Trend Analyzer – 11/21/18 – YTD Takes A Tumble

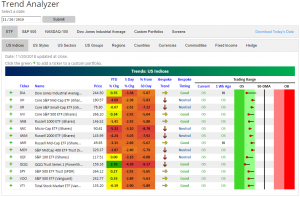

The picture has gotten much more deeply oversold in our Trend Analyzer tool following further selling off over the past few days. Every major US Index ETF is now oversold and not a single one less than 5% below their respective 50-DMAs. Prior to yesterday, mid-caps had primarily been the only ETFs that turned negative YTD, but today that is no longer the case. Across the board, there are more that have gone negative. Currently, there are only five ETFs that have gains on the year; even these gains have to be taken with a grain of salt as four of them are only under half a percentage point. Despite notably poor performance this week, the Nasdaq (QQQ) is still up the most YTD at 2.76%. Taking a look at longer-term trends, the outlook has once again gotten bleak. Today there is not a single major index ETF that is in an uptrend. Half are trending sideways and the other half have entered downtrends. The Dow (DIA) had been the holdout for some time now, but yesterday’s selling changed that.

Bespoke’s Global Macro Dashboard — 11/21/18

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

Bespoke’s Morning Lineup: Worst Starts to Q4

In today’s Bespoke Morning Lineup, we provide our usual updated look at market internals, indicators, news events, and analysis. In addition, we’ve highlighted the tables below. The first table on the left shows the worst starts to Q4 for the S&P 500 on record. As shown, this Q4 has been the 6th worst so far with a decline of 9.34%! Just brutal. We go into more detail in the full Morning Lineup release.

The second table on the right simply shows the Dow Jones Industrial Average’s point change on each trading day over the last month. As shown, the Dow has experienced triple-digit moves on 21 of the last 22 trading days!

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer — Small Caps, Vol, Crypto Crushed, Eurodollar Rally, Housing Digest — 11/20/18

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we take a long look at housing data released today in the context of other recent releases. We also review price action in small caps, the rapid shift upward and into full inversion for the VIX curve, the bitcoin crash into unprecedented territory on an RSI basis, and an enduring rally in the Eurodollar curve.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

A Historically Bad Q4 So Far

With the S&P 500 falling 9.08% QTD, it has been the sixth-worst start to the fourth quarter in the history of the S&P 500. The only worse Q4s (through 37 trading days) came during some of the worst years for the stock market (1929, the 1930s, 1973, 1987, and 2008).

Below is a table showing the worst starts to Q4 for the S&P 500 through 37 trading days. Any drop of more than 2% at this point in the quarter made the list. As shown in the table, the average change for the S&P for the remainder of these years has been a gain of 2.77% with positive returns 78.26% of the time. For all other Q4s in the S&P’s history, the average change for the remainder of the year has been +1.61%.

Of course, it’s not all good news. If you look at the window of Q4s that were down between 8% and 12% like we are this year, the S&P actually declined for the remainder of those four years.

And in case you don’t remember, at this point in Q4 2008, the S&P was down 35.5%! In that year, the S&P ended up rallying 20% for the remainder of the year before plummeting to new lows again in the first quarter of 2009.

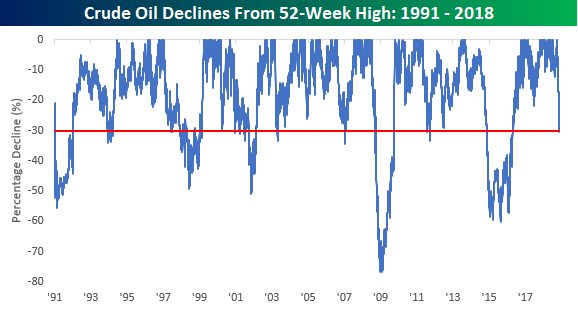

Crude Oil Declines Start to Get Real

After trying to stabilize in the last few days, crude oil prices took another leg lower today, falling more than 5% and below $55 per barrel. Relative to its 52-week high on October 3rd (less than two months ago) crude oil prices are now down over 30%. While there have been drawdowns of this magnitude in the past going back to 1991, there haven’t been many, and only five of them went on to see materially larger declines. Concerns regarding excess supply have pressured prices, but the magnitude of the recent declines doesn’t paint much of a positive picture for global growth.

B.I.G. Tips: Bubble Comparisons

Bespoke Stock Scores — 11/20/18

Chart of the Day: Turnaround Tuesday?

Morning Lineup – Rush For the Exits

The highways will be crowded this evening as the Thanksgiving rush will begin in earnest, but this morning investors are rushing for the exits with Technology and Retail leading the way lower. Apple (AAPL) is trading down close to 3%, Facebook (FB) is under $130, and Nvidia (NVDA) is down another 5%. While NVDA’s decline is bad enough by itself it follows two days of trading where the stock was down 18% and 12%, respectively. Since early October, the stock is now down over 50%!

In economic data, Housing Starts for October actually came in right inline or slightly ahead of forecasts, which is a bit of a surprise given the very weak homebuilder sentiment report on Monday.

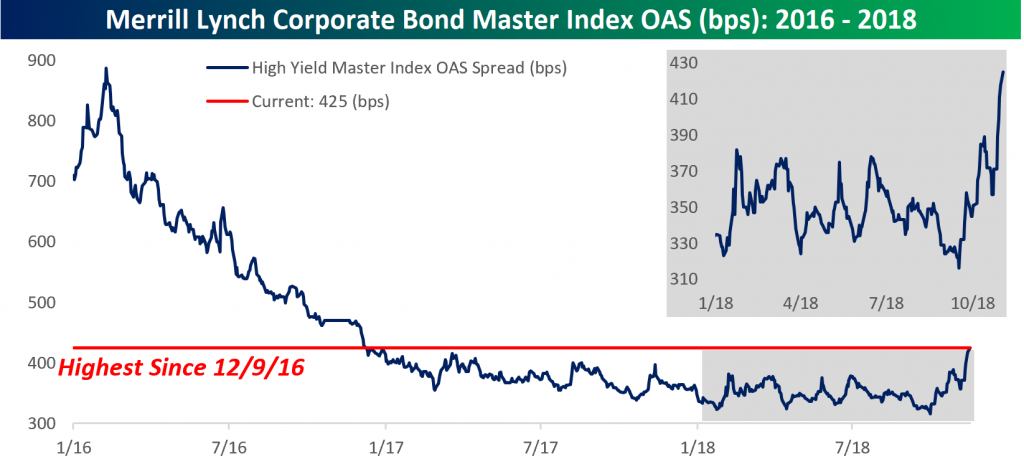

We often look to the high yield market for signs of confirmation of a move or divergences, and unfortunately for bulls, recent moves haven’t been positive. As shown in the chart below, after moving up and down within a range of 310 bps to 390 bps for much of the year, spreads have surged in the last several days to their current levels of 425 bps. That’s the highest level since December 2016, erasing nearly all of the narrowing that we saw in the thirteen months spanning the November 2016 election through early 2018. From the equity market’s perspective, this negative divergence suggests equity prices could be vulnerable to further weakness.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.