Sep 23, 2019

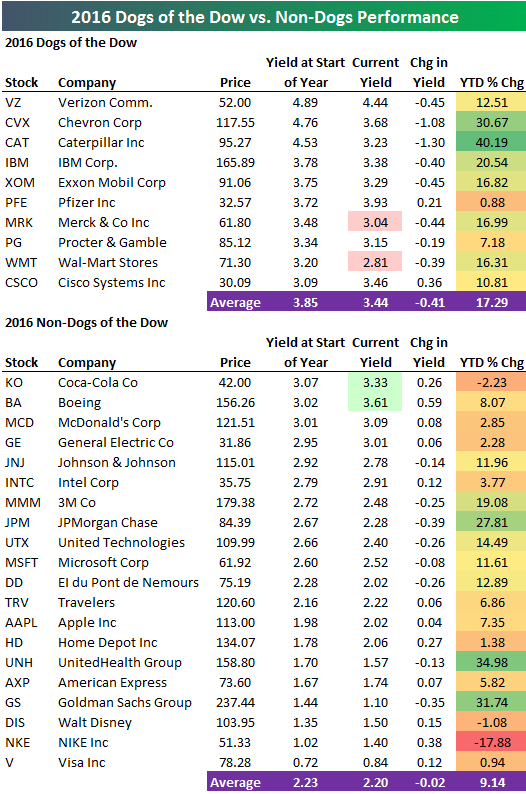

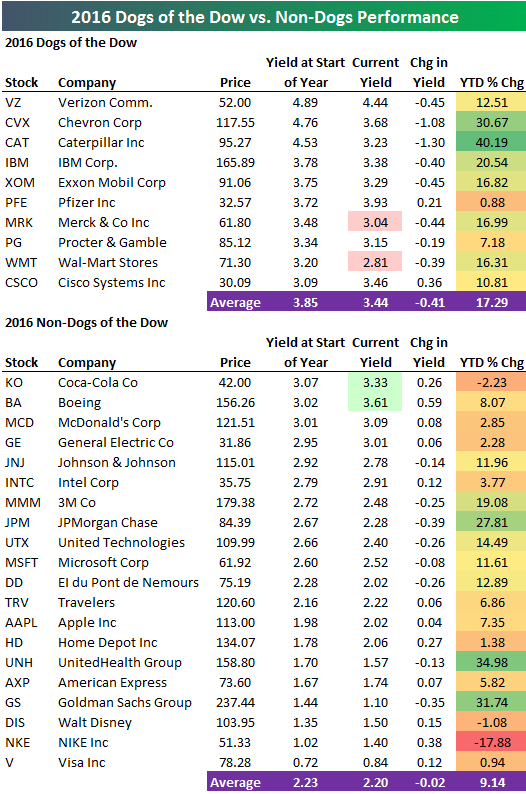

Below is an updated look at the total return performance of the 10 Dogs of the Dow for 2019 versus the 20 non-Dogs. As shown, the 10 Dogs are up 16.34% so far this year, which is 150 basis points less than the gain of 17.8% for the non-Dogs. Procter & Gamble (PG), IBM, and JP Morgan (JPM) have been the best performing Dogs, while Pfizer (PFE) has been the only loser with a YTD decline of 14.34%. Of the non-Dogs, Apple (AAPL) is up the most at +40.74%, followed by Microsoft (MSFT), Home Depot (HD), Visa (V), and Goldman Sachs (GS). Walgreens (WBA) is down the most of any Dow stocks with a YTD decline of 18.17%, while 3M (MMM) and UnitedHealth (UNH) are the only other names in the red.

Below is a look at total return performance for Dow members so far in 2019 as well as over the last 12 months. Year-to-date, these stocks are up 17.35%, but they’re up just 5.91% over the last 12 months. Apple (AAPL) is the top performing Dow stock in 2019 with a total return of 40.74%, but its total return over the last 12 months is just +2.24% because of its horrific performance in Q4 2018. Other stocks with big YTD gains but low or negative 12-month returns include Goldman Sachs (GS), United Tech (UTX), IBM, and JP Morgan (JPM).

There are three Dow stocks down 10%+ YTD (MMM, PFE, WBA) while there are six stocks that are down 10%+ over the last 12 months (XOM, CAT, UNH, MMM, PFE, WBA). Start a two-week free trial to receive our market research and access our interactive tools.

