Bears Back in Full Force

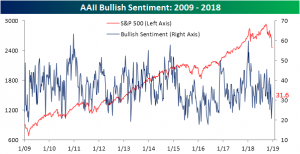

In spite of major declines in the past week, bullish sentiment through the AAII survey of individual investors actually rose for the second week in a row to 31.6%. That is up from the very low 24.9% reading from last week and an even lower 20.9% the prior week.

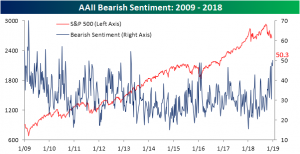

Turning to bearish sentiment, this week’s readings are similar to what we anticipated from last week’s release. As we previously mentioned, due to the timing of the survey, the heavy losses following the FOMC’s rate decision and Fed Chair Powell’s press conference did not likely fully come into play. That is not the case this week, and after continued weakness right up until Christmas Eve, it comes as no surprise that bearish sentiment jumped to just above 50%, completely overtaking last week’s small downtick. Bearish sentiment has remained at elevated levels for some time now, but the last time investors were this pessimistic was back in April 2013.

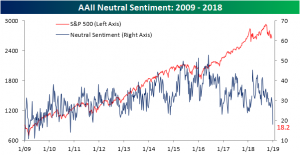

With both Bullish and Bearish sentiment increasing, Neutral sentiment fell significantly. The current reading is down 9.7% from last week to a multi-year low of 18.2%. The last time that neutral sentiment was this low was back in November 2010.

Morning Lineup – Giving Some Back

We were bound to give some of it back, but even with futures suggesting a near 300 point decline at the open, that would only take us back to levels we traded at 30 minutes before yesterday’s closing bell! For bulls, the weakness at the open should actually be welcome. If yesterday’s buying was real money coming in, you would expect to see this morning’s weakness met with buying later on in the morning. So, that will be the test to watch for.

Read today’s Bespoke Morning Lineup below for major macro and stock-specific news events, updated market internals and commentary.

Bespoke Morning Lineup – 12/27/18

Volatility has definitely made a comeback over the last two months, so much so that the S&P 500’s average daily range has now ticked up to 1.19%. While we are nowhere near the record levels of over 4% from the peak of the Financial Crisis, the current level is the highest since early 2012. Just another indicator showing how the current environment is a major shift from recent history.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

Trend Analyzer – 12/26/18 – Further Oversold

A shorter session and the Christmas holiday did nothing to stave off further declines on Monday. This can be seen through our Trend Analyzer. All of the ETFs tracking the major indices are currently extremely oversold. The tails are very short meaning they have not moved very far from where they were this time last week. To further hammer home just how oversold these ETFs are, every single one is more than 12% below its 50-day moving average.

The past few months of steep declines are now fully visible through year-to-date performance as well. The Nasdaq (QQQ) is still the best performer even though it is now down 7.35%. The rest are down 10%+ YTD with the Micro-Cap (IWC) down the most at 18.06%.

B.I.G. Tips – Washout Breadth

Chart of the Day: Bear Markets — What to Expect Once -20% is Reached

Morning Lineup – Let’s Try This Again

After the Christmas Holiday provided a welcome timeout to a relentless market decline, US equity futures are indicated higher (if we had a penny for every time that was the case this month). It’s not often that a sitting US President comments on the stock market, but this is no ordinary President, and over the holiday Trump weighed in on the market’s decline by saying, “We have companies, the greatest in the world, and they’re doing really well. They have record kinds of numbers. So I think it’s a tremendous opportunity to buy. Really a great opportunity to buy.” More than that, though, investors were encouraged by the fact that the President also expressed confidence in his Treasury Secretary easing concerns that he would be the latest member of the administration to hit the chopping block. Read today’s Bespoke Morning Lineup below for major macro and stock-specific news events, and updated market internals. Due to market closures outside of the US and a lack of data, there will be no commentary section in today’s report.

Bespoke Morning Lineup – 12/26/18

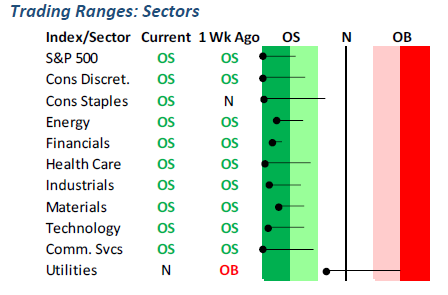

There’s really no shortage of charts we could show this morning to illustrate just how crazy the last several days/weeks of trading have been, but we’ll keep it at three for now. For starters, check out the chart of how the S&P 500 and each sector are trading relative to their trading ranges. As shown, the S&P 500 and four sectors are literally off the charts oversold!

