Fixed Income Weekly – 11/7/18

Searching for ways to better understand the fixed income space or looking for actionable ideals in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

This week we take a look at the biggest slate of ballot initiatives for state/local bond issuance since 2006.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

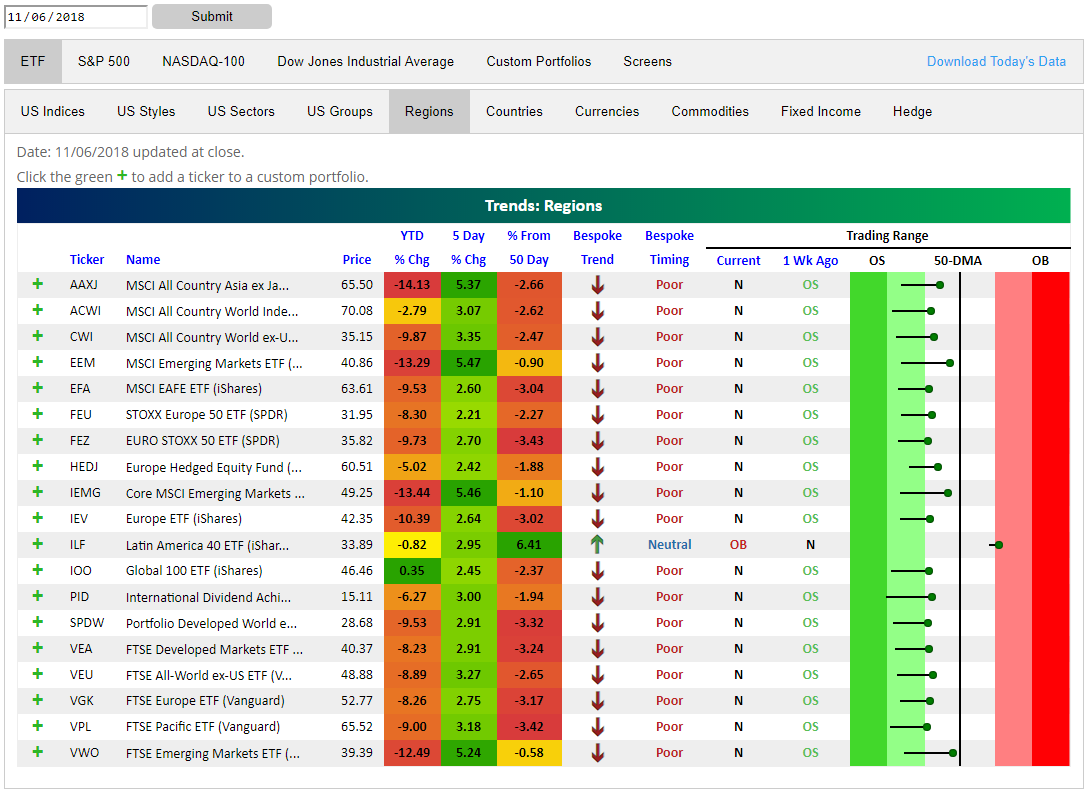

Global Stock Market ETFs Bounce Back

Just as US index ETFs have moved higher, global stock markets have moved higher recently as well. Below is a snapshot of regional stock market ETFs from our popular Trend Analyzer tool. As you can see, while YTD changes are still deep in the red and ETFs are still well below their 50-day moving averages, the 5-day percentage change is extremely strong. The move higher over the last week has pushed every ETF in the group out of oversold territory and into neutral territory. One ETF (Latin America) has actually moved to overbought levels.

While all of these ETFs have moved higher recently, note that because of the severe weakness experienced for global stocks over the last few months, they’re nearly all in long-term downtrends. It’s going to take more than just a week of gains for new uptrends to emerge. There’s still a lot of work for the bulls to do!

