Nov 1, 2018

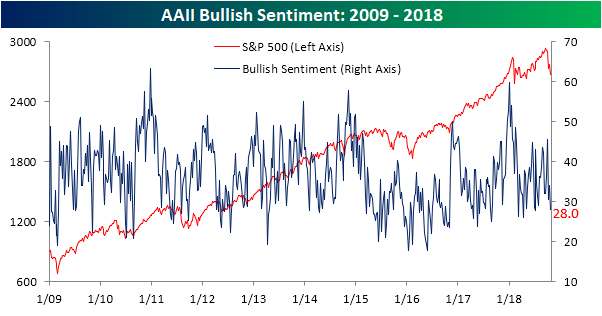

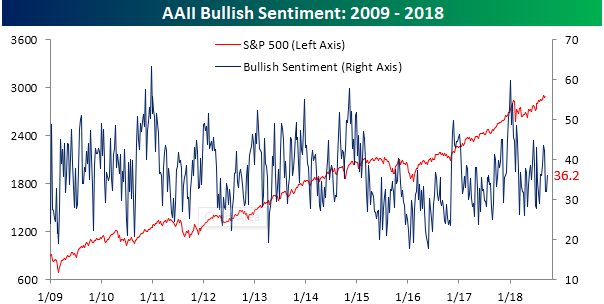

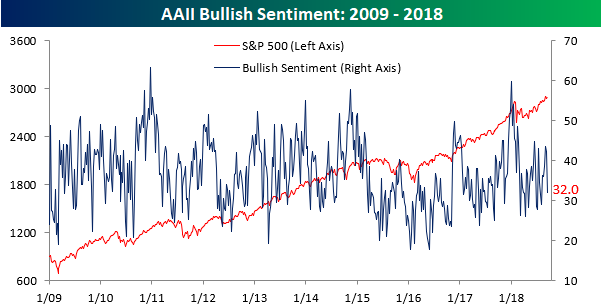

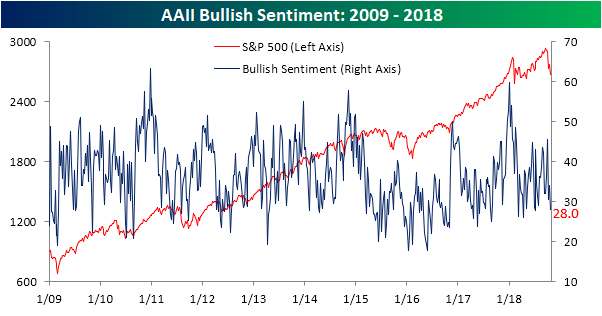

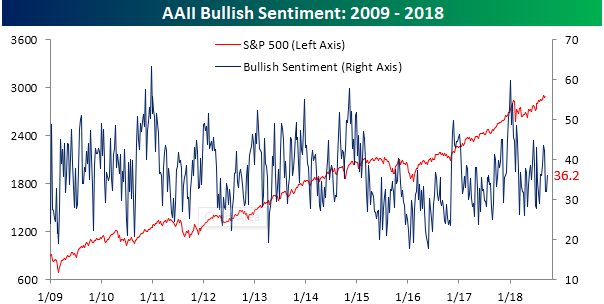

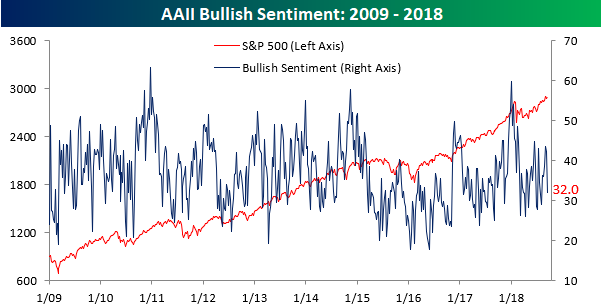

Last week on the backs of negative price action, bullish sentiment fell sharply to the fourth lowest reading this year. According to the weekly survey from AAII, there has been quite the turn around this week as bullish sentiment jumped from just under 28% all the way up to 37.9%. This is actually just above the average of the year and an impressive improvement in a short span of time. If the rally from the last two days of October continues throughout the week, we should expect to see bullish sentiment increase once again next week.

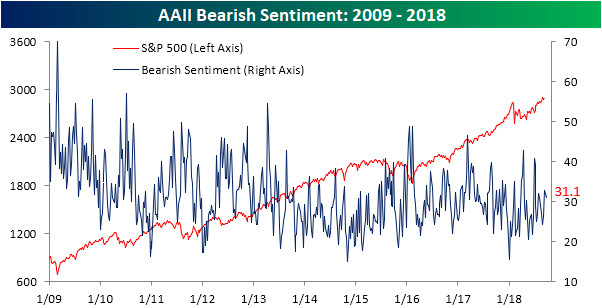

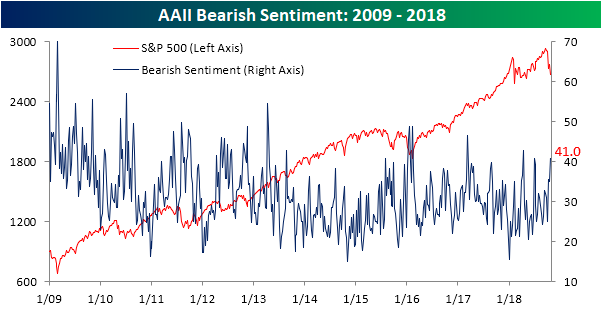

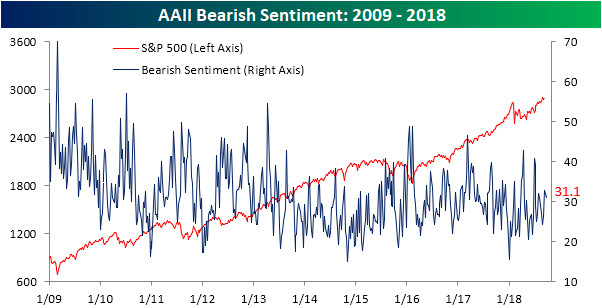

Conversely, the bearish camp shrunk this week to 34.5%. While this is lower than last week, it is still at fairly elevated levels compared to most of the year and is about in line with readings from early October.

