paywall]

Despite criticism and concerns, FDA approves a new opioid 10 times more powerful than fentanyl by Ed Silverman (STAT News)

Despite ongoing concerns about the prevalence of opioid abuse, the FDA has approved a new drug that is drastically stronger than even fentanyl, a substance that’s already so dangerous that tiny exposure can kill those handling it. [Link]

Gasoline

Trump Car Standards Rollback Knocked for Faulty Analysis by Abby Smith (Bloomberg)

The EPA and NHTSA have proposed rolling back Obama-era fuel economy standards, arguing that their cost benefit analysis shows $200bn in benefits and 12,700 fewer fatalities through 2029. But global automakers led by Honda have raised challenges to the analysis, arguing that it relies on unrealistic assumptions which when corrected flip the entire analysis from benefits to costs. [Link]

Crack whacked as surplus back by Matt Smith (ClipperData)

The gasoline market in the US has flipped from deficit into surplus, driving down crack spreads between gasoline and raw crude. [Link]

Innovation

Machine-learning algorithm beats 20 lawyers in NDA legal analysis by Cal Jeffrey (TechSpot)

A machine-learning approach has yielded a 94% accuracy versus 85% for a panel of lawyers, in a tiny fraction of the time. [Link]

Stupid Patent of the Month: How 34 Patents Worth $1 Led to Hundreds of Lawsuits by Daniel Nazer (EFF)

The story of Shipping & Transit, a small company which leveraged a small number of patents into millions of dollars worth of lawsuits. [Link]

Pop Culture

30 Rock’s Werewolf Bar Mitzvah: An Oral History by Mike Roe (LAist)

The oral history of one of the strangest but persistent Halloween jokes of the past generation. [Link]

Labor Markets

The ‘gig economy’ is hugely overhyped, new study says by Adriana Belmonte (Yahoo!)

New BLS and Conference Board data suggests that the gig economy (freelance, independent work, these days mostly empowered by apps like Uber, Instacart, and the like) is vastly overhyped and a tiny share of the overall labor market. [Link; auto-playing video]

Hedge Funds

Bridgewater’s New Brain: A Millennial Woman Is Blazing To The Top Of The World’s Largest Hedge Fund by Nathan Vardi (Forbes)

The head of Bridgewater Associates investment research group is 31 years old and sits in a critical seat steering the capital of the world’s largest hedge fund. [Link]

Incarceration

America’s Other Family-Separation Crisis by Sarah Stillman (The New Yorker)

With the number of women in state prisons up more than 5% per year for 4 decades straight (despite crime rates that have been falling consistently for the last 20 years) a huge number of mothers have been separated from their children with disastrous consequences for those kids. [Link]

Health Care

A Sense of Alarm as Rural Hospitals Keep Closing by Austin Frakt (NYT)

Hospitals in rural areas are consolidating and closing. While sometimes that can have positive effects on health outcomes, in general it’s a massive source of concern. Many factors are at play, but given the huge majority of closures are in states that have not expanded Medicaid, accepting federal money tied to the ACA seems to be one weapon states can use to preserve rural hospital infrastructure. [Link; soft paywall]

Read Bespoke’s most actionable market research by starting a two-week free trial today! Get started here.

Have a great Sunday!

2018 Week 9

Week 8 Results: 7-6, Overall: 62-46 (57.4%)

Outside of financial markets, we’re also sports fans here at Bespoke. With new legal sports betting avenues now available across the US, we figured we’d have some fun and pick each NFL game versus the spread this season (as of Saturday evening). Let’s see how we do…on to Week 8. (Lines as of 9:48 PM ET on 11/3/18.)

We were 7-6 in week 8, bringing our overall record through 8 weeks to 62-46 (57.4%).

2018 NFL Week 9 Bespoke Picks:

Chicago (-10) at Buffalo: Buffalo +10

Kansas City (-8) at Cleveland: Kansas City -8

NY Jets at Miami (-3): NY Jets +3

Detroit at Minnesota (-5): Detroit +5

Atlanta at Washington (-2): Atlanta +2

Tampa Bay at Carolina (-6.5): Tampa Bay +6.5

Pittsburgh at Baltimore (-2.5): Pittsburgh +2.5

Houston at Denver (-1): Houston +1

LA Chargers at Seattle (Even): LA Chargers (Even)

LA Rams (-2) at New Orleans: New Orleans +2

Green Bay at New England (-5.5): Green Bay +5.5

Tennessee at Dallas (-5): Dallas -5

2018 NFL Week 8 Bespoke Results:

Philadelphia (-3) at Jacksonville (in London): Jacksonville +3 (Loss)

NY Jets at Chicago (-9.5): NY Jets +9.5 (Loss)

Tampa Bay at Cincinnati (-3.5): Tampa Bay +3.5 (Win)

Seattle at Detroit (-3): Seattle +3 (Win)

Denver at Kansas City (-9.5): Kansas City -9.5 (Loss)

Washington (-1) at NY Giants: NY Giants +1 (Loss)

Cleveland at Pittsburgh (-8): Cleveland +8 (Loss)

Baltimore (-2.5) at Carolina: Carolina +2.5 (Win)

Indianapolis (-3) at Oakland: Indianapolis -3 (Win)

Green Bay at LA Rams (-8): Green Bay +8 (Win)

San Francisco (-1.5) at Arizona: Arizona +1.5 (Win)

New Orleans (-1.5) at Minnesota: Minnesota +1.5 (Loss)

New England (-13.5) at Buffalo: New England -13.5 (Win)

The Bespoke Report – Tweet This

The Closer: End of Week Charts — 11/2/18

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. We also take a look at the trend in various developed market FX markets.

Below is a snapshot from today’s Closer highlighting positioning of speculators in energy futures. If you’d like to see more, start a free trial below.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by starting a two-week free trial to Bespoke Institutional now!