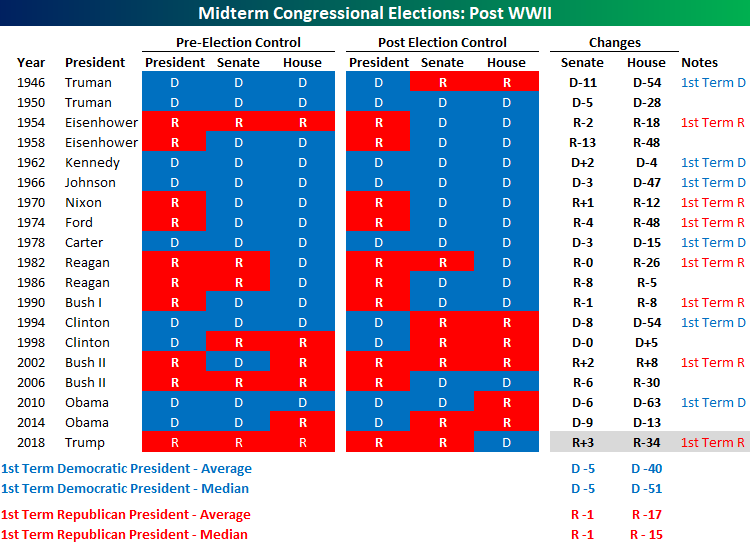

Midterm Election Results Relative to History: Something For Everyone

The midterm elections are behind us, so we can finally move on to the 2020 contest! Just kidding. With the results of yesterday’s election, both sides are out there claiming victory and justifiably so. The table below breaks down the results of historical midterm elections in the post-WWII period. For each midterm, we show the political makeup in Washington before and after the election results, showing how many seats the incumbent President’s party gained or lost in each chamber of Congress. At the bottom of the table, we also include a look at the average and median swing in the balance of the Senate for Democratic Presidents as well as Republican Presidents.

Based on how things stand now according to ABC News, Republicans are expected to lose 34 seats in the House and gain 3 seats in the Senate. From the perspective or Republicans, they are writing off the loss of House seats as ‘typical’ losses in a midterm, while pointing to the gain in Senate seats as a major victory and validation of the President’s policies. Democrats, on the other hand, are dismissing the weak showing in the Senate as a ‘bad map’ and hanging their hats on the pickups in the House. So which party is right?

They actually both are. As shown at the bottom of the table, while the party of the incumbent President typically loses seats during the first midterm election year, Democrats usually do much worse than Republicans, losing an average of 40 seats in the House and 5 seats in the Senate. Losses for Republicans tend to be much smaller on average at 17 seats in the House and just one seat in the Senate. Based on these numbers, the results in the House yesterday for Republicans were worse than average, while the gains in the Senate were much better than average. In fact, the only midterm in the post-WWII period where the GOP lost more seats in the House during a President’s first term in office was in 1974 under President Ford right after the Watergate scandal and Nixon’s resignation. That year the GOP lost 48 House seats. Reagan’s first midterm in 1982 also saw big losses at -26, but that was still 8 better than this year. The Senate, however, is another story. With what looks like a pickup of 3 seats in the Senate, Republicans have never picked up that many seats during a Republican President’s first midterm election in office.

“The Biggest Senate Pickup During a President’s First Midterm Since at Least WWII” or “The Biggest Loss of Seats in the House for a First-Term Republican President since Ford” — Which headline do you think Republicans and Democrats will latch on to?

Bespoke’s Global Macro Dashboard — 11/7/18

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

Morning Lineup – Everybody Wins

Now what are we going to talk about? With mid-term elections now behind us, investors will have to find something else to worry about, and fortunately (or unfortunately depending on how you look at it), there’s no shortage of issues. Don’t forget, the FOMC kicks off a 2-day meeting today!

With the election results coming in basically just as the consensus had forecast, there wasn’t much in the way of shock in last evening’s results, although both sides are out there claiming victory (justifiably) with Democrats taking control of the House and Republicans gaining a stronger foothold in the Senate. Get ready for gridlock!