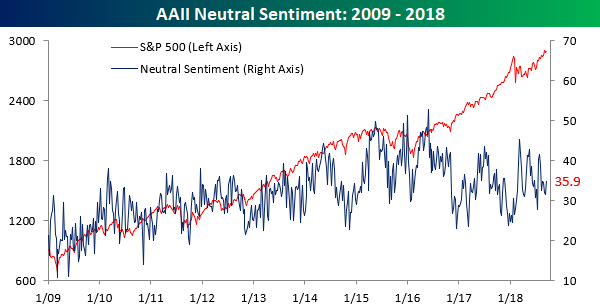

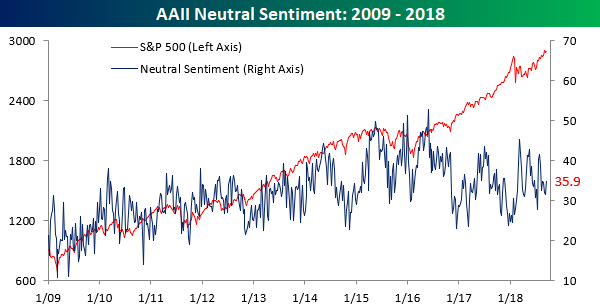

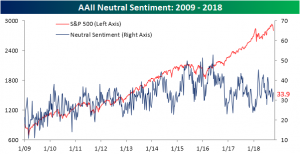

Neutral sentiment fell to its lowest since February 1st of this year. Investors seem to be increasingly taking sides with most leaving the bearish camp for the bulls.

Oct 25, 2018

With US equities getting sucked into the global equity rout, individual investors are heading for the exits, although given the weakness, we’re a bit surprised it hasn’t been more of a rush. According to the weekly sentiment survey from AAII, bullish sentiment saw another decline this week falling from just under 34% to 27.97%. That’s low enough to rank as the fourth weakest reading in bullish sentiment this year. This week’s survey results also probably don’t fully take into account the weakness equities saw on Wednesday either, so barring a big v-recovery in the next several days, we could even see a weaker reading next week.

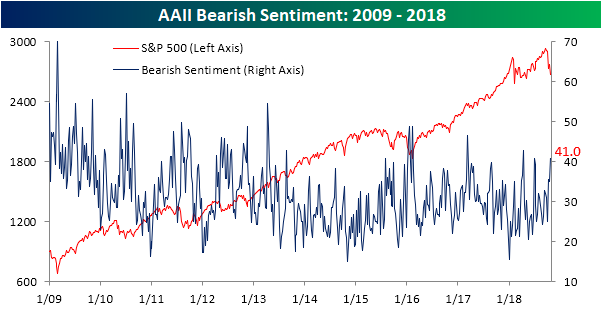

On the bearish side of the ledger, negative sentiment rose by a similar amount that bullish sentiment declined, jumping from 35.0% up to 41.0%. That’s the highest reading since the last week of June, right before the July 4th rally, and the third highest reading in bearish sentiment of the year.

Oct 11, 2018

With the market’s reversal over the past week, as expected, investor sentiment has been becoming less bullish. From the AAII survey of individual investors, bullish sentiment had its largest one week drop since mid-November 2017, falling 15.05 percentage points. Bullish sentiment is now down to 30.6% from 45.66% last week. This is the lowest level for bullish sentiment since the first week of August, but it’s still pretty far from the lowest level on the year that we saw in April when it fell to 26.09%.

Investors flooded into the bearish camp this week with the largest one week rise in bearish sentiment since June. Bearish sentiment rose to 35.5%; the highest level since the first week of July.

Not all investors that are no longer bullish have become bearish, though. Neutral sentiment has seen an uptick this week moving to 33.9%, which is back to around where it was a couple weeks ago. Since this survey was released this morning, the current reading may not have picked up on the full impact of yesterday’s movements on investor sentiment, which we would expect to cause investors to heavily flock towards uncertainty. If this small lag is the case, next week we could be in for an interesting release.

Sep 27, 2018

With the Dow Jones – America’s “Main Street” equity index – joining the S&P at new highs to close out last week, we were not too surprised to see that individual investors turned more bullish in the latest week. But even after the increase, positive sentiment remains at extremely depressed levels given what the market has done recently. According to the weekly survey from AAII, bullish sentiment rose from 32.04% up to 36.22%. That’s still below the average reading of 36.7% for the current bull market.

Even with the increase in bullish sentiment, bearish sentiment barely declined, falling less than one percentage point from 32.0% down to 31.1%.

The main source for the increase in bullish sentiment came from the ‘fence-sitters’ as neutral sentiment declined from 35.9% down to 32.7%.

Sep 20, 2018

The stock market is back at record highs, but don’t tell that to individual investors. In the latest survey of individual investor sentiment from AAII, bullish sentiment declined (ever so slightly) for the third straight week, dropping from 32.09% down to 32.04%.

Interestingly enough, bearish sentiment came in at the exact same level as bullish sentiment this week, dropping from 32.84% down to 32.04%. The last time both gauges of sentiment were at the exact same level was in June 2016.

With both bearish and bullish sentiment at the same levels and neutral sentiment right around a third as well, can individual investors be any more indecisive? We do have to say that the last three days of gains for the US equity market have caught a lot of people off guard.