Rude Crude

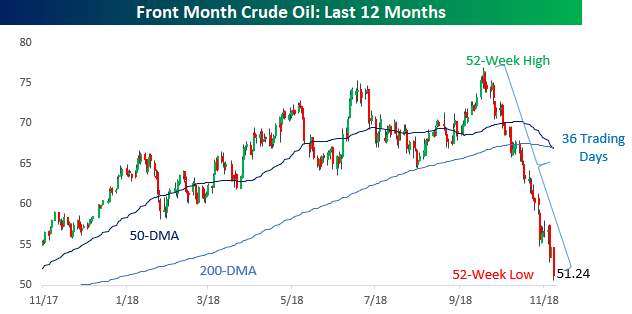

While US equities are set to trade lower on this holiday-shortened day after Thanksgiving, the big story is the sharp drop in crude oil prices. Crude is trading down over 5% this morning to another 52-week low near $50 per barrel. Looking at the chart, it’s amazing to see how sharp and fast the drop has been from what were multi-year highs just a few short weeks ago. In the span of just 36 trading days, prices have dropped by about a third!

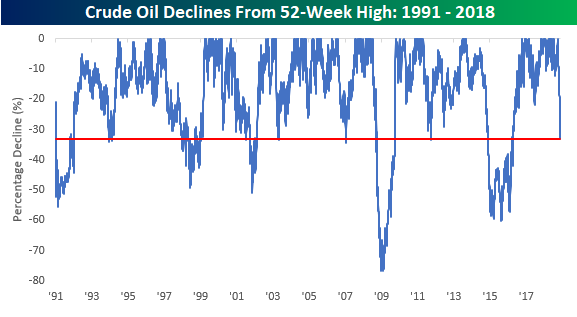

Looking back at crude oil declines over time, the magnitude of this drawdown is right up there with some of the biggest on record. The last time prices were down this much from a 52-week high was in 2015 and 2016, but the key difference between now and then is that the magnitude and length of this decline (at least up until this point) has been shorter and less severe.

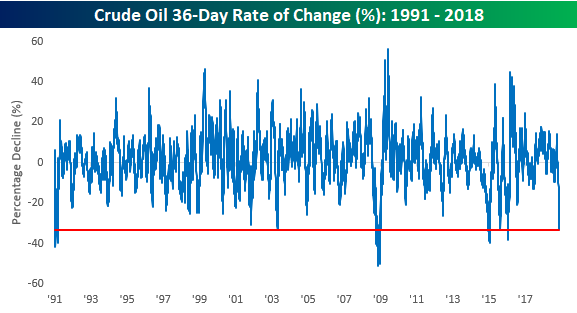

We realize that measuring a 36-day rate of change is a bit arbitrary, but just to show how sharp a decline this has been, there haven’t been many other similar lengths of time where crude oil declined more over a such a short period of time.

Country Stock Market ETFs Down Double-Digits in 2018

Below is a look at the year-to-date percentage change of the 34 country stock market ETFs tracked in our popular Trend Analyzer tool. As shown, just 2 out of 34 countries are in positive territory for the year, while 32 of 34 are in the red. The best performing country stock market ETF has been Israel with a gain of 4.7%, while the US (SPY) is the only other country in positive territory with a gain of 0.6%. (While SPY is up YTD still, the S&P 500 is actually down 0.89%, however.)

The average YTD change for all country ETFs is currently -12.7%. Turkey (TUR) has posted the biggest decline at -42.1%, followed by South Africa (EZA) at -25.8% and South Korea (EWY) at -20.4%. The Philippines (EPHE), Germany (EWG), Italy (EWI), and Mexico (EWW) round out the worst 7 countries. A large majority of countries (70%) are down double-digit percentage points on the year. 2018 is shaping up to be a very brutal year for global equities.

Bespoke Morning Lineup – Short But Not Sweet

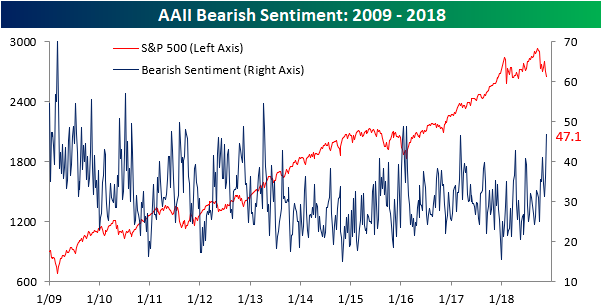

It was bound to happen sooner or later given the weakness, and we started to see it this week as individual investors grow increasingly nervous. In this week’s sentiment survey from AAII, bearish sentiment ticked up to its highest level since February 2016.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

2018 Week 12 Thanksgiving Day NFL Picks

Week 11 Results: 8-4, Overall: 85-59 (59.02%)

Outside of financial markets, we’re also sports fans here at Bespoke. With new legal sports betting avenues now available across the US, we figured we’d have some fun and pick each NFL game versus the spread this season (as of Saturday evening). This week we’ve got a special Thanksgiving Day picks edition to cover the three games scheduled for Turkey Day.