With S&P 500 futures significantly higher (+0.75%) this morning, the S&P 500 is on pace to trade back above its 200-DMA for the first time since 10/22. If it can hold above this level throughout the trading day, it will be a big psychological victory for bulls as the market looks to recover from October’s correction.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer — Breadth In Price, Breadth In Earnings, Company Concerns, JOLTs — 11/6/18

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we take a look at how breadth has been the recently, for both single stock price action and earnings estimates. We also review what companies have been talking about on their earnings calls recently, the backdrop for global crude markets, and today’s JOLTS report from the BLS.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

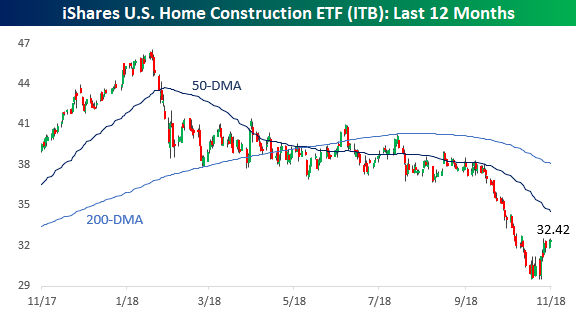

Homebuilder Bounce

After performing miserably all year, homebuilders stopped going down in mid-September and have rallied close to 10% since. While the iShares Home Construction ETF (ITB) is still down sharply YTD and well below both its 50 and 200-day moving average (DMA), the fact that it finally caught a bid and made a low before the S&P 500 has bulls on the sector optimistic that this could be the beginning of a more substantial rally. Only time will tell if this sentiment is accurate or just wishful thinking.

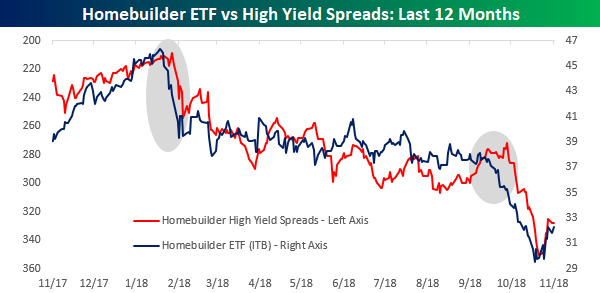

Whenever we see situations like this, one area of the market we like to look at is the fixed income high yield market. The first chart below compares spreads for the overall high yield market to spreads on high yield credit for homebuilders over the last three years. From November 2015 right up through February of this year, spreads in the homebuilder group tracked spreads for the overall high yield market pretty closely. Beginning in late February, though, spreads for the homebuilder group widened out considerably, while spreads in the overall high yield market were much more contained. In fact, in the homebuilder group spreads widened out by over 100 basis points (bps) or 49%, rising from 234 bps in late February to 350 bps as of 10/26.

Looking at this another way, the chart below compares high yield spreads in the homebuilder group (plotted below on an inverted basis) to the price of the iShares Home Construction ETF (ITB) over the last 12 months. During this span, the two series have tracked each other very closely, where big declines in ITB were generally accompanied by much wider spreads in the high yield debt of homebuilders. More recently, as the homebuilder stocks have rallied, spreads for the group have narrowed right along with them.

Looking more closely at this chart, we would note that if you are looking for early signs of a big move in the homebuilder stocks, moves in high yield debt for the group probably won’t be the tipoff. Take a look at the two shaded regions in the chart. Each one of them shows the two big legs lower that the homebuilder stocks (blue line) have seen during the course of the year, but in each case, it was the stocks that led the move in high yield spreads (red line) rather than the other way around. In the case of homebuilders, high yield spreads haven’t been much of a leading indicator this year.

Best Performing Stocks YTD 2018

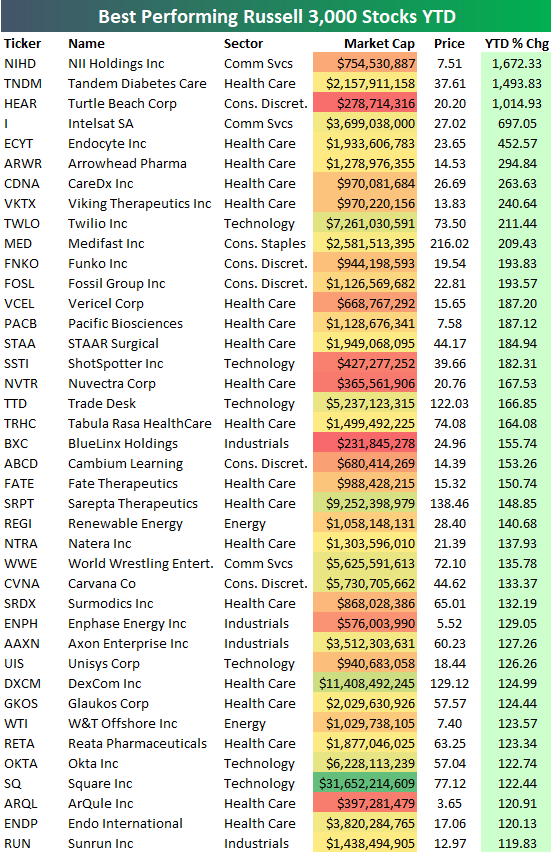

There are 66 stocks in the Russell 3,000 that are up more than 100% year-to-date in 2018. Below is a list of the 40 best performers. As shown, three stocks — NII Holdings (NIHD), Tandem Diabetes (TNDM), and Turtle Beach (HEAR) — are up 1,000%+ year-to-date, meaning they’ve recorded “10-baggers” already in 2018. NIHD is up the most at 1,672%, TNDM is up 1,493%, and HEAR is up 1,014.9%.

The next closest stock on the list is Intelsat (I) with a gain of 697%, while Endocyte (ECYT) rounds out the top five with a gain of 452.6%.

The list of best performers is dominated by Health Care/Biotech names, which is usually the case with these lists (at least during bull markets). Below we show the best performers of 2018 that aren’t Health Care sector stocks. A few notables include Twilio (TWLO), Trade Desk (TTD), World Wrestling Entertainment (WWE), and Square (SQ). Payment processor Square (SQ) is by far the biggest stock on the list with a market cap of $31 billion. The next biggest in terms of market cap is recent IPO and cloud communications company Twilio (TWLO).

Sector Heatmaps

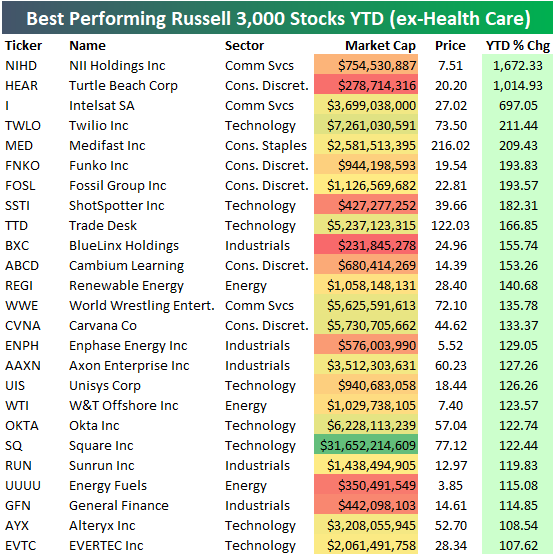

Stock market rotation has been a pretty big theme this year but you wouldn’t necessarily know it from our sector performance heatmap. Below we show which sectors have the best and worst performances YTD over the course of the year. Three have been outperformers for most of the year: Consumer Discretionary, Health Care, and Technology. Underperformers have been less consistent. Communications Services and Consumer Staples have lagged pretty consistently, but Staples has started to turn itself around. Utilities lagged badly to start the year but is now an outperformer, while Financials started off on good footing but have lagged into the close of the year. The Industrials sector looks similar to the Financials sector — it was in the top half of performers through April before losing steam. At this point in the year, Industrials are one of the weaker sectors in terms of YTD performance.

Another way to show rotating fortunes at the sector level is to use our rolling heatmap of S&P 500 sector performance. As shown below, only two sectors (Utilities, Health Care) are up over the last three months; Communications Services and Real Estate have started to outperform as well. The big laggards are Energy and Materials, which have been falling behind on a rolling 3 month basis for quite some time now.