Apr 15, 2019

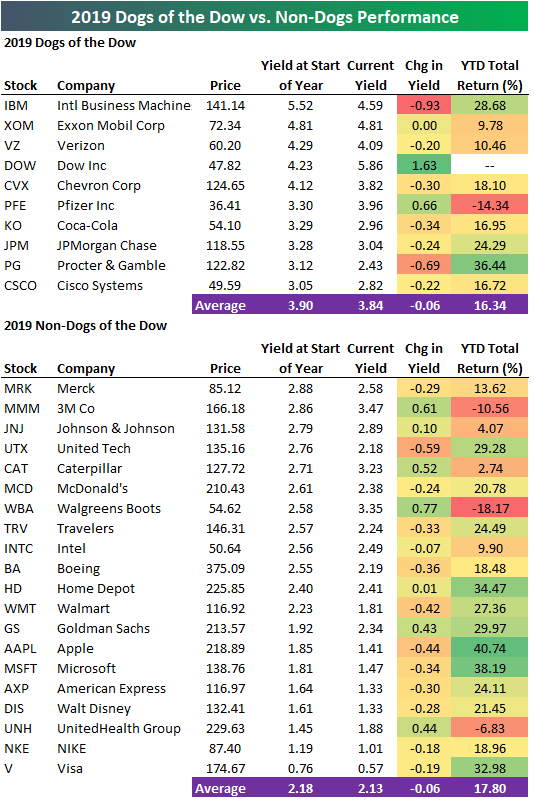

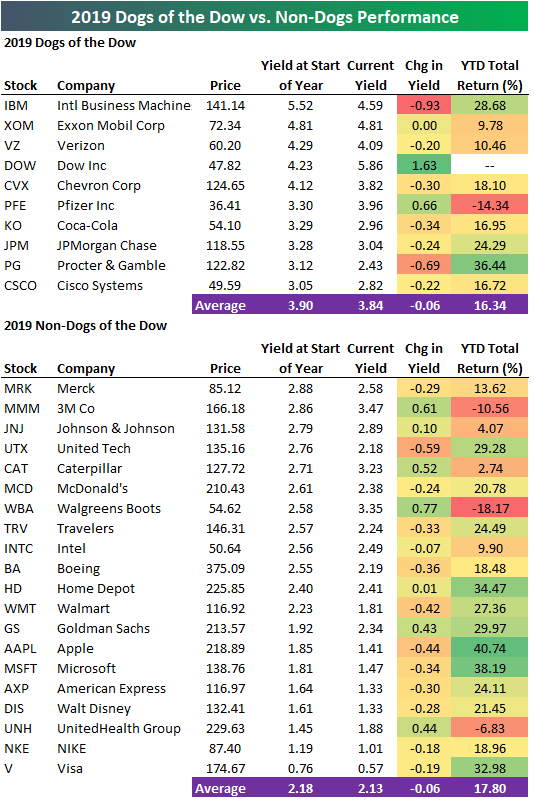

Below is a look at the performance of the Dogs of the Dow strategy so far in 2019. This hands-off, buy-and-hold strategy simply buys the 10 highest yielding Dow Jones Industrial Average stocks at the start of each year.

As shown, the 10 Dogs of the Dow stocks are up 13.56% on a total return basis so far this year. The 20 non-Dogs are up 13.39%, so the performance difference between the two groups is just 17 basis points.

Two Tech stocks that are part of this year’s Dogs are up the most, with IBM up 28.05% and Cisco (CSCO) up 32.05%. IBM started the year yielding 5.52%, but its yield is now down to 4.37% after a significant share price gain. CSCO started the year with a yield of 3.05% that is down to 2.48% as of today.

Only two Dogs are down so far this year. Pfizer (PFE) is down the most at -3.28%, while Coca-Cola (KO) is just barely in the red at -0.18%.

Of the 20 non-Dogs, United Tech (UTX) is up the most at +27.24%, while Apple (AAPL) is up the 2nd most at +26.72%. Walgreens Boots (WBA) — the most recently added Dow member — is down the most at -20.55%. UnitedHealth (UNH) is the only other non-Dog that’s in the red for the year with a decline of 9.38%.

Start a two-week free trial to Bespoke Institutional to unlock the full Bespoke interactive research portal.

Oct 22, 2018

Below is a check-up on the performance of the “Dogs of the Dow” strategy so far in 2018. For those unfamiliar with the strategy, it’s a simple portfolio allocation and re-balance at the start of each year into the 10 highest yielding stocks in the Dow Jones Industrial Average.