We were 8-4 in week 11, bringing our overall record through 11 weeks to 85-59 (59.02%).

2018 NFL Thanksgiving Day Picks:

Chicago (-3) at Detroit: Chicago -3

Washington at Dallas (-7): Dallas -7

Atlanta at New Orleans (-12.5): Atlanta +12.5

2018 NFL Week 11 Bespoke Results:

Carolina (-4.5) at Detroit: Detroit +4.5 (Win)

Dallas at Atlanta (-3): Dallas +3 (Win)

Cincinnati at Baltimore (-5.5): Cincinnati +5.5 (Win)

Minnesota at Chicago (-2.5): Minnesota +2.5 (Loss)

Philadelphia at New Orleans (-7.5): Philadelphia +7.5 (Loss)

Tennessee at Indianapolis (-1.5): Indianapolis -1.5 (Win)

Houston (-3) at Washington: Washington +3 (Win)

Tampa Bay at NY Giants (-2.5): NY Giants -2.5 (Win)

Denver at LA Chargers (-7): LA Chargers -7 (Loss)

Oakland at Arizona (-5.5): Oakland +5.5 (Win)

Pittsburgh (-5.5) at Jacksonville: Pittsburgh -5.5 (Loss)

Kansas City at LA Rams (-3.5): Kansas City +3.5 (Win)

Chart of the Day: No Low in New Lows

Consumer Comfort Slowing But Still Very Strong

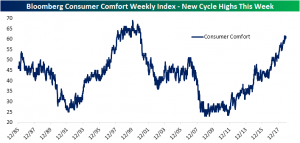

Bloomberg’s weekly consumer comfort data released this morning at 61.3. Consumer comfort is still very close to cycle highs (61.6), but over the past couple of months—during the time markets have been selling off—it hasn’t not been steadily moving higher as it did for most of the year, instead staying within a range of 59 to 61. This slowing is by no means a negative sign seeing as the level is still so strong. Given the equity market’s recent price action, it may simply be the wealth effect dampening.

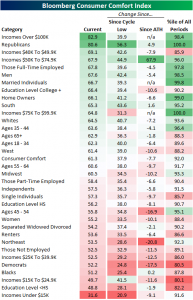

Breaking comfort levels down by demographic, the same trends still seem to be in place. Most readings are still in high percentiles compared to history, meaning comfort is still high across the board. Those with lower income and education levels unsurprisingly remain at the bottom, while higher-income individuals sit at the top. Also near the bottom of the group is Democrats, which as we have highlighted in the past is normal for the out of power party. On that note, the reading is still higher for both Republicans and Democrats since the election likely due to both sides perceiving wins.

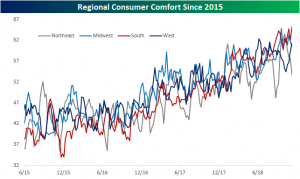

Geographically, there was a big drop in comfort in the Northeast. These demographics are some of the more volatile ones though—as you can see in the chart below—so it is not necessarily a bad sign. The Northeast especially has seen many of these huge drops throughout the history of the survey. There was an even larger fall only a few months ago. In other words, while Northeast comfort may seem bad, with its level being one of the lowest demographics in regards to its percentile, it should not raise any red flags, and we could very easily expect this low comfort level to turn around.