One sector that has been especially weak is Consumer Staples. Normally a defensive sector, given the sector’s relatively high dividend yields and stable businesses, the Consumer Staples sector has been down over 1% for seven consecutive trading days now. The last time that happened? Never!

Finally, with stocks tanking and treasuries rallying to close out 2018, the S&P 500’s dividend yield is starting to look a lot more attractive relative to long-term Treasuries. Through Monday’s close, the S&P 500’s dividend yield was 2.32%, which is just 41 basis points (bps) below the yield on the 10-year. From a long-term investor’s perspective, that’s an increasingly attractive yield for equities.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

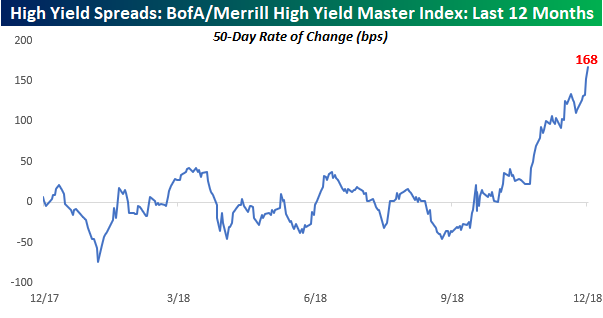

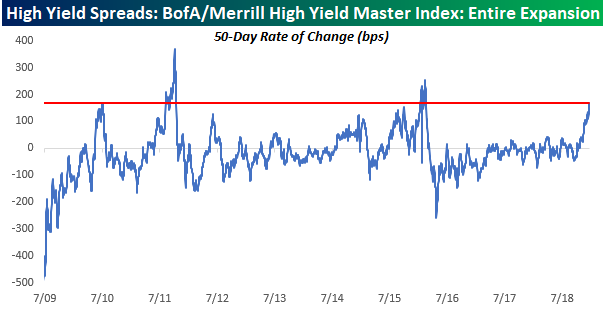

High Yield Spreads Come Unhinged

As equity prices have cratered in the last several trading days, one area of the market that has predictably come under selling pressure is high yield credit. The chart below shows the 50-day rate of change in spreads on high yield bonds relative to treasuries. When spreads are rising, it indicates that investors are becoming more risk-averse and demanding higher payment in the form of higher interest rates on riskier credit. As risk aversion fades, the opposite is the case as investors demand less in the form of interest payments causing spreads to decline.

A look at how credit spreads have changed over the course of the last year certainly supports the meltdown we have seen in equity prices. Over the last 50 trading days, spreads on high yield debt have increased by 168 basis points (bps), which is a seismic shift relative to the range of the last 12 months. Prior to this recent move, spreads never widened by more than 50 bps over the prior year.

While the move in spreads looks seismic over the short-term, we would note that there have been three other periods during this current economic expansion where we saw spreads widen by as much or even more than they have over the last 50 trading days. To be sure, each one of those periods saw messy markets and/or a slowdown in the US economy, but they didn’t market the end of the expansion either. Things could change from here and easily get worse, but at this point, the move we have seen in high yield spreads over the last few months are not unprecedented.

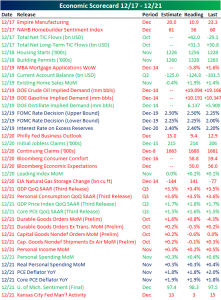

This Week’s Economic Indicators – 12/24/18

Last week we saw 37 data releases, of which 18 came in below estimates while only 13 beat estimates. Monday kicked off on a sour note as Empire Manufacturing came in way below expectations and homebuilder sentiment from the NAHB broke its streak of releasing above 60. Despite these misses, both indicators are still at positive levels. Tuesday was quiet with only a couple pieces of housing data, both of which came in above expectations. Wednesday was the real market mover day as the FOMC announced their rate decision which sent markets further into a tailspin. This event greatly overshadowed beats from the Current Account and Existing Home Sales. Thursday and Friday were the busiest data days last week, and most of the report missed expectations. The Philly Fed’s Business Outlook came in lower despite an expected uptick. Friday’s GDP release saw a slight decline in GDP and mixed PCE numbers. Goods orders all came in weaker on top of the Kansas City Fed’s manufacturing activity keeping the trend of weaker regional Fed activity data.