As shown in the table, the 2018 Dogs are currently up an average of 4.77% YTD on a total return basis compared to a total return of 5.11% for the 20 non-Dogs. Coming into the month, the non-Dogs were outperforming the Dogs by a much wider margin, however. With investors shifting out of cyclicals and into more defensive names, the lower-yielding non-Dogs have fallen 4.61% in October, while the Dogs are down just 0.61%. If it weren’t for IBM’s 13.91% drop this month due to another bad earnings report, the Dogs would actually be up 87 basis points MTD.

Merck (MRK) and Pfizer (PFE) have been the best performing Dogs of the Dow this year with total returns of more than 25%. Apple (AAPL) and Microsoft (MSFT) have been the best performing non-Dogs with gains of more than 30%.

If we were to re-balance the strategy now, Merck (MRK) would be removed and JP Morgan (JPM) would enter the Dogs. Note that IBM is now the highest yielding stock in the Dow at 4.82%!

Mar 13, 2017

Learn more about Bespoke’s research and wealth management services.

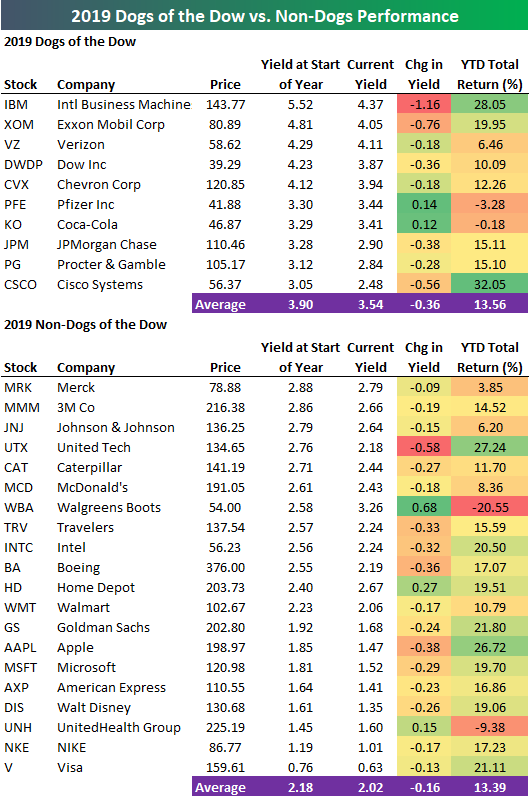

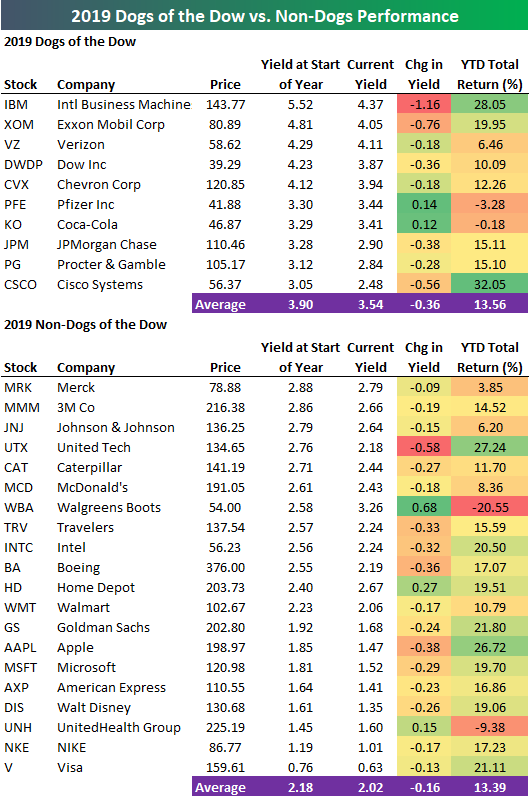

The “Dogs of the Dow” crushed it in 2016, but they’ve gotten off to a slow start in 2017. Below is a table of 2017’s Dogs, which are the 10 highest yielding stocks in the Dow 30 at the start of the year. (Read more about the Dogs of the Dow strategy here.) We also include a list of the 20 non-Dogs along with their YTD performance.

As shown, this year’s Dogs are up an average of 2.44% year-to-date. That compares to an average YTD gain of 6.29% for the 20 non-Dogs. Four of the ten Dogs are in the red so far this year, with Exxon Mobil (XOM) down the most at -9.99%. Just three of the twenty non-Dogs are in the red, with General Electric (GE) down the most at -5.43%.

We’ll provide another update on the “Dogs” strategy in a couple of months, so be sure to check back if you’re interested.