Bespoke CNBC Appearance (11/21)

Fixed Income Weekly – 11/21/18

Searching for ways to better understand the fixed income space or looking for actionable ideals in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

Global rates are rallying, with the belly of the global curve outperforming.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

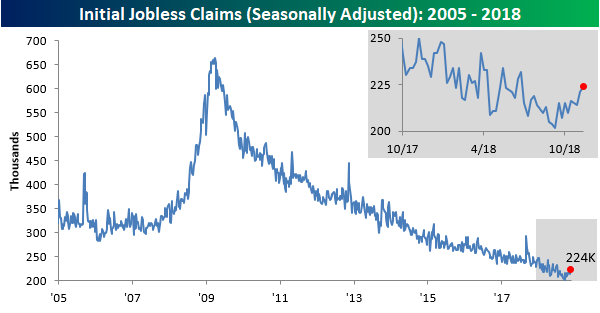

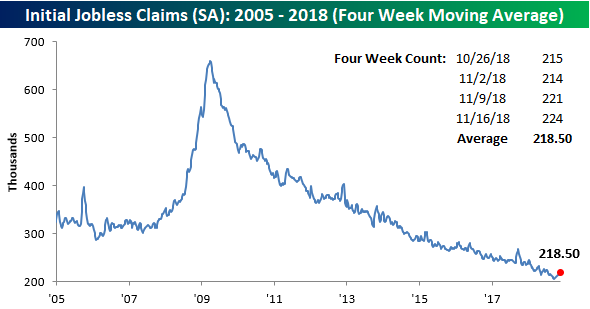

Jobless Claims Drifting Higher

It has now been nine weeks since Jobless Claims last made a new low for the cycle, and while that really isn’t long of a time, after being spoiled with extraordinarily low readings for several weeks, the recent drift higher stands out. In this week’s report, Jobless Claims rose from 221K up to 224K, and while the magnitude of the increase was small, the actual print was 9K above expectations. Again, a margin of 9K isn’t really significant, but the last time a weekly claims report was 9K above expectations was all the way back in May. The important thing to keep in mind, though, is that the trend of lower highs and lower lows remains in place.

Even with this week’s increase, though, the big streaks remain in place. Claims have now been at or below 300K for a record 194 straight weeks, at or below 250K for 59 straight weeks, and at or below 225K for 20 weeks. With respect to that streak of readings at or below 225K, if we can go two more weeks without ticking up more than 1K from this week’s level, it will set a new record.

The four-week moving average increased by 2K this week to 218.5K. At that level, the average is now 12.5K above its cycle low of 206K back from mid-September. Barring any big declines next week, we can expect this average reading to increase over time.

On a non-seasonally adjusted (NSA) basis, claims dropped from 236K down to 226.1K. Going back to 2000, that’s nearly 130K below the average of 355.5K for the current week of the year, and to find a lower reading for this specific week you have to go all the way back to 1969.

