B.I.G. Tips – Death by Amazon – 9/25/17

This content is for members onlyB.I.G. Tips – Death by Amazon – 5/16/17

This content is for members onlyTraders Betting on “Death By Amazon” in the Retail Space

Earlier today, we published an update to our “Death By Amazon” index of stocks, which tracks the performance of stocks in companies whose sales are the most Amazon-able. In the update, we mentioned how the “Death By Amazon” index just recently made a four-year low. On a related note, short interest figures for the end of March were released earlier this week, and looking at the data, Death By Amazon is a trade that hasn’t gone on unnoticed.

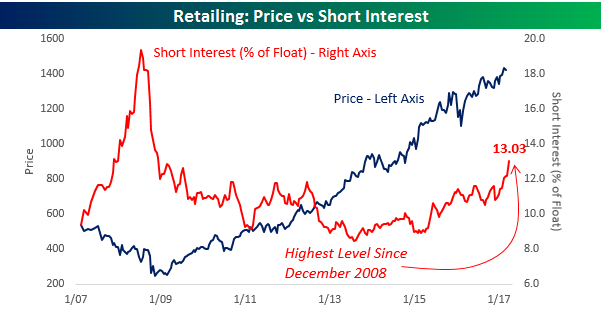

The chart below compares the price of the S&P 1500 Retailing Group and the average short interest as a percentage of float (SIPF) for stocks in the group going back to 2007. For the last several months now, average short interest levels have been rising steadily for the group and currently stand at over 13%, which is the highest reading for the group since December 2008. Not since the depths of the financial crisis have traders been more negative on the group, although we would note that they were a lot more negative back then compared to now. One thing to note in this chart is that even though it looks as though the Retailing Group has performed well over the last few years, practically all of the gains in the sector are the result of Amazon.com (AMZN), Home Depot (HD), and Priceline.com (PCLN). Outside of these three stocks, the vast majority of the group’s members have been trending the other way.

In terms of individual stocks, the table below shows the sixteen stocks in the group that have more than 20% of their float sold short. Looking at the list, all but three stocks are down so far this year. Ironically, the stock with the highest short interest, RH (formerly Restoration Hardware), is up sharply YTD. That’s more of a special situation, though, as RH is coming off hard times from prior years and is still down more than 50% from its highs in late 2015. Lumber Liquidators (LL) is another example. Although it is up 37% this year, it’s trading at a fifth of its level from late 2013. For just about every other stock shown, 2017 has already been a year to forget, especially when you consider the fact that the broader market is up about 5% on the year.

While the outlook for many of the names in the retail space is bleak, there will undoubtedly be some companies that buck the trend and turn things around. In our earlier update to the Death By Amazon index, we actually highlighted one of the names in the list below as a turnaround candidate. So if you haven’t already, sign up for a free trial and check out the report!

Bespoke’s “Death By Amazon” Index Makes 4-Year Low

Bespoke created its “Death By Amazon” index back in 2014 as a way to track the retail companies most affected by the rise of Amazon. Companies included must be direct retailers with a limited online presence (or core business based on physical retailing locations), a member of either the Retail Industry of the S&P 1500 or the S&P Retail Select index, and rely primarily on third party brands. We view these attributes as the best expression of AMZN’s threat to traditional retail.

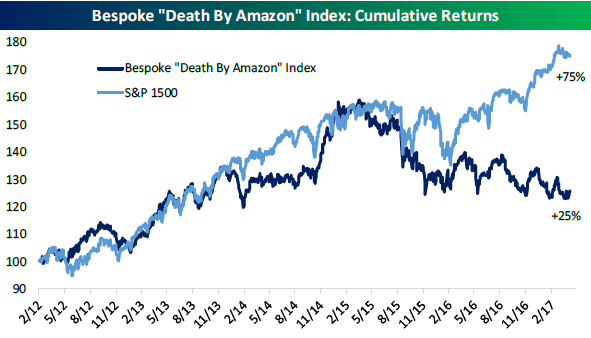

Below is a look at the performance of Bespoke’s “Death By Amazon” index versus the S&P 1500 since the start of 2012. As shown, the index has underperformed the market significantly over this 5-year period. The DBA is up 25% versus the S&P 1500’s gain of 75%. And how has Amazon.com (AMZN) performed since early 2012? It’s up more than 300%.

Each month we provide an update of our “Death By Amazon” index along with a look at the performance of the index’s individual members. In this month’s report, we also feature one long idea from the department store group and one short idea from the “off-price” retailer group.

To see this month’s Death By Amazon report, sign up for a 14-day free trial to our Bespoke Premium research service.