Turning to this week, with a shortened day today and tomorrow’s Christmas holiday, it will be a much lighter week of economic data. Earlier this morning, the Chicago Fed released their National Activity Index, which came in above the 0.20 forecasted level at 0.22. Aside from some treasury auctions later on, that is the only economic data point for today. Tomorrow will see no releases domestically due to the Christmas holiday; even abroad the only release to speak of will be Japan’s leading and coincident indices. Wednesday will be another light day with only the Richmond Fed’s Manufacturing Index on the docket. Thursday we get more home price data with the FHFA Home Price Index and New Home Sales alongside the weekly jobless claims and Bloomberg Consumer Comfort reports. The Conference Board’s Consumer Confidence numbers will also come out Thursday morning. We cap off the week with the preliminary Trade Balance for November, Chicago PMI, and more home data with Pending Home Sales. You can keep up with all of these releases daily with our Economic Scorecard.

Morning Lineup – Bah Humbug

Futures are getting in the Christmas spirit this morning, although not in the way you might expect as we have already seen the market trade both firmly in the green and deeply in the red. After trading decently higher overnight, they started to drop sharply shortly after six. There’s been a slight rebound off the lows since the initial leg lower, but they are still indicating a lower open.

A walk around Main Street and the malls this weekend would suggest that the economy remains on a firm footing, but after a rocky 72 hours in DC, confidence on K street is a whole different story. One thing we’re sure of, though, is that if you thought markets were thin lately, any expectations for liquidity today are nothing more than a mirage. Read today’s Bespoke Morning Lineup below for major macro and stock-specific news events, updated market internals, and detailed analysis and commentary:

Bespoke Morning Lineup – 12/24/18

Last week they even got the Utilities to break. While still holding up better than most sectors, which are trading at extreme oversold levels, the Utilities sector, which had been trading at extreme overbought levels just a week earlier is now firmly below its 50-DMA and not far from oversold territory,

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

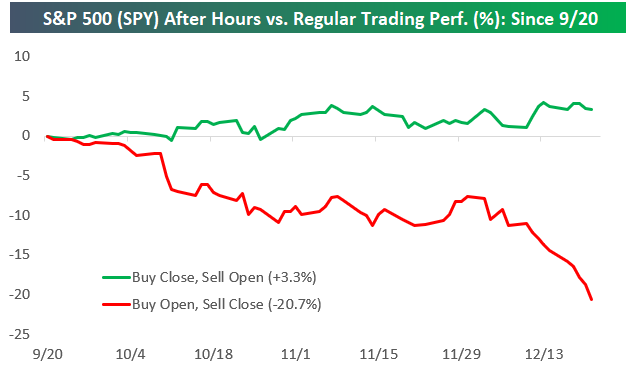

The Intraday Bear Market

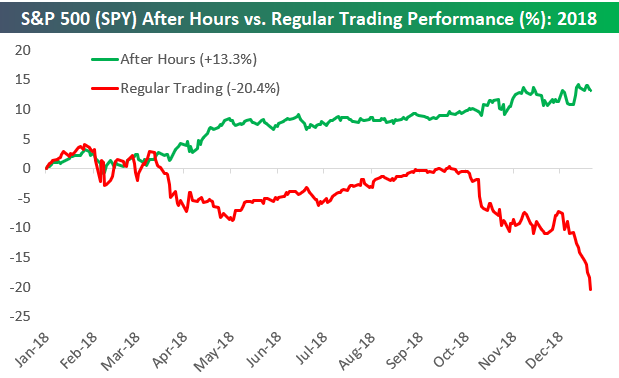

One of the most remarkable characteristics about the stock market’s sell-off from its highs over the last three months is that all of the declines have come during regular trading hours. Basically, if the stock market has been open for trading (between the 9:30 AM ET open and the 4 PM ET close), investors have been selling.

The way to track this is to look at how the S&P 500 performs inside of regular trading hours versus outside of regular trading hours. Since the 9/20 closing high for the S&P 500, had you bought SPY at the close of trading every day and then sold at the next day’s open (the after hours strategy), you’d actually be up 3.3%! Conversely, had you bought SPY at the open on every trading day and sold at the close that day (the regular trading strategy), you’d be down 20.7%. Based on these numbers, more than 100% of the stock market’s declines since the 9/20 peak have come during regular trading hours.

The numbers are even more lopsided when you run the analysis on the two strategies for all of 2018. As shown below, you’d actually be doing very well this year if you only owned SPY outside of regular trading hours. Had you bought SPY at the close every day and sold at the next open, you’d be up 13.3% this year. Had you bought at the open every day and sold at the close, however, you’d be down 20.4%.

Join Bespoke Premium to read our 2019 market outlook report now!