To see Bespoke’s full line of macro and micro research, sign up for one of our premium membership options today! You won’t be disappointed.

Dec 12, 2016

Get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

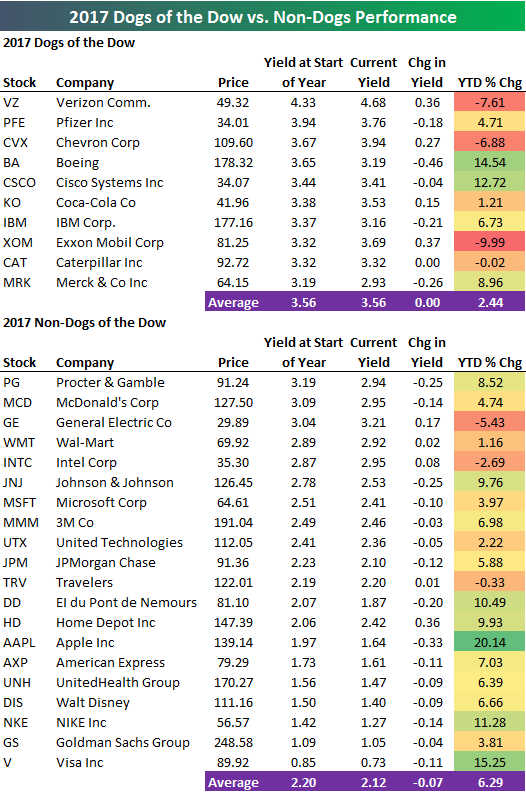

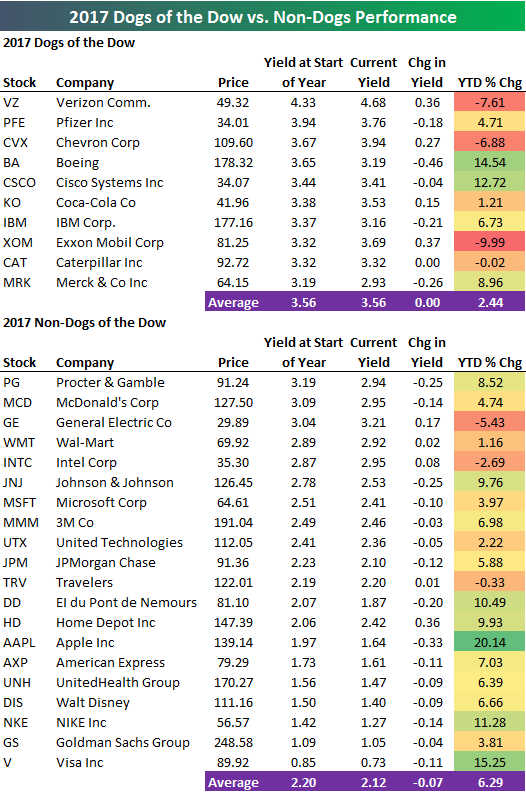

Back on October 12th, we published this report on the performance of 2016’s “Dogs of the Dow” strategy, which says to simply buy the 10 highest-yielding stocks in the Dow Jones Industrial Average at the start of each year. (You can read more about the strategy at this Investopedia link if you’re looking to learn more about the reasoning behind it.)

In our October post, the 10 “Dogs of the Dow” for 2016 were absolutely crushing the non-Dogs. At that point, the Dogs were up 12% on the year, while the non-Dogs were up just 0.57%.

Obviously a lot has changed for the market since October 12th, so how are the two baskets doing now that two more months have passed? Well, the Dogs have continued even higher, but the non-Dogs have also done extremely well thanks to stocks like Goldman Sachs (GS) and JP Morgan (JPM).

Below is a look at the updated year-to-date performance of the “Dogs of the Dow” versus non-Dogs. As shown, the Dogs are now up 17.3%, while the non-Dogs are up 9.14%. The Dogs are still up nearly double the non-Dogs, but the non-Dogs have rallied more since our last update.

We’ll provide a final update on 2016 performance at the end of the year and post the official list of 2017’s Dogs as well. If the year ended today, Merck (MRK) and Wal-Mart (WMT) would be removed and Coca-Cola (KO) and Boeing (BA) would be added. We also thought it was worth noting that tech-giant Cisco (CSCO) is now the fourth highest-yielding stock in the Dow with a yield of 3.46%. That’s pretty remarkable when you think back to where the stock stood during the Dot Com heyday of the late 90s.