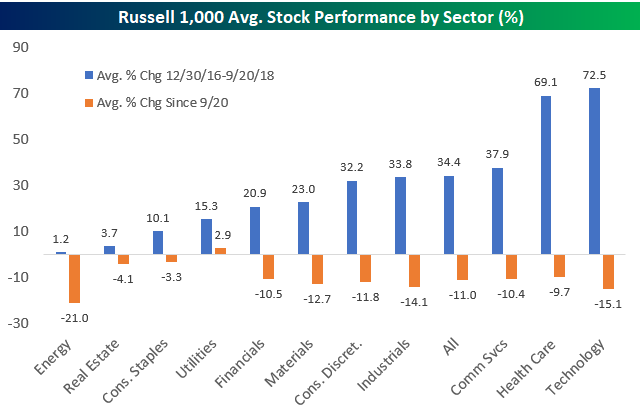

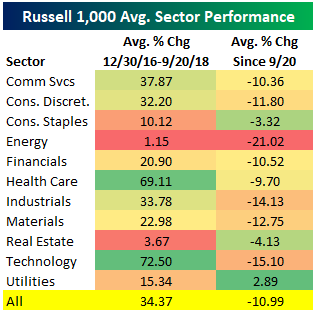

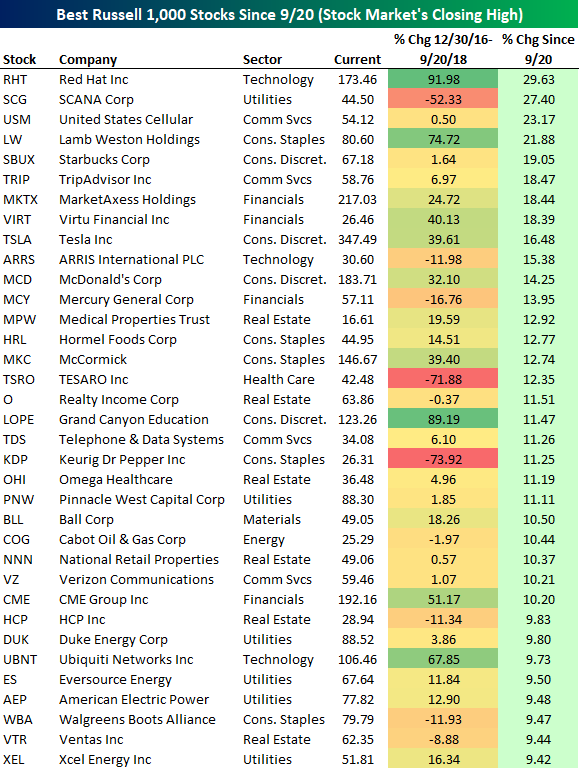

Sector Performance Since the 9/20 Peak; Best and Worst Performing Stocks

Below we show the average change of stocks in each Russell 1,000 sector from the start of 2017 through the 9/20 equity market peak compared to the average change since the 9/20 peak. For all stocks in the Russell 1,000, the average stock gained 34.4% from the start of 2017 through 9/20. Since 9/20, the average stock in the index is down 11%.

Looking at sectors, Technology and Health Care stocks gained by far the most from 2017 through 9/20 — up 72.5% and 69.1%, respectively. Since 9/20, Tech stocks have averaged a drop of 15.1%, while Health Care stocks have fallen 9.7%.

The best stocks since 9/20 have been Utilities, which are actually up an average of 2.9%. Consumer Staples and Real Estate — two more defensives — are only down slightly.

Energy has been the weakest sector for quite a while now. During the broad market’s rally from the start of 2017 through 9/20, the average Energy stock was up just 1.2%. Since 9/20, the average Energy stock has fallen 21%, which is by far the biggest drop of any sector.

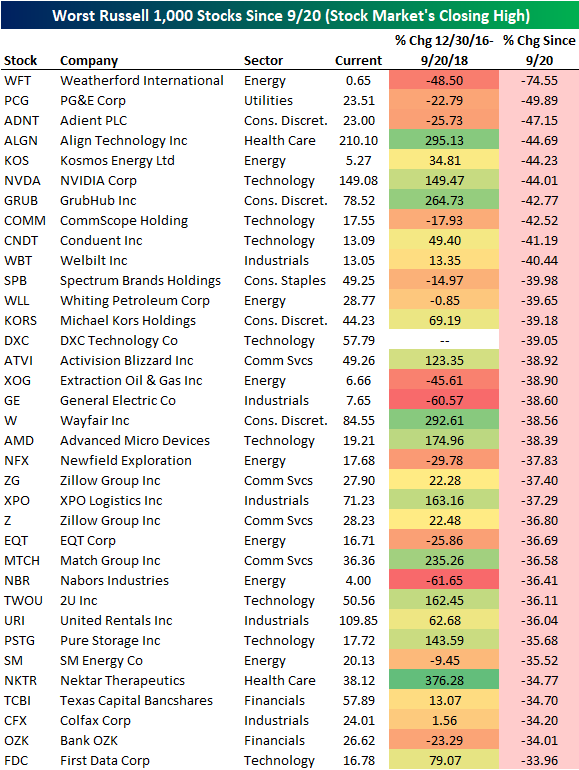

Individual stocks have experienced some epic declines over the last two months. Five percent of stocks in the Russell 1000 are down 30%+ since 9/20, while nearly 20% of stocks in the index are down 20%+. Just 15% of stocks are up since 9/20, and most are defensives.

As shown below, Weatherford International (WFT) is down the most since 9/20 at -74.55%. PG&E (PCG) is down 49.89%, followed by Adient (ADNT), Align Tech (ALGN), Kosmos Energy (KOS), and NVIDIA (NVDA). Align and NVDA had posted huge gains from 2017 through 9/20 before experiencing huge drops since, but the three biggest losers since 9/20 were actually down from 2017 through 9/20 as well.

Some other notables on the list of biggest losers since 9/20 include General Electric (GE) — down 38.6%, Advanced Micro (AMD) — down 38.4%, and Zillow Group (ZG) — down 37.4%.

Below is a list of the best performing stocks since the broad market sell-off began on 9/20. These are stocks that have bucked the overall trend and traded higher.

Notables include Starbucks (SBUX), TripAdvisor (TRIP), Tesla (TSLA), McDonald’s (MCD), Hormel (HRL), Verizon (VZ), and CME Group (CME). If you’ve been long any of these names, you’ve at least experienced some upside over the last couple of months.