Bespoke’s Sector Snapshot — 11/8/18

Chart of the Day: Sabre (SABR) Rattling

Individual Investors Continue To Be Optimistic

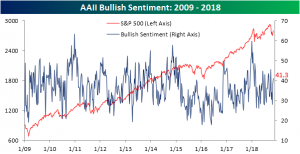

The sentiment of individual investors in the weekly AAII survey saw a huge jump in bullishness last week. This week, while the number did not skyrocket, there was another increase after a solid week of equity market gains. The bullish camp saw a 3.4 percentage point increase to 41.28% from 37.93%.

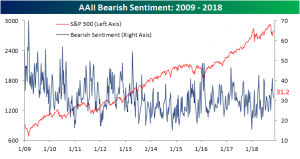

Bearish sentiment fell to 31.19% from 34.48%. It is now well below the high of 41% from only a couple weeks ago. According to these sentiment levels, it would be fair to say any fear stemming from the October decline has now tapered off.

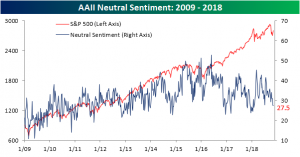

The share of investors sitting on the fence went basically unchanged, only falling 0.07%. Suffice to say that the influx of bulls has not come from the neutral camp.

Jobless Claims Inline With Expectations

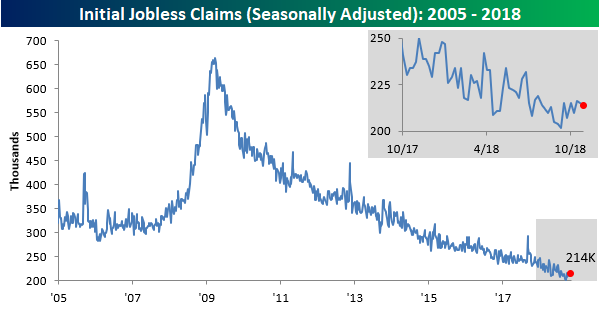

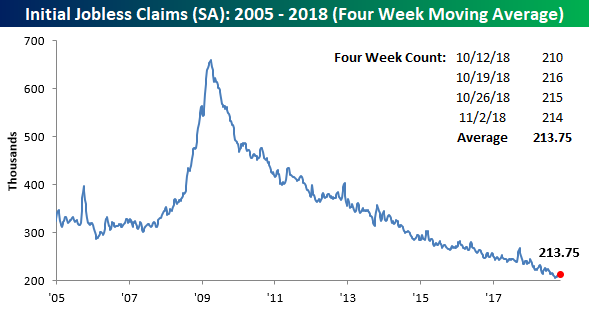

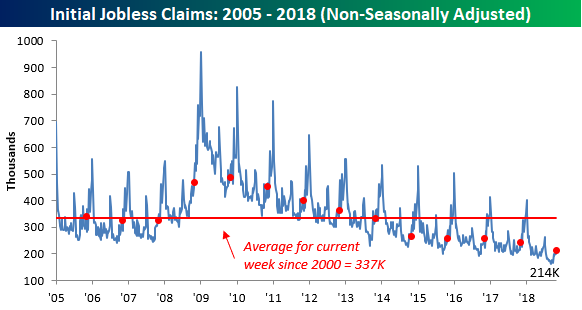

Jobless claims came in right inline with expectations this morning falling from 215K last week to 214K. With this week’s report, claims have now been at or below 300K for a record 192 straight weeks, at or below 250K for 57 straight weeks, and at or below 225K for 18 straight weeks.

The four-week moving average was essentially unchanged, falling from 214K down to 213.75K. That’s less than 8K above the multi-decade low of 206K that we saw back in mid-September.

On a non-seasonally adjusted (NSA) basis, claims ticked up to 214K from last week’s reading of 198.5K. This is the first weekly reading above 200k for NSA claims since late July but is still well below the average of 337K for the current week of the year dating back to 2000. In fact, for the current week of the year, NSA claims still haven’t been this low since 1969.

the Bespoke 50 — 11/8/18

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” has beaten the S&P 500 by 86.1 percentage points. Through today, the “Bespoke 50” is up 190.1% since inception versus the S&P 500’s gain of 104%. Always remember, though, that past performance is no guarantee of future returns.

To view our “Bespoke 50” list of top growth stocks, click the button below and start a trial to either Bespoke Premium or Bespoke Institutional.

Morning Lineup – Calm After the Storm

Markets are extremely quiet this morning following Wednesday’s fireworks. There’s still been a number of big earnings reports from the likes of Qualcomm (QCOM), News Corp (NWSA), and Square (SQ) to name a few. Jobless claims came in at 214K, which was right around expectations of 213K. At 2 PM we will hear from the FOMC where traders are hoping that the statement will imply a slightly less hawkish tone.

Also, we just released the latest episode of our Bespokecast featuring Patrick Wyman, who hosts the popular podcast Tides of History. Make sure to check it out. It’s a bit different from some of our prior episodes, but you’ll definitely like it!

Bespokecast Episode 27 featuring Patrick Wyman

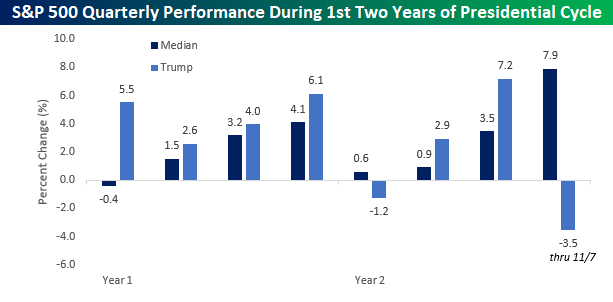

With all the talk about market performance around and after midterm election years, we wanted to provide a quick comparison of the S&P 500’s quarterly performance during the first two years of President Trump’s tenure to the media quarterly returns of the S&P 500 during the first two years of the four-year Presidential cycle. Looking at the chart, while there have been a number of quarters where returns have been similar under Trump to the historical norm, as one might expect, there have also been some wide disparities. This quarter, for example, the S&P 500 is down 3.5% in a quarter where it has historically rallied 7.9%

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer — Midterms Made It, EIA Hated — 11/7/18

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we break down how equity markets reacted to the midterm elections last night. This was the best one day change in the S&P 500 on the day after the midterms since 1982, but the drivers of the rally are totally unrelated to what sent up stocks in the post-Presidential election rally. We also review weekly EIA petroleum market data and some fixed income price action.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Bespokecast Episode 27 — Patrick Wyman — Now Available on iTunes, GooglePlay, Stitcher and More

Our newest episode of Bespokecast is now available! Be sure to subscribe to Bespokecast on your preferred podcast app to gain access to our full collection of episodes. We’d also love for you to provide a review as well!

Our newest episode of Bespokecast is now available! Be sure to subscribe to Bespokecast on your preferred podcast app to gain access to our full collection of episodes. We’d also love for you to provide a review as well!

In this episode of Bespokecast, we sit down with Patrick Wyman, the host of popular podcast Tides of History. Patrick is a historian with a PhD from the University of Southern California with a broad range of knowledge on antiquity, the middle ages, and the early modern period. Instead of our usual focus on investing and contemporary analysis, this week Patrick helps us compare and contrast how four very different economies (late Roman, Medieval, early modern, and our own) compare, where similarities lie, and how they were different. Using four different institutions as focal points for comparative analysis, Patrick helps us understand the functioning of a Roman estate, a medieval manor, an early modern trading house, and a modern corporation and what key drivers of activity, market intensity, and relationships to the state they all have. This conversation was a significant departure from our typical format, but we found it fascinating and hope you do too. You can follow Patrick on Twitter here.

To listen to our newest episode or subscribe to the podcast via iTunes, GooglePlay, OvercastFM, or Stitcher, please click the button or links below. Please note that third-party podcast feeds may update at a lag of a few hours to